Risk Management Trading: A Comprehensive Guide

Risk management in trading is the process of identifying, analyzing, and accepting or mitigating the uncertainties in the investment decisions. Risk management in trading is crucial for sustaining in the volatile markets where the potential for both gain and loss is significant. By implementing effective risk management strategies, traders can minimize losses and maximize returns, thus ensuring the longevity and profitability of their trading endeavors.

What is Risk Management?

Risk management involves the application of strategies and techniques to manage and mitigate financial risk. It encompasses a broad range of activities, from setting stop-loss orders to diversifying portfolios. The ultimate goal of risk management in trading is to control potential losses without significantly impacting potential gains.

Important readings for risk management:

- Risk Reward Ratio Trading

- Stop Loss Trading

- Trading with Leverage

- Meaning of Market Volatility

- What is Drawdown in Trading

The Importance of Risk Management in Trading

Without proper risk management, traders expose themselves to unnecessary risks, potentially leading to significant financial losses. Effective risk management not only protects capital but also improves a trader’s confidence by providing a safety net that allows for more controlled and informed trading decisions.

Key Principles of Effective Risk Management Trading

- Risk Assessment: Understanding the various types of risks associated with trading, including market risk, credit risk, and operational risk, is the first step in effective risk management.

- Risk Identification: Identifying specific risks within a trading strategy or investment portfolio is essential for developing targeted risk mitigation strategies.

- Risk Measurement: Quantifying risk enables traders to make informed decisions about how much risk to take on in relation to their risk tolerance and investment goals.

Strategies for Risk Management in Trading

Implementing robust risk management strategies is fundamental for successful trading. Strategies such as diversification, the use of stop-loss orders, and proper position sizing are key components of a comprehensive risk management plan.

Diversification Strategies

Diversification is a critical strategy for mitigating risk. By spreading investments across various asset classes, sectors, or geographical regions, traders can reduce the impact of a poor performance in any single investment.

Use of Stop-Loss and Take-Profit Orders

Stop-loss orders are an essential risk management tool that automatically closes a position at a predetermined price to limit potential losses. Similarly, take-profit orders secure profits by closing positions once they reach a certain profit level.

Position Sizing Techniques

The Fixed Percentage Method

This technique involves risking a fixed percentage of the total portfolio on each trade, ensuring that losses are kept to a manageable level relative to the trader’s overall capital.

The Martingale and Anti-Martingale Strategies

These strategies adjust the trade size based on previous outcomes, with the Martingale strategy doubling down on losses and the Anti-Martingale strategy capitalizing on wins.

Leveraging Financial Derivatives for Risk Management

Financial derivatives, such as options and futures, can be used to hedge against market volatility and protect against adverse price movements.

Tools and Software for Risk Management Trading

The right tools and software are indispensable for effective risk management in trading. They provide the analytics, real-time data, and automation necessary to implement risk management strategies efficiently.

Risk Management Software Solutions

Risk management software solutions offer comprehensive tools to monitor and manage risk across various trading portfolios. These platforms can automate risk assessment processes, provide risk exposure analytics, and suggest mitigation strategies.

Analytical Tools for Risk Assessment

Value at Risk (VaR)

VaR is a widely used risk management tool that estimates the maximum potential loss over a specified time frame with a given confidence level. It is crucial for assessing market risk and making informed trading decisions.

Scenario Analysis and Stress Testing

These tools allow traders to simulate various market conditions and stress scenarios to evaluate how their portfolios would perform. This insight is invaluable for preparing for potential market downturns and volatile conditions.

Psychological Aspects of Risk Management in Trading

Understanding and managing the psychological aspects of trading is as important as mastering technical skills. Emotions can significantly impact decision-making processes in trading.

Understanding Trader Psychology and Risk

Fear and greed are powerful emotions that can lead to risky trading behaviors. Recognizing these emotional triggers and developing strategies to mitigate their impact is essential for successful risk management.

Overcoming Emotional Trading Decisions

Establishing a disciplined trading routine, setting clear rules, and maintaining a level head can help traders avoid emotional decision-making and stick to their risk management plans.

Further Readings on Risk Management Trading:

-

Take Profit Trading for Optimal Gains

-

Position Sizing Techniques for Traders

-

Mastering Risk Management and Trading Psychology

-

Prop Trading Risk Management Essentials

-

Risk Management Swing Trading Tips

-

Intraday Trading Risk Management Strategies

-

High Frequency Trading Risk Management Insights

-

Mastering Day Trading Risk Management

-

Essential Forex Risk Management Tools for Traders

-

Essential Trading Risk Management Tools Guide

-

Risk Management Strategies for Funded Forex Accounts

-

Risk Management Stock Trading Essentials

-

Essential Futures Trading Risk Management Tips

-

Crypto Trading Risk Management Essentials

-

Risk Management in Forex Trading Essentials

-

Commodity Trading Risk Management Strategies

-

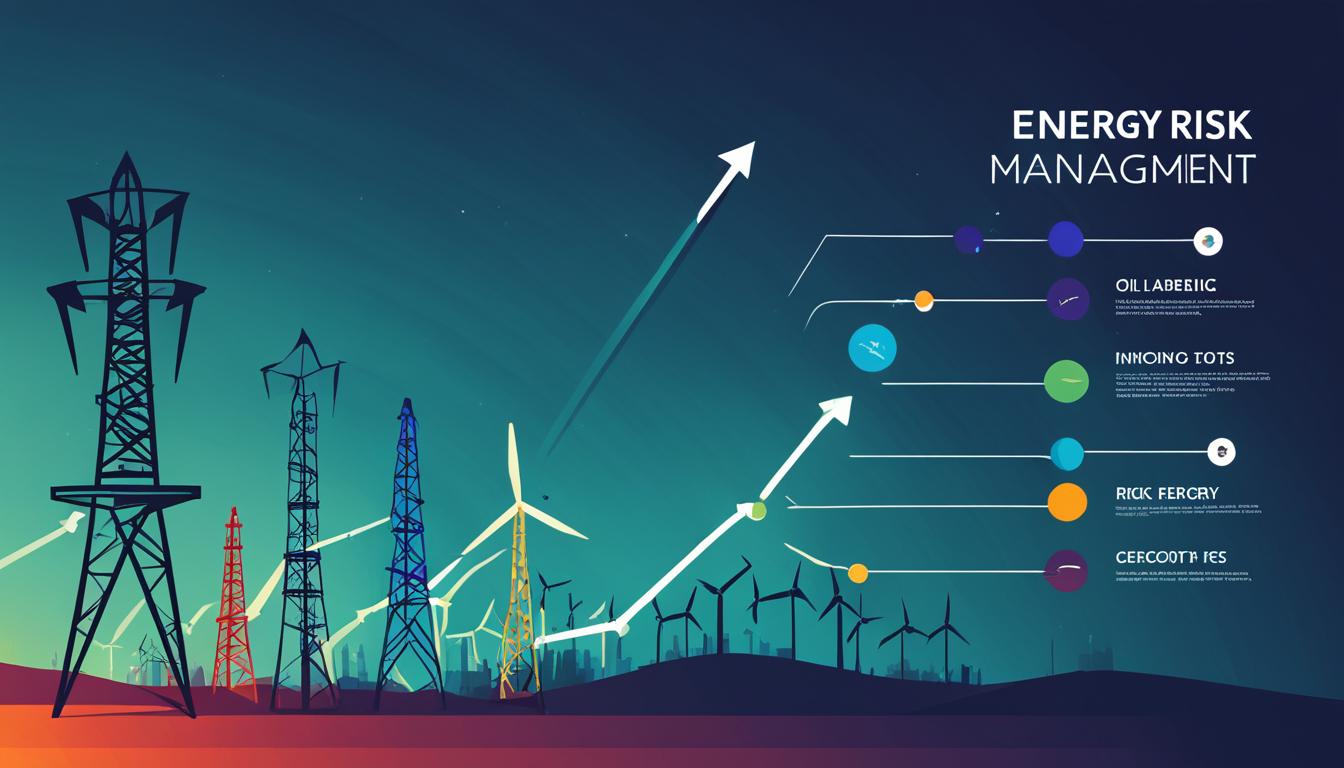

Energy Trading Risk Management Strategies

-

Risk Management Strategies in Options Trading

Conclusion: Mastering Risk Management in Trading

In conclusion, risk management in trading is a multifaceted discipline that requires a thorough understanding of market risks, disciplined strategy implementation, and continuous learning. By applying the principles, strategies, and tools discussed, traders can significantly improve their chances of success in the volatile world of trading.

Effective risk management is the cornerstone of successful trading. It protects capital, limits losses, and provides a foundation for consistent trading performance.