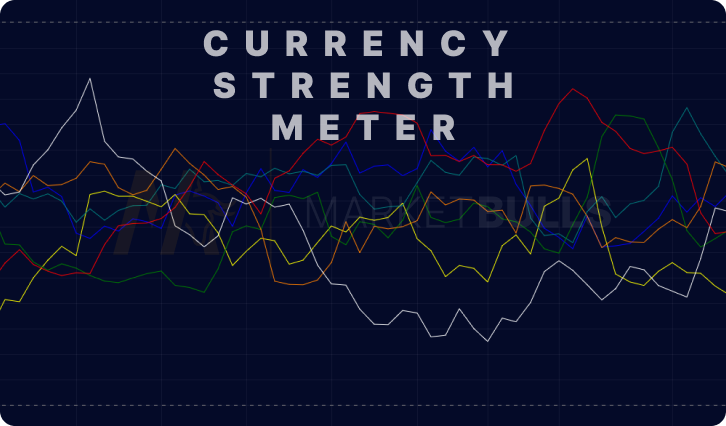

The currency strength indicator, also known as the forex meter, is an invaluable tool for those delving into the world of foreign exchange. By revealing the relative strength or weakness of different currencies, this indicator is key to underline the seasonal trading strategy.

Understanding the Currency Strength Indicator

The currency strength indicator is a technical analysis tool that gauges the strength of individual currencies relative to others. It's like a compass, pointing traders towards currencies that are either strong for buying or weak for selling. Here's how it works:

- The indicator breaks down the forex market into individual currency components.

- It analyzes the movement of these components – appreciating or depreciating.

- It ranks currencies from the strongest (bullish) to the weakest (bearish).

The currency strength indicator is calculated using the price data from the forex market. By analyzing this data, the indicator provides an aggregated view of the overall currency market.

Currency Strength Meter in Action

The currency strength meter takes data from multiple currency pairs and consolidates it into an easy-to-understand meter or chart. This allows traders to see at a glance which currencies are strengthening and which are weakening. The following steps explain how a trader might use a currency strength meter:

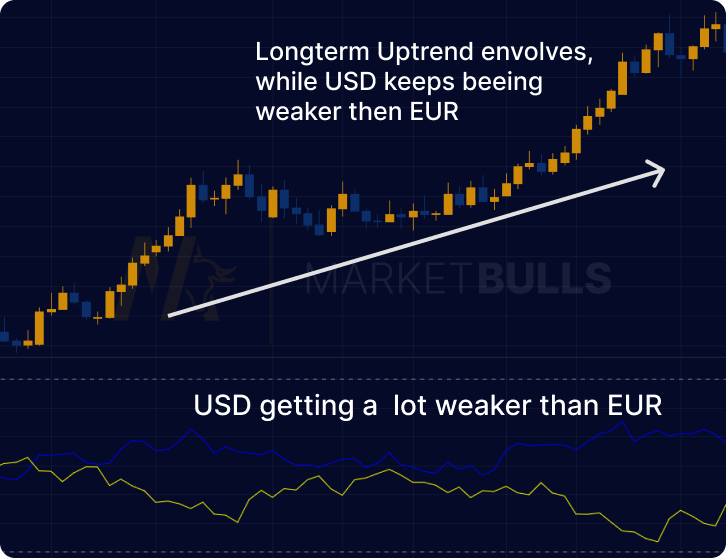

- Analyze the meter to identify the strongest and weakest currencies.

- Pair a strong currency against a weak one.

- Look for a trend confirmation using other technical indicators.

- Execute a buy or sell order depending on the strength and trend direction.

The currency strength meter can also help traders avoid the pitfalls of being caught on the wrong side of a trade. For example, if the meter indicates that a particular currency is strong, a trader might avoid selling or shorting that currency.

Applications of Currency Strength Meter MT4 and MT5

The currency strength indicator is available on popular trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms provide customizable and easy-to-read currency strength charts. The currency strength meter MT4 and MT5 versions come with unique features:

- Real-time updates of currency strength.

- Ability to switch between different timeframes.

- Alerts when a currency crosses a certain strength level.

- User-friendly interface and customizable chart styles.

Traders can use the currency strength meter MT4 or MT5 to identify potential forex trades. By comparing the strength of various currencies, they can predict which pairs are likely to have the most movement and thus the most potential profit.

Best Practices for Forex Meter Indicator Trading

Trading with the forex meter involves a few best practices to maximize its benefits:

- Always pair a strong currency against a weak one. This strategy can enhance your chances of entering a profitable trade.

- Use the currency strength meter alongside other technical indicators, like RSI or EMA. This can provide a more comprehensive picture of the market.

- Be mindful of economic news events. They can drastically affect currency strengths.

- Regularly update and recalibrate your forex meter for the best results.

The currency strength indicator is a versatile tool in a trader's arsenal. By correctly interpreting its signals, forex traders can capitalize on market trends, mitigate risks, and enhance their profitability.

Conclusion

The currency strength indicator is a cornerstone tool in the forex trading world. By offering deep insights into the relative strengths of various currencies, it equips traders with the knowledge to make informed trading decisions. As with any trading tool, mastering its use requires practice, diligence, and a keen understanding of the forex market dynamics.

FAQs about Currency Strength Indicator

A currency strength indicator is a tool that measures the relative strength of individual currencies in the forex market.

The meter uses price data from various forex pairs to compute the strength or weakness of individual currencies.

Traders can use the meter to identify the strongest and weakest currencies, pair them together, and execute trades based on these pairings.

Using a currency strength meter can help traders identify potential forex trades, avoid being caught on the wrong side of a trade, and mitigate risks.

Currency strength meters are commonly found on forex trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Yes, it’s recommended to always pair a strong currency against a weak one, use the meter alongside other technical indicators, keep an eye on economic news events, and regularly update and recalibrate your forex meter.