As traders approach the complex world of forex trading, they often gravitate towards technical analysis to discern market directions and craft strategic trades. Among the myriad of tools available, trading patterns have proven to be invaluable in painting a clear picture of potential price movements. Channel patterns, in particular, stand out in forex analysis, offering traders a robust framework for understanding price trends and foreseeing lucrative entry and exit points.

These patterns serve as the backbone of many forex strategies, providing a visual guide—much like meticulously drawn blueprints—for predicting where prices may trend. Drawing parallels between the skid marks on a road to the parallel support and resistance levels seen in these channels, traders glean insights into market behaviors. As such, channel patterns in forex are not simply tools, they are the optical language of the market, articulating peaks and troughs with astounding reliability.

Understanding Channel Patterns in Forex Trading

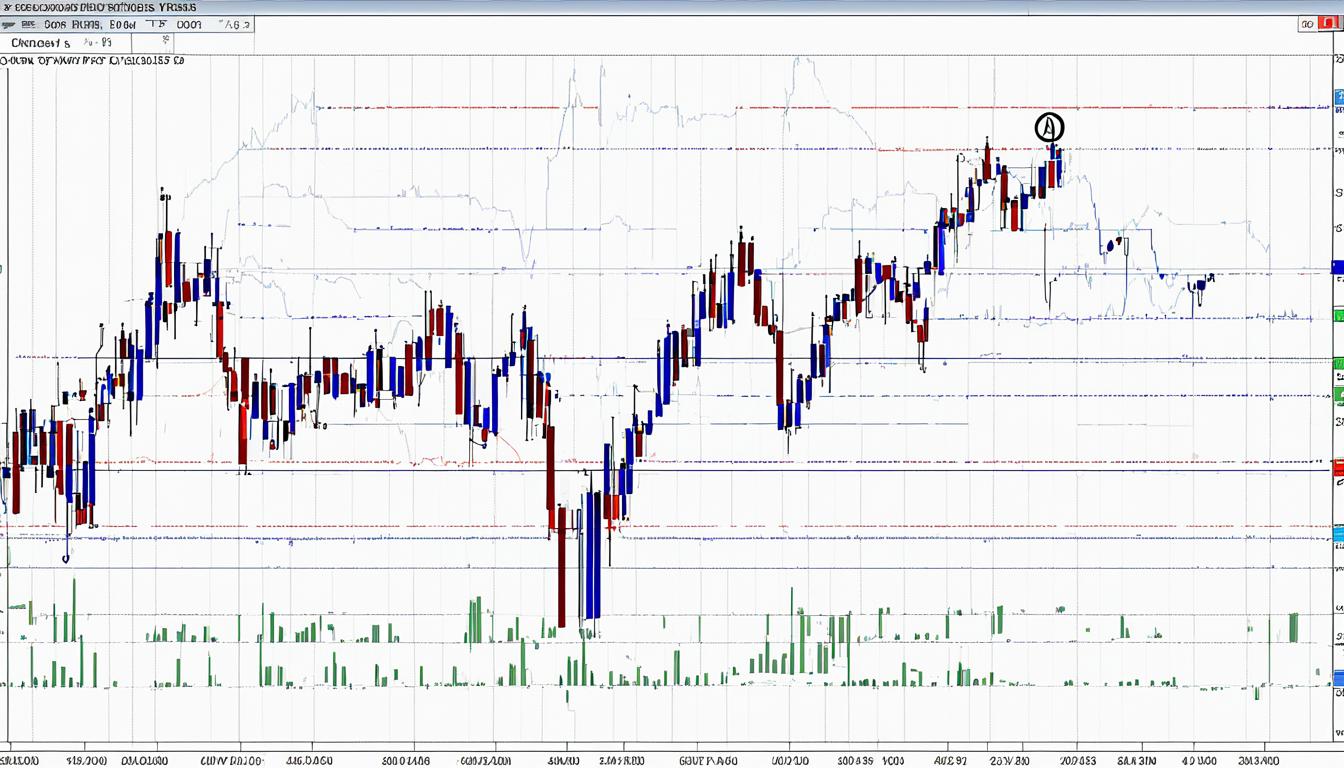

In the realm of forex trading, grasping the concept of forex channel patterns is invaluable for those seeking to bolster their market analysis efficacy. These patterns embody two fundamental lines that run parallel along a price chart, demarcating the support and resistance levels—the walls within which price action bounces back and forth. This dynamic facilitates a more comprehensive understanding of market trends, as traders monitor the historical interactions between prices and these technical boundaries.

Traders adept at interpreting chart patterns can glean insights into potential future market movements. By identifying the price oscillation that occurs within the confines of these channels, strategic trading decisions become more apparent. It is critical to recognize that these price movements are not random; rather, they consistently adhere to the rhythm established by past price action, allowing traders to anticipate probable trend continuities or reversals.

Let’s delve into the practical components of applying channel patterns to price action within the forex market:

- Determination of entry points: Traders can enter the market when the price touches the lower channel line, signaling a buy opportunity, or the upper channel line, signaling a sell prospect.

- Forecasting breakout points: A price that breaks through the channel boundaries may indicate a powerful underlying momentum, setting the stage for a breakout trade.

- Optimizing exit strategies: Aligning exit tactics with channel patterns can enhance the timing and profitability of closing positions within the markets.

To encapsulate the predictive power of forex channel patterns, consider the following table wherein recurring price actions and their implications are outlined:

| Price Contact Point | Implication |

|---|---|

| Touching Lower Channel Line | Potential Buy Signal |

| Touching Upper Channel Line | Potential Sell Signal |

| Breaking Below Lower Channel Line | Indication of Downward Breakout |

| Breaking Above Upper Channel Line | Indication of Upward Breakout |

In synthesizing the principles of channel patterns in forex trading, traders can refine their interpretative skills, elevating the sophistication of their strategic approaches within an ever-evolving forex marketplace.

Types of Channel Patterns and Their Significance

Forex traders often leverage the power of trend channels to predict market movements with higher accuracy. Diving into the granular aspects of channel patterns, we can identify three major types: the ascending, descending, and horizontal channels. Each pattern not only reflects ongoing market sentiments but also heralds potential breakout patterns. The true proficiency lies in analyzing these formations and executing trades that are aligned with underlying market trends and reversals.

Ascending Channel Pattern in Forex Analysis

An ascending channel is a bullish formation that encapsulates a trend consisting of higher highs and higher lows. This pattern underpins a robust buyer-driven market, wherein the demand for an asset is consistently outstripping the supply, propelling the prices upward.

Descending Channel Pattern and Market Sentiments

In contrast, a descending channel maps out a bearish trend, highlighting a trajectory of lower highs and lower lows. This signals heightened selling activity where market participants are eager to offload the asset, resulting in a downward price trend.

Horizontal Channel Patterns as Reversal Signals

The horizontal channel stands out as the embodiment of market consolidation, indicating a relative equilibrium between buying and selling forces. A breakout from such a pattern could potentially signal a significant trajectory reversal, making it a critical signal for forex traders.

| Channel Type | Market Trend | Significance for Traders |

|---|---|---|

| Ascending Channel | Bullish | Indicator of sustained buyer interest with potential for upward breakouts |

| Descending Channel | Bearish | Reflects an increase in selling pressure with possibilities for downward breakouts |

| Horizontal Channel | Neutral/Consolidation | Can serve as a prelude to a trend reversal |

Understanding these distinct channel patterns allows for enhanced decision-making in forex trading. Validating each pattern with multiple points of support and resistance provides a higher confidence level in the trades, while keeping a close watch for breakout patterns informs timely entries and exits. With such knowledge, traders can navigate the ebbs and flows of the market while safeguarding their investments against unforeseeable volatilities.

Channel Patterns Forex: Capitalizing on Breakout Strategies

In the realm of forex trading, breakout patterns act as essential catalysts for profitable opportunities. These patterns, identified through rigorous technical analysis, signify critical moments where traders can take strategic actions to enhance their market positions. Breakouts are pivotal junctures in price movements, breaking away from established trading channels and suggesting the commencement of a new trend.

To effectively leverage breakout patterns, traders should closely monitor these scenarios. A breach above the top of a channel indicates potential buying opportunities, while a break below could imply upcoming selling trends. However, discretion is advised—as falling victim to false breakouts can result in undue losses. Hence, it’s imperative to seek confirmation before executing a trade.

One robust method to validate a breakout is to observe a pullback on lower time frames. This technique acts as a filter, distinguishing genuine breakouts from erratic price spikes. Waiting for a pullback helps in confirming the persistence of the new trend and providing a better risk-reward ratio for the trade setup.

The table below illustrates the essential considerations when capitalizing on breakout strategies within channel patterns:

| Breakout Type | Strategy | Confirmation Technique | Trader Action |

|---|---|---|---|

| Upward Breakout | Monitor for buy signal | Wait for pullback and smaller timeframe validation | Consider entering long position |

| Downward Breakout | Assess for sell signal | Require evidence of sustained trend | Potential short position entry |

| False Breakout | Be cautious of quick price movements | Use pullbacks as fail-safes | Avoid entering prematurely |

A disciplined approach to forex trading involves not only identifying breakout patterns but also understanding the significance of timing and confirmation. This balance between proactive trading and risk mitigation forms the cornerstone of successful trading strategies within the forex market. As with any financial endeavor, managing trades remains a delicate interplay between mathematical precision and human intuition.

Technical Indicators that Complement Forex Channel Patterns

In the intricate world of forex trading, channel patterns provide a structured approach to market analysis. Traders seeking to enhance the predictability and profitability of these patterns would benefit from integrating specific technical analysis tools into their strategies. Key among these tools are the moving averages and momentum oscillators, which when used in tandem with channel patterns, can result in a powerful combination for technical analysis.

Utilizing Moving Averages with Channel Patterns

Moving averages are fundamental to smoothing market noise and identifying the direction of the trend. When applied with channel patterns, these averages can serve as dynamic support and resistance levels that adapt over time. This synergy empowers traders to pinpoint more accurate trade entry and exit points, especially when the price action bounces off or crosses these moving averages within the context of a channel.

Momentum Oscillators: RSI and Stochastics in Channel Trading

Momentum oscillators are invaluable in ascertaining the strength and potential duration of a trend. The Relative Strength Index (RSI) and Stochastics oscillator each offer unique insights into market momentum. These tools reveal overbought and oversold conditions that often precede reversals, which channel traders can exploit. A careful analysis of these oscillator levels in relation to channel patterns can signal the opportune moment to enter or exit trades.

Consider the table below, which illustrates how combining channel patterns with moving averages and RSI/Stochastics can enhance trade decisions:

| Indicator | Function in Channel Patterns | Trade Signal Enhancement |

|---|---|---|

| Moving Averages | Identifies trend direction, acts as dynamic support/resistance | Confirms channel boundary bounces and breakouts |

| RSI | Indicates overbought/oversold conditions | Highlights potential reversal points within channels |

| Stochastics | Measures momentum; predicts trend continuations and reversals | Validates strength of channel movement; warns of weakening trends |

By harmonizing channel patterns with these technical indicators, traders can cultivate a more nuanced view of the market, leading to strategic and informed trading decisions. The combination of visual pattern recognition and quantitative indicators aids in solidifying the analysis, providing a rounded approach to navigating the forex market with precision.

Money Management and Risk Control in Channel Trading

When it comes to trading forex channels, understanding the mechanics of money management and risk control can be as crucial as recognizing the technical configurations on the chart. Traders who thrive in the volatile forex market have often mastered the art of applying stringent money management principles and exercising comprehensive risk control measures.

Setting Appropriate Stop Losses Within Forex Channels

The placement of stop losses is a cornerstone of a robust forex strategy, helping traders to manage their risks effectively. A stop-loss order positioned too close to the current price can be triggered by normal market fluctuations, whereas one placed too far may result in unnecessary losses. It is essential for forex traders to appreciate the balance between these two extremes by considering the volatility within the channel and setting stop losses that incorporate this dynamic.

Profit Targets and the Psychology of Trading Channels

Beyond the technical aspects of setting profit targets, there exists a psychological component that can affect trading performance significantly. Clear profit targets encourage traders to act objectively, rather than emotionally, allowing them to secure profits methodically. It is important for traders to maintain patience and follow the trading plan without succumbing to greed in moments when market behaviour appears favourable, or conversely, fear during market downturns. Consistency in following a well-thought-out plan leads to disciplined trading within the forex channel frameworks.

| Element of Trading | Purpose | Implementation in Channel Trading |

|---|---|---|

| Stop Losses | Risk Limitation | Set outside the channel, considering volatility |

| Profit Targets | Gain Realization | Set based on realistic expectations and channel’s dynamics |

| Psychological Discipline | Maintaining Strategy Integrity | Resist overtrading, adhere to the trading plan |

| Risk Management | Protecting Capital | Use stop losses and profit targets to manage trades effectively |

Conclusion

The strategic integration of channel patterns forex into a trader’s arsenal underscores a dedication to a disciplined and structured methodology essential for success in forex trading. These pattern formations are not just mere guides; they embody a crucial analytical tool that can distinctly outline potential price paths, offering traders foresight on market trends. With an in-depth grasp of different channel patterns—whether ascending, descending, or horizontal—traders are equipped to traverse the forex terrain with enhanced precision.

Supplementing technical analysis with various indicators, such as moving averages and momentum oscillators, can refine a trader’s ability to identify and act on prime trading opportunities. However, beyond analytics, the meticulous application of robust forex strategies, together with firm money management and risk control practices, ensures a sustainable trading career. These strategies involve setting consequential stop losses and reasoned profit targets aligning with the natural ebb and flow of market movements.

Ultimately, the pursuit of proficiency in using channel patterns for forex takes traders on a journey through continuous education, patience, and steadfast adherence to their trading blueprint. As market dynamics evolve, the key to navigating the unpredictable waves of forex lies in the trader’s ability to apply channel patterns thoughtfully and adaptively, making this disciplined approach an indispensable component of any trader’s technical toolkit.

FAQ

Channel patterns in forex trading consist of two parallel lines on a chart that represent the support and resistance levels through which the price moves. These patterns are powerful tools used in technical analysis, offering visual cues to traders on potential price action within a trend.

There are three primary types of forex channel patterns – ascending, descending, and horizontal. Ascending channels indicate a bullish market trend, descending channels suggest a bearish trend, and horizontal channels often indicate a phase of consolidation or potential reversal in the market.

Validating channel patterns with multiple touches of support and resistance levels increases the reliability of the channel. A minimum of two contacts with each boundary is required for a valid channel, providing stronger trade signals when more contact points are observed. This validation helps to confirm the strength and stability of the channel pattern for trading.

Channel patterns provide a framework for assessing the potential direction of price movements based on historical trading within the channel. While they can offer valuable insights and clues about future price action, no predictive tool is foolproof. Traders must apply channel patterns within a comprehensive trading plan that includes analysis of market dynamics and economic indicators.

Trading within the channel can offer consistent returns by capitalizing on known ranges of price movement. On the other hand, trading channel breakouts can garner significant profits from larger market movements. Both methods require careful analysis and a solid trading plan; the choice depends on the trader’s risk tolerance, strategy preference, and market assessment.