Risk & Trade Planning

Position Size CalculatorLot Size Calculator

Stop Loss Take Profit Calc

Risk to Reward Calculator

Breakeven & Win Rate

Risk of Ruin Calculator

Margin Call Calculator

Forex Calculators

Pip Value CalculatorMargin Calculator

Forward Rate Calculator

Carry Trade Calculator

Leverage Calculator

Volatility Calculator

Spread Calculator

Forex Rebate Calculator

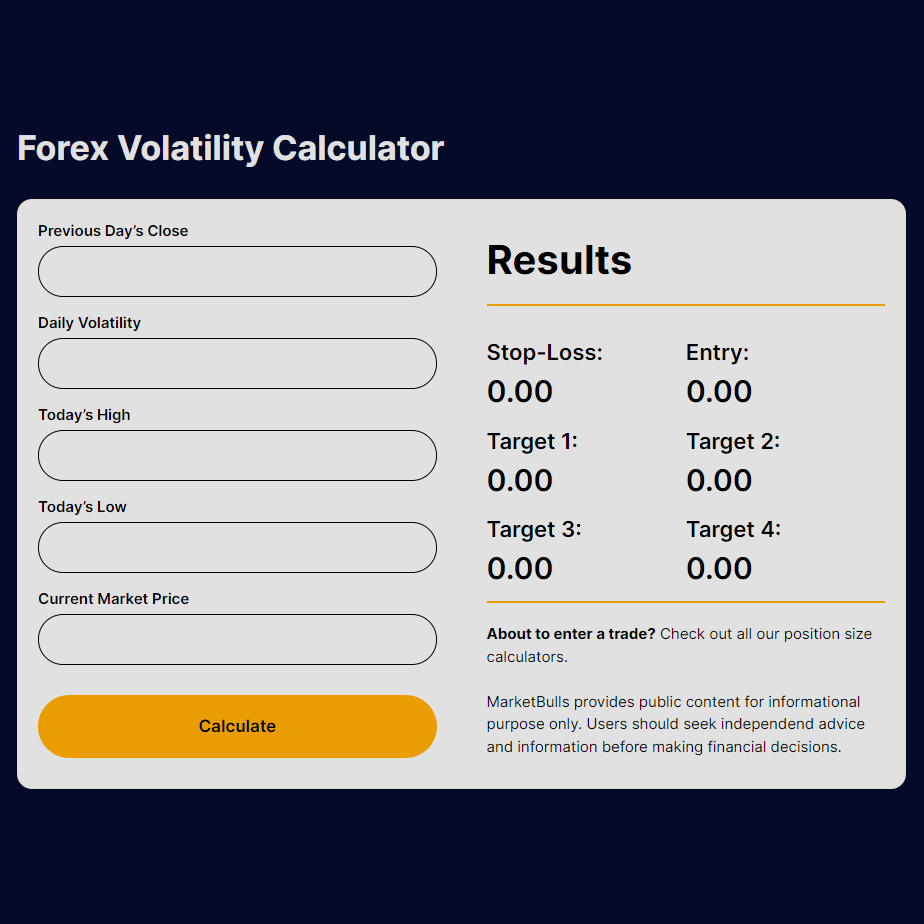

Forex Volatility Calculator

Results

Stop-Loss:

0.00

Entry:

0.00

Target 1:

0.00

Target 2:

0.00

Target 3:

0.00

Target 4:

0.00

About to enter a trade? Check out all our trading calculators.

Stay ahead of the game by analyzing your trades with precision, ensuring accurate and long-term profitable trading decisions.

Forex Volatility Calculator

Forex and Volatility

Navigating the Forex market demands keen insight into market volatility. Our Forex Volatility Calculator is an indispensable tool for traders seeking to stay ahead. By understanding and utilizing volatility, you can make informed decisions to manage risks and capitalize on market movements.

How to Use the Forex Volatility Calculator

Our Forex Volatility Calculator empowers you to gauge the pulse of the market with precision. To calculate volatility, simply input the Previous Day’s Close, Daily Volatility, Today’s High, Today’s Low, and the Current Market Price. The calculator will furnish key metrics, including Stop-Loss, Entry, and Target Levels, assisting you in crafting a robust trading strategy.

To understand how is volatility calculated, it’s essential to recognize that forex volatility reflects the frequency and extent of currency price fluctuations. High volatility indicates significant price movement, while low volatility suggests minimal change.

Maximizing Trading Strategies with Volatility

Incorporating volatility calculation into your trading can significantly enhance your strategies. By pinpointing periods of high volatility, you can anticipate market trends and adjust your positions accordingly. Conversely, recognizing low volatility can signal a time for caution.

Our volatility calculator is designed to provide real-time data, which is crucial in the fast-paced Forex market. Understanding how volatility is calculated in forex market dynamics enables traders to adapt to rapid changes, ensuring they remain profitable in diverse market conditions.

Understanding the Calculation Formula for Forex Volatility

When diving into the Forex market, understanding the calculation formula for volatility is key to effective trading. Volatility in Forex is a statistical measure of the dispersion of returns for a currency pair over a given period. It’s often expressed as the standard deviation or variance between returns from that same currency pair.

Here’s a simplified breakdown of the formula used in a Forex Volatility Calculator:

Standard Deviation:

The formula for standard deviation (σ) is the square root of the sum of squared deviations from the mean, divided by the count of observations minus one. In plain terms, it is:

σ = square root of [(1/(N-1)) * Σ(i=1 to N) (Pi – μ)^2]

Where:

σ is the standard deviation,

N is the number of observations,

Pi is the price of the i-th observation,

μ is the mean price of the dataset,

Σ represents the sum of the following values from i=1 to N.

Average True Range (ATR):

The formula for Average True Range (ATR) is the average of true ranges over a specified number of periods. It is expressed as:

ATR = (1/N) * Σ(i=1 to N) TRi

Where:

ATR is the average true range,

N is the specified number of periods,

TRi is the true range of the i-th period,

Σ represents the sum of the true ranges across N periods.

Moving Average

This is applied to both the standard deviation and ATR to smooth out the volatility curve, making it easier to identify trends and patterns over a certain period.

These mathematical concepts behind the volatility calculation provide the backbone for the Forex Volatility Calculator. It processes these complex formulas instantly to present traders with actionable data. This includes anticipated price movements and potential risk, which is critical for setting stop-losses and target levels.

FAQ

A Forex Volatility Calculator is a trading tool that computes the expected volatility of a currency pair by analyzing past market movements. It helps traders in decision-making by forecasting potential price swings.

By assessing the current and historical volatility, the calculator suggests entry points that align with periods of lower volatility, aiming for stability as you enter the market.

Target levels are set based on anticipated price movements derived from volatility calculations, allowing traders to position their targets within realistic bounds of expected price action.

Volatility-based stop-loss and target levels adjust for market conditions, optimizing the balance between risk management and profit potential.

Monitor the calculator’s updates and be prepared to modify your stop-loss and target levels, as well as entry points, to adapt to new volatility patterns.