Dive deep into the world of technical analysis with our comprehensive guide to the Triple Exponential Moving Average (TRIX) Indicator. This powerful momentum oscillator can identify market reversals, assess trend strength, and enhance your trading strategy. Let's unpack how the TRIX indicator can unlock new trading possibilities.

An Introduction to the TRIX Indicator

The TRIX indicator, often referred to as the trix index, is a unique momentum oscillator that captures the rate of change in the triple smoothed exponential moving average of an asset's closing price. It helps traders cut through the market noise, offering a clearer picture of market trends.

Unraveling the Triple Exponential Moving Average (TRIX)

Unlike most oscillators, the TRIX utilizes a triple exponential moving average, which helps minimize lag and provides more accurate signals. The TRIX can be used in various trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), allowing traders to easily monitor market trends.

The Formula Behind the TRIX Indicator

The calculation of the TRIX involves several stages:

- Calculate the Exponential Moving Average (EMA) of the closing price.

- Calculate the EMA of the first EMA.

- Calculate the EMA of the second EMA.

- Finally, calculate the percentage change between the most recent EMA and the previous EMA.

The resulting value is the TRIX, providing a smoothed measure of price change, highlighting the trend's strength while filtering out minor price fluctuations.

Best TRIX Indicator Settings

Typically, the TRIX is calculated using a 14-day period, which is then smoothed three times with a moving average and percentaged to generate an oscillator. However, you can adjust these settings based on your trading strategy and market conditions. Remember, a shorter time period will result in a more responsive indicator, while a longer time period will provide a smoother indicator.

Implementing the TRIX Indicator in MT4 and MT5

Adding the TRIX to your trading toolbox in MetaTrader 4 and MetaTrader 5 is straightforward.

For MT4, the TRIX indicator isn't available by default. However, you can easily download a custom TRIX indicator and install it in the platform's data folder. Once done, simply navigate to 'Insert' –> 'Indicators' –> 'Custom' –> 'TRIX' to apply it to your charts.

In contrast, MT5 includes the TRIX indicator by default. To activate it, navigate through 'Insert' –> 'Indicators' –> 'Oscillators' –> 'TRIX'. You can tweak the period and smoothing parameters as per your preferences.

Applying the TRIX Indicator in Forex and Crypto Trading

In the realm of Forex and crypto trading, the TRIX indicator shines bright. It helps to minimize the influence of market noise, making it easier to spot genuine trends amidst the volatility of the Forex and crypto markets.

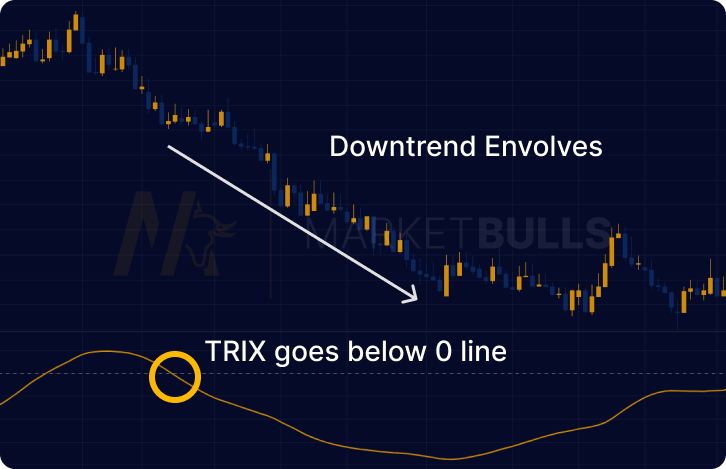

The indicator's oscillation around the zero line provides clear signals for potential market reversals, making it an invaluable tool for both Forex and crypto traders alike. Plus, when combined with other technical analysis tools, the TRIX can guide traders towards potentially profitable trades.

Effective TRIX Indicator Strategies

The TRIX Indicator offers valuable insights that can enhance your trading strategies:

- TRIX Crossovers: Bullish and bearish signals are generated when the TRIX line crosses the signal line or the zero line.

- Divergence: If the price reaches a new high, but the TRIX fails to reach a new high, it could signal a bearish divergence. The opposite scenario indicates a bullish divergence.

- Confirmation: Always use the TRIX in conjunction with other indicators to confirm signals and avoid false positives.

The Limitations of the TRIX Indicator

While the TRIX indicator is a powerful tool, it's not without its limitations. It may generate false signals in sideways or ranging markets, and due to its complexity, it can be challenging for beginners. Therefore, it's crucial to use it alongside other technical analysis tools and indicators to confirm signals and reduce the risk of false alarms. A good strategy is the combination of wyckoff and TRIX.

Conclusion

The TRIX indicator is a versatile tool in the hands of a knowledgeable trader. By highlighting the strength of market trends and potential reversals, it can guide you through the turbulence of financial markets. But remember, like any other technical indicator, it's not foolproof and should be used as part of a comprehensive trading strategy.

FAQs

The TRIX is a momentum oscillator that captures the rate of change in the triple smoothed exponential moving average of an asset’s closing price.

The TRIX is calculated by taking a triple exponential moving average of the closing price and then finding the rate of change of the smoothed average.

Common strategies include watching for crossovers, looking for divergence with price, and using the TRIX to confirm signals from other indicators.

In Forex trading, the TRIX Indicator helps to filter out market noise, enabling traders to identify genuine trends and make informed decisions.

In crypto trading, the TRIX Indicator helps to highlight the main trend amidst market volatility, providing clear signals for potential market reversals.

The TRIX can generate false signals in ranging markets and can be complex for beginners. It should always be used alongside other indicators to confirm signals.