Understande the Gann Square of 9

Discover the enigmatic world of W.D. Gann’s Square of 9, a tool that has captivated traders’ imaginations and analytical skills for generations. As we unfold the secrets of this fascinating square, we will illustrate how our intuitive Gann Square of 9 Calculator can become an indispensable part of your trading arsenal.

Historical Context of the Gann Square of 9

The origins of the Gann Square of 9 are as intriguing as its creator. W.D. Gann, a finance trader from the early 20th century, unveiled a method that proposed a harmonious relationship between time and price. Gann’s methodology, deeply rooted in ancient mathematics and geometry, suggests that financial markets move in predictable cycles, mirrored in the structure of the Square of 9.

Basic Principles of the Gann Square of 9

At its core, the Gann Square of 9 is built on a numerical system that spirals outward from a central point. This spiral arrangement of numbers can be used to identify potential support and resistance levels in the market. Each number in the square represents a potential pivot point or a change in the market direction, hinged upon Gann’s theory of time and price balance.

Utilization of the Gann Square in Market Analysis

The power of the Gann Square of 9 lies in its ability to forecast critical points in the market where significant price movements are likely to occur. By using our Gann Square of 9 Calculator, traders can calculate these pivotal points with ease, applying Gann’s principles to predict market highs and lows. This section would offer readers a glimpse into the practical application of the Gann Square for both short-term and long-term market predictions.

Market Movements with the Gann Square of 9 Calculator

Unlock the mysteries of market timing and price movements with our user-friendly Gann Square of 9 Calculator. This powerful tool encapsulates the essence of W.D. Gann’s trading principles, modernized for today’s financial markets. In this section, we provide a comprehensive guide on how to harness this calculator to enhance your trading decisions.

Navigating the Gann Square of 9 Calculator Interface

When you land on our Gann Square of 9 Calculator page, you’re greeted with a sleek and straightforward interface designed for ease of use. Central to this interface is the input section where you can enter the current Market Price of the asset you’re trading. Accompanying this is the Pip value input, allowing for precise adjustments corresponding to your trading needs.

Step-by-Step Usage:

- Enter the Market Price: Locate the ‘Market Price’ field on our calculator. This is the price you want to analyze, usually the closing price of the previous trading day or the current live price.

- Adjust the Pip Value: Input the pip value that suits the scale of your trading operations. This value determines the increment used by the calculator to generate the Gann numbers.

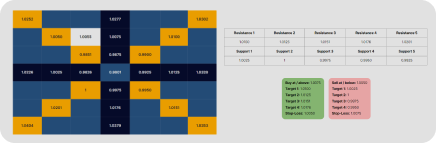

- Calculate: Hit the ‘Calculate’ button and watch as the calculator generates a series of numbers laid out in the iconic Gann Square of 9 pattern. This grid is your map to potential future price points.

- Interpret the Results: The calculator provides you with a visual array of numbers increasing from the center outwards. The central value is your input market price, surrounded by potential resistance and support levels.

- Utilize Support and Resistance Data: Below the Gann Square, you’ll find the calculated support and resistance levels. These are instrumental in planning entry and exit points for trades.

- Incorporate Gann Trading Entries: At the bottom of the page, specific long and short trading entries are suggested based on the calculations. These include targets and stop-loss points, crucial for risk management.

By following these steps, you can efficiently apply Gann’s time-honored techniques to contemporary markets. Our Gann Square of 9 Calculator not only simplifies complex calculations but also brings a wealth of analytical power to your fingertips, enabling you to make informed trading decisions backed by one of the most influential theories in market analysis.

Whether you’re new to Gann’s methods or a seasoned trader, this calculator is designed to provide valuable insights that align with Gann’s original intent, all while providing a user experience that meets the expectations of modern traders. With just a few clicks, you can transform raw market data into a geometric representation of time and price, paving the way for strategic trading that resonates with the cyclical nature of financial markets.