Share this review:

Trading carries high risks. Losses can exeed initial funds.

- Vantage Pros and Cons

- Why to choose Vantage

- Trading Instruments at Vantage

- Trading Fees

- Regulation

- Vantage Trading Platform

- Deposit & Withdraw

- Research & Education at Vantage

- Customer Support

- Account Types

- Account Opening

- Vantage Review Results

- Best 4 Vantage Alternatives

- FAQ

- MarketBulls Testing Methodology

- Vantage Client Reviews

Trading carries high risks. Losses can exeed initial funds.

Visit VantageVantage is a globally recognized online broker offering access to a wide array of financial markets, including forex, commodities, indices, shares, and cryptocurrencies. Established in 2009, Vantage has steadily grown to become a trusted name in the trading community, known for its cutting-edge trading technology, competitive spreads, and a strong regulatory framework. With a client-centric approach, Vantage provides traders with a range of account types, flexible trading conditions, and an intuitive trading platform that caters to both beginners and seasoned professionals. In this self-tested review of Vantage, we will delve into every aspect, giving you a comprehensive overview of what this broker has to offer.

Is Vantage Available in My Country?

Check if Vantage is available in your country:

Vantage Pros and Cons

Pros

- Regulated by Multiple Authorities

- Competitive Spreads and Low Commissions

- Advanced Trading Platforms

- Excellent Customer Support

Cons

- Limited Number of Tradable Instruments

- High Inactivity Fee

- No Proprietary Trading Platform

Why to choose Vantage?

Choosing Vantage as your trading broker comes with several compelling advantages. First and foremost, the broker’s commitment to transparency and regulatory compliance is evident through its licensing with multiple top-tier financial authorities. This ensures that your funds are held securely and that the broker operates under strict guidelines.

Vantage also stands out for its competitive trading conditions, offering tight spreads and low commissions that are particularly attractive for forex traders. The availability of advanced trading platforms, including MetaTrader 4 and 5, caters to both beginner and professional traders, providing powerful tools and seamless execution.

Trading Instruments at Vantage

Vantage offers a diverse selection of trading instruments, covering major asset classes that appeal to a broad range of traders. The available instruments include:

| Trading Instrument | Available |

|---|---|

| Forex | Available |

| Stocks | Available |

| Crypto | Available |

| Futures | Not Available |

| Options | Not Available |

| Bonds | Not Available |

| ETFs | Not Available |

| CFDs | Available |

Forex: Vantage provides access to over 40 currency pairs, including major, minor, and exotic pairs. This makes it an ideal platform for forex traders looking to diversify their portfolios.

Commodities: Traders can engage in the trading of popular commodities such as gold, silver, oil, and natural gas. These instruments offer opportunities for hedging and diversification.

Indices: Vantage offers trading on major global indices such as the S&P 500, NASDAQ, FTSE 100, and more. These instruments allow traders to speculate on the overall performance of a stock market rather than individual stocks.

Shares: Through its trading platform, Vantage provides access to a range of global shares, allowing traders to invest in some of the world’s largest and most well-known companies.

Cryptocurrencies: Vantage has expanded its offerings to include popular cryptocurrencies like Bitcoin, Ethereum, and Ripple. This allows traders to take advantage of the growing interest and volatility in the digital currency market.

With this broad range of instruments, Vantage caters to traders with different interests and strategies, ensuring there are plenty of opportunities for portfolio diversification and strategic trading.

Trading Fees

Vantage is known for offering competitive trading fees, which are structured to cater to both beginner and advanced traders. Here’s a detailed breakdown of the trading fees associated with this broker:

| Fees | Vantage |

|---|---|

| Deposit Fee | $0 |

| Withdraw Fee | $0 |

| Account Fee | No |

| Inactivity Fee | No |

| EUR/USD Spread | 0.5 |

| S&P 500 Cfd Spread | 0.2 |

Deposit Fee at Vantage

Vantage does not charge any fees for deposits across most payment methods. Whether you choose to fund your account via bank transfer, credit/debit card, or e-wallets, you can expect your entire deposit to be credited to your account without any deductions.

Withdraw Fees at Vantage

Similar to deposits, Vantage does not impose withdrawal fees on most of its available payment methods. However, international bank withdrawals may incur charges from intermediary banks, which is something to be mindful of.

Account Fee

Vantage does not charge any account maintenance or management fees. This means that you can maintain your trading account with Vantage without worrying about hidden charges eating into your profits.

Inactivity Fee

Vantage applies an inactivity fee of $50 if your account remains dormant for 12 months or longer. This fee is relatively standard in the industry but may be a consideration for traders who do not trade frequently.

Spreads and Commissions

Vantage offers highly competitive spreads, especially for major forex pairs. Spreads can be as low as 0.0 pips on RAW ECN accounts, which is a significant advantage for high-frequency traders. Standard accounts have slightly wider spreads but are commission-free, while the RAW ECN and Pro ECN accounts charge a low commission fee per trade, making them ideal for traders who prioritize cost efficiency.

Regulation

Regulation is a critical factor when choosing a broker, and Vantage stands out due to its compliance with several top-tier regulatory bodies. This section covers the regulatory framework that ensures Vantage operates under strict guidelines, providing traders with a secure and trustworthy trading environment.

Regulator Licences of Vantage

Vantage is regulated by multiple financial authorities across different jurisdictions, ensuring a high level of security and compliance. These include:

-

ASIC – Australian Securities and Investments Commission – Australia:

Vantage is licensed and regulated by the Australian Securities and Investments Commission (ASIC) under the license number AFSL 428901. ASIC is one of the most respected regulatory bodies in the world, known for its rigorous enforcement of financial regulations. ASIC ensures that Vantage adheres to strict guidelines regarding capital requirements, client fund protection, and operational transparency. -

FCA – Financial Conduct Authority – United Kingdom:

In the UK, Vantage is regulated by the Financial Conduct Authority (FCA) under the license number FRN 590299. The FCA is globally recognized for its stringent regulatory framework, which emphasizes transparency, consumer protection, and market integrity. Vantage’s adherence to FCA regulations is a testament to its commitment to maintaining the highest standards in financial services. -

VFSC – Vanuatu Financial Services Commission – Vanuatu:

Vantage operates its international services under the regulation of the Vanuatu Financial Services Commission (VFSC) with license number 700271. While the VFSC is considered a less stringent regulator compared to ASIC and FCA, it still ensures that Vantage adheres to basic international standards for financial services.

These regulatory licenses ensure that Vantage operates within a strict framework designed to protect traders and maintain the integrity of financial markets.

Investors Protection

As part of its regulatory obligations, Vantage provides robust investor protection measures. Client funds are kept in segregated accounts with top-tier banks, ensuring that they are not mixed with the broker’s operational funds. This segregation of funds ensures that in the unlikely event of insolvency, client funds remain secure. Additionally, as an FCA-regulated broker, Vantage clients in the UK are protected by the Financial Services Compensation Scheme (FSCS), which offers coverage up to £85,000.

About Vantage

Vantage was established in 2009 and has since grown into a globally recognized broker, serving clients in over 150 countries. The broker has built a solid reputation for its transparency, reliability, and commitment to providing traders with a superior trading experience. Over the years, Vantage has received numerous awards for its trading platforms, customer service, and overall performance, further cementing its position as a leading broker in the industry.

Vantage Trading Platform

Vantage offers a range of powerful and intuitive trading platforms designed to meet the needs of all types of traders, from beginners to professionals. The platforms provide access to various markets with advanced tools and features that enhance the trading experience.

Mobile Trading Platform

Vantage offers mobile trading through the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These mobile apps are available for both iOS and Android devices, allowing traders to manage their accounts, monitor the markets, and execute trades on the go. The mobile platform is user-friendly and retains most of the functionality available on the desktop version, including charting tools, technical indicators, and real-time quotes.

Web Trading Platform

The Vantage web trading platform is accessible directly through a web browser, eliminating the need for any software download. The web platform is powered by MT4 and MT5, offering a seamless trading experience with advanced charting tools, customizable interfaces, and one-click trading capabilities. The web platform is ideal for traders who prefer to trade from different devices or locations.

Desktop Trading Platform

For traders who prefer a more robust trading environment, Vantage offers the MT4 and MT5 desktop platforms. These platforms are known for their advanced features, including algorithmic trading, expert advisors (EAs), and comprehensive charting tools. The desktop platform is suitable for professional traders who require high-level analytical tools and custom indicators.

| Trading Platform | Vantage |

|---|---|

| MT4 | Yes |

| MT5 | Yes |

| CTrader | No |

| Own platform | No |

| Mobile: IOS | Yes |

| Mobile Android | Yes |

Social/ Copy Trading

Vantage supports social and copy trading through its partnership with ZuluTrade and Myfxbook. These platforms allow traders to follow and copy the trades of experienced traders automatically. This feature is especially beneficial for novice traders or those who wish to diversify their trading strategies by leveraging the expertise of others.

Overall, Vantage’s trading platforms are well-equipped with the tools and features needed for successful trading. Whether you prefer trading on a desktop, web, or mobile, Vantage has you covered with reliable and advanced solutions.

Deposit & Withdraw

Vantage provides a wide range of deposit and withdrawal options designed to offer convenience and flexibility to its global client base. The broker supports multiple payment methods, account currencies, and ensures fast processing times to make transactions as seamless as possible.

Deposit Methods and Process

Vantage offers several deposit methods, including:

Bank Transfer: Available for both local and international transfers. While local bank transfers are generally free and processed within 1-2 business days, international transfers may take 3-5 business days depending on the banks involved.

Credit/Debit Cards: Vantage accepts Visa and MasterCard payments. Deposits made via credit or debit card are typically processed instantly, allowing you to start trading without delay.

E-wallets: Options such as PayPal, Neteller, and Skrill are supported. E-wallet deposits are processed almost instantly and are a popular choice due to their speed and ease of use.

Cryptocurrency: Vantage also accepts deposits in cryptocurrencies such as Bitcoin. These deposits are processed quickly, making them a suitable option for traders who prefer using digital assets.

Vantage does not charge fees for deposits, but third-party payment processors or banks may impose their own charges.

Withdrawal Methods and Process

Vantage supports the same methods for withdrawals as for deposits, including bank transfers, credit/debit cards, e-wallets, and cryptocurrency. Withdrawal requests are typically processed within 1-2 business days, though the time for the funds to reach your account may vary depending on the method chosen.

Bank Transfer: Local withdrawals are processed quickly, usually within 1-3 business days. International withdrawals may take longer, and fees may apply due to intermediary bank charges.

Credit/Debit Cards: Withdrawals to credit/debit cards are processed within 1-2 business days, but the time for funds to appear on your card may vary depending on your card issuer.

E-wallets: E-wallet withdrawals are processed rapidly, often within a few hours to 1 business day, making them one of the fastest withdrawal options.

Cryptocurrency: Cryptocurrency withdrawals are processed quickly, usually within a few hours, depending on blockchain network confirmations.

Vantage does not charge withdrawal fees for most methods, but international bank withdrawals might incur fees due to intermediary banks.

Account Currencies

Vantage supports a variety of account base currencies, including USD, EUR, GBP, AUD, CAD, SGD, and JPY. Having multiple account currency options allows traders to avoid currency conversion fees, which can save money on deposits and withdrawals.

Overall, Vantage’s deposit and withdrawal processes are efficient, with a range of options to suit different trader preferences. The lack of deposit and withdrawal fees on most methods is a significant advantage, although traders should be aware of potential third-party charges.

Research & Education at Vantage

Vantage is committed to empowering its traders with top-notch research and educational resources. The broker offers a range of materials tailored to both beginners and experienced traders, ensuring everyone has access to the knowledge they need to succeed. From video tutorials and webinars to detailed articles, Vantage covers the fundamentals of trading, technical analysis, and risk management. These resources are continually updated to reflect the latest market developments.

For more advanced traders, Vantage provides in-depth market analysis, daily commentary, and trading signals. These tools are designed to help traders make informed decisions and stay ahead of market trends. The broker also hosts live webinars and trading events where traders can engage with industry experts and refine their trading strategies.

Vantage enhances its educational offerings by partnering with leading market research providers. This collaboration ensures that traders receive the latest market news, economic data, and professional insights. Overall, Vantage’s blend of education and research tools equips traders with the knowledge and confidence to navigate the financial markets effectively.

Customer Support

Vantage offers comprehensive customer support designed to assist traders at every stage of their trading journey. The broker provides 24/5 multilingual support, ensuring that traders from various regions can communicate in their preferred language. The support team is highly responsive, knowledgeable, and capable of addressing a wide range of inquiries, from technical issues and account management to trading-related questions.

Traders can reach Vantage’s customer support through multiple channels:

Live Chat: Instant response for urgent queries.

Email: Responses typically within 24 hours.

Phone: Direct and immediate assistance for complex issues.

Additionally, Vantage has an extensive FAQ section on its website, covering common questions and providing quick solutions without the need to contact support directly.

Vantage’s commitment to customer service is further evidenced by its proactive approach to client satisfaction. The broker frequently gathers feedback from users to improve its services and ensure a seamless trading experience. Overall, Vantage’s customer support is robust, reliable, and tailored to meet the diverse needs of its global clientele.

Account Types

Vantage offers a variety of account types designed to accommodate traders with different levels of experience, trading styles, and capital. Whether you are a beginner looking for a straightforward account or a professional trader seeking advanced features, Vantage has an account that suits your needs.

Standard STP Account

This is the ideal choice for beginners or casual traders. The Standard STP account offers commission-free trading with slightly wider spreads. It provides access to the full range of trading instruments and platforms, with a minimum deposit requirement that is accessible for most traders.

RAW ECN Account

The RAW ECN account is tailored for more experienced traders who prefer tighter spreads. This account type features spreads starting from 0.0 pips, with a competitive commission per trade. The RAW ECN account is suitable for scalpers and high-frequency traders who need the best possible pricing.

Pro ECN Account

The Pro ECN account is designed for professional traders and institutional clients. It offers the lowest possible spreads, starting from 0.0 pips, and a lower commission rate compared to the RAW ECN account. This account requires a higher minimum deposit, reflecting its focus on serious traders who manage larger volumes.

Islamic Account

Vantage also offers a swap-free Islamic account that complies with Sharia law. This account type is available on both the Standard STP and RAW ECN accounts, making it a flexible option for traders who require swap-free trading conditions.

Demo Account

Vantage provides a demo account option, which is perfect for beginners or anyone looking to test the platform before committing real funds. The demo account offers virtual funds and access to all the trading features, allowing traders to practice strategies and get comfortable with the platform without any risk.

Each account type at Vantage provides access to the broker’s full suite of platforms, including MetaTrader 4, MetaTrader 5, and the mobile trading app. The variety of account types ensures that every trader, regardless of experience or strategy, can find a suitable option with Vantage.

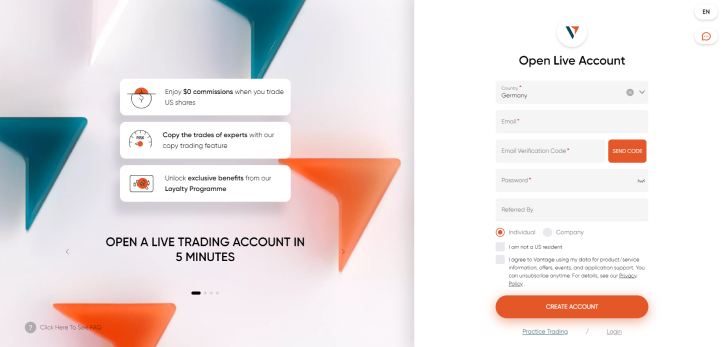

Account Opening

Opening an account with Vantage is a straightforward process that can be completed online within minutes. The broker has streamlined the account opening procedure to ensure that traders can start trading as quickly and efficiently as possible. The process involves a few key steps that require minimal documentation, making it accessible to both beginners and experienced traders.

Steps to Open an Vantage Account:

- Registration: Begin by visiting the Vantage website and clicking on the “Open Live Account” button. You will be prompted to fill out a registration form with your personal details, including your name, email address, phone number, and country of residence.

- Account Selection: After registration, you will need to choose the type of account that best suits your trading needs. Vantage offers several account types, including Standard STP, RAW ECN, Pro ECN, and Islamic accounts. You can also select your preferred base currency at this stage.

- Verification: To comply with regulatory requirements, Vantage will ask you to verify your identity and address. This step involves uploading a government-issued ID (such as a passport or driver’s license) and a proof of address (such as a utility bill or bank statement). Verification is typically completed within 24 hours.

- Funding: Once your account is verified, you can proceed to fund it. Vantage supports various deposit methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrency. There are no deposit fees for most methods, and funds are usually available in your account instantly.

- Start Trading: After funding your account, you’re ready to start trading. You can download the MetaTrader platform of your choice or use the web trader to begin accessing the markets.

Vantage’s account opening process is designed to be user-friendly and efficient, allowing traders to get up and running with minimal hassle. Whether you are a beginner or an experienced trader, the process is intuitive, with clear instructions provided at each step.

Open AccountVantage Review Results

After thoroughly testing and evaluating Vantage in this broker review, it is clear that this broker stands out as a strong contender in the online trading space. Vantage offers a well-rounded package with competitive spreads, low trading fees, and a robust selection of trading instruments. The broker’s commitment to regulatory compliance, as evidenced by its licenses with ASIC, FCA, and VFSC, provides traders with a secure trading environment and peace of mind.

Vantage’s trading platforms, including MetaTrader 4 and MetaTrader 5, cater to both beginner and professional traders, offering advanced tools and seamless execution. The variety of account types ensures that all traders, from novices to high-frequency professionals, can find a suitable option tailored to their needs. Additionally, the broker’s strong customer support and extensive educational resources make it an excellent choice for those seeking both guidance and a solid trading experience.

Overall, Vantage is a reliable and well-regulated broker that excels in providing a user-friendly, feature-rich trading environment. Whether you are new to trading or an experienced trader looking for a broker with competitive pricing and advanced tools, Vantage is a highly recommended choice.

Best 4 Vantage Alternatives

Fusion Markets

Trading carries a high risk. Losses can exeed initial funds.

Read review Visit BrokerFAQ

MarketBulls Testing Methodology

At MarketBulls, our commitment to delivering accurate, reliable, and comprehensive reviews is at the core of everything we do. Our testing methodology is designed to provide traders with insights that are grounded in real-world experience, thorough analysis, and a deep understanding of the financial markets.

1. Expertise and Experience:

Our reviews are conducted by seasoned trading professionals who bring years of market experience to the table. Each review is meticulously fact-checked and validated by our in-house experts to ensure it meets the highest standards of accuracy and relevance.

2. Self-Testing and Hands-On Evaluation:

We don’t just rely on theoretical data or external sources. Every broker review undergoes a rigorous self-testing process, where our analysts actively trade on the platforms under review. This hands-on approach allows us to assess the broker’s performance across key areas such as execution quality, platform usability, fee structures, and customer support. By engaging with the platforms ourselves, we provide insights that are both practical and trustworthy.

3. Transparent and Unbiased:

Integrity is central to our methodology. MarketBulls operates with complete transparency, ensuring that all reviews are unbiased and free from external influence. We disclose any potential conflicts of interest and maintain objectivity throughout our review process. Our goal is to empower traders with information that helps them make informed decisions tailored to their specific trading needs.

To support the ongoing work of our platform, MarketBulls may earn commissions from affiliate links. However, this does not impact our review process or the information we provide. Our reviews are based solely on the quality, features, and performance of the brokers, ensuring that our readers receive honest and reliable assessments.

4. Comprehensive Analysis:

Our reviews cover a broad spectrum of factors, including regulatory compliance, asset diversity, trading conditions, and user experience. By considering the needs of both novice and professional traders, we deliver well-rounded evaluations that highlight both the strengths and areas for improvement for each broker.

5. Continuous Updates:

The financial markets are dynamic, and so are our reviews. We continuously monitor changes in broker offerings, regulations, and market conditions to ensure our content remains up-to-date. This commitment to ongoing accuracy allows us to provide our readers with the most current and relevant information available.

Risk Disclaimer

Trading financial instruments, including but not limited to forex, CFDs, stocks, and cryptocurrencies, carries a high level of risk and may not be suitable for all investors. The leveraged nature of these products can work both to your advantage and disadvantage. As a result, you may lose more than your initial investment.

Before deciding to trade, it is essential to understand the risks involved fully. Ensure you are aware of your risk tolerance and seek independent financial advice if necessary. Past performance is not indicative of future results, and no trading strategy can guarantee returns.

MarketBulls makes every effort to provide accurate and reliable information. However, we do not guarantee the completeness, timeliness, or accuracy of the information provided. MarketBulls is not responsible for any losses incurred as a result of trading decisions based on the information presented on this site.

Please note that trading leveraged products carries a significant risk of losing all your invested capital. It is crucial to only trade with money you can afford to lose. MarketBulls does not offer financial advice, and all content is for informational purposes only.

Vantage Client Reviews: Verified Trader Feedback

Explore real reviews from Vantage traders. Every review is carefully vetted before being published to ensure authenticity and trust. Discover what our clients have to say about our trading platforms, customer support, and overall experience with Vantage. Have you traded with Vantage? We encourage you to share your experience by writing your own review today!

There are no reviews yet. Be the first one to write one.