Risk & Trade Planning

Position Size CalculatorLot Size Calculator

Stop Loss Take Profit Calc

Risk to Reward Calculator

Breakeven & Win Rate

Risk of Ruin Calculator

Margin Call Calculator

Forex Calculators

Pip Value CalculatorMargin Calculator

Forward Rate Calculator

Carry Trade Calculator

Leverage Calculator

Volatility Calculator

Spread Calculator

Forex Rebate Calculator

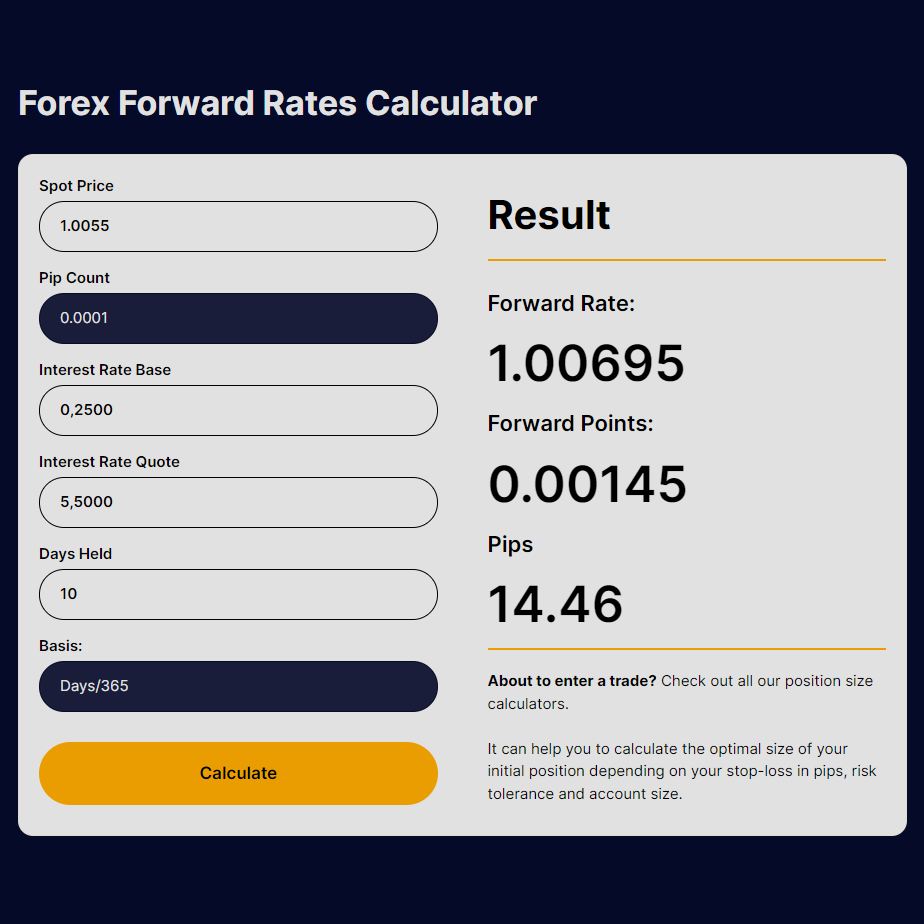

Forex Forward Rates Calculator

Result

Forward Rate:

0.0000

Forward Points:

0.00

Pips

0.00

About to enter a trade? Check out all our trading calculators.

Stay ahead of the game by analyzing your trades with precision, ensuring accurate and long-term profitable trading decisions.

Forward Rates

Unlock the Future with Forward Rates

In the dynamic world of Forex trading, the only certainty is uncertainty. Market volatility can turn the tide in an instant, which is why forward rates are not just tools but lifelines for investors who wish to hedge their bets against this constant flux. A forward rate calculator stands as your financial compass, guiding you through the fog of currency speculation into clearer, more predictable waters. Whether you’re securing a 1-year forward rate for a major enterprise or calculating EUR/USD exchange for an upcoming transaction, this tool is indispensable.

Forward Rates Demystified

At its core, a forward rate is an agreed-upon future price of a currency pair. Unlike spot rates, which reflect current values, forward rates are predictive, fixed, and legally binding. They’re the epitome of financial foresight—locking down prices today to avoid the twists and turns of tomorrow’s Forex market.

How to calculate forward rate remains a question for many. It’s a complex interplay of current exchange rates and the interest rate differentials between two currencies. The forward rate calculator streamlines this process, converting complexity into simplicity with just a few clicks.

The Mechanics of Forward Rate Calculation

The calculation of forward exchange rates is a dance of numbers: spot prices pirouette with interest rates over the time frame stage. Each field in our calculator mirrors an element of this dance. The ‘Spot Price’ reflects today’s market valuation, while ‘Pip Count’ measures the exchange rate movement—both set the stage. ‘Interest Rate Base’ and ‘Interest Rate Quote’ are the tempo, dictating the rhythm of different currencies’ interest rates over the chosen ‘Days Held’. The ‘Basis’ is the choreography, determining how interest rate dance aligns with the calendar year.

The formula itself may seem arcane, but its application is made user-friendly through our tool. Take the EUR/USD forward rate calculation—by inputting the current exchange rate and respective interest rates, our calculator deftly determines what rate should be locked in today for a transaction set a year or any other term into the future.

Using the Forward Rate Calculator

The true power of our fx forward rate calculator lies not just in its functionality but in its ease of use. Begin with accurate current market data, and fill in each field carefully. The Spot Price should reflect the current exchange rate of your currency pair. Next, the Pip Count—the smallest price move that a given exchange rate can make—adds precision to your calculation. Then, enter the Interest Rate Base and Interest Rate Quote, which are the current interest rates of the currencies involved.

For traders involved in longer-term financial planning, the 1 year forward rate calculator option projects the rate 365 days ahead, taking into account the number of days held and the basis for the year.

Forward Rate Calculation as Your Trading Ally

Currency forward rate calculation is not just a mere convenience—it’s a cornerstone of savvy Forex strategy. By leveraging the insights from the forward rate calculator, traders and businesses can make informed decisions, minimize risk, and capitalize on financial opportunities.

In the ever-shifting landscape of global finance, tools that provide clarity and foresight are not just helpful; they’re essential. Our forward rate calculator is more than just a tool—it’s your partner in navigating the Forex markets.

FAQ

A forward rate calculator is an online tool that calculates the future exchange rate between two currencies based on current rates and interest differentials.

To calculate the forward rate, you input the spot price, pip count, interest rates for both currencies, and the duration into the calculator. The tool then provides the forward rate.

The formula typically involves the spot rate adjusted for the interest rate differential between the two currencies over the desired time frame.

The accuracy of the calculation depends on the current data inputs and the reliability of the interest rates provided.

It calculates the future exchange rate for the EUR/USD pair by comparing the current spot rate and the interest rate differential for the Euro and U.S. dollar.