Risk & Trade Planning

Position Size CalculatorLot Size Calculator

Stop Loss Take Profit Calc

Risk to Reward Calculator

Breakeven & Win Rate

Risk of Ruin Calculator

Margin Call Calculator

Forex Calculators

Pip Value CalculatorMargin Calculator

Forward Rate Calculator

Carry Trade Calculator

Leverage Calculator

Volatility Calculator

Spread Calculator

Forex Rebate Calculator

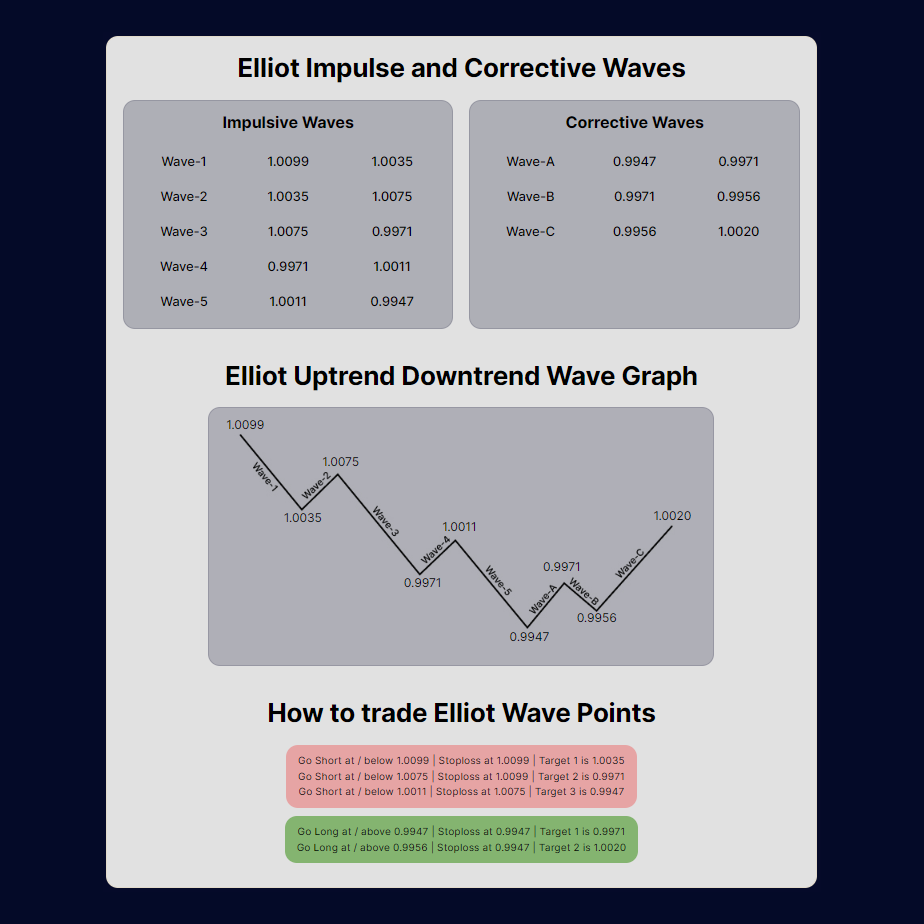

Elliot Wave Calculator with Graph

Elliot Impulse and Corrective Waves

Impulsive Waves

Wave-1

Wave-2

Wave-3

Wave-4

Wave-5

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Corrective Waves

Wave-A

Wave-B

Wave-C

0.00

0.00

0.00

0.00

0.00

0.00

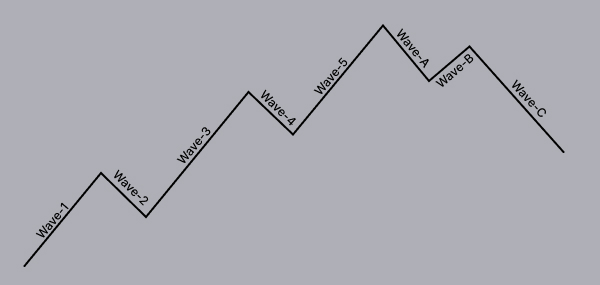

Elliot Uptrend Downtrend Wave Graph

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

How to trade Elliot Wave Points

Go Long at / above 0 | Stoploss at 0 | Target 1 is 0

Go Long at / above 0 | Stoploss at 0 | Target 2 is 0

Go Long at / above 0 | Stoploss at 0 | Target 3 is 0

Go Short at / below 0 | Stoploss at 0 | Target 1 is 0

Go Short at / below 0 | Stoploss at 0 | Target 2 is 0