Risk & Trade Planning

Position Size CalculatorLot Size Calculator

Stop Loss Take Profit Calc

Risk to Reward Calculator

Breakeven & Win Rate

Risk of Ruin Calculator

Margin Call Calculator

Forex Calculators

Pip Value CalculatorMargin Calculator

Forward Rate Calculator

Carry Trade Calculator

Leverage Calculator

Volatility Calculator

Spread Calculator

Forex Rebate Calculator

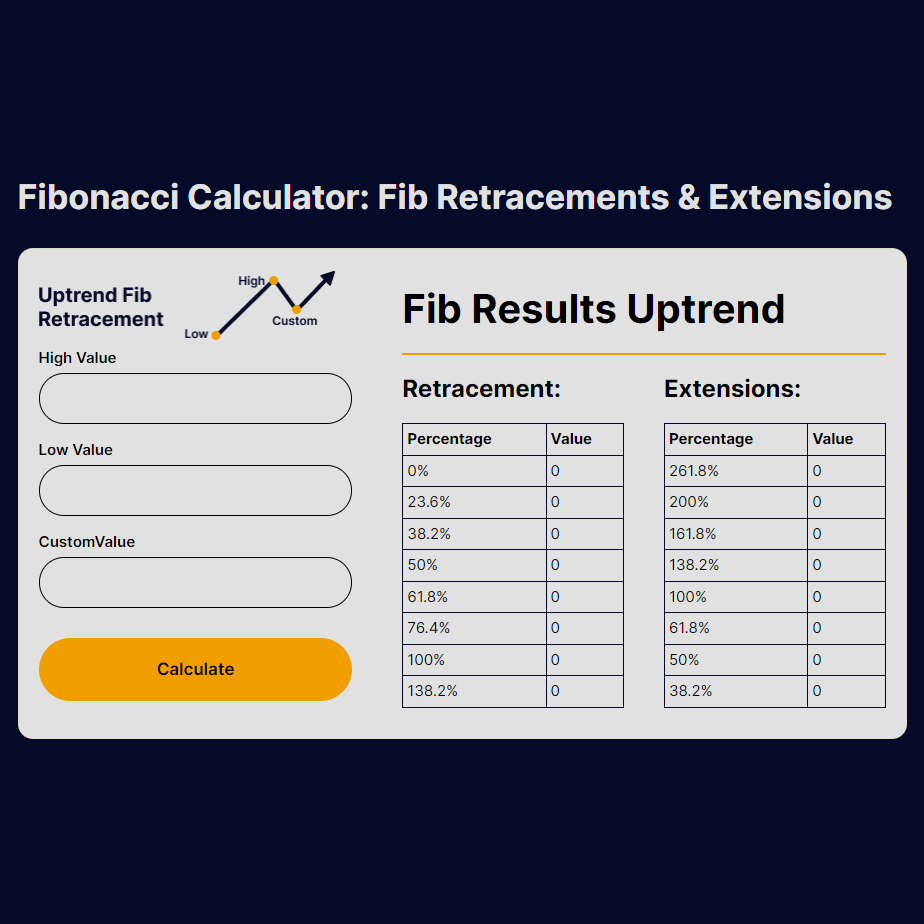

Fibonacci Trading Calculator: Fib Retracements & Extensions

Fib Results Uptrend

Retracement:

| Percentage | Value |

|---|---|

| 0% | 0 |

| 23.6% | 0 |

| 38.2% | 0 |

| 50% | 0 |

| 61.8% | 0 |

| 76.4% | 0 |

| 100% | 0 |

| 138.2% | 0 |

Extensions:

| Percentage | Value |

|---|---|

| 261.8% | 0 |

| 200% | 0 |

| 161.8% | 0 |

| 138.2% | 0 |

| 100% | 0 |

| 61.8% | 0 |

| 50% | 0 |

| 38.2% | 0 |

Fib Results Downtrend

Retracement:

| Percentage | Value |

|---|---|

| 138.2% | 0 |

| 100% | 0 |

| 76.4% | 0 |

| 61.8% | 0 |

| 50% | 0 |

| 38.2% | 0 |

| 23.6% | 0 |

| 0% | 0 |

Extensions:

| Percentage | Value |

|---|---|

| 38.2% | 0 |

| 50% | 0 |

| 61.8% | 0 |

| 100% | 0 |

| 138.2% | 0 |

| 161.8% | 0 |

| 200% | 0 |

| 261.8% | 0 |

Fib Uptrend & Downtrend Calculation

Understanding Fibonacci Retracements

Fibonacci Retracements are based on the idea that markets will retrace a predictable portion of a move, after which they will continue to move in the original direction. These retracements are expressed as percentages of the original move. The most common Fibonacci Retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. Traders use the fibonacci golden zone levels to identify potential reversal points in the price of an asset.

Fibonacci Retracement Calculation

Fibonacci Retracement levels are calculated by identifying two extreme points on a chart: a high point and a low point. The vertical distance between these two points is divided by the key Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 78.6%) to determine potential levels of support and resistance. These levels represent where the price could potentially pause or reverse.

For example, if a stock moves from $100 to $200, then retraces to $150 (the 50% level), traders might watch this level for signs of reversal. The calculation is straightforward: from the bottom to the top of the move (or vice versa for a downtrend), apply the Fibonacci percentages, and plot the resulting levels on the chart. These levels, then, guide traders in making decisions about entry, stop-loss, and take-profit points.

Fibonacci Extension Calculation

Fibonacci Extensions are used to predict potential future targets or reversal points beyond the original high or low of a market move. These are calculated by taking three points into consideration: the start of the move, the end of the move, and the retracement level. The most commonly used Fibonacci Extension levels are 138.2%, 161.8%, and 261.8%.

To calculate these levels, traders first measure the distance between the start and end of the move (A to B), then apply the Fibonacci ratio to the retracement move (B to C), projecting the extension levels beyond the original point B. For instance, if a stock moves from $100 to $200, retraces to $150, and traders are calculating the 161.8% extension level, they would look for the stock to potentially move to $261.80 ($100 move extended by 161.8%) beyond the original high of $200.

Fib Retracement Formulas

Fibonacci Retracements are percentages of the primary trend’s total movement, which traders use to predict potential reversal levels in the market.

- Uptrend Formula: In an uptrend, you calculate retracement levels by identifying the recent high (peak) and the recent low (trough). The difference between these two points is then multiplied by the key Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 78.6%). The result is subtracted from the high to get the retracement levels. Retracement Level=High−(High−Low)×Fibonacci Ratio.

- Downtrend Formula: In a downtrend, the process is similar but inverted. You start with the recent low and the recent high. The difference is multiplied by the Fibonacci ratios, and the result is added to the low. Retracement Level=Low+(High−Low)×Fibonacci Ratio.

Fib Extension Formulas

Fibonacci Extensions help predict potential future levels of interest beyond the current trend, often used for setting profit targets in a trade. It is important to understand how to use fib extensions precisely.

- Uptrend Formula: For extensions in an uptrend, after identifying the start (low), peak (high), and retracement low, calculate the difference between the high and low of the move and multiply this by the Fibonacci ratios (commonly 138.2%, 161.8%, and 261.8%). Add this result to the retracement low. Extension Level=Retracement Low+(High−Low)×Fibonacci Ratio.

- Downtrend Formula: For a downtrend, the calculation is similar but reversed. Subtract the result of the high-low difference multiplied by the Fibonacci ratio from the retracement high. Extension Level=Retracement High−(High−Low)×Fibonacci Ratio.

FAQ

A Fibonacci Calculator is a tool that calculates the potential retracement or extension levels based on the Fibonacci sequence, which is a series of numbers where each number is the sum of the two preceding ones. Traders use these levels as potential support and resistance in the markets.

To calculate Fibonacci retracement levels in an uptrend, identify the recent significant low and high prices, input them into the calculator, and it will provide the retracement levels – typically 23.6%, 38.2%, 50%, 61.8%, and 78.6% pullbacks from the high.

Fibonacci extensions in an uptrend forecast potential price targets above the recent high. Use the low, high, and end of the retracement to calculate extension levels such as 138.2%, 161.8%, and 261.8%.

Fibonacci levels can be applied to any timeframe, but they are often considered more reliable on longer timeframes where the price movements are less susceptible to random fluctuations.

Traders might use custom values to analyze retracement levels from a specific point of interest that doesn’t align with the absolute high or low, such as a mid-swing high or low.

No, Fibonacci levels should not be used in isolation as they are just one part of technical analysis. They should be used in conjunction with other technical indicators and fundamental factors for making well-rounded trading decisions.