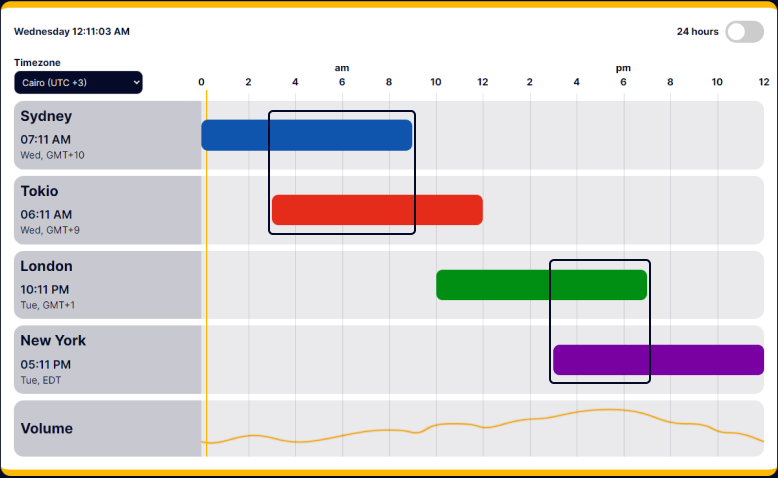

Forex Market Hours Time Zone Converter

Understanding Forex market hours is essential for optimizing trading strategies, as different sessions—Sydney, Tokyo, London, and New York—offer varying levels of volatility and liquidity. A Forex Time Zone Converter helps track these sessions’ opening and closing times, ensuring traders capitalize on the most active periods.

am

pm

Sydney

Tokio

London

New York

Volume

Understanding Forex Market Hours

What Are Forex Market Hours?

The Forex market operates 24 hours a day, five days a week, with trading sessions in major financial centers around the world. These sessions overlap, providing continuous trading opportunities for forex traders. The main trading centers are Sydney, Tokyo, London, and New York.

Why Are Forex Market Hours Important?

Forex market hours are crucial for traders because they influence liquidity, volatility, and trading opportunities. Understanding these hours can help traders plan their strategies, identify the best times to trade, and optimize their trading activities to achieve better results.

Forex Market Trading Sessions

Sydney Session

Time Zone: GMT+10

Trading Hours: 10 PM to 7 AM GMT

Key Features: Less volatile, ideal for trading AUD pairs. The session is characterized by lower liquidity compared to other sessions, making it suitable for long-term traders who prefer stability.

Tokyo Session

Time Zone: GMT+9

Trading Hours: 12 AM to 9 AM GMT

Key Features: Moderate volatility, strong influence from the Asian markets. This session often experiences significant movements in JPY pairs and is a key session for traders focusing on economic developments in Asia.

London Session

Time Zone: GMT+1

Trading Hours: 8 AM to 5 PM GMT

Key Features: High liquidity, significant overlap with the New York session. The London session is the most active trading session, with major market movements and high trading volumes, making it ideal for day traders.

New York Session

Time Zone: GMT-4

Trading Hours: 1 PM to 10 PM GMT

Key Features: High volatility, significant economic releases from the US market. The New York session is particularly important for traders focusing on USD pairs, with market activity peaking during economic announcements and news releases.

Overlapping Forex Market Hours

Best Times to Trade Forex

The best times to trade forex are during the overlap of major trading sessions, particularly the London/New York overlap. This period sees the highest liquidity and volatility, providing excellent trading opportunities. The London/Tokyo overlap is also significant, though less pronounced.

Benefits of Overlapping Hours

Increased Liquidity: More market participants result in higher trading volumes, reducing the cost of trading.

Higher Volatility: More price movements can lead to better trading opportunities, especially for short-term traders.

Enhanced Trading Opportunities: Economic news releases often occur during these overlaps, impacting currency pairs and creating profitable trading opportunities.

Using a Forex Market Time Zone Converter

A Forex Market Time Zone Converter helps traders track the opening and closing times of different trading sessions across various time zones. This tool can be customized to match the trader’s local time, ensuring they never miss important trading opportunities. It’s essential for managing trading schedules and planning trades effectively.

Forex Trading Strategies Based on Market Hours

Strategies for Sydney and Tokyo Sessions

Focus on AUD and JPY Pairs: These pairs are most active during these sessions.

Range Trading: Since these sessions are less volatile, range trading strategies can be effective, capitalizing on price oscillations within a range.

Strategies for London and New York Sessions

News Trading: Many significant economic announcements occur during these sessions, providing opportunities for news trading strategies. Traders can take advantage of the rapid price movements following major news releases.

Trend Following: Higher volatility can be conducive to trend-following strategies, where traders identify and follow the direction of the market trend.

Forex Market Trading Sessions

| Trading Session | Time Zone | Opening Time (GMT) | Closing Time (GMT) |

|---|---|---|---|

| Sydney | GMT+10 | 7 AM | 4 PM |

| Tokyo | GMT+9 | 9 AM | 6 PM |

| London | GMT+1 | 8 AM | 5 PM |

| New York | GMT-4 | 8 AM | 5 PM |

Tips for Trading During Different Sessions

- Monitor Economic Calendars: Stay updated with major economic events and news releases that can impact currency pairs.

- Use a Forex Market Time Zone Converter: Customize it to your local time for better planning and to ensure you trade during the most active sessions.

- Adapt Your Trading Strategy: Different sessions require different strategies. Adjust your approach based on the session’s characteristics and market conditions.

- Manage Your Risk: Higher volatility means higher risk. Use appropriate risk management techniques, such as stop-loss orders, to protect your capital.

Conclusion

Understanding Forex market hours is essential for effective trading. By using tools like a Forex Market Time Zone Converter and applying strategies suited to different trading sessions, traders can optimize their performance and achieve better results. Staying informed about the best times to trade and the characteristics of each session will help traders make informed decisions and enhance their trading success.

Common Questions

The London/New York overlap is typically the most volatile trading session due to the high trading volume and major economic news releases from both the UK and the US. This period is ideal for traders seeking high activity and large price swings.

The forex market is closed on weekends, from Friday 10 PM GMT until Sunday 10 PM GMT. However, traders can prepare for the upcoming week by analyzing market trends and economic indicators during the weekend.

Forex Market Hours refer to the time periods during which forex market participants can buy, sell, exchange, and speculate on currencies. The market is open 24 hours a day, five days a week, across different global trading sessions.

The main Forex trading sessions are the Sydney session, Tokyo session, London session, and New York session.

The Sydney trading session opens at 10 PM GMT and closes at 7 AM GMT.

The Tokyo trading session opens at 12 AM GMT and closes at 9 AM GMT.

The London trading session opens at 8 AM GMT and closes at 5 PM GMT.

The New York trading session opens at 1 PM GMT and closes at 10 PM GMT.

The best time to trade Forex is during the overlap of the London and New York sessions, which typically sees the highest liquidity and volatility.