Tracing the roots of America’s economic tribulations, we often rewind to the causes of the panic of 1819, a historical juncture of financial turmoil. As we dissect the panic of 1819 causes, it becomes clear how a confluence of fiscal and societal forces ushered in the first widespread financial crisis the nation had faced. This period marked by an economic downturn in 1819, set a precedent the history of financial crises.

Understanding this significant event in economic history not only helps in appreciating the resilience of the American economy but also in learning from past challenges to fortify future financial stability.

Understanding the Era of Good Feelings and Its Economic Impact

The period post-War of 1812 in the United States, known as the Era of Good Feelings, is often romanticized for its sense of national unity and sweeping sense of patriotism. However, beneath the surface of this nationalistic facade was a complex interplay of economic strategies and policies that had far-reaching, enduring impacts.

The Rise of Nationalistic Fervor and Economic Programs

Driven by a newfound sense of American identity, key economic programs were rolled out to stabilize and improve the young nation’s economy. This included the chartering of the Second National Bank, designed to foster federal supremacy in fiscal matters, and the introduction of the protective tariff, aiming to shield domestic industries from foreign competition. These measures underscored the government’s intention to create a robust economic framework, central to which was the consolidation of national unity.

Industrialization and Transportation: Binding the Nation

Amidst the fervor of the Era of Good Feelings, industrialization took bold strides, transforming the American economy and society. Improvements in transportation, such as the expansion of the canal system and the advent of the steam locomotive, revolutionized commerce and the movement of goods. This infrastructural development was a boon for the post-war economic depression, facilitating the knitting together of a geographically vast and diverse nation.

Political Divisions and the Onset of Economic Challenges

Not all outcomes of this era were positive. The economic policies instituted during the Era of Good Feelings were not universally acclaimed. The very protective tariff and the perceived overreach of the National Bank were sources of tension, contributing to a North-South divide. Matters of the Supreme Court and states’ rights added fuel to the fire of political division. These disputes, deeply enmeshed with the issues of federal supremacy and state sovereignty, foreshadowed the more serious conflicts that awaited the Union.

| Economic Initiative | Purpose | Outcome |

|---|---|---|

| National Bank | Stabilize national currency and credit | Centralized financial power but provoked regional distrust |

| Protective Tariff | Safeguard new industries | Benefitted the North, but alienated the South |

| Transportation Improvements | Connect distant markets, spur economic growth | Fostered national trade, yet highlighted sectional differences |

As a post-war economic depression foreshadowed later financial crises, the Era of Good Feelings, ironically, laid the groundwork for the contentious decades to follow, challenging the ideals of national unity it initially sought to uphold.

Origins and Immediate Effects of the 1819 Financial Crisis

The financial panic of 1819 set a precedent as a monumental economic depression in US history, and its reach extended well beyond American borders. The crisis was multifaceted, emerging from the repercussions of a post-war economy alongside domestic monetary policies. However, an unexpected external factor added to the market chaos: the sudden recovery of European agricultural production, which sharply contrasted with American market expectations and caused international trade balances to shift unforeseeably.

The heartland of the issue was a consequence of an intricate weave of financial and agricultural policies. A significant drop in cotton prices, a staple of American exports, distorted the country’s trade equilibrium. Consequent credit constriction by the Bank of the United States aimed to stave off inflation but ended up suffocating economic growth.

In direct response to the tumultuous economic conditions, distress radiated across the nation. This manifested most notably in urban areas—indicative of which was Cincinnati, with bankruptcy sales flooding the market. Factories across industrial centers such as Lexington, Kentucky, stood silent, embodying the profound impacts of the crisis with their dormant machinery and hushed hallways of production.

Public sentiment during this period soured sharply. Resentment burgeoned against financial institutions, particularly towards the Bank of the United States, whose strict monetary policies were considered too harsh for the already struggling population.

- Escalation of unemployment to over half a million individuals

- Discontent and public demonstrations against banking practices

- Stringent monetary policy and its socioeconomic repercussions

The societal impacts of the 1819 financial panic were profound, casting a long shadow over the immediate future of the US economy and societal well-being, and laying the groundwork for policy changes in how America navigated its future financial ordeals.

| Factor | Before Crisis | After Crisis |

|---|---|---|

| Cotton Prices | High | Significantly Lower |

| Credit Availability | Expansionary | Contracted |

| European Agricultural Production | Weak | Recovering Strongly |

| Unemployment | Low | Over 500,000 jobless |

| Public Sentiment | Optimistic | Resentful towards banks |

An Overview of the First Major Financial Crisis

The Panic of 1819 stands as a defining moment in American history, epitomizing the first major financial crisis that swiftly eroded the economic stability of the fledgling nation. Compounded by a landscape fraught with bank failures, the nation grappled with a national economic downturn that would set the stage for later financial regulation and intervention. Let’s delve into the multifaceted nature of this financial upheaval and its enduring repercussions.

An In-depth Look at National Economic Turmoil

The severity of the 1819 crisis sent shockwaves through the country’s economic system, leading to widespread hardship and the unsettling realization of the volatility of national markets. Businesses buckled under the pressure, and banks were shuttered, triggering an unprecedented rise in unemployment that swept across every sector, plaguing both urban and rural communities alike.

Property Values and Unemployment: A Harsh Reality

The ripple effects of the financial crash culminated in a sharp decline in property value, with an observable deterioration that had a tangible impact on ordinary Americans. Homeownership, once a symbol of stability, became uncertain as foreclosure rates escalated. Homes, farms, and enterprises, once flourishing, saw their values plummet, leaving many bereft of their livelihoods and savings.

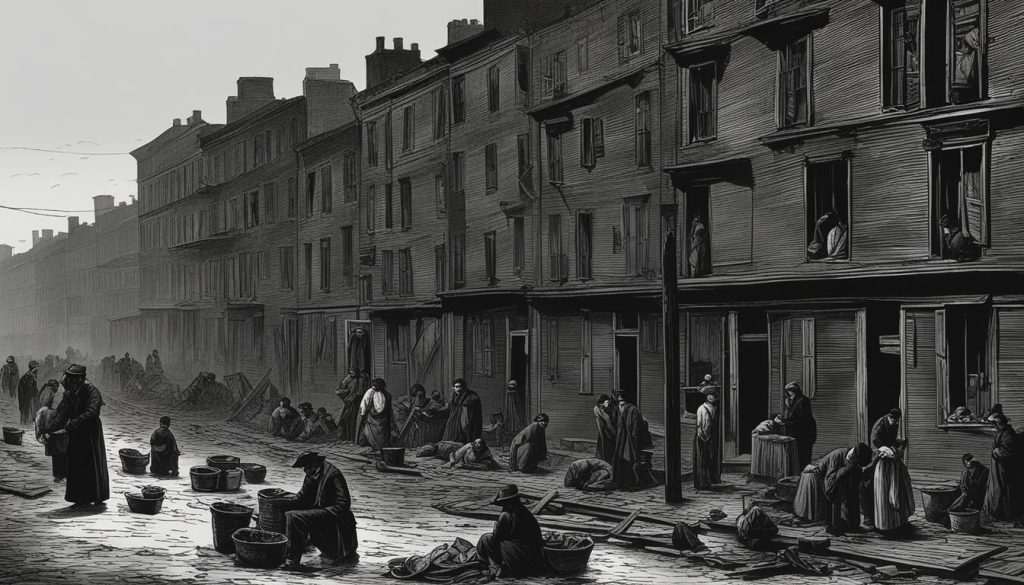

Understanding Urban Poverty in the Early 19th Century

The Panic of 1819 cast a glaring light on the stark conditions of urban poverty. The crisis exacerbated the hardships faced by the working class, with increasing numbers of families finding themselves without food or shelter. Charity support became a dire necessity as cities struggled to cope with the growing demands of their impoverished populations.

- Unemployment soared as businesses closed their doors

- Foreclosure became a common affair as banks recalled loans

- Charitable organizations were overwhelmed by the need for basic goods

- Urban centers grappled with burgeoning populations of the destitute

The data below highlights the immediate fallout of property value decline in key states, demonstrating the extent of the financial crisis on housing stability and personal wealth.

| Location | Property Value Before Crisis | Property Value After Crisis | Percentage Decline |

|---|---|---|---|

| New York State | $315 Million | $256 Million | 20% |

| Pennsylvania Land Value (per acre) | $150 | $35 | 77% |

In closing, the Panic of 1819, with its aftermath of unemployment, property value decline, and heightened urban poverty, remains a significant chapter in America’s economic narrative, offering lessons that resonate through modern financial systems. The implications of this first national economic downturn provided impetus for subsequent reforms and underscored the need for robust financial oversight.

Banking Policies: The Root of Economic Downturn in 1819

The Panic of 1819 was an economic maelstrom that shook the United States to its core. Central to the turmoil were the banking policies of the era, particularly those involving the contraction of credit instigated by the nation’s central financial institution, the Second Bank of the United States. This financial strategy, aimed at stabilizing the economy, unwittingly precipitated a domino effect of bank collapses and triggered a nationwide banking crisis in 1819.

Contraction of Credit and Banking Failures

The tightening of credit availability marked the beginning of widespread economic hardship. As loans became scarcer, businesses floundered, leading to a ripple of bank failures. The austerity measures imposed by the Second Bank of the United States further exacerbated these conditions, leaving many to face financial ruin and severe distress.

The Involvement of the Second Bank of the United States

The central bank was not immune to criticism; its earlier practices of aggressive expansion and lax credit had sown the seeds of instability. In a belated response, the Second Bank attempted to reverse the tide by calling in loans and reducing the credit supply in 1818, resulting in a sharp contraction that caused public outcry and a surge in foreclosures.

Public Reaction and Legislative Response to Banking Crises

As widespread discontent burgeoned, a series of public protests demanding debt relief swept the country. These demonstrations shed light on the plight of the indebted and underscored a growing distrust of banking institutions. In turn, legislative bodies began contemplating measures aimed at providing relief to those affected and enacting a reduction in government cost, as well as considering broader reforms to prevent a recurrence of such a crisis.

| Year | Policy Action | Public Response | Legislative Outcome |

|---|---|---|---|

| 1818 | Loan reduction by the Second Bank | Foreclosure increase and bitterness | Debate on banking reforms begins |

| 1819 | Contraction of credit | Public protests and demands for debt relief | Enactment of debt relief laws |

| Post-1819 | Reduced government spending | Skepticism towards “privileged” institutions | Legislation to regulate banking practices |

The intersection of financial policy and public sentiment during this crucial period fostered a significant reevaluation of economic governance, one that would ultimately shape the trajectory of the U.S. banking system in the decades to come.

Diving into the Economic Causes of the Panic: Detailed Analysis

The economic cataclysm of 1819, known as the Panic, wasn’t a result of singular events but a tapestry interwoven with various economic threads. Among the primary fibers were the decline in agricultural prices that rattled farmers, the contraction of western land sales that unsettled investors, and the global market adjustments that affected international trade relationships.

Agricultural Price Declines and the Speculative Bubble

The agricultural sector, once buoyant with wartime demand, faced a sharp downturn as peace returned to Europe. Grain prices plummeted, leading to widespread financial distress in rural America. This sudden deflation was a harsh contrast against the backdrop of a speculative real estate bubble that had inflated land prices to unsustainable levels. As the bubble burst, landholders and investors alike experienced the shock of rapid devaluation.

The Role of Global Market Adjustments After Napoleonic Wars

Global market adjustments post-the Napoleonic Wars saw European agriculture return to productivity, reducing the reliance on American exports. This shift not only put pressure on U.S. farmers but also affected the nation’s overall economic health, reflecting the intertwined nature of international commerce.

External Factors: Cotton Boom, European Demand, and Specie Drains

The cotton industry, once a boon for the U.S. economy due to the European demand for cotton, faced a downturn as competition rose from India. Coupled with diminishing European demand, the price of U.S. cotton slumped dramatically, signifying the onset of a crisis that would ripple through the economy. Similarly, specie drains—the flight of gold and silver abroad—tightened monetary supply, exacerbating the situation.

| Year | Cotton Price Decline | Land Sales Contraction | Agricultural Price Downturn |

|---|---|---|---|

| 1819 | Sharp Fall | Significant Decrease | Steep Drop |

| 1820 | Moderating Prices | Stabilizing but Low | Continued Descent |

| 1821 | Gradual Recovery | Modest Improvement | Slight Uptick |

As this period underscored, the economic fabric of the time was delicate, intricate, and subject to a multitude of influences—ranging from domestic policies to shifts in global demand—as the Panic of 1819 impressively illuminated.

Assessing the Role of Overexpansion of Credit

The tumultuous financial landscapes of post-War of 1812 America were in large part defined by the overexpansion of credit. A considerable explosion in the number of state-chartered banks led to a proliferation of paper money issuance, with little to no gold or silver—specie—to back it up. Such inflationary practices created widespread specie scarcity, fueling a delusory economy that was unsustainable in the long run.

At the heart of this financial misadventure was a frenzied rush into financial speculation. Frontier land acquisitions and real estate ventures experienced ballooning values due to the vast amounts of circulating unbacked paper money. Yet the repercussions of these illusory investments came at a high cost, haunting the economy with the specter of instability and eventual crash. Here we witness economic nationalism, characterized by a push for self-reliance and development, albeit with a lack of regulatory foresight which might have tempered the excessive credit creation.

- The onset of numerous state-chartered banks, unrestrained by a centralized monetary authority, gave rise to loose credit practices that magnified the economy’s susceptibility to crisis.

- Eager investors and settlers, fueled by accessible credit, engaged in rampant land speculation that far exceeded pragmatic value assessments.

- An acute shortage of specie made it increasingly difficult for banks to redeem paper notes, further eroding public trust in the financial system.

- The confluence of these factors, underpinned by a wave of economic nationalism, precipitated a severe correction in the form of the Panic of 1819—a watershed event in American economic history.

This era’s tale of overexpansion and subsequent contraction offers invaluable lessons on the importance of financial regulation and prudent economic planning. It serves as a historical mirror, reflecting the potential perils of an unbridled credit marketplace and the need for safeguarding economic stability through sound monetary policymaking.

Conclusion

The tumultuous period that followed the War of 1812, known as the post-war economic depression, encapsulates not just an epoch of financial affliction but a transformative chapter in American economic evolution. The Panic of 1819 was more than an isolated phenomenon; it was an alarm that sounded the need for systemic financial change. Its occurrence underscored the perils of a rapidly expanding economy—untamed speculation, weak regulatory mechanisms, and the precariousness of heavily leveraged economic structures.

Significantly, the crisis underscored the intricate web of global economic influences that America was becoming increasingly a part of, signaling that domestic financial stability was no longer insulated from worldwide trends. Moreover, the economic calamity provoked considerable American System criticism, with voices demanding a reassessment of protectionist policies that seemed to benefit the few at the expense of the many. As a result, a conversation was sparked, prompting societal acknowledgment that more robust oversight was necessary.

As the nation reflected on the devastating impacts of this financial upheaval, a clarion call for banking and monetary policy reforms was heeded. This led to landmark regulations designed to stabilize the economy and lay the groundwork for a more resilient financial system. As we revisit this critical juncture in our history, we reaffirm the value of vigilant economic stewardship and the adaptive capacity required to navigate the currents of a dynamic fiscal landscape.

FAQ

The Panic of 1819 was triggered by a combination of causes, such as the overexpansion of credit, particularly by state-chartered banks, a sharp decline in agricultural prices leading to the bursting of a speculative land bubble, a contraction of credit by the Bank of the United States, and the subsequent bank failures and foreclosures. The crisis was America’s first widespread financial crisis, marking a significant national economic downturn.

The Era of Good Feelings was characterized by nationalistic fervor and unity, which included the establishment of a national bank and a protective tariff, hinting at federal supremacy. Despite advancements in industrialization and transportation that boosted economic resilience, the era also saw the beginning of political divisions and triggered challenging economic issues, including post-war economic depression.

The immediate effects of the financial panic of 1819 included a dramatic slump in trade, rapid unemployment, a wave of bank failures, and a steep decline in land and property values. The crisis caused a sudden recovery of European agricultural production which also contributed to the economic depression in the U.S.

The Panic of 1819 led to a substantial drop in property values across various states, with some areas, such as New York State, experiencing a 20% fall in property values over two years. Pennsylvania also witnessed a steep decline in land prices. Unemployment soared, with estimates of half a million jobless, indicating a severe national economic downturn.

The Second Bank of the United States played a pivotal role in the Panic of 1819 by first contributing to inflationary practices and then contracting credit in an attempt to address these issues, which resulted in widespread foreclosures and aroused public resentment. This institution’s involvement was a central aspect of the banking crisis of 1819.

A severe decline in agricultural prices, particularly for cotton, fueled the Panic of 1819 by destabilizing the speculative real estate bubble that had formed. This decline was influenced by global market adjustments post-Napoleonic Wars, where European demand for American crops decreased as their agricultural sectors recovered.

External factors impacting the Panic of 1819 included the cotton boom, fueled by high European demand during the Napoleonic Wars, which collapsed as demand shifted away from American cotton. British investment in Indian cotton led to a glut in the market and a sharp drop in U.S. cotton prices. Additionally, the Congressional mandate for hard-currency land purchases in 1817 pressured financial stability, leading towards the panic.

The overexpansion of credit was a key catalyst for the Panic of 1819. State-chartered banks, unchecked by a national regulatory institution, issued paper money excessively, leading to inflationary practices. This surge in available credit encouraged rampant land speculation, which, once the bubble burst, resulted in widespread financial hardship and sparked an economic downturn.