Risk & Trade Planning

Position Size CalculatorLot Size Calculator

Stop Loss Take Profit Calc

Risk to Reward Calculator

Breakeven & Win Rate

Risk of Ruin Calculator

Margin Call Calculator

Forex Calculators

Pip Value CalculatorMargin Calculator

Forward Rate Calculator

Carry Trade Calculator

Leverage Calculator

Volatility Calculator

Spread Calculator

Forex Rebate Calculator

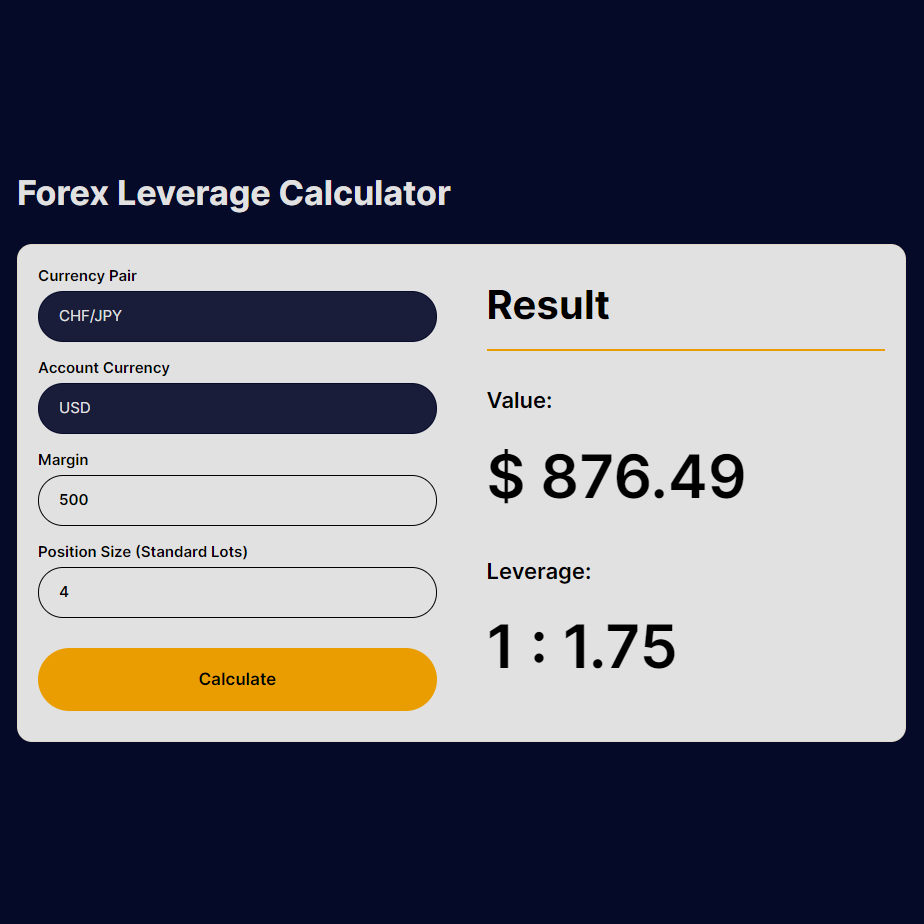

Forex Leverage Calculator

Result

Value:

$0.00

Leverage:

1 : 0

Leverage

Forex Leverage Calc

When trading in the foreign exchange market, leveraging your investment is a powerful tool. It allows you to increase your exposure to the market without committing the full amount of capital. Our Forex Leverage Calculator is an essential tool for managing your risk and understanding your potential for profit or loss.

Understanding Forex Leverage Calculator

Our Forex Leverage Calculator helps you calculate the leverage you are using and the size of your position in the market. By inputting the currency pair, account currency, margin, and position size, you can instantly see the value of your position and the leverage ratio. This tool is an efficient way to determine how much you need to have in your account to take a particular position.

How to Use the Leverage Ratio Calculator

Using a leverage ratio calculator is straightforward. Select your currency pair and the currency of your account. Then, enter the margin you’re willing to put up and the position size you wish to take. Click ‘Calculate’ to get instant results, allowing you to make informed trading decisions.

Advantages of Using a Leverage Calculator

A leverage calculator for forex traders use is vital for risk management. It allows traders to:

- Understand potential profits or losses

- Plan trade size according to account balance

- Avoid over-leveraging

- Adjust position sizes quickly based on market conditions

Strategic Application of Leverage in Forex Trading

Leverage trading is a double-edged sword that, if wielded wisely, can amplify your trading results. Our Forex Leverage Calculator ensures that you can execute trades with precision, tailoring your leverage to fit both your trading style and market conditions. To use leverage to your advantage, consider the following strategies:

- Conservative Approach: Use lower leverage for positions you intend to hold long term, reducing the impact of market volatility on your account.

- Aggressive Tactics: Apply higher leverage for short-term trades when market conditions are favorable, but ensure you have stop-loss orders in place to manage potential losses.

- Diversification: Spread your leverage across different currency pairs to diversify risk. Our calculator can assist in managing the leverage for multiple positions simultaneously.

FAQ

A Forex leverage calculator is a specialized tool designed for currency traders. It calculates the level of leverage you are applying in your Forex trading account when you open a position. By inputting values such as the currency pair, account currency, margin, and position size, the calculator provides you with the leverage ratio, essentially informing you of the potential expansion of your trade size based on your selected margin.

Leverage in Forex is a mechanism that enables traders to gain a larger exposure to the market than the amount they deposited to open a trade. It’s essentially a loan provided by the broker to the trader. The impact of leverage is significant; it can magnify both profits and losses. For instance, with a leverage of 100:1, a market movement of 1% could potentially increase the profits or losses by 100%.

To calculate the correct leverage when trading Forex, divide the total value of your trade by the amount of margin you’re required to put down. For example, if you want to trade $100,000 worth of currency and your broker requires a 1% margin, you would need to deposit $1,000 of your own capital. That would be a leverage ratio of 100:1.

In Forex trading, leverage levels above 100:1 are generally considered high. While high leverage can lead to large profits, it can also result in substantial losses and increased risk, so it’s crucial to use high leverage levels cautiously and with a robust risk management strategy in place.

A leverage calculator benefits your Forex trading strategy by providing clarity on the potential risks and requirements for each trade. It ensures that you maintain leverage within a range that suits your risk management strategy, helping to protect your capital. By incorporating this tool into your trading plan, you can better manage your positions and adjust your strategies in response to market movements.