Broker Comparison 2025: Trading, Forex, Stocks

Choosing the right broker is essential for your trading success, whether you’re dealing in forex, stocks, or other assets. Our Broker Comparison 2025 offers a detailed analysis of the top brokers in the industry, highlighting their strengths and weaknesses. We evaluate key factors such as fees, instruments, deposit & withdraw, trust, regulatory compliance, trading platforms, and customer support to help you find the best broker for your needs. Explore our expert research and user feedback to make an informed decision and enhance your trading strategy.

How to Choose the Right Broker for Your Needs

Choosing the right broker can shape your entire trading journey—impacting both convenience and profitability. Broker reviews offer in-depth insights that help you decide which platform aligns best with your trading goals. Below is a concise roadmap to guide you through any forex broker comparison, stock broker comparison, or online broker comparison.

-

Assess Your Trading Goals:

Decide whether you’re focusing on short-term day trading or long-term investments. Knowing your investment horizon, risk tolerance, and trading frequency helps in narrowing down the right broker.

-

Evaluate Broker Regulation and Security:

Always pick a regulated broker that offers safeguards like segregated client funds and robust encryption. Bodies such as the SEC (US), FCA (UK), and ASIC (Australia) enforce strict standards.

-

Explore Trading Platforms:

A user-friendly, feature-rich platform (with real-time data, advanced charting, and a solid mobile app) can significantly enhance your trading experience.

-

Compare Fees and Commissions:

Scrutinize trading commissions, spreads, account charges, and inactivity fees. Even small costs can chip away at profits over time.

-

Check Customer Support:

Reliable, responsive support can save you headaches—especially if you trade across multiple time zones or are new to online trading.

-

Look at Available Assets:

Ensure the broker offers the markets you want to trade—forex, stocks, commodities, indices, or cryptocurrencies—so you can diversify as needed.

-

Use Demo Accounts:

A demo account lets you practice in real market conditions without risking capital. It’s invaluable for both novices and experienced traders testing new strategies.

-

Read Reviews & Gather Feedback:

Seek out genuine user testimonials and expert analyses. Forums and social media often reveal both positives and red flags that official sites might not mention.

-

Final Considerations:

Once you’ve narrowed down your options, confirm your top pick aligns with your financial goals and comfort level. Action Steps:

- List your top priorities (e.g., low fees, wide asset range, great mobile app).

- Use comparison tools and detailed reviews to filter choices.

- Start small—test with a demo or minimal deposit.

Following these steps ensures you select a broker that supports your strategy, boosts your overall trading experience, and helps you achieve financial targets for 2025 and beyond.

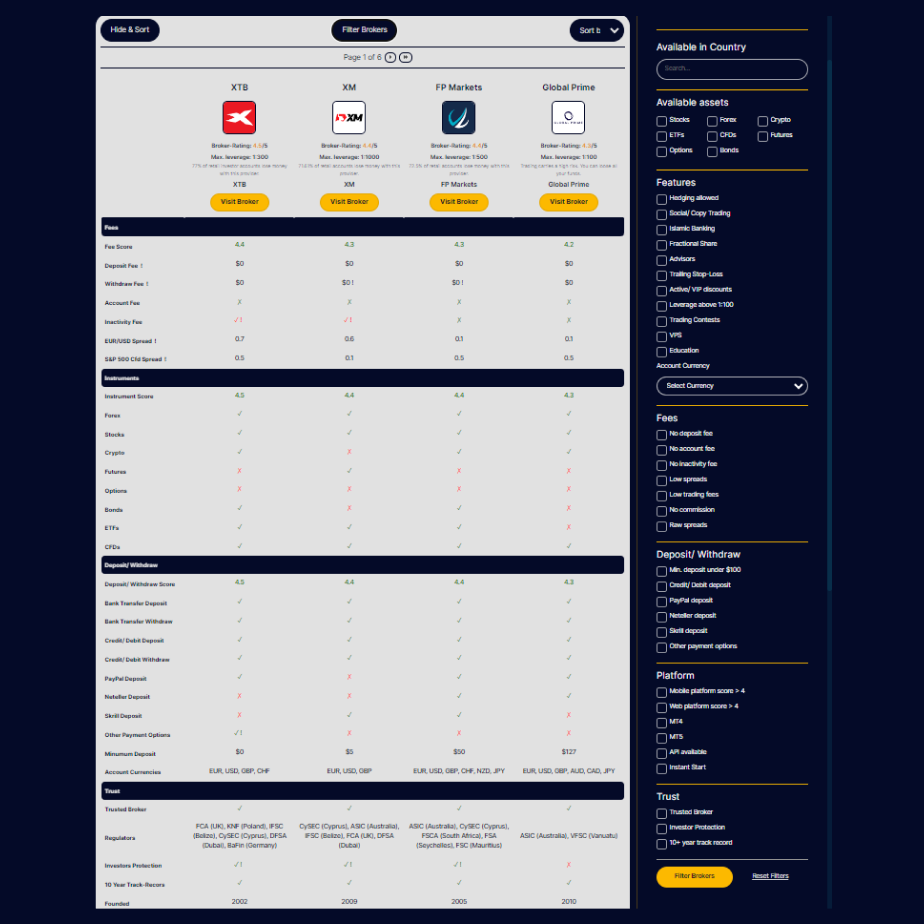

Comparing Trading Brokers Has Never Been Easier

Comprehensive Filters

Narrow your options using advanced filtering. Whether you prefer a low-commission broker or a top forex broker, our system focuses on fees, platform features, asset variety, and regulatory compliance.

Side-by-Side Comparison

View key aspects—like trading costs, platform usability, and support channels—in an easy-to-read table. Quickly pinpoint the best broker for your unique trading style.

Expert Research

Leverage detailed reviews crafted by industry experts and real users. These insights highlight each broker’s strengths and weaknesses, guiding you toward a smart decision in any broker comparison.

How the MarketBulls Broker Comparison Works

Our tool streamlines broker selection with a clear, side-by-side analysis. Whether you’re pursuing a forex broker comparison or stock broker comparison, here’s the process:

- Select Your Criteria: Filter by country availability, asset classes (forex, stocks, crypto, etc.), fees, platform capabilities, and trust factors.

- Compare Brokers Side-by-Side: Examine fees, regulations, trading platforms, and more in one table, making it easy to spot top picks.

- Check Detailed Ratings & Reviews: Each broker is scored on important metrics such as fees, deposit/withdrawal methods, and overall trustworthiness.

- Interactive Filtering & Sorting: Sort by rating, spreads, or specific features to narrow down your selection effectively.

- Quick Access to Broker Details: Click “Visit Broker” for comprehensive info, from regulatory status to account minimums.

- User-Friendly Interface: Enjoy an intuitive design that even beginners can navigate with ease.

By harnessing the MarketBulls comparison tool, you can swiftly evaluate multiple brokers based on real-time data, community feedback, and expert insights, ensuring a confident choice.

MarketBulls Broker Comparison Methodology

At MarketBulls, accuracy, impartiality, and consistency drive our evaluations. Here’s a snapshot of our methodology:

- Data Collection: We compile up-to-date facts from regulatory bodies, official broker websites, and genuine user reviews.

- Evaluation Criteria: Each broker is measured on fees, regulatory compliance, platforms, asset range, support, and any additional perks.

- Expert Reviews: Industry professionals perform hands-on testing to verify trading conditions and platform usability.

- User Feedback: Real-world testimonials supplement our findings, reflecting actual client satisfaction and experiences.

- Regular Updates: Our listings are refreshed to account for market shifts, new broker features, and changing regulations.

This multi-faceted approach guarantees that our broker comparisons are current, thorough, and suited to traders with diverse strategies and goals.

Find Your Broker NowThe information presented here is for educational purposes and doesn’t constitute financial advice. While we aim for accuracy and timeliness, no guarantee is given regarding completeness or reliability. Trading involves substantial risk, including potential loss of principal. Perform independent research or consult a qualified advisor before investing.

Actions taken based on this information are at your own risk; MarketBulls is not liable for any related direct or indirect damages.

For full disclosures, fee structures, and risk guidelines, visit each broker’s official site and review their terms, risk statements, and conditions.