Modern portfolio optimization is a method to make financial portfolios better. It looks closely at which assets to put money into. This is to help investors get more diversity and lower risks.

It’s all about analyzing your portfolio to see what works best. By looking at modern strategies, you can make a strong investment plan. The aim is to reach your financial goals while being able to handle the risks involved.

Key Takeaways

- Understanding modern portfolio optimization can significantly enhance investment strategies.

- Diversification benefits reduce the overall risk of the investment portfolio.

- Thorough financial portfolio analysis is crucial for better asset allocation.

- Modern strategies help in crafting robust investment plans tailored to individual needs.

- Balancing risk tolerance with financial goals is key to successful portfolio management.

Understanding Modern Portfolio Optimization

Modern portfolio optimization is key in the world of finance. It finds the best ways to mix different investments. This way, risk is lowered, and returns are increased. It uses complex math and statistics to carefully choose where to invest your money.

Defining Modern Portfolio Optimization

Portfolio optimization today uses math to pick investments. It’s not just about lowering risk in each investment. It also looks to boost the total return of a group of investments. By looking at which investments go well together and how risky they are, this approach builds a smarter mix of investments.

The Evolution of Portfolio Optimization Techniques

It started with Harry Markowitz’s theory on spreading investments to lower risk. Over time, methods got smarter, taking into account things like how emotions affect choices. Now, using current data, we can make investment choices that change as the market does, adapting to new information in real time.

The Role of Technology in Modern Portfolio Optimization

New tech has changed how we manage investments. It has made understanding and reducing risk easier. With machine learning and big data, we can understand market trends and assets better. This high-tech approach helps financial experts make the best choices for their clients.

Investment Portfolio Management

Investment portfolio management is about using smart ways to get the best returns while keeping risks low. Investors mix different strategies to build a strong portfolio. This way, they can make the most out of their investments.

Key Principles of Investment Portfolio Management

One key thing in managing an investment portfolio is to do a detailed risk-return analysis. This involves looking at the risks and returns of different investments. It’s done to make sure they match the investor’s financial plans and how much risk they’re willing to take. It’s important to keep an eye on things and change the portfolio as needed to grab new chances and deal with market shifts.

Another important part is finding the right balance between risk and reward. This balance is key for doing well in the long run. Various strategies are used to lower the risks while aiming for higher returns.

Integrating Modern Portfolio Optimization into Investment Management

Modern portfolio optimization is crucial in today’s investment world. It uses advanced ideas to make a portfolio that gets the best returns with a set level of risk. This includes using sophisticated modern portfolio optimization tools to pick the best mix of assets.

Keeping the portfolio in line with the investor’s risk level and goals is where portfolio rebalancing techniques come in. They help adjust the portfolio regularly to prevent it from going off track. This is important in making sure the portfolio continues to do well, even when the market changes.

Here is a comparative analysis of the principles discussed:

| Principle | Key Aspect | Importance |

|---|---|---|

| Risk-Return Analysis | Evaluation of potential risks and expected returns | Ensures investment alignment with goals and risk tolerance |

| Modern Portfolio Optimization | Application of advanced theories and models | Maximizes returns for a given level of risk |

| Portfolio Rebalancing Techniques | Regular adjustment of asset allocation | Maintains portfolio’s alignment and performance |

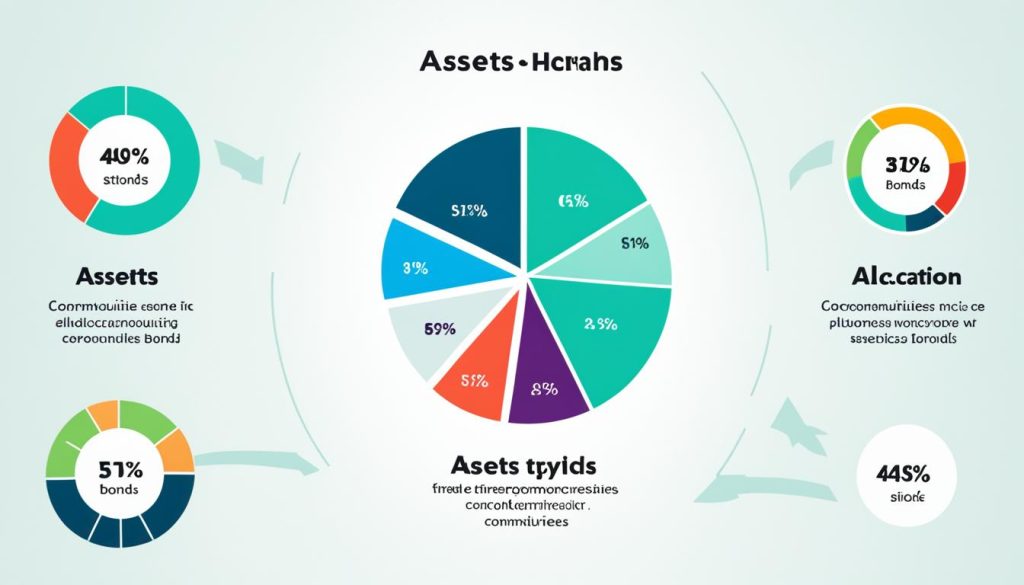

Asset Allocation Strategies for Optimal Returns

Asset allocation is key for any successful investment plan. It’s about dividing your money wisely. This helps you meet your financial goals and works well with modern investing methods.

Core Asset Allocation Principles

The main idea is to invest in different things like stocks, bonds, and houses. This variety lowers your risk and keeps your returns steady. Mixing these assets right aims to make your investment safer but still rewarding, a must in today’s investing world.

Dynamic vs. Static Asset Allocation

Asset allocation can be done in two ways: changing (dynamic) or fixed (static). The dynamic method adjusts your investments as the world changes. This can catch the best market moments while keeping risk low.

Meanwhile, the static method keeps your investment mix unchanged. It’s simpler but may not get you the highest returns all the time. Each approach has its benefits and downsides, depending on what you aim for and the market’s state.

Impact of Market Conditions on Asset Allocation

The market’s status hugely affects where you should put your money. Things like the economy, politics, and market trends change the game. Being aware and flexible is vital in making smart investment choices.

With the right tools, investors can steer through these uncertain times. They can keep their investment strategy strong and even in the face of fluctuating conditions.

Markets always shift, so your investment plan should too. Review your strategies often to make sure they keep up with your goals and what’s happening in the world.

Risk-Return Analysis and Efficient Frontier Modeling

Understanding the link between risk and reward is key in investments. This link is called the risk-return tradeoff. It forms the basis for wise investment choices. Thanks to efficient frontier modeling, investors can spot the best portfolios. These offer the top returns for a certain risk level, boosting diversification gains.

The Concept of Risk-Return Tradeoff

The risk-return tradeoff says that higher risks often come with higher rewards. When picking investments, people need to balance their comfort with risk against chances for more money. This adjusting helps set up portfolios that match an investor’s goals and how much risk they’re okay with.

Constructing the Efficient Frontier

Efficient frontier modeling maps out the ideal portfolios. These portfolios give the best expected return for their risk levels. The ‘efficient frontier’ shows on a graph, with risk on the x-axis and return on the y-axis. Portfolios on this curve find the best balance between risk and reward.

Applying Efficient Frontier in Portfolio Management

By using efficient frontier modeling, investors can enjoy the perks of diversified assets. They can form portfolios with assets that don’t move the same way. This means less overall risk and higher chances for returns. Such an approach leads to portfolios that are well-crafted, matching the investor’s risk limits and financial aims.

| Portfolio | Expected Return | Risk | Position on Efficient Frontier |

|---|---|---|---|

| Portfolio A | 8% | 5% | On Frontier |

| Portfolio B | 10% | 8% | On Frontier |

| Portfolio C | 12% | 12% | On Frontier |

| Portfolio D | 15% | 20% | Not Efficient |

Portfolio Rebalancing Techniques

Portfolio rebalancing is key for managing your investments. It helps keep the right mix of assets that match your financial goals. By rebalancing regularly, your investments stay in line with your risk level and plan, even when markets change.

Importance of Portfolio Rebalancing

Rebalancing your portfolio is important for reducing risk. It keeps your money from being too focused in one area, which could be risky. Doing this often keeps your investments spread out like you wanted, lowering risk.

Common Rebalancing Strategies

There are different ways to rebalance your investments. Investors use strategies like calendar rebalancing, threshold rebalancing, and a mix of both. These methods provide flexibility and the ability to react to changes in the market.

Frequency of Rebalancing and Its Impact

How often you rebalance can greatly affect your investment success. Rebalancing a lot can help reduce risks but it might cost more in fees. On the other hand, rebalancing less often could increase your portfolio’s risk over time.

It’s important to find the right balance in how often you rebalance. This ensures you maximize the benefits without paying too much in costs. By doing so, you can manage your investments effectively for the long run.

Conclusion

Modern investment strategies are complex. It’s important to understand portfolio optimization well. This helps investors create portfolios that meet both their profit and risk goals.

When we look at how to spread investments, we see two main ways. There’s a static and a dynamic method. Which one works better depends on the market and your investment goals.

Efficient frontier modeling shows how sophisticated portfolio building can be. It helps find the best balance between risk and return. This way, investors can lower risks and use opportunities wisely.

The key to good portfolio management is using these smart strategies together. It means always watching and adjusting to the market’s changes. This keeps investors on track to reach their financial dreams.

By understanding and using modern portfolio methods, investors can do well even when the market shifts. They can grow their money over time, avoiding big risks. This approach helps them succeed in the financial world.

FAQ

What is modern portfolio optimization?

Modern portfolio optimization is a method that boosts investment return. It does this by spreading investments out across different markets. This lowers the overall risk of investing. It looks at your financial goals and how much risk you are willing to take.

How has portfolio optimization evolved over time?

At first, it was about Markowitz’s theory. Now, we use new methods that include how people act in the market. These new ways are thanks to better math and technology. They help make better plans and know the risks more clearly.

What role does technology play in modern portfolio optimization?

Technology helps a lot in making investment plans better. It makes it easier to see and understand risks. Plus, it helps set up your investments in a smart way. This is thanks to using complex math tools.

What are the key principles of investment portfolio management?

Managing investments needs looking at the risks and returns all the time. You also have to balance your investments regularly. These steps make sure your money plans match what you want in the long run.

How does modern portfolio optimization integrate into investment management?

It makes old investment ways better with new strategies. One key thing is to always keep your money plan aligned with your needs and the market changes.

What are the differences between dynamic and static asset allocation?

Dynamic asset allocation changes with the market. But, static asset allocation stays the same. Both ways have good and bad points, and they look at many different things to work well.

How does risk-return analysis inform portfolio management?

It shows how much risk is worth the possible rewards. This is important in making a plan that gives the most return for the least risk.

It finds the best portfolios that mix risks well to get good returns.

What are the benefits of constructing the efficient frontier?

It lets investors see the best mix of investments for their goals. This helps them make choices that gain the most while risking less.

Why is portfolio rebalancing important?

It’s key to keep what you invest in line with your risk and earning needs. By adjusting your investments, it stays right with what you aim for.

What are common portfolio rebalancing strategies?

There’s periodic, threshold, and tactical rebalancing. Each one has a different way of updating your investments. They help your money plans keep up with your goals and how the market changes.

How often should an investment portfolio be rebalanced?

How often you update your investments depends on what you are comfortable with and how the market is doing. Some change it every year or every quarter. Others do it when their investments stray too far. Doing it more often can keep your investments well-tuned, but it may cost more in fees and taxes.