Economic cycles, or business cycles, are periods of growth and decline in markets. By studying these patterns, we can spot the different phases of recession and growth. This knowledge is crucial for businesses and investors.

Understanding market changes is key to making smart decisions. Factors like government policies, supply and demand, and global events play big roles. They all affect how markets move.

The National Bureau of Economic Research offers valuable insights. Their data helps us see how economic cycles shape policy and business plans.

Next, we’ll explore the phases of economic cycles and the important indicators that measure them.

Introduction to Economic Cycles

Economic cycles are the ups and downs of the economy. They help us understand the economy’s health. These cycles are key for keeping the economy stable and planning finances wisely.

Definition and Importance

Economic cycles have two main parts: growth and downturns. Knowing these cycles helps predict the market and prepare for changes. It’s vital for making smart financial plans and keeping the economy stable.

Historical Context and Evolution

The history of economic cycles shows how the economy has changed. From the Great Depression to the Global Financial Crisis, studying these events is crucial. It teaches us the value of being proactive in financial planning, especially during ups and downs.

| Period | Event | Impact |

|---|---|---|

| 1930s | Great Depression | Severe global economic downturn |

| 2008 | Global Financial Crisis | Significant recession and regulatory changes |

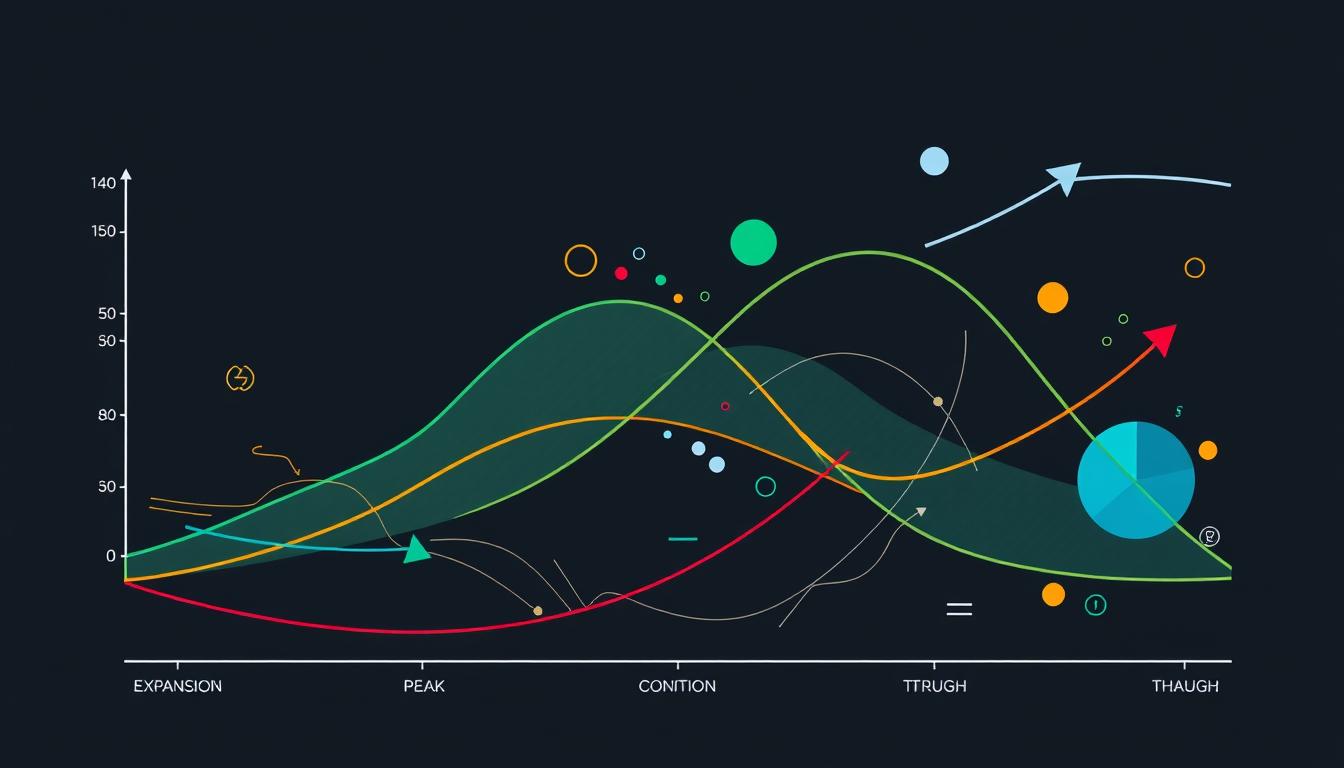

The Four Phases of Economic Cycles

Economic cycles have four main phases. Each phase affects different parts of the economy. These include consumer confidence, credit cycles, and how people invest.

Expansion

The expansion phase is when the economy grows. More people spend money, and businesses make more money. This leads to more jobs and higher consumer confidence.

The Federal Reserve watches these signs closely. They aim to keep the economy growing but also control inflation.

Peak

The peak is when the economy is at its strongest. It’s a time of full employment and high production. But, it also means inflation might rise.

At this point, the economy might start to balance out. This could lead to a slowdown or even a downturn.

Contraction

After the peak comes the contraction phase. This is when the economy slows down. You’ll see less spending, lower production, and less investment.

Unemployment goes up, and demand falls. Businesses try to stay afloat during this tough time.

Trough

The trough is the lowest point in the cycle. It’s a time of low activity and little investment. But, it’s also when the economy starts to recover.

Signs of growth begin to appear. The economy slowly starts to move back into growth.

Key Economic Indicators

Key economic indicators are important for checking the economy’s health. They help us see how different parts of the economy are doing. This information guides policy and shapes market expectations. The main indicators include Gross Domestic Product (GDP), unemployment rates, and inflation and deflation.

Gross Domestic Product (GDP) Fluctuations

GDP is a key economic measure. It shows the total value of goods and services made in a time period. Changes in GDP help us understand if the economy is growing or shrinking. These changes show when the economy is doing well or not so well.

Unemployment Rates

Unemployment rates show how the job market is doing. The Bureau of Labor Statistics closely watches these rates. High rates mean the economy is struggling, while low rates suggest it’s doing well.

Inflation and Deflation Metrics

Inflation and deflation metrics check if prices are stable. They use the Consumer Price Index (CPI) to see if prices are going up or down. Keeping prices stable is key for a strong economy. It affects how people spend money and plan for the future.

- GDP: Monitors economic output and growth trajectory

- Unemployment Rates: Reflects the state of the labor market

- Inflation/Deflation: Assesses the stability of prices

| Indicator | Purpose | Agency |

|---|---|---|

| GDP | Economic growth measurement | Bureau of Economic Analysis |

| Unemployment Rates | Labor market statistics | Bureau of Labor Statistics |

| Inflation/Deflation | Price stability | Bureau of Economic Analysis |

By watching these key indicators, experts and policymakers can understand the economy better. They can make better choices to help the economy grow and stay stable.

Expansion Phase: Characteristics and Impact

The expansion phase is a time of economic growth. It’s when businesses invest more and jobs increase. This shows a strong investment climate.

Business Investments and Growth

During this phase, companies start new projects and buy new tech. This leads to more jobs and better economic performance. It helps businesses grow and keeps the economy strong.

Consumer Spending Trends

People tend to spend more during the expansion phase. The U.S. Department of Commerce says spending goes up. This is because people have more money and feel hopeful.

Stock Market Performance

The stock market does well during this time too. Stock prices often go up, showing investors are confident. This is because companies are making more money and the economy is doing well.

| Economic Indicator | Effect During Expansion |

|---|---|

| Business Investments | Increase |

| Consumer Spending | Rises |

| Stock Market | Positive Performance |

| Corporate Profits | Growth |

Contraction Phase: Implications and Strategies

During the contraction phase, businesses and economies face big challenges. Demand drops, and production levels go down. This leads to many problems.

Decreasing Demand and Production

When people spend less due to economic worries, demand falls. Businesses then face inventory problems. They might cut back on making things to save money.

Data from the U.S. Census Bureau shows this. Companies adjust their plans to avoid more financial trouble.

Unemployment Increases

Unemployment rises in this phase. Companies cut back, leaving many without jobs. Governments step in with financial help and policies to ease the burden.

History shows that unemployment rates go up. This calls for careful planning to keep workers stable.

Market Correction Strategies

It’s crucial to have good strategies for market correction. Risk management, like diversifying, can help reduce losses. Also, preparing for recessions can make businesses stronger.

By using these tactics, companies and investors can stay stable. This helps them survive market ups and downs.

Economic Forecasting and Predicting Cycles

Economic forecasting is key to understanding future market trends. It helps make informed decisions. Experts use advanced statistical models and data from market indicators to create economic projections. These projections guide government policies and business strategies.

The International Monetary Fund (IMF) uses complex economic models to predict growth rates and key economic metrics. These market forecasting methods are crucial for setting fiscal regulations and guiding long-term investments.

Predictive analytics are vital for business planning. They help businesses forecast economic cycles. This way, companies can adjust their strategies, manage risks, and allocate resources better. Predictive models also help investors spot market shifts and keep their finances stable during tough times.

Despite the challenges of predicting global economies, combining historical data with advanced tools improves economic projections. This makes decision-making more reliable across different sectors.

How Businesses Navigate Economic Cycles

Learning how businesses handle economic ups and downs is key to their success. Companies use important strategies and techniques to grow and stay strong. These help them face challenges and keep moving forward.

Adaptive Strategies

Adopting adaptive strategies is crucial for businesses. They innovate, reallocate resources, and stay flexible. This way, they can quickly adapt to changes in the market.

For example, companies can change their products or services to meet new demands. This keeps them relevant and competitive.

Risk Management Techniques

Good risk management is essential for businesses. They use scenario planning, financial hedging, and diversifying investments. This protects them from economic downturns.

Studies show that companies that prepare well can handle unexpected economic shocks. This helps them stay stable in the long run.

Case Studies and Examples

Looking at successful companies can teach us a lot. During the 2008 crisis, Procter & Gamble cut costs and diversified. Their actions show the value of flexible planning and risk management.

By using adaptive strategies, strong risk management, and learning from others, businesses can thrive. Being prepared and adaptable are key to success.

The Role of Government in Economic Cycles

The government plays a key role in managing economic cycles. It uses fiscal policies, monetary interventions, and economic regulation. These tools help soften the blow of downturns or boost growth in good times.

For example, the Federal Reserve sets interest rates. This affects how much people pay to borrow money and how much they spend. It’s a big part of monetary interventions.

Fiscal policies, like government spending and taxes, are also crucial. In tough times, more spending and lower taxes can help. This can encourage businesses to invest and people to spend more.

The U.S. Department of the Treasury shows how these policies can lessen the impact of downturns. They help the economy recover faster.

Economic regulation keeps markets fair and efficient. It stops fraud and monopolies. Good regulation can keep markets stable and investors confident.

But, bad management can make things worse. It shows the importance of making smart, timely decisions.

FAQ

What are economic cycles?

Economic cycles, also known as business cycles, are periods of growth and decline in an economy. They are shaped by government actions, supply and demand, and global events.

Why are economic cycles important to understand?

Knowing about economic cycles is key for businesses and investors. It helps them make smart choices. These cycles can show what the market might do next, helping with planning and stability.

What are the phases of economic cycles?

Economic cycles have four phases: expansion, peak, contraction, and trough. Each phase affects consumer confidence, credit, and investment.

How do key economic indicators like GDP and unemployment rates relate to economic cycles?

Indicators like GDP and unemployment rates show how well the economy is doing. They help figure out where we are in the cycle and the economy’s health.

What characterizes the expansion phase of an economic cycle?

The expansion phase sees more business investment, growth, and jobs. Consumer spending goes up, leading to a strong economy and a good stock market.

What happens during the contraction phase of an economic cycle?

In the contraction phase, demand and production drop, leading to more unemployment. To get through this, diversifying and preparing for recessions are key strategies.

How is economic forecasting done?

Forecasting uses statistical models and indicators to guess future trends. The International Monetary Fund and others use these to guide policy and planning.

How do businesses navigate economic cycles?

Businesses use flexible strategies and risk management to stay strong through cycles. Learning from companies that have made it through tough times is helpful.

What role does the government play in economic cycles?

Governments shape cycles with policies, money moves, and rules. They use tools like stimulus and interest rates to help during downturns, as the U.S. Department of the Treasury shows.