The late 19th century witnessed one of the most tumultuous periods in the financial history of the United States—the Panic of 1893. This economic depression was not just a blip on the historical radar of market crisis; it was an event that ravaged the economy, disrupted lives, and prompted significant shifts in both government response and public policy. As we delve into this 19th-century financial crisis, we’ll explore the intricate web of factors that led to the collapse and pave the way toward understanding the path to economic recovery.

Before we unfold the story of resilience and reform, it’s essential to recognize how this financial phenomenon echoed beyond the ledgers and banking halls, influencing the fabric of American society and the political landscape of the time. Join us as we step back into history to dissect the Panic that reshaped America.

Understanding The Panic of 1893

The Panic of 1893, a watershed moment in American financial history, provides crucial insights into economic vulnerability and political transformation. By dissecting the causes of the panic and evaluating the effects of the panic, we gain a comprehensive perspective on the cyclical nature of financial crises. The phenomenon also serves as a lens through which to observe the political realignment that ushered in President William McKinley’s era following President Grover Cleveland’s tumultuous tenure.

What Was The Panic of 1893?

Resulting from a complex web of economic challenges, the Panic of 1893 epitomized the fears and fragility associated with a depression. It was characterized by banking insolvencies, a tightening of credit, and a stock market beset by chaos, deeply impacting the socio-economic stability of the nation.

Timeline of the Crisis

- 1893: The bankruptcy of the Philadelphia and Reading Railroad signals the onset of the crisis.

- Mid-1893: Cascading failures hit the National Cordage Company, leading to widespread market panic.

- Late 1893: The Sherman Silver Purchase Act is repealed in a bid to stabilize the economy.

- 1894-1895: Bank runs and the gold reserve depletion dominate headlines.

- 1896: William McKinley wins the presidency, signaling a shift in political power.

Key Players During The Panic

| Name | Role | Action | Impact |

|---|---|---|---|

| Grover Cleveland | U.S. President (1893-1897) | Repealed the Sherman Silver Purchase Act | Attempted to curb economic descent and restore confidence |

| William McKinley | 1896 Republican Presidential Candidate | Elected President | Marked the beginning of political realignment following the panic |

| People’s Party (Populists) | Political Movement | Advocated for the interests of farmers and laborers | Challenged established capitalist structures and influenced political discourse |

The period following the Panic of 1893 saw significant changes in the American political landscape. Leaders emerged in response to economic calamities, influencing policies intended to prevent future crises. President Cleveland’s actions during this time were particularly consequential, albeit contentious, shaping the economic course of the nation and the livelihoods of its citizens.

International Influences and The Onset of Panic

The late 19th century was characterized by a complex web of economic ties that stretched across the globe, making the United States’s financial system particularly susceptible to international influences. As the country grappled with the question of the gold standard and the silver debate, it became increasingly clear how domestic economic policies were markedly affected by foreign investment flows and commodity prices.

The Role of International Investments

International investments of the 1890s were a double-edged sword, providing a source of capital but also posing a risk of rapid outflow. U.S. enterprises, especially those in agriculture and mining, had become attractive destinations for European capital, which led to a surge in international investments. The fluctuating fortunes of these ventures not only affected investors but had a knock-on impact on the U.S. economy as a whole.

The Argentine Trigger and European Reaction

The Panic of 1893 was precipitated by a series of international events, notably a significant crop failure in Argentina. This agricultural powerhouse’s sudden downturn sent shockwaves through the markets and led European investors to pull their funds from international investments, including those in the United States. The European reaction was swift, with investors demanding gold in exchange for their U.S. holdings, leading to a precipitous depletion of the U.S. gold reserves.

Impact of Global Commodities on the US Economy

As American investors and policymakers were engrossed in the silver debate, another commodity was making headlines: wheat. Global wheat prices collapsed, adding to the economic pressures of the day. This crash in commodity prices illustrated how the U.S. economy, despite its significant size, was not immune to fluctuations in the global market. Commodity prices served as the canary in the coal mine, signaling deeper issues within the global financial system that would soon resonate within domestic borders.

| Commodity | Price Impact during Panic of 1893 | Economic Consequence |

|---|---|---|

| Wheat | Significant Price Drop | Losses in Agricultural Sector; Investor Panic |

| Silver | Volatility and Decline | Intensified Currency Debate; Disrupted Mining Industry |

| Gold | Depleted Reserves | Pressure on Gold Standard; European Run on U.S. Gold |

These economic nuances played a vital role in steering economic policies during an era where the debate over the gold standard continued to dominate political discourse. The United States found itself at a crossroads where the need for robust economic policies could no longer be ignored in light of international market dependencies.

The Railroads: Expansion and Oversupply

The American railroads epitomized progress and economic growth. Yet, the closing decades of the 19th century witnessed a crescendo of overinvestment in the industry, creating an environment ripe for financial disaster. This era of expansion, characterized by speculation and oversupply in the railroad sector, underscored a volatile period in American economic history leading up to the Panic of 1893.

Overinvestment in Railroads

Excessive funding poured into American railroads, with magnates and investors alike dreaming of infinite growth, inadvertently brewed an unsustainable bubble. The allure of the American railroads, symbols of innovation and conquest of the vast American landscape, captured speculative interests. However, the widespread neglect in assessing practical demand led to a glut of tracks, trains, and associated resources.

Bankruptcy of Key Railroad Companies

The Philadelphia and Reading Railroad, once among the venerated titans of American industry, became the most prominent casualty of the era when it declared bankruptcy. This event in 1893 marked a significant turning point, emblematizing the deep-seated problems within the industry. As this keystone of the American railroads buckled, the ensuing shockwaves reverberated throughout the nation’s financial arteries, precipitating widespread economic instability.

Legislation Affecting Rail Expansion

The Sherman Silver Purchase Act of 1890 foreshadowed troubles for the American railroads and the broader US economy. By compelling the increase of silver currency backed by dwindling gold reserves, the Act is often cited as a crucial factor that amplified the stock market crash. It misaligned monetary policy with economic realities, culminating in strained confidence amongst domestic and international investors in American financial solvency.

Below is a comparative view of how key developments and legislation contributed to the railroad industry’s expansion and the subsequent oversupply:

| Year | Significant Event | Impact on Railroads | Government Intervention |

|---|---|---|---|

| 1890 | Sherman Silver Purchase Act Enacted | Increase in silver purchases weakened gold reserves affecting railroad financing. | Mandatory government silver purchases. |

| 1893 | Philadelphia and Reading Railroad Bankruptcy | Bankruptcy signaled the beginning of widespread economic panic. | None directly aimed at immediately resolving the railroad crisis. |

The Silver Debate and Economic Turmoil

The twilight of the 19th century ushered in an era of unprecedented economic turmoil. Key to this turmoil was the debate over silver and gold currency, a complex issue that gave rise to the Free Silver movement and left indelible marks on the United States economy. The Free Silver movement, an impassioned response to severe deflationary pressures, advocated for the increased coinage of silver. Their efforts and beliefs would clash with the nation’s fiscal policy, contributing to a whirlwind of bank failures and market instability.

Free Silver Movement’s Motivations

The Free Silver movement, driven by a coalition of farmers, miners, and political dissidents, called for a monetary policy that favored the free coinage of silver. Their motivation was clear: to inflate currency values and ease the burdens of debt repayment for those hit hardest by the economic downturn. They saw silver as the democratizing metal that could uplift the common man and chisel away at the gold standard’s perceived elitism.

Sherman Silver Purchase Act Controversy

The Sherman Silver Purchase Act became the legislative embodiment of the Free Silver movement’s aims. It mandated significant government purchases of silver, seeking to buoy silver prices and satisfy both silver miners and those who wished to see more currency in circulation. However, the act soon became contentious. Critics argued that the law’s requirements not only failed to support silver prices but also threatened to destabilize gold reserves, as the public could exchange silver notes for gold, depleting the treasury’s stock.

Declining Silver Prices and National Panic

Declining silver prices in the 1890s exacerbated the instability within the economy. As value decreased, so too did confidence in silver-backed notes, catalyzing a rush for gold that would thrust the treasury into jeopardy. The dwindling gold reserve, coupled with the inability to maintain the gold standard, precipitated a series of bank failures that rippled through the nation, manifesting the anxieties of the economic turmoil.

The table below summarizes key events and their impact, encapsulating the tumultuous period defined by the silver and gold currency debate.

| Event | Impact on Economy | Impact on Public Sentiment |

|---|---|---|

| Free Silver Advocacy | Inflationary hopes, though unmet | Increased political mobilization and optimism |

| Sherman Silver Purchase Act Enactment | Temporary stability, followed by fiscal stress | Controversy and polarization among economic classes |

| Decline in Silver Prices | Increased financial insecurity, pressure on gold reserves | Panic and a rush to redeem silver notes for gold |

| Bank Failures | Economic contraction, credit crunch | Widespread fear and distrust in financial institutions |

In understanding this pivotal moment in America’s economic past, it becomes clear that the implications of the Free Silver movement and the ensuing turmoil stretched far beyond the minting of coins, touching the lives of citizens and shaping the fiscal policy of the United States for years to come.

Ripple Effects: Bank Failures and Unemployment

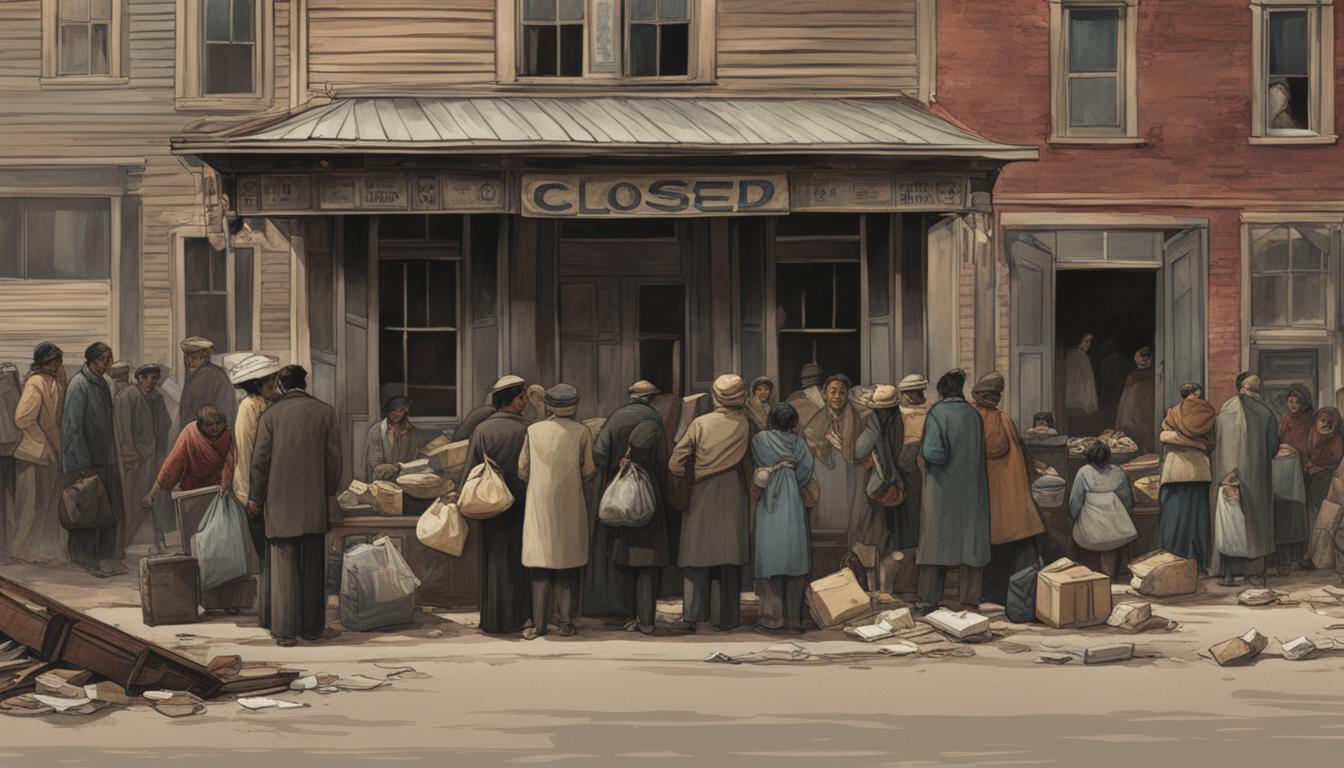

The economic turmoil of the late 19th century was marked not only by widespread financial panic but also by the severe aftermath that ensued. The ripple effects of the Panic of 1893 transcended financial markets, leaving deep scars on the fabric of society. Bank failures proliferated as the shockwaves of economic depression were felt across the nation, leading to catastrophic unemployment rates and jeopardizing the life savings of countless Americans.

Bank Runs and the Domino Effect

As confidence in financial institutions faltered, bank runs became common, with desperate depositors seeking to withdraw funds en masse, fearing total loss. This domino effect compounded the pressures on banks, many of which were unable to meet the demand, culminating in their ultimate failure and closure.

Unemployment Rates Spike

The impact of these bank failures was immediately felt in the labor market. Unemployment rates, which serve as a strong indicator of economic well-being, skyrocketed between 17% to 19%. Jobs evaporated overnight, leading to a drastic escalation of financial insecurity among the working class.

Impact on the General Population

The reverberations of this economic depression reached far beyond Wall Street and the banking sector, taking a substantial toll on the general population. Families lost their life savings, homes were foreclosed, and basic living conditions plummeted. The stark rise in unemployment forced many to seek assistance through soup kitchens or makeshift community gardens, highlighting a stark survivalist response to widespread destitution.

| Year | Unemployment Rate | Number of Bank Failures |

|---|---|---|

| 1893 | 18.4% | 158 |

| 1894 | 17.7% | 172 |

| 1895 | 12.4% | 89 |

| 1896 | 14.5% | 53 |

In reflecting on this tumultuous period, the clear interconnectedness of financial security, employment, and societal well-being is apparent. The Panic of 1893 serves as a historical touchstone, reminding us of the potential depth and breadth of economic despair and the profound ripple effects that can radiate throughout a nation.

Government Response to the Crisis

The U.S. was plunged into financial turmoil following the Panic of 1893, but the swift government response played a crucial role in steering the country towards economic recovery. Measures undertaken by the federal administration, particularly by President Cleveland, were instrumental in managing the repercussions on the stock market and restoring stability within the U.S. Treasury.

President Cleveland’s Reaction

Amidst the unfolding crisis, President Grover Cleveland’s decisive actions were pivotal. His leadership was characterized by a determination to address systemic issues within the national economy. In an effort to stabilize the faltering financial system, Cleveland tackled the contentious silver policy which many believed was inflating the currency and undermining confidence in the economy.

The Legislative Rethinking of Currency

The administration, facing an economy on the brink of collapse, initiated a comprehensive legislative rethinking of U.S. currency policies. The bold move to repeal the Sherman Silver Purchase Act and the subsequent borrowing of millions in gold represented a significant shift in monetary strategy, paving the way for the U.S. to return to a more secure financial footing. Such decisive action underscored the integral role of government intervention during periods of economic distress and set the stage for future policy development.

As we reflect on this chapter of American financial history, it becomes clear that the response to the Panic of 1893 involved complex maneuvering by President Cleveland and lawmakers. The interplay between government decisions and market reactions provides insightful lessons on the dynamics of economic crisis management and the pathways to recovery.

Long-term Economic and Social Consequences

The far-reaching impact of the Panic of 1893 manifested in significant changes within financial institutions, societal shifts, and political recalibration. Reeling from the financial hardship, the United States witnessed a transformation in its national banking systems aimed at preventing future economic catastrophes. Likewise, the social fabric of the nation evolved as communities collectively navigated the rough waters of economic distress.

Changes to National Banking Systems

One of the long-term consequences of the 1893 depression was a comprehensive overhaul of the national banking systems. This led to the eventual implementation of regulations that aimed to stabilize financial institutions and temper the potential for systemic risk. The adoption of stringent banking practices underscored the importance of such reforms to safeguard the economy.

Social Responses to Financial Hardship

Social responses to the period of financial hardship were characterized by a heightened awareness of economic disparities and an intensified demand for change. Labor movements burgeoned, pushing for laws that would provide greater protection for workers, while community support systems emerged to assist those hardest hit by the economic downturn.

The 1896 Election and Its Aftermath

The Panic played a critical role in shaping the outcome of the 1896 election. Economic issues took center stage, influencing voter sentiment and leading to the ascent of Republican President William McKinley. His victory marked the commencement of a new political era, shaping national policies that would dictate American economic trajectory well into the new century.

| Reform Initiative | Impact | Implementation Year |

|---|---|---|

| Bank Reserve Requirements | Enhanced financial stability | 1894 |

| Labor Protection Laws | Improved workplace conditions | 1896 |

| Populist Party Growth | Increased representation for workers and farmers | 1892-1896 |

| Gold Standard Act | Solidified monetary policy | 1900 |

Conclusion

The financial crisis known as the Panic of 1893 is far more than a chapter of economic history—it is a narrative that exposed the fragility of the 19th-century American financial systems and left lasting effects that still resonate today. This pivotal event was propelled by a confluence of factors including international financial instability, fervent debates over the silver standard, unchecked railroad investments, and widespread banking failures. The collective weight of these issues did not just precipitate a short-term collapse; they altered the very foundations of American economic and social policy.

In navigating through the aftermath of the panic of 1893, the United States had to confront its susceptibilities to global economic fluctuations and the repercussions of speculative excess. The studied response to the calamity helped forge new pathways for national economic management and governance. It set in motion a series of reforms and regulatory mechanisms designed to avert such crises in the future, ultimately steering the nation towards a more stable and resilient economic environment. The legacy of the Panic of 1893 thus embodies the need for constant vigilance and adaptation in the face of economic adversity.

Reflecting on this monumental crisis provides invaluable insights into the dynamic interplay between national policies and international economic trends. It underscores the importance of proactive measures and the need for robust frameworks to safeguard against the inherent vulnerabilities of financial markets. As we continue to navigate through our own complex economic landscapes, the lessons gleaned from the past are ever pertinent, guiding today’s policy makers and investors in their ongoing quest to anticipate and mitigate the impact of potential financial disturbances.

FAQ

The Panic of 1893 was a severe economic depression in the United States that lasted from 1893 to 1897, marked by a severe downturn in the economy, widespread bank failures, and a high unemployment rate.

The panic began after the failure of the Philadelphia and Reading Railroad and the National Cordage Company, which led to a stock market crash, bank runs, and widespread economic instability.

Important figures during the panic included President Grover Cleveland, who tried to mitigate the crisis by repealing the Sherman Silver Purchase Act, and President William McKinley, whose election marked a political realignment after the panic.

Overseas investments, particularly in Argentina’s agricultural and mining sectors, went south, leading to a loss of confidence and a run on US gold reserves by European investors, which significantly contributed to the panic.

Overinvestment in railroads led to the creation of a speculative bubble. When the bubble burst, companies went bankrupt, affecting related industries and the overall economy.

Declining silver prices meant that the value of silver notes fell, leading the public to exchange them for gold, depleting the gold reserve and creating panic over the U.S. government’s ability to maintain the gold standard.

President Cleveland focused on stabilizing the economy by repealing the Sherman Silver Purchase Act and borrowing gold from J.P. Morgan to replenish the Treasury, which helped to restore confidence in the financial system.