Share this review:

Trading carries a high risk. Losses can exeed initial funds.

- Fusion Markets Pros and Cons

- Why to choose Fusion Markets

- Trading Instruments at Fusion Markets

- Trading Fees

- Regulation

- Fusion Markets Trading Platform

- Deposit & Withdraw

- Research & Education at Fusion Markets

- Customer Support

- Account Types

- Account Opening

- Fusion Markets Review Results

- Best 4 Fusion Markets Alternatives

- FAQ

- MarketBulls Testing Methodology

- Fusion Markets Client Reviews

Trading carries a high risk. Losses can exeed initial funds.

Visit Fusion MarketsFusion Markets is a relatively new yet rapidly growing Australian-based forex and CFD broker, renowned for its ultra-low trading costs, advanced trading platforms, and exceptional customer service. Launched in 2017, Fusion Markets was established with the mission to provide traders with a seamless and cost-effective trading experience. The broker offers an extensive range of trading instruments, including forex, indices, commodities, and cryptocurrencies, making it a versatile option for both novice and experienced traders. With its headquarters in Melbourne, Australia, and a strong regulatory framework, Fusion Markets is a compelling choice for traders looking for reliability, transparency, and a commitment to reducing trading expenses.

This broker review of Fusion Markets is based on an in-depth self-test of the platform, covering everything from trading conditions to customer support, ensuring you get the most accurate and comprehensive insights available.

Is Fusion Markets Available in My Country?

Check if Fusion Markets is available in your country:

Fusion Markets Pros and Cons

Pros

- Low Trading Costs

- Comprehensive Range of Trading Instruments

- User-Friendly Trading Platforms

- Exceptional Customer Support

Cons

- Limited Educational Resources

- Limited Account Types

- Lack of Social/Copy Trading Features

Why to choose Fusion Markets?

Fusion Markets stands out in the crowded brokerage industry due to its unwavering commitment to delivering a cost-effective and transparent trading experience. For traders who prioritize low costs, Fusion Markets is an ideal choice, offering some of the lowest spreads and commissions in the industry. This makes it particularly attractive to high-frequency traders and those using scalping strategies, where every pip counts.

Beyond its competitive pricing, Fusion Markets offers a robust selection of over 250 trading instruments, including a vast array of forex pairs, indices, commodities, and cryptocurrencies. This diversity ensures that traders can diversify their portfolios and capitalize on various market opportunities.

Fusion Markets also excels in user experience, providing access to the highly respected MetaTrader 4 and MetaTrader 5 platforms. These platforms are known for their reliability, comprehensive charting tools, and automated trading capabilities, making them suitable for both beginner and experienced traders.

Furthermore, the broker is regulated by the Australian Securities and Investments Commission (ASIC), ensuring a high level of trust and security. With a strong focus on customer support, Fusion Markets offers fast and efficient service, with knowledgeable agents available to assist with any trading-related inquiries. All these factors combined make Fusion Markets a top contender for traders looking for a reliable, low-cost broker.

Trading Instruments at Fusion Markets

Fusion Markets offers a comprehensive range of trading instruments, ensuring that traders have access to diverse markets and can implement a variety of trading strategies. The broker provides over 250 financial instruments across multiple asset classes, including:

| Trading Instrument | Available |

|---|---|

| Forex | Available |

| Stocks | Available |

| Crypto | Available |

| Futures | Not Available |

| Options | Not Available |

| Bonds | Not Available |

| ETFs | Not Available |

| CFDs | Available |

Forex: Fusion Markets is particularly strong in forex trading, offering more than 90 currency pairs. This includes major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as a wide selection of minor and exotic pairs. This extensive range allows traders to capitalize on global forex market opportunities 24/5.

Indices: Fusion Markets offers a range of global indices, including popular options like the S&P 500, NASDAQ 100, FTSE 100, and DAX 30. These indices allow traders to gain exposure to broader market movements and diversify their trading portfolios beyond individual stocks.

Commodities: Traders can access a variety of commodity markets, including precious metals like gold and silver, energy products like oil and natural gas, and agricultural commodities. This broad selection caters to those interested in trading physical goods and hedging against market risks.

Cryptocurrencies: Fusion Markets also offers trading on popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). This gives traders the opportunity to engage in the rapidly growing digital asset market with competitive spreads and leverage options.

Shares (CFDs): Fusion Markets provides CFDs on shares of leading companies across various sectors, including technology, finance, healthcare, and more. This allows traders to speculate on price movements of individual stocks without owning the underlying assets.

With such a wide array of instruments, Fusion Markets enables traders to diversify their strategies, hedge against risks, and seize opportunities across different market conditions. This variety is a key factor that makes Fusion Markets appealing to both seasoned traders and those looking to explore new markets.

Trading Fees

Fusion Markets is recognized for its transparent and competitive fee structure, making it a top choice for traders who are sensitive to costs. Below is a breakdown of the key trading fees associated with using this broker:

| Fees | Fusion Markets |

|---|---|

| Deposit Fee | $0 |

| Withdraw Fee | $0 |

| Account Fee | No |

| Inactivity Fee | No |

| EUR/USD Spread | 0.0 |

| S&P 500 Cfd Spread | 0.2 |

Deposit Fee at Fusion Markets

Fusion Markets does not charge any fees for deposits, regardless of the payment method. This policy ensures that the full amount you deposit is available for trading, providing added value, especially for frequent deposits.

Withdraw Fees at Fusion Markets

Fusion Markets offers free withdrawals for most methods, which is a significant advantage compared to many competitors. However, international bank transfers may incur a fee depending on your bank and the currency used. It’s advisable to check with your bank for specific charges.

Account Fee

Fusion Markets does not charge any account maintenance fees. Whether you are a casual trader or an active investor, you won’t incur any costs simply for holding an account with them.

Inactivity Fee

Unlike many brokers, Fusion Markets does not impose an inactivity fee. This is particularly beneficial for traders who may take extended breaks between trades, as they can do so without worrying about incurring unnecessary charges.

Spreads and Commissions

Fusion Markets is highly competitive when it comes to spreads and commissions. For forex trading, the broker offers spreads starting from as low as 0.0 pips on major currency pairs, combined with a commission of just $4.50 per standard lot traded (round-turn). This makes Fusion Markets one of the most cost-effective brokers for forex traders. For other asset classes, spreads vary but remain competitive, ensuring that traders can engage in the markets with minimal cost impact.

Overall, Fusion Markets’ fee structure is designed to be as trader-friendly as possible, with no hidden fees, low spreads, and minimal commissions. This ensures that traders can maximize their profits while keeping costs to a minimum, a key reason why many choose this broker.

Regulation

Fusion Markets operates under a strong regulatory framework, which adds a layer of trust and security for traders. The broker is committed to maintaining transparency and adhering to industry standards, making it a reliable choice for traders worldwide. Here’s an in-depth look at the regulatory aspects of Fusion Markets:

Regulator Licences of Fusion Markets

-

ASIC – Australian Securities and Investments Commission – Australia:

Operating under the Australian Financial Services License (AFSL) number 226199, Fusion Markets is required to comply with strict financial standards, including maintaining sufficient capital reserves, segregating client funds, and undergoing regular audits. This ensures that the broker operates with integrity and in the best interest of its clients.

Investors Protection

As an ASIC-regulated broker, Fusion Markets offers a high level of investor protection. Client funds are held in segregated accounts with top-tier Australian banks, ensuring that your money is kept separate from the broker’s operational funds. This means that even in the unlikely event of Fusion Markets facing financial difficulties, your funds remain protected. Additionally, ASIC requires brokers to have comprehensive insurance policies to further safeguard clients against potential losses due to broker insolvency.

About Fusion Markets

Fusion Markets was founded in 2017 by a team of experienced professionals in the forex and CFD industry. Since its inception, the broker has focused on providing low-cost trading solutions and exceptional customer service. Over the years, Fusion Markets has grown rapidly, attracting a global clientele thanks to its transparent operations, competitive pricing, and reliable trading platforms. The broker’s strong regulatory oversight by ASIC and its commitment to protecting client interests have played a crucial role in building its reputation as a trustworthy and dependable trading partner.

In summary, Fusion Markets’ regulatory compliance, combined with its strong investor protection measures and reputable history, make it a secure and reliable choice for traders looking to engage in the global markets.

Fusion Markets Trading Platform

Fusion Markets offers a robust and versatile trading platform experience that caters to the needs of various traders, whether they are beginners or experienced professionals. The broker provides access to the widely recognized MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader platforms, both known for their reliability, advanced features, and ease of use.

Mobile Trading Platform

The mobile trading experience with Fusion Markets is seamless and highly functional, thanks to the MT4 and MT5 mobile apps available for both iOS and Android devices. These apps allow traders to manage their accounts, execute trades, and monitor markets on the go. The mobile platforms are equipped with most of the features available on the desktop versions, including advanced charting tools, technical indicators, and customizable alerts. The user interface is intuitive, ensuring that traders can quickly access important information and place trades with minimal effort.

Web Trading Platform

Fusion Markets also offers the MetaTrader WebTrader platform, which allows traders to access their accounts directly from their web browser without needing to download any software. The WebTrader platform is fully synchronized with the desktop and mobile versions, ensuring that you can switch between devices without missing any data or trade opportunities. It offers the same powerful charting tools, indicators, and trading functionalities, all within a secure and user-friendly interface. This is ideal for traders who need flexibility and want to trade from any location with internet access.

Desktop Trading Platform

The desktop versions of MT4 and MT5 provided by Fusion Markets are the most comprehensive and feature-rich trading platforms available. They offer advanced charting capabilities, automated trading through Expert Advisors (EAs), and a wide range of technical indicators. Traders can also customize their workspace, set up multiple charts, and use sophisticated order types to enhance their trading strategies. The desktop platform is particularly suitable for traders who require in-depth analysis tools and prefer a more detailed and customizable trading environment.

| Trading Platform | Fusion Markets |

|---|---|

| MT4 | Yes |

| MT5 | Yes |

| CTrader | Yes |

| Own platform | No |

| Mobile: IOS | Yes |

| Mobile Android | Yes |

Deposit & Withdraw

Fusion Markets provides a straightforward and cost-effective process for deposits and withdrawals, catering to the needs of both beginner and seasoned traders. The broker supports a variety of payment methods and account currencies, making it easy to manage your funds efficiently.

Deposit Methods

Fusion Markets offers several deposit methods, including:

Bank Transfer: Available for both local and international transfers.

Credit/Debit Card: Major cards such as Visa and MasterCard are accepted.

E-wallets: Options like Skrill and Neteller are supported.

Cryptocurrency: Fusion Markets also allows deposits in popular cryptocurrencies like Bitcoin.

Deposits are typically processed instantly for most methods, except for bank transfers, which may take 1-3 business days. Importantly, Fusion Markets does not charge any fees for deposits, regardless of the payment method.

Withdrawal Methods

The withdrawal process at Fusion Markets is equally smooth, with the same variety of methods available:

Bank Transfer

Credit/Debit Card

E-wallets

Cryptocurrency

Withdrawals are processed within one business day, ensuring that you can access your funds quickly. For most methods, Fusion Markets does not charge a withdrawal fee. However, international bank transfers might incur a fee depending on your bank and the currency used.

Account Currencies

Fusion Markets offers a variety of base currencies for trading accounts, allowing you to avoid conversion fees. The supported account currencies include:

USD (United States Dollar)

AUD (Australian Dollar)

EUR (Euro)

GBP (British Pound)

SGD (Singapore Dollar)

JPY (Japanese Yen)

The availability of multiple base currencies provides flexibility, especially for international traders, as it reduces the need for currency conversion, thereby lowering trading costs.

In summary, Fusion Markets offers a hassle-free and cost-efficient deposit and withdrawal process with a variety of options to suit different trader preferences. The absence of deposit fees, quick withdrawal processing, and the availability of multiple account currencies make it a convenient broker for managing your trading funds.

Research & Education at Fusion Markets

Fusion Markets provides a solid foundation for traders through its research and educational resources, although the offerings are more limited compared to some competitors. The broker focuses on providing essential tools and content to help traders make informed decisions, but it may not fully cater to those seeking in-depth educational material or advanced market analysis.

Research Tools

Fusion Markets offers a range of basic research tools that are integrated into the MetaTrader 4 and MetaTrader 5 platforms. These tools include:

Economic Calendar: A regularly updated calendar that highlights key economic events, such as interest rate decisions, GDP reports, and employment figures, which can impact market movements.

Market News: The broker provides access to market news from reputable sources directly within the trading platform. This news covers major developments in the forex, commodities, indices, and cryptocurrency markets.

Technical Analysis Tools: The MT4 and MT5 platforms offer a variety of charting tools, indicators, and graphical objects to help traders perform technical analysis and identify potential trading opportunities.

Educational Resources

While Fusion Markets focuses more on providing a low-cost trading environment, it does offer some educational content aimed primarily at beginner traders:

Trading Guides: Fusion Markets provides basic trading guides that cover fundamental topics such as forex trading basics, risk management, and platform tutorials. These guides are useful for those new to trading who need to understand the essentials.

Webinars: Occasionally, the broker hosts live webinars that cover market updates and trading strategies. These sessions can be valuable for traders who want to learn directly from industry experts.

Glossary: A comprehensive glossary is available to help traders understand common trading terms and jargon, making it easier to navigate the world of forex and CFD trading.

Areas for Improvement

While the existing research and educational resources are practical, Fusion Markets could enhance its offering by providing more advanced content, such as in-depth market analysis, trading strategies, and more frequent webinars. Expanding its educational materials would make the broker even more attractive to novice traders and those looking to develop more sophisticated trading skills.

In summary, Fusion Markets provides essential research tools and basic educational content to support its traders. However, those looking for a more extensive educational experience or advanced research capabilities may need to supplement these offerings with external resources.

Customer Support

Fusion Markets takes customer support seriously, providing traders with reliable and efficient assistance whenever needed. The broker offers multiple channels for contacting their support team, ensuring that clients can get help in a timely manner.

Contact Methods

Fusion Markets offers several ways to reach their customer support team:

Live Chat: Available directly on the Fusion Markets website, live chat is the fastest way to get answers to your questions. During our testing, we found that responses were prompt, usually within a few minutes, and the support agents were knowledgeable and courteous.

Email Support: Traders can reach out via email at [email protected]. Email queries are typically responded to within 24 hours. This method is ideal for more detailed inquiries or if you need a written record of the communication.

Phone Support: For those who prefer speaking to a representative directly, Fusion Markets offers phone support. Their phone lines are staffed during business hours, and the support team is well-trained to handle various issues from account setup to technical problems.

Social Media: Fusion Markets is also active on social media platforms like Facebook, Twitter, and LinkedIn, where they can address general inquiries and provide updates.

Availability and Response Time

Fusion Markets’ customer support is available 24/5, aligned with the forex market hours. During our tests, we found that live chat responses were almost immediate, while email responses were received within a few hours, even outside of peak times. Phone support was also efficient, with minimal waiting time.

Support Quality

The quality of support at Fusion Markets is commendable. The agents are well-informed and capable of resolving a wide range of issues, from account-related queries to platform troubleshooting. Whether you’re a beginner needing help with the basics or an experienced trader facing complex issues, the support team is equipped to assist effectively.

In summary, Fusion Markets provides excellent customer support with multiple contact options, quick response times, and knowledgeable agents. This makes the broker a reliable partner for traders who value strong and accessible customer service.

Account Types

| Feature | Classic Account | Zero Account | Swap-Free Account | Pro Account |

|---|---|---|---|---|

| Spreads | Included in spread (no commission) | 0.0 pips (raw spreads) | Depends on chosen account type | Lower spreads with higher leverage |

| Commission | No commission | $2.25 per side | No swap fees | Requires Wealth or Sophisticated Investor Test |

| Best For | Simple trading, no additional calculations | Active traders and scalpers | Traders adhering to religious beliefs | AU and ASIC traders seeking higher leverage |

| Leverage | Up to 1:500 | Up to 1:500 | Available across all account types | Up to 1:500 |

Fusion Markets offers a streamlined approach to account types, focusing on simplicity and low costs. This approach makes it easy for traders to choose the account that best suits their needs without being overwhelmed by too many options. Here’s a detailed look at the available account types:

Standard Account

The Standard Account is designed for traders who want to benefit from Fusion Markets’ low-cost trading environment without any additional complexities. Key features of the Standard Account include:

Spreads from 0.0 pips: Combined with a low commission of $4.50 per lot traded (round-turn).

Leverage up to 500:1: Depending on the asset and regulatory jurisdiction.

No account maintenance fees: Keeping trading costs to a minimum.

Access to MT4 and MT5 platforms: Suitable for both beginner and experienced traders.

Hedging and scalping allowed: Offering flexibility in trading strategies.

Zero Account

The Zero Account is tailored for traders who prefer tighter spreads and are willing to pay a slightly higher commission per trade. This account is ideal for high-frequency traders or those using Expert Advisors (EAs) who benefit from ultra-low spreads. Key features include:

Spreads from 0.0 pips: Providing the tightest possible spreads.

Commission of $4.50 per lot traded (round-turn): A slightly higher cost per trade to achieve zero spreads.

Leverage up to 500:1: Similar to the Standard Account, offering ample leverage.

No account maintenance fees: Ensuring cost-effective trading.

Access to MT4 and MT5 platforms: Full functionality for advanced trading.

Islamic Account

Fusion Markets also offers an Islamic Account option, which is compliant with Sharia law. This account type is swap-free, meaning no interest is charged on overnight positions. The Islamic Account is available upon request and provides the same trading conditions as the Standard Account, but without the interest-related fees.

Demo Account

For traders looking to test the platform and trading strategies, Fusion Markets provides a Demo Account. This account mirrors live trading conditions without the risk, allowing traders to practice with virtual funds. It’s a great tool for beginners to get comfortable with the trading environment and for experienced traders to refine their strategies.

In summary, Fusion Markets offers a straightforward selection of account types that cater to various trading styles and needs. Whether you are a novice trader, a high-frequency trader, or someone seeking swap-free trading, Fusion Markets has an account option that aligns with your trading goals.

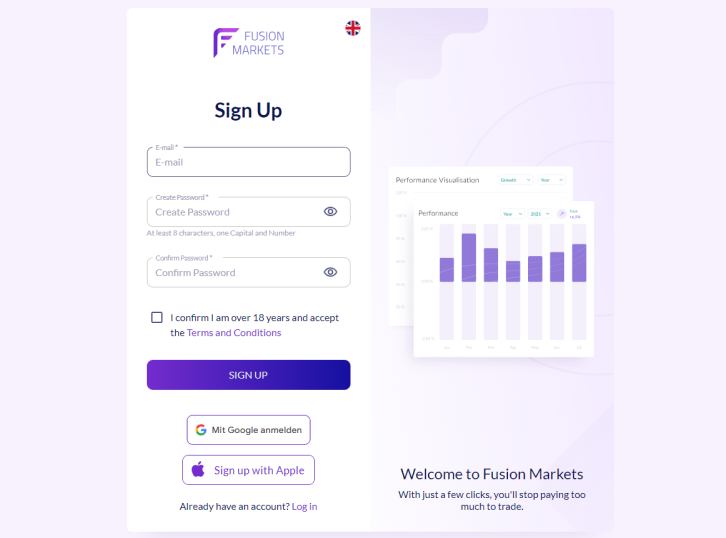

Account Opening

Opening an account with Fusion Markets is a straightforward and user-friendly process designed to get you trading as quickly as possible. The broker has streamlined the process to ensure that both new and experienced traders can set up their accounts with minimal hassle.

Steps to Open an Fusion Markets Account:

- Visit the Fusion Markets Website: Start by navigating to the Fusion Markets website. Click on the “Open Account” button, typically found at the top right corner of the homepage.

- Select Account Type: You will be prompted to choose between the Standard Account, Zero Account, or Islamic Account. Select the account type that best suits your trading preferences.

- Complete the Registration Form: Fill out the registration form with your personal details, including your name, email address, phone number, and country of residence. You’ll also need to create a secure password for your account.

- Verify Your Identity: To comply with regulatory requirements, Fusion Markets requires you to verify your identity. You’ll need to upload a copy of your government-issued ID (passport, driver’s license, or national ID) and proof of address (utility bill or bank statement). The verification process is typically completed within 24 hours.

- Fund Your Account: Once your account is verified, you can proceed to fund it. Fusion Markets offers various deposit methods, including bank transfer, credit/debit card, e-wallets, and cryptocurrency. Choose the method that is most convenient for you and complete the deposit process.

- Start Trading: After funding your account, you can log in to the MetaTrader 4 or MetaTrader 5 platform and begin trading. You’ll have access to all the instruments and features available with your chosen account type.

Account Approval Time

Fusion Markets aims to approve new accounts within 24 hours, provided all documentation is correctly submitted. The process is quick and efficient, allowing you to start trading as soon as possible.

Ease of Process

The account opening process is designed to be intuitive and simple, with clear instructions at each step. The Fusion Markets website is user-friendly, and customer support is available to assist if you encounter any issues during the process.

In summary, opening an account with Fusion Markets is a fast and hassle-free experience. The broker’s efficient process, combined with the availability of multiple account types, ensures that traders can quickly start their trading journey with minimal delays.

Open AccountFusion Markets Review Results

In conclusion, Fusion Markets stands out as a top-tier broker for traders seeking a cost-effective, reliable, and straightforward trading experience. The broker’s competitive edge lies in its ultra-low trading fees, robust regulatory framework, and user-friendly trading platforms, which cater to both beginner and experienced traders.

Key Strengths:

Low Trading Costs: With some of the lowest spreads and commissions in the industry, Fusion Markets is an ideal choice for cost-conscious traders.

Wide Range of Instruments: The broker offers access to over 250 trading instruments, including forex, indices, commodities, and cryptocurrencies, allowing for diversified trading strategies.

Strong Regulation: Regulated by ASIC, Fusion Markets provides a secure and transparent trading environment, backed by robust investor protection measures.

Excellent Customer Support: With multiple contact options and quick response times, Fusion Markets excels in customer service, ensuring traders receive the support they need.

Areas for Improvement:

Limited Educational Resources: While adequate for beginners, the educational content could be expanded to include more in-depth material and advanced market analysis.

No Proprietary Platform: Fusion Markets relies on the popular MT4 and MT5 platforms but lacks a proprietary trading platform, which some traders might prefer.

Final Verdict:

Fusion Markets is an outstanding broker for those who prioritize low costs, regulatory security, and a user-friendly trading experience. Its streamlined offerings and focus on delivering value to traders make it a compelling choice, particularly for those engaged in forex and CFD trading. Although it could enhance its educational resources and consider adding a proprietary platform, Fusion Markets’ overall package is highly competitive and well-suited for traders of all levels.

Best 4 Fusion Markets Alternatives

FAQ

MarketBulls Testing Methodology

At MarketBulls, our commitment to delivering accurate, reliable, and comprehensive reviews is at the core of everything we do. Our testing methodology is designed to provide traders with insights that are grounded in real-world experience, thorough analysis, and a deep understanding of the financial markets.

1. Expertise and Experience:

Our reviews are conducted by seasoned trading professionals who bring years of market experience to the table. Each review is meticulously fact-checked and validated by our in-house experts to ensure it meets the highest standards of accuracy and relevance.

2. Self-Testing and Hands-On Evaluation:

We don’t just rely on theoretical data or external sources. Every broker review undergoes a rigorous self-testing process, where our analysts actively trade on the platforms under review. This hands-on approach allows us to assess the broker’s performance across key areas such as execution quality, platform usability, fee structures, and customer support. By engaging with the platforms ourselves, we provide insights that are both practical and trustworthy.

3. Transparent and Unbiased:

Integrity is central to our methodology. MarketBulls operates with complete transparency, ensuring that all reviews are unbiased and free from external influence. We disclose any potential conflicts of interest and maintain objectivity throughout our review process. Our goal is to empower traders with information that helps them make informed decisions tailored to their specific trading needs.

To support the ongoing work of our platform, MarketBulls may earn commissions from affiliate links. However, this does not impact our review process or the information we provide. Our reviews are based solely on the quality, features, and performance of the brokers, ensuring that our readers receive honest and reliable assessments.

4. Comprehensive Analysis:

Our reviews cover a broad spectrum of factors, including regulatory compliance, asset diversity, trading conditions, and user experience. By considering the needs of both novice and professional traders, we deliver well-rounded evaluations that highlight both the strengths and areas for improvement for each broker.

5. Continuous Updates:

The financial markets are dynamic, and so are our reviews. We continuously monitor changes in broker offerings, regulations, and market conditions to ensure our content remains up-to-date. This commitment to ongoing accuracy allows us to provide our readers with the most current and relevant information available.

Risk Disclaimer

Trading financial instruments, including but not limited to forex, CFDs, stocks, and cryptocurrencies, carries a high level of risk and may not be suitable for all investors. The leveraged nature of these products can work both to your advantage and disadvantage. As a result, you may lose more than your initial investment.

Before deciding to trade, it is essential to understand the risks involved fully. Ensure you are aware of your risk tolerance and seek independent financial advice if necessary. Past performance is not indicative of future results, and no trading strategy can guarantee returns.

MarketBulls makes every effort to provide accurate and reliable information. However, we do not guarantee the completeness, timeliness, or accuracy of the information provided. MarketBulls is not responsible for any losses incurred as a result of trading decisions based on the information presented on this site.

Please note that trading leveraged products carries a significant risk of losing all your invested capital. It is crucial to only trade with money you can afford to lose. MarketBulls does not offer financial advice, and all content is for informational purposes only.

Fusion Markets Client Reviews: Verified Trader Feedback

Discover authentic reviews from Fusion Markets traders. Every review is thoroughly vetted before publication to ensure accuracy and trustworthiness. Learn what our clients have to say about our trading platforms, customer service, and overall experience with Fusion Markets. Have experience with Fusion Markets? Share your feedback by writing your own review today!

There are no reviews yet. Be the first one to write one.