Risk & Trade Planning

Position Size CalculatorLot Size Calculator

Stop Loss Take Profit Calc

Risk to Reward Calculator

Breakeven & Win Rate

Risk of Ruin Calculator

Margin Call Calculator

Forex Calculators

Pip Value CalculatorMargin Calculator

Forward Rate Calculator

Carry Trade Calculator

Leverage Calculator

Volatility Calculator

Spread Calculator

Forex Rebate Calculator

Forex Margin Calculator

Result

Value:

0.00

About to enter a trade? Check out all our trading calculators.

Stay ahead of the game by analyzing your trades with precision, ensuring accurate and long-term profitable trading decisions.

Forex Margin Calculator

What is Forex Margin?

Forex margin is essentially a good faith deposit required to maintain open positions in the forex market. It’s a portion of your trading account funds set aside and allocated as a margin deposit. Margin is not a fee or a transaction cost, but rather a security deposit to ensure you can cover any losses incurred on your positions.

Understand Required Margin in Forex

The required margin is the amount of money a trader needs to have in their trading account to open and maintain a forex position. It varies depending on the broker, the size of the trade, the currency pair being traded, and the level of leverage applied. The required margin is a fraction of the size of the trade and is expressed as a percentage.

Leverage in Margin Calculation

Trading with leverage directly affects the required trading margin: higher leverage reduces the required margin and lower leverage magnifies the required margin. Traders must use leverage cautiously, as it can magnify both potential gains and losses. Use the Forex Leverage Margin Calculator to calculate your required margin including your accounts leverage.

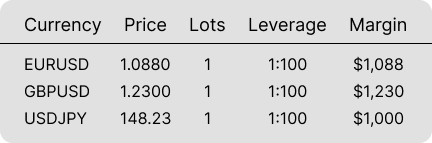

Forex Margin Calculation Formula

The formula for calculating the required margin in forex trading is straightforward:

Required Margin = (Trade Size / Leverage) x Price Base Currency to Account Currency

For example, if a trader wants to open a position of $100,000 with a leverage of 50:1, and the base currency is USD with a price of 1.20 relative to the account currency, the required margin would be:

Required Margin = ($100,000 / 50) x 1.20 = $2,400

This forex margin calculation formula helps traders assess how much capital they need to hold a position and manage their risk effectively.

Importance of Forex Margin Calculator

A Forex Margin Calculator is an invaluable tool for traders. It automates the calculation of the required margin, making it easier for traders to:

- Quickly and accurately determine margin requirements for different trades.

- Assess the impact of different leverage levels on margin requirements.

- Make informed decisions about trade sizes and manage risks more effectively.

- Avoid over-leveraging and its associated risks.

FAQ

Forex margin is the collateral required by traders to open and maintain positions in the forex market. It’s a percentage of the trade size, set aside from a trader’s account.

Margin Level is calculated as: (Equity / Used Margin) x 100%.

It indicates the percentage of equity available to cover used margin and helps assess the risk of a margin call.

Margin is calculated using the formula:

Margin = (Trade Size / Leverage) x Price of Base Currency relative to Account Currency

It determines the amount of funds needed to open a trade.

A margin call occurs when equity falls below the required margin level. Brokers have specific levels, often around 50-80% of the margin. Below the margin level they issue a margin call.

Required margin is calculated as:

Required Margin = Brokers Margin Level * (Trade Size / Leverage) x Price of Base Currency relative to Account Currency

It shows the minimum capital needed to open and maintain a position.