Risk & Trade Planning

Position Size CalculatorLot Size Calculator

Stop Loss Take Profit Calc

Risk to Reward Calculator

Breakeven & Win Rate

Risk of Ruin Calculator

Margin Call Calculator

Forex Calculators

Pip Value CalculatorMargin Calculator

Forward Rate Calculator

Carry Trade Calculator

Leverage Calculator

Volatility Calculator

Spread Calculator

Forex Rebate Calculator

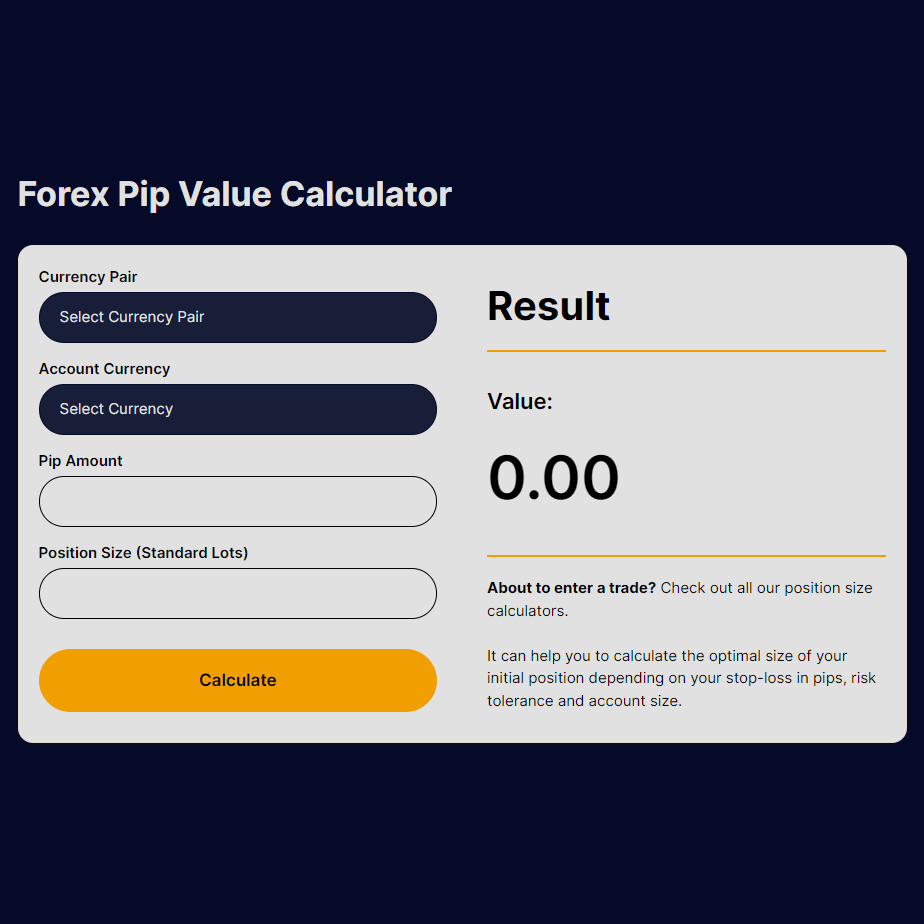

Forex Pip Value Calculator

Result

Value:

0.00

About to enter a trade? Check out all our trading calculators.

Stay ahead of the game by analyzing your trades with precision, ensuring accurate and long-term profitable trading decisions.

Pip Value Calculation

How is Pip Value Calculated in Forex?

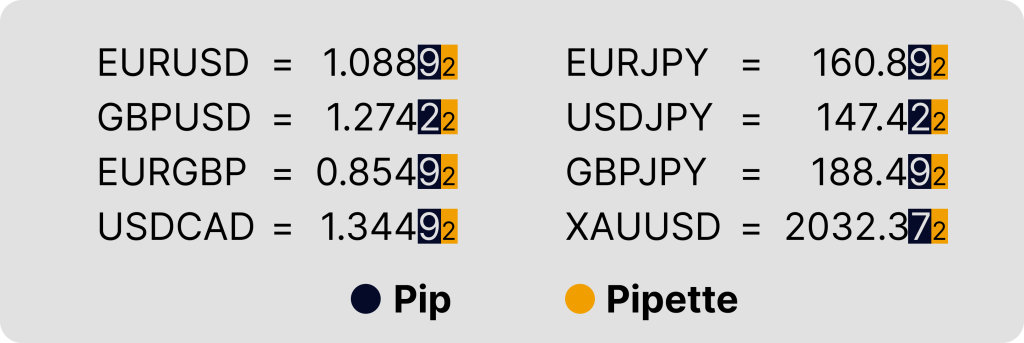

In Forex trading, understanding the calculation of pip value is key to effective risk management. A pip, standing for ‘percentage in point,’ denotes the smallest price movement in a currency pair. Pip value varies based on the currency pair and your trade size. Only a Pipette is a smaller forex unit, which is equal to one-tenth of a pip. Tools like the Forex Pip Value Calculator offer clear insights into these calculations, aiding traders in making informed decisions.

Trade Size (Lot Size)

In Forex, trades are measured in lots. A standard lot is 100,000 units of the base currency, a mini lot is 10,000 units, and a micro lot is 1,000 units. The larger your lot size, the more significant the pip value. For example, a one-pip change in a standard lot has a more substantial monetary impact than in a micro lot. Here, a Forex Pip Value Calculator proves invaluable, helping traders gauge the financial implications of their lot sizes.

Currency Pair and Market Price

Pip value is directly tied to the currency pair in question. For most pairs, a pip equates to a movement in the fourth decimal place, while for Japanese yen (JPY) pairs, it’s the second decimal place. Market price also influences pip value, which can change with market dynamics. A Forex Pip Value Calculator helps traders adapt to these fluctuations by providing real-time pip value calculations.

Account Currency

Pip value also hinges on the currency of your trading account. If your account currency matches the quote currency of the traded pair, the pip value remains constant. However, if they differ, converting the pip value to your account currency is necessary—a task effortlessly handled by a Forex Pip Value Calculator.

Pip Value Calculation Formula

To calculate pip value in your account currency, the formula is:

Pip Value = (One Pip / Exchange Rate) * Lot Size

For pairs with USD as the quote currency: Pip Value = 0.0001 * Lot Size

For pairs with JPY as the base currency: Pip Value = 0.01 * Lot Size

When different currencies are involved, adjust the pip value using the relevant exchange rate. A Forex Pip Value Calculator automates these calculations, ensuring accuracy and efficiency.

Example Calculation

Consider trading EUR/USD with a lot size of 1 standard lot (100,000 units) and an account in USD.

The calculated pip value would be:

Pip Value = 0.0001 * 100,000 = $10

This exemplifies how, for each pip movement in EUR/USD, the movement’s monetary value is $10, easily determined using a Forex Pip Value Calculator.

FAQ

To calculate a pips value, use the formula:

Pip value = (one pip / exchange rate) x lot size.

Using the pip value formula:

Pip value = (0.0001 / exchange rate) x lot size

For 50 pips, it would be:

50 pip value = 50 x (0.0001 / exchange rate) x lot size

For example, if you are trading 1 standard lot (100,000 units) of EUR/USD at an exchange rate of 1.1050, the value of 50 pips would be approximately $45.25.

To find out how many pips equate to $10, use this formula:

Number of pips = $10 / Pip value

Suppose you’re trading 1 standard lot (100,000 units) of EUR/USD and the exchange rate is 1.1050.

First, calculate the pip value:

Pip value = (0.0001 / 1.1050) x 100,000 = $9.05 (approximately)

Then, use the formula to find how many pips $10 is:

Number of pips = $10 / $9.05 = approximately 1.105 pips.

For calculating $1 in pips, use the formular:

Number of pips = ($1 / (0.0001 / exchange rate)) / lot size.

For instance, if you are trading 1 standard lot (100,000 units) of EUR/USD at an exchange rate of 1.1050, $1 would be approximately 9.05 pips. The actual number of pips will vary based on the exchange rate and lot size.

Ten pips represent a 0.0001 change for most currency pairs and a 0.01 change for pairs involving the Japanese Yen.

For example, if you’re trading 1 standard lot (100,000 units) of EUR/USD at an exchange rate of 1.1050, the value of 10 pips would be approximately $90.50. This value varies depending on the exchange rate and lot size.