Commitments Of Traders

COT Report Data, Charts & Index –

Commitments Of Traders

MarketBulls provides you the latest Commitment of Traders report as well as a clean, understandable chart preparation, cot data tables and the historical data for each market for the COT report. You will get all relevant insights for free and on one view.

Important: The backlog has been cleared and all missing reports have been released; the CFTC has returned to its normal weekly COT publication schedule, with regular weekly reports continuing as usual.

Latest Update: February 13, 2026 | Next Update: February 20, 2026

Below is the latest COT Report which was published on Friday 22-03-2022 after market close at 15:30 CET by the CFTC. The Commitments of Traders Report shows the positions as of Tuesdays close at 20-03-2022.

*Click the futures symbols to draw the chart and get the futures specific insights!

| Market | COMMERCIALS | LARGE SPECULATORS | SMALL TRADERS | OPEN INTEREST | NET COMMERCIALS | COT | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | Long | Change | Short | Change | Long | Change | Short | Change | Long | Change | Short | Change | Value | Change | Change % | Positions | Change % | Index | |

CFTC COT Report

What is Commitments of Traders Data?

The Commitments of Traders (COT) report is a market report, which is published weekly by the CFTC (Commodity Futures Trading Commission). The COT report gives insights on the positions of different market participants in the US. The Position Data is based on reports by different firms, like clearing members and brokers. The COT classification/ category of each firm is based on the major business purpose. This business purpose is specified by the firm itself and is checked by the CFTC on veracity. At the point of checking the classification, the CFTC does not know the specific reasons for the positions of the traders. That could lead to misleading information, because one trader holds different positions of a specific future for different reasons, but is specified in one classification for the whole report. That’s nothing evil, just something to keep in mind on deeper COT analysis.

Publication Date

When COT is published?

The Commitments of Traders Report is published on every Friday of the week at 03:30 E.T. The latest Cot Data Table contains the positions of the different market participants from Tuesday the same week. The COT report stands for transparency of the futures market and provides all investors the latest information how different market participants are placed with their orders.

CFTC Commitments of Traders Legacy Report –

ICE Futures U.S. – Short Format

Types of COT Reports

The COT Report includes 4 different reports: Legacy, Traders in Financial Futures, Supplemental and Disaggregated.

Legacy Report

The COT Legacy Report is provided as a futures only report and a futures and options report. The Legacy Report classifies all traders in commercial, non-commercial traders and non-reportable traders. MarketBulls provides you the graphical and tabular real time and historical Commitments of Traders Legacy Report for each asset above.

Traders in Financial Futures Report

The Traders in Financial Futures Report is a COT Report, which classifies the different market participants in “sell side” and “buy side” entities. The report is available as a futures only report or a combined options and futures report. The report classifies traders into 4 different market participants…

Disaggregated

This COT report gives more insights on the Commercials and Non-commercial Traders. The Disaggregated report splits the commercial traders into producers, merchants, processors and swap dealers. On the other hand, the Non-commercial Traders are split into managed money and other reportables. This COT report is used to get a transparent view on how the different commercial groups are placed in comparison to the different speculators.

Supplemental

The Supplemental COT Report is specialized on agriculture commodity assets. The report classifies the different market participants into Commercial, Non-commercial and Index Traders. This COT report includes futures and options positions.

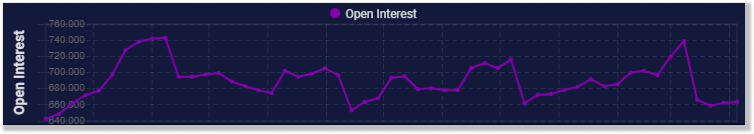

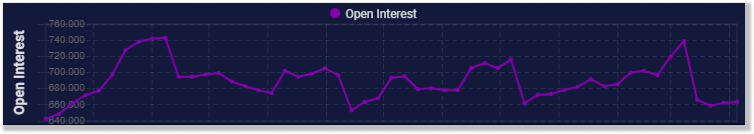

OI

Open Interest Data

The COT Open Interest is the total position that entered the market in a specific time. The long open interest should be equal to the short open interest. The overall open interest is the basis of the COT data. Open interest is needed to calculate the nonreportable positions. At the same time, we can use the open interest to analyze the behavior of specific market participants, for example, which percentage of the open interest was entered by the commercials.

MarketBulls COT Open Interest Chart

Positions

Net Positions Chart

The raw CFTC data is not very helpful. Standalone long and short positions in their self do not give many insights about the overall positioning of a market participant. For that, we calculate the net positions of every market participant. That gives a much clearer view on the overall positioning in that market. The comparison of the net positions is giving us the first understanding of the overall situation. You can get the chart and historical comparison on each market on the overview table.

MarketBulls COT Net Positions Chart

MarketBulls COT Open Interest Chart

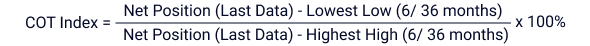

Index

COT Index Charts

The net positions can give us first impressions of the positioning, but to view the ratio between the net positioning of each participant to the historical net positioning is much more important. The COT Index brings the actual net positions in perspective to the historical net position data. For that, we provide you with 2 Cot indexes: The 6-month cot index and 36-month cot index. Important for the calculation are the last net position, the lowest low of each period (3 years/ 36 months or 6 months) as well as the highest high in the same period. With this index, you can clearly see if the participants are extremely long or short with their net positions.

MarketBulls COT Index Chart

Trading Insights

How to use COT Data for Trading?

To use the COT report & charts for your own trading, you must analyze the net positioning of the different market participants as well as the long and short extremes on a specific period (36 or 6 months). For deeper insights you can use our free Cot index, which puts the net positions in perspective to the extremes of the period. That is how you analyze a cot report correctly. A correct cot analysis can make you a participant for a long-term trend which is already in progress or is just evolving with a market reversal.

Implementation

There is no Holy Grale

The COT report gives us a clear understanding of the overall market situation. But it is not a timing instrument and does not give any clear information when to enter the market. We can get insights if a trend will remain, or a reversal is taking place. With that, you should use the cot analysis in combination with seasonal tendencies and actual entry techniques. Use the Cot report as part of your higher timeframe and fundamental analysis to get clear institutional insights.

CFTC: Commodity Futures

Trading Commission