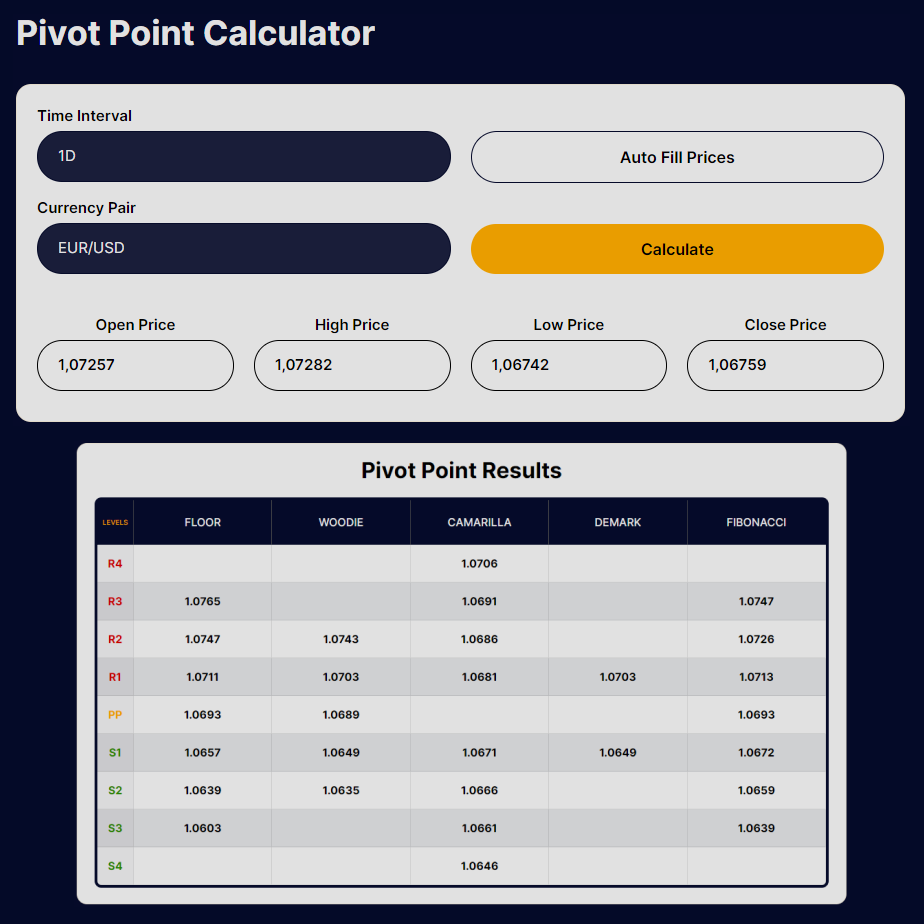

The Science Behind Pivot Point Calculation

How are pivot points calculated? These levels are derived from a simple mathematical formula based on the average of the high, low, and close prices from the previous trading session.

Our calculator features several methods:

- Pivot Points Floor Calculation: This traditional method focuses on the basic pivot level (PP) and calculates support and resistance levels (S1-S4, R1-R4) as potential turning points for price action.

- Pivot Points Woodie Calculation: Woodie’s method gives more weight to the closing price of the previous period, offering a different perspective on market sentiment.

- Pivot Points Camarilla Calculation: Camarilla equations use a sequence of numbers to provide a more refined set of potential support and resistance levels, intended for short-term, intraday trends.

- Pivot Points Demark Calculation: Tom Demark’s approach is unique in that it gives a single pivot point, helping to anticipate potential price movements.

- Pivot Points Fibonacci Calculation: This method applies Fibonacci ratios to the high, low, and close to predict future support and resistance levels, respecting the market’s tendency to move in waves.

Advanced Pivot Point Calculations

Whether you’re interested in forex, stocks, commodities, or indices, pivot points are universal. They serve as a foundation for many trading strategies, and our calculator is equipped to support traders of all levels.

Incorporate our pivot point calculator into your trading routine to enhance your market analysis. It’s not just a tool but a critical component for informed and strategic trading decisions.