Within the trading realm, risk management is a cornerstone of a sustainable strategy. Understanding the max trailing drawdown definition is pivotal to this pursuit. Max Trailing Drawdown (TMD) is a versatile risk management tool that not only serves to protect capital but also adapts as the market ebbs and flows. TMD is critical for setting a trailing limit on potential losses, allowing traders to keep drawdowns within a predetermined threshold, thus guarding against dramatic declines in account balance.

In essence, the max trailing drawdown calculation tracks the peak of a trading account’s success and sets a dynamic loss threshold accordingly. It is a real-time enforcement net, preventing day-end balances from slipping beyond the tolerated loss borders. This approach not only frames the financial brinkmanship for trades but also emboldens traders to drive their strategies with a level of confidence backed by quantitative risk management.

Understanding the Basics of Max Trailing Drawdown

The concept of maximum trailing drawdown is integral to the toolkit of any serious trader or financial institution. As a dynamic risk management protocol, it offers a robust framework for preserving capital while navigating the often tumultuous financial markets. By using a drawdown calculator, investors can restrict potential losses and minimize risk, all while the market continues to fluctuate.

Definition and Purpose of Max Trailing Drawdown

Max trailing drawdown is defined as a monitoring technique that sets a moving threshold for losses in an investment account. Its primary purpose is to adapt with the growth of the account, ensuring that as gains are made, the risk of losing the accrued profits is mitigated. This approach counters the rigidity of conventional drawdown measures, which do not account for incremental gains and instead only focus on absolute peaks and troughs. To fully grasp what is max trailing drawdown, one must consider not just its formula but also the intention behind its use: to safeguard a trader’s capital from significant downturns.

Comparison with Traditional Drawdown Measures

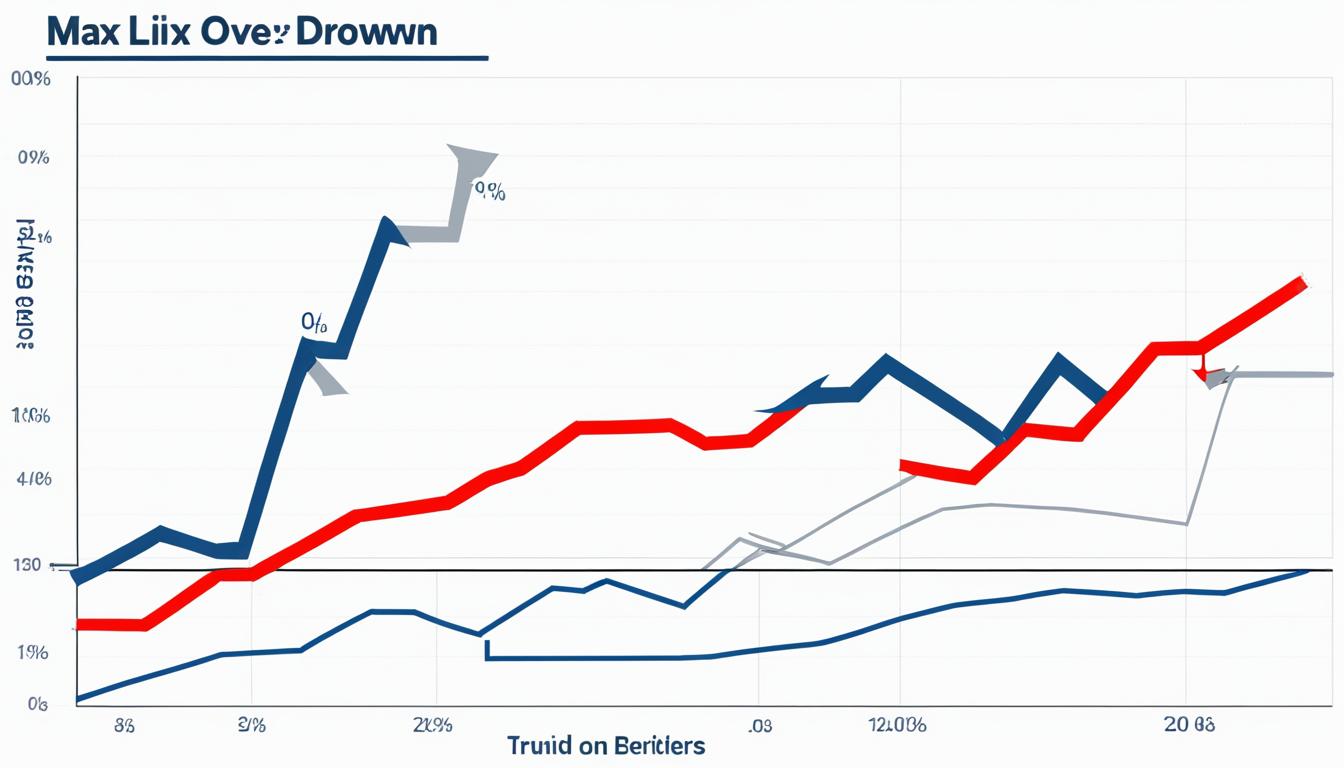

In the sphere of trading, drawdown measurements can make the difference in achieving long-term profitability. Traditional drawdown methods typically entail a static approach, fixing the risk limits regardless of the account’s performance. In contrast, the maximum trailing drawdown offers a more nuanced and dynamic mode of management. Its adaptability means that during periods of gain, the drawdown threshold moves upward, effectively trailing behind and creating an evolving safety net for traders. The maximum trailing drawdown explanation distinctly highlights this advantage over traditional fixed measures, which lack the flexibility to accommodate the trader’s growing capital.

The Role of Max Trailing Drawdown in Risk Management

When discussing max trailing drawdown risk management, the focus is on its preventative capabilities. With the implementation of a max trailing drawdown, trading entities such as TradeDay position themselves to preemptively sidestep substantial losses. The unique characteristic of the trailing drawdown is its capacity to ‘freeze’ at the highest account balance achieved, even if subsequent losses occur. Consequently, max trailing drawdown becomes a crucial component in the treasury of risk control measures, actively contributing to a trading strategy solidified against undue volatility.

Fluctuating market conditions demand that traders remain vigilant with an eye on minimizing potential losses. Drawdown management, specifically in the guise of max trailing drawdown, stands at the forefront of risk management strategies fostering that vigilance. Thus, understanding the mechanics, advantages, and strategic deployment of max trailing drawdown is essential for both novice and experienced traders aiming to fortify their investments against downside risks.

How Max Trailing Drawdown Functions

The max trailing drawdown risk analysis operates on a dynamic principle, offering a unique safeguard for traders. Its core function is to provide a safety mechanism that protects against large losses while still allowing for capital growth. The dynamics of max trailing drawdown calculation allow it to adjust in real-time as profits are secured.

Traders benefit from this methodology due to the flexibility it affords in continually shifting markets. As profits rise, so does the threshold for acceptable risk—yet, during downturns or losses, the max trailing drawdown remains static. This ensures that traders are not penalized for temporary setbacks as long as they stay within the prescribed drawdown limits.

Consider the scenario where a trader’s account starts with a balance of $50,000. With a max trailing drawdown activated, the trader has a pre-determined safety net that operates as follows:

- Profit Gain: If the account balance increases to $60,000, the max trailing drawdown threshold automatically adjusts upwards.

- Experiencing Losses: Should the account then suffer losses, the drawdown limit remains at the highest achieved balance, protecting from further financial risk.

This real-time calculation offers an adaptable environment that, unlike traditional methods, considers the performance highs as the new baseline for risk evaluation. The upshot is a risk management technique that evolves with the trader’s portfolio, ensuring that success is rewarded and not unduly restricted by past metrics.

| Account Balance | Profit/Loss | Max Trailing Drawdown Threshold |

|---|---|---|

| $50,000 | Initial Balance | $47,000 |

| $60,000 | +$10,000 | $57,000 |

| $55,000 | -$5,000 | $57,000 |

Ultimately, such protection through max trailing drawdown ensures that traders can operate with greater confidence, knowing they have a responsive and intelligent system in place to manage downside risk efficiently.

What is Max Trailing Drawdown in Practical Trading Scenarios

Understanding the max trailing drawdown definition is instrumental in trading risk management. This section will dissect how the maximum trailing drawdown operates in actual trading environments, shaping the strategies that professional traders adopt to maintain control over their risk exposure. In unfolding how max trailing drawdown functions in the trenches of market realities, we recognize its influence on trading behavior and decision-making processes.

Trailing Drawdown Calculation Example

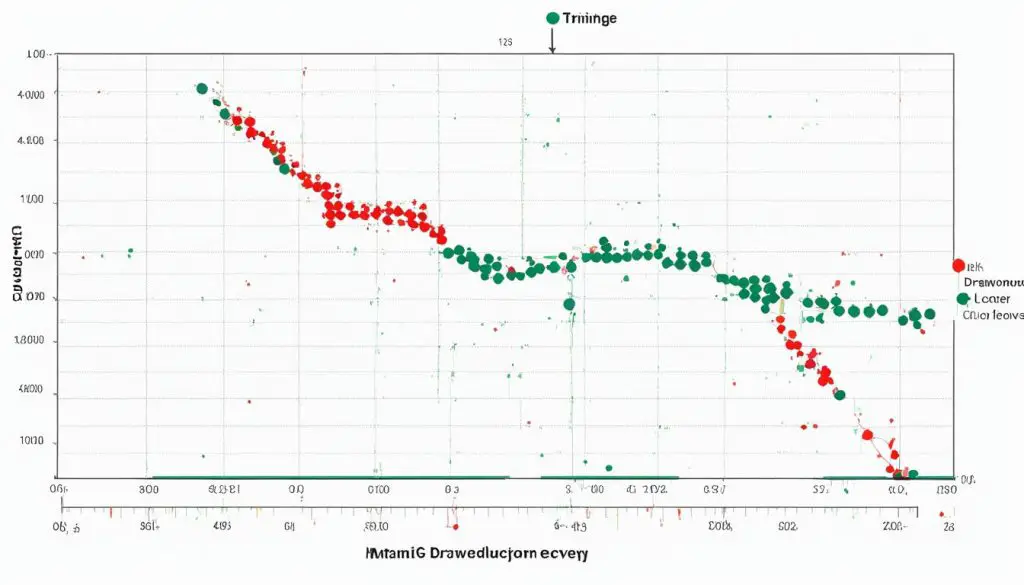

Consider a trader initiating the day with an account value of $100,000 and a pre-set trailing drawdown of $3,000. The account is not allowed to dip below $97,000 without signaling a breach. To illustrate:

Should the trader endure losses on day one, the threshold for drawdown would not be modified the subsequent day. Only when gains are made, which elevate the account above the original starting point, does the drawdown limit adjust upwards. Imagine the balance growing to $103,000, the new safety net becomes $100,000, solidifying at this peak and providing a buffer against future losses.

Real-Time Application and Its Impact on Trading Strategies

The reality of trading with a maximum trailing drawdown mechanism in place is the tangible ceiling it establishes over the risk a trader can take. It influences traders to vigilantly manage their positions, ensuring that each trade does not jeopardize the account’s health by breaching the drawdown threshold. The consequence of exceeding this limit is severe—automatic account suspension. Hence, traders plot their strategies to factor in both potential gains and the critical point of drawdown, which can derail their trading journey prematurely.

Max Trailing Drawdown from a Professional Trader’s Perspective

From a seasoned trader’s viewpoint, the max trailing drawdown is more than a rule. It is a compass that directs both trade entry and exit strategies. It is a crucial component in the mosaic of risk management, ensuring that while pursuit of profit is the motive, preservation of capital is the law. This dynamic safeguard compels a thoughtful approach to each potential trade and mitigates the risk of impactful losses.

As no two trading scenarios are identical, here’s an analytical breakdown of how max trailing drawdown might translate into a trader’s ledger:

| Account Value | Profit/Loss | End of Day Trailing Drawdown Limit | Comments |

|---|---|---|---|

| $100,000 | – | $97,000 | Initial starting point with a TMD of $3,000 |

| $98,500 | -$1,500 | $97,000 | No change in TMD as the end of day balance is a loss |

| $102,500 | $4,000 | $99,500 | TMD adjusts up following the day’s profit |

| $101,000 | -$1,500 | $99,500 | No change in TMD despite the loss, as it trails the highest balance achieved |

| $105,000 | $4,000 | $102,000 | TMD increases, securing a greater amount of earned profits |

By integrating a max trailing drawdown into their portfolio, traders enshrine a process of rigorous evaluation and preemptive caution, embracing a mindset of strategic foresight and disciplined money management.

Comparing Max Trailing Drawdown with Alternative Risk Management Tools

Max trailing drawdown is a significant innovation in financial risk management, offering investors and traders a dynamic approach to protect their portfolios. However, any comprehensive max trailing drawdown risk analysis would point out that this method, while robust, serves best when combined with an assortment of other risk management tools to create a more well-rounded strategy.

Pros and Cons of Max Trailing Drawdown in Risk Analysis

Implementing max trailing drawdown as part of risk management provides the clearest advantage of setting a dynamic threshold for losses. Thereby, creating a safety net for the investment capital. Particularly in trending markets, this tool dynamically adjusts with profits, protecting from significant downside without stifling growth. Nonetheless, it can present challenges, especially where markets are erratic and volatile in the short term—an environment where trailing drawdown parameters may be overly restrictive.

How Professionals Manage Risks Beyond Trailing Drawdown

Seasoned professionals aren’t solely reliant on max trailing drawdown for risk management. They often employ a diversified approach. Portfolio diversification, stop-loss orders, and options strategies are but a few alternatives used to navigate the investment landscape effectively. By recognizing and adapting to various market conditions, professionals mitigate risk without capping their potential upside.

Leveraging Drawdown Strategies for Optimizing Returns

In the quest to optimize returns, blending max trailing drawdown with other strategic elements can be highly effective. Pairing it with proportional position sizing, or volatility-adjusted stop losses, traders can tailor their risk parameters to market conditions, thereby enhancing potential returns without assuming undue risk.

- Dynamic Thresholds: Adjust risk levels in response to changes in account balance

- Portfolio Diversification: Spread risk across various assets or strategies

- Volatility Analysis: Modify exposure based on market turbulence levels

- Stop-Loss Orders: Exit losing trades automatically to prevent larger losses

- Options Strategies: Use derivatives to hedge positions and reduce risk exposure

In summary, while max trailing drawdown is both practical and advantageous for managing risks, integrating it with additional risk control measures can lead to a more robust risk management framework. This reality underscores the need for ongoing max trailing drawdown risk management education among traders, enhancing their ability to shield investments from excessive loss without debilitating their capacity for gain.

Conclusion

In summary, Max Trailing Drawdown stands as an indispensable element in the realm of max trailing drawdown risk management. Its capabilities enable traders to execute strategies with a safety net in place, ensuring that their capital is defended against deep financial declines. This dynamic tool’s design is tailored to provide a protective threshold, moving in unison with account balance increases and crystallizing at peak levels to avoid a setback during downturns, embodying the answer to the question, what is max trailing drawdown? in practical terms.

Despite the notable advantages this risk management strategy offers, it’s imperative for traders to recognize its limitations. Relying solely on Max Trailing Drawdown could be inadequate in the multifaceted world of trading where market volatility and the complexity of financial instruments require a more robust and versatile risk management framework. Therefore, it is advisable to complement the trailing drawdown with an array of other risk mitigation tools, striking a balance to suit individual trading styles and market conditions.

Indeed, Max Trailing Drawdown contributes significantly to the arsenal of risk management techniques, with its unique approach to preserving trading capital. Nonetheless, the most effective risk management strategy is holistic, encompassing diverse tools that together empower traders to navigate financial markets with confidence and achieve sustained success. A judicious combination of Max Trailing Drawdown with other risk management measures can furnish traders with a formidable defense mechanism for their investment endeavors.

FAQ

Max Trailing Drawdown (TMD) is a risk management measure that sets a trailing limit on the maximum allowable loss in a trading account, ensuring that a trader’s positions are liquidated before their account balance falls below a predetermined level. The limit trails the growth of the account and is enforced in real-time.

Max Trailing Drawdown is calculated by monitoring the end-of-day account balance and adjusting the maximum allowable loss threshold as the account appreciates in value. It is enforced in real-time and ensures that intraday fluctuations do not breach the preset drawdown limit.

Max Trailing Drawdown plays a crucial role in risk management by dynamically limiting potential losses while allowing for flexibility in trading strategies. It helps maintain the financial stability of a trader’s account by preventing the balance from dropping too low and acts as a ‘safety net’ during times of market volatility.

Traders must operate within the boundaries set by the Max Trailing Drawdown, which influences how aggressively or conservatively they trade. Breaching the drawdown limit can result in the liquidation of positions and blocking of the account, which necessitates cautious and strategic trade management.