Risk & Trade Planning

Position Size CalculatorLot Size Calculator

Stop Loss Take Profit Calc

Risk to Reward Calculator

Breakeven & Win Rate

Risk of Ruin Calculator

Margin Call Calculator

Forex Calculators

Pip Value CalculatorMargin Calculator

Forward Rate Calculator

Carry Trade Calculator

Leverage Calculator

Volatility Calculator

Spread Calculator

Forex Rebate Calculator

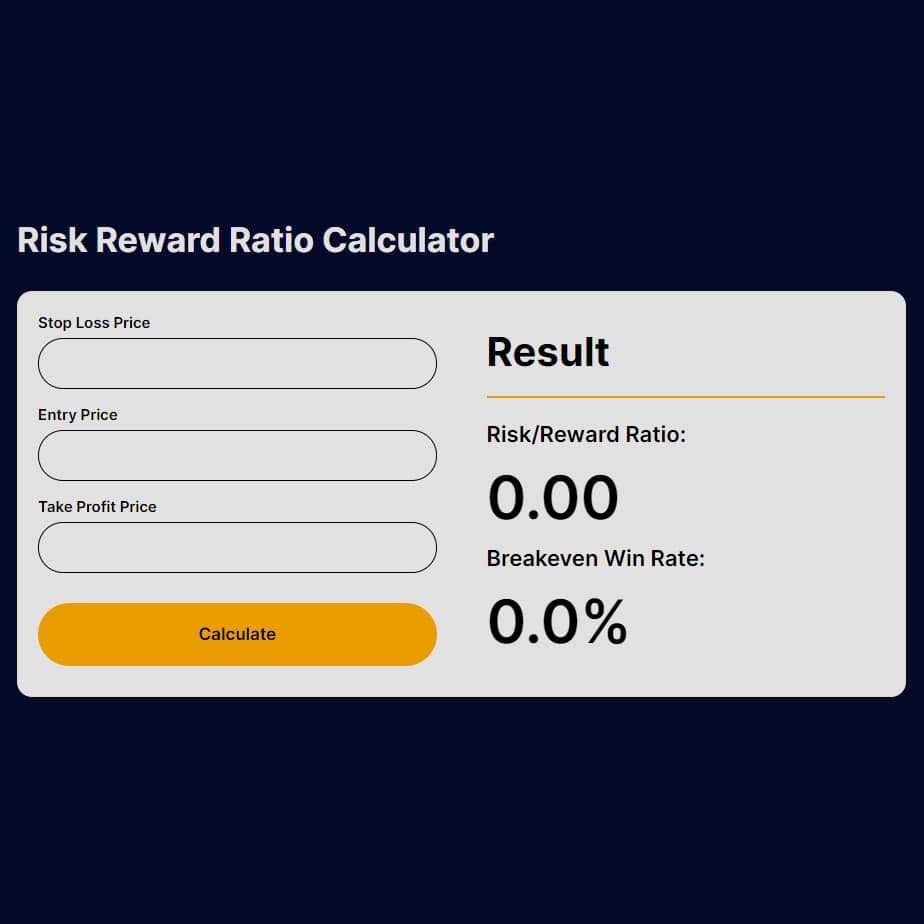

Risk Reward Ratio Calculator

Result

Risk/Reward Ratio:

0.00

Breakeven Win Rate:

0.0%

Risk To Reward

RRR Calculator: Maximizing Your Trades

In the dynamic world of investing, understanding and managing the balance between risk and reward is fundamental to achieving long-term success. The risk reward ratio calculator emerges as an essential tool for investors and traders alike, offering a clear insight into the potential risks and rewards associated with their investment decisions. This guide explores the utility of the risk reward ratio calculator, elucidating how to calculate risk to reward ratio and, conversely, how to calculate reward to risk ratio, thereby empowering investors with the knowledge to make more informed choices.

Understanding Risk Reward Ratio

The risk reward ratio is a popular metric used by investors to compare the potential return of an investment to its risk. A favorable risk reward ratio is indicative of an investment where the potential reward outweighs the risk involved. This ratio is critical for making strategic investment decisions, as it helps in identifying opportunities that align well with one’s risk tolerance and investment objectives.

How to Use Risk Reward Ratio Calculator

The risk reward ratio calculator is a straightforward tool designed to help investors easily assess the risk-reward profile of their investments. By inputting a few key parameters, such as the entry price, stop loss, and take profit levels, the calculator automatically computes the risk reward ratio. This not only simplifies the analysis process but also provides immediate insights that can be critical in planning trades or investments.

Trading with Risk Reward Ratios

Understanding how to calculate the risk to reward ratio in trading is paramount in maximizing investment decisions. A higher ratio signifies a more favorable investment opportunity, where the potential rewards significantly exceed the risks involved. Conversely, a lower ratio indicates a less desirable scenario, where the risks may not justify the potential rewards. By leveraging the risk reward ratio calculator, investors can quantify these aspects and tailor their investment strategies accordingly.

How to Use Our Risk Reward Ratio Calculator

- Step 1: Input the Stop Loss Price: Begin by entering the price at which you intend to exit your position to prevent further losses if the market moves against you. This is your ‘Stop Loss Price’.

- Step 2: Enter the Entry Price: Input the price at which you plan to enter the market. This is the price at which you will buy or sell the asset and is referred to as the ‘Entry Price’.

- Step 3: Specify the Take Profit Price: Determine and input the price at which you aim to close your position to lock in profits, known as the ‘Take Profit Price’.

- Step 4: Calculate: Once all the data is entered into their respective fields, click on the ‘Calculate’ button. The calculator will process the inputted figures to provide two key pieces of information.

Result Interpretation

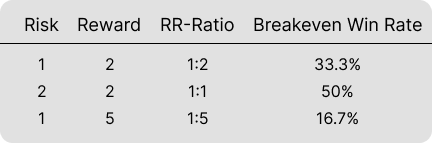

- Risk/Reward Ratio: This figure indicates the potential risk versus the potential reward of the investment. For example, a ratio of 1:3 means you’re risking $1 to potentially make $3.

- Breakeven Win Rate: This percentage reflects the frequency at which your trades need to be successful for you to break even. For instance, if the calculator displays 33.3%, you need to win one out of every three trades to not lose money over time.

FAQ

To calculate the risk to reward ratio, divide the potential profit (the difference between the take profit and the entry price) by the potential loss (the difference between the entry price and the stop loss level).

A good risk reward ratio varies depending on one’s investment strategy and risk tolerance, but typically, a ratio of 1:2 or higher is considered favorable, indicating that the potential rewards are twice the potential risks.

Generally, a higher risk reward ratio is preferable as it indicates that the potential rewards of an investment outweigh the associated risks.

The risk reward ratio doesn’t predict the success of a trade but indicates potential profitability. The win rate is equally crucial, as it shows how often trades must succeed to maintain profitability. Both metrics combined give a clearer picture of a strategy’s effectiveness rather than relying on just one.

Focus on enhancing trade selection, refining entry points, and setting more strategic take profit levels to improve potential rewards with the same level of risk.