Risk & Trade Planning

Position Size CalculatorLot Size Calculator

Stop Loss Take Profit Calc

Risk to Reward Calculator

Breakeven & Win Rate

Risk of Ruin Calculator

Margin Call Calculator

Forex Calculators

Pip Value CalculatorMargin Calculator

Forward Rate Calculator

Carry Trade Calculator

Leverage Calculator

Volatility Calculator

Spread Calculator

Forex Rebate Calculator

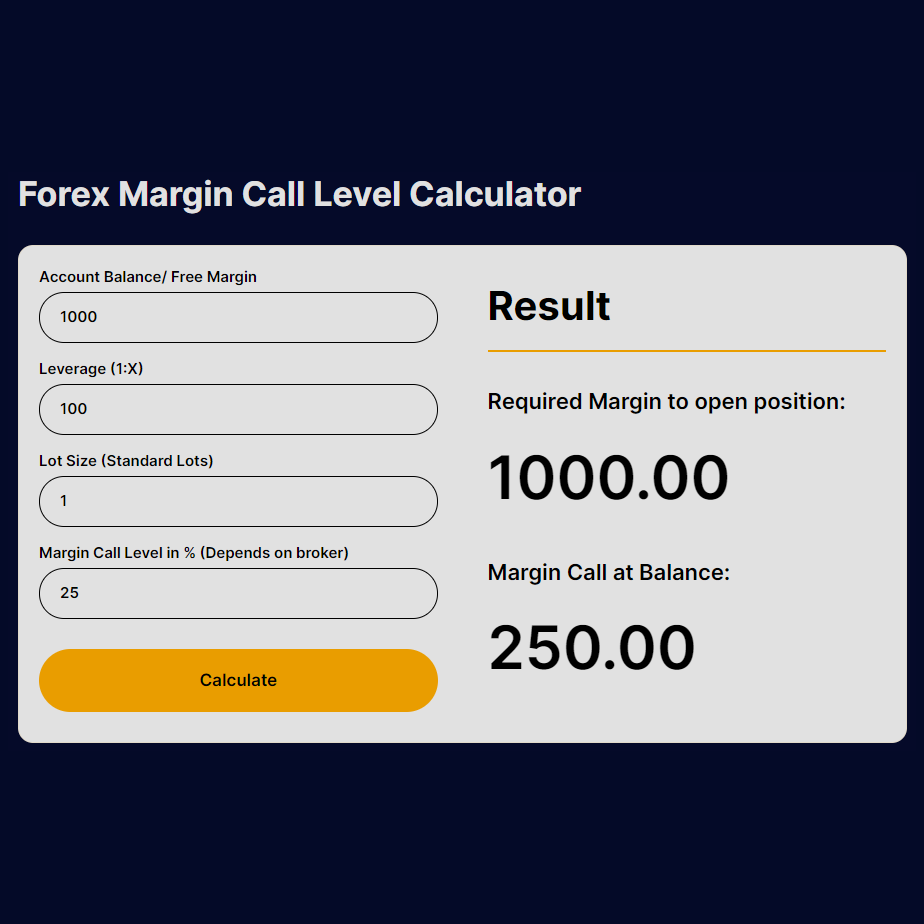

Forex Margin Call Level Calculator

Result

Required Margin to open position:

0.00

Margin Call at Balance:

0.00

Forex Margin Calculator

Margin Call Level Calculator for Forex Trading Safety

Navigating the complex world of Forex trading requires not just intuition and strategy but also the right tools to manage financial risk. A margin call calculator is an essential asset for every Forex trader, ensuring that you’re informed about the levels at which you might receive a margin call, helping you to make proactive decisions to prevent it.

Understanding Margin Calls in Forex

A margin call is a scenario in Forex trading where a broker notifies you that your account balance has dropped below the required minimum level to keep your positions open. This happens due to market fluctuations impacting your open trades negatively. To avoid liquidation of positions, you must understand how to calculate margin call and adjust your trades accordingly.

Why Margin Calls Matter

The significance of a margin call cannot be overstated. It is essentially a safety net that protects not only the trader but also the broker from entering into a negative balance. In highly volatile markets, a margin call acts as an early warning system, prompting traders to take action before experiencing substantial financial loss.

How the Margin Call Level Calculator Works

Our forex margin call calculator allows you to determine when a margin call could happen. It takes into account your account balance (or free margin), leverage, lot size, and the specific margin call level set by your broker.

To use it, you input:

- Account Balance/Free Margin

- Leverage

- Lot Size (Standard Lots)

- Margin Call Level in %

Press ‘Calculate’, and it’ll display two crucial pieces of information: the ‘Required Margin to open position’ and the ‘Margin Call at Balance.’

Margin Call Calculation Formula:

Required Margin = (Lot Size×Contract Size) / Leverage

Once the required margin is known, the margin call threshold is calculated using the margin call level percentage provided by your broker.

FAQ

A margin call occurs when your account equity falls below the broker’s required level to keep trades open.

You calculate a margin call by determining the required margin and then applying your broker’s margin call level percentage.

It’s a tool that calculates at what account balance a margin call will occur based on your trading parameters.

Leverage increases your trading power, which affects the required margin and, consequently, the margin call level.

The formula is the lot size times the contract size divided by the leverage.