The world of technical analysis is replete with intricate chart patterns that map the ongoing narrative of market trends. Among them, the asymmetrical triangle is particularly noteworthy. Not to be confused with its more balanced counterpart, the asymmetrical triangle in market analysis serves as a prognosticator of potential price movements, thereby providing traders with prospects of strategic positioning prior to significant price breakouts.

As traders scrutinize the canvas of market activity, deciphering the meaning behind these patterns becomes a crucial element in forecasting future market behaviors. The asymmetrical triangle, with its unique set of angles and converging trend lines, is a treasure trove for those who can interpret its language. It hints at either continuations or reversals in market trends, underscored by the consolidation period it represents.

Mastery in identifying these asymmetrical figures is not just an act of recognition; it is an analytical skill that facilitates decision-making in an environment where precision and readiness can lead to significant gains. This introductory glimpse into asymmetrical triangle patterns promises to unravel the essentials of this powerful tool in the arsenal of those who navigate the financial markets.

Introduction to Triangle Patterns in Technical Analysis

The landscape of technical analysis is rich with indicators and patterns that inform savvy traders about upcoming market behaviors. Among these, triangle chart patterns stand out as a key tool for identifying trading opportunities. Known for their distinct shape, comprised of converging trend lines, triangle patterns represent valuable periods of price consolidation. During these phases, the future direction of the market is typically unknown, offering traders the chance to prepare for significant movements.

Triangle chart patterns are broadly categorized into two main types: the symmetrical triangle, which signals a period of equilibrium and low volatility, and the asymmetrical triangle, often indicative of a forthcoming reversal in trend. Spotting these patterns and understanding their implications can lead to the identification of strong breakout signals.

- Symmetrical Triangle: Balance between buyers and sellers with a breakout trending in either direction.

- Asymmetrical Triangle: Typically indicates that a current trend is weakening and might reverse soon.

Traders tune into these nuances as an asymmetrical triangle, with its sloping trend lines, could intimate a buildup to an upward or downward trend shift, which symmetrical triangles may not clearly indicate.

| Triangle Pattern | Indicated Market Condition | Typical Breakout Direction |

|---|---|---|

| Symmetrical Triangle | Consolidation phase | Uncertain/Direction Neutral |

| Asymmetrical Triangle | Reversal setup | With the direction of the prevailing trend |

By decoding these technical formations, traders can not only forecast potential price movements but also adapt their strategies to align with expected trends, and ultimately harness market movements to maximize profits.

Recognizing and leveraging triangle chart patterns is thus a critical skill for anyone operating within the financial markets, be it stock or cryptocurrency trading. Mastery of these patterns enables a data-driven approach to trading—utilizing breakout signals to craft robust, informed, and confidently executed trading strategies.

The Role of Asymmetrical Triangles in Market Analysis

When dissecting trading charts, the astute identification of chart patterns is vital, with asymmetrical triangles standing out as critical indicators. These patterns are not only visually distinctive but are also packed with informational value concerning upcoming market shifts. Through asymmetrical triangle identification, investors gain a strategic edge by teasing out reversal signals well ahead of time, providing them the ability to pivot within tumultuous financial landscapes.

Characteristics of Asymmetrical Triangles

The essence of asymmetrical triangles lies in their ability to reflect the ongoing psychological tug-of-war between buyers and sellers. These triangles are characterized by one steeper trendline, suggesting that once the price breaches this slant, a strong market sentiment may be unveiled. In the faceted world of market sentiment analysis, recognizing the nuances of these triangles permits a trader to brace for potential reversals.

Interpreting Market Sentiment with Asymmetrical Triangles

Interpreting these patterns transcends mere shape recognition; it demands an understanding of market dynamics. Asymmetrical triangles can serve as a gauge for investor sentiment, where the imbalance suggested by their slopes frequently signals an impending reversal. Professionals adept at market sentiment analysis use these formations to forecast possible shifts in the prevailing trend. Anchoring their analysis in concrete chart patterns, experts can more reliably anticipate market movement direction.

| Aspect | Implication for Traders |

|---|---|

| Unequal sides of trendlines | Indication of strength in ongoing trend |

| Prolonged formation period | Potential for larger breakout and stronger sentiment shift |

| Steepness of trendlines | Predictive of breakout direction |

The anatomy of an asymmetrical triangle on trading charts presents a powerful instrument for refining investment strategies. Smart investors engage in rigorous market sentiment analysis to excavate these reversal signals and formulate decisions that could potentially fortify their portfolios against market volatility.

Asymmetrical Triangle Identification and Interpretation

In the realm of technical analysis, the ability to navigate through complex chart patterns is crucial. Asymmetrical triangle patterns are particularly noteworthy for their indicative power and the pivotal role they play in pattern recognition and breakout anticipation. Understanding how to spot and interpret these patterns is key for any trader aiming to thrive by capitalizing on market movements.

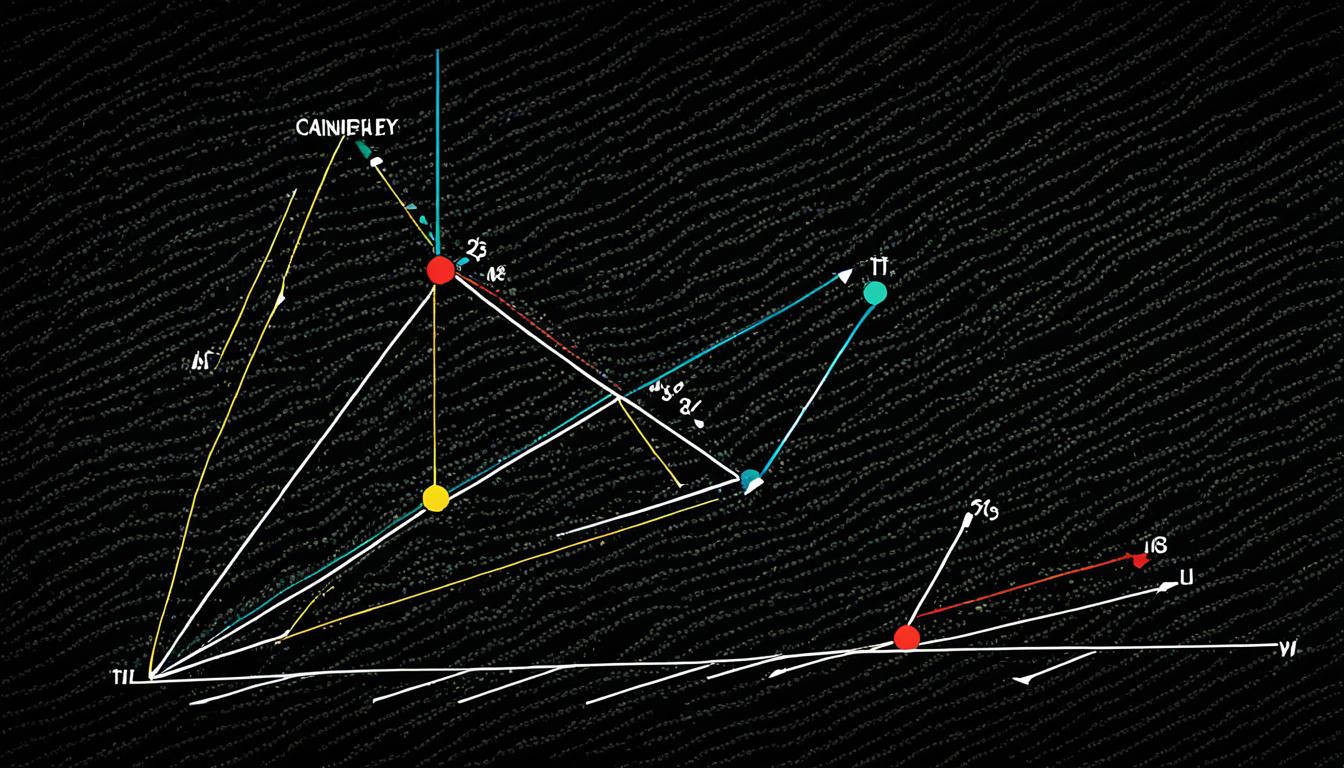

These triangles are typically identified by their distinctive shape on trading charts, characterized by two converging trend lines at different angles. This configuration hints at an undercurrent of tension between market forces, a tension that will eventually resolve in a price breakout. The steeper trend line often suggests the direction in which this breakout is more likely to occur. By recognizing these nuances, traders position themselves to make informed decisions regarding entry and exit points, preempting future market trends.

- A steeper descending trend line may indicate impending selling pressure.

- A steeper ascending trend line often points to a buildup of buying momentum.

Let’s delve into a detailed table that contrasts the different features of a typically spotted asymmetrical triangle to aid in better understanding:

| Feature | Description | Significance |

|---|---|---|

| Trend Line Convergence | One line is steeper than the other | Indicates imbalance, suggesting breakout direction |

| Volume Trend | Decreases leading up to the apex | Conforms to pattern’s consolidation phase |

| Breakout Point | Often occurs prior to the triangle’s apex | Allows for early anticipation and strategizing |

| Price Action Post-Breakout | Sharp move in one direction | Confirms the anticipated market shift |

Interpreting these triangles involves more than recognizing their signature shape; it requires a nuanced understanding of market dynamics. For instance, an asymmetrical triangle forming during an uptrend may suggest continuation, whereas its development in a downtrend may signal a potential reversal. Thus, strategic planning based on this pattern analysis becomes essential.

To summarize, asymmetrical triangle patterns serve as a beacon for traders, lighting the path toward potentially profitable market entries and timely exits. With the combination of theoretical knowledge and practical examination of the charts, recognition, and anticipation of breakouts can be a compelling part of a trader’s arsenal in navigating the frequently turbulent rivers of the financial markets.

Asymmetrical Triangle Versus Symmetrical Triangle

Within the realm of technical analysis, understanding the difference between asymmetrical and symmetrical triangle chart patterns is vital for developing a refined trading strategy. These patterns signal crucial breakout points and can significantly influence a trader’s decisions during a consolidation phase. As they differ in formation and implications, recognizing the nuances of each pattern is essential for any trader.

Distinguishing Factors Between Asymmetrical and Symmetrical Triangles

Asymmetrical and symmetrical triangles may appear similar at first glance but are distinct in several key aspects. A symmetrical triangle is characterized by the convergence of two trend lines at a similar angle, which points to a period where buyers and sellers are in a tug-of-war, awaiting new information to tip the scales. On the other hand, the asymmetrical triangle is formed with trend lines that converge unevenly, suggesting an impending trend shift as one side gains strength over the other.

| Characteristic | Symmetrical Triangle | Asymmetrical Triangle |

|---|---|---|

| Trend Lines | Converge at equal angles | Converge at unequal angles |

| Market Sentiment | Indecision, consolidation | Imbalance, potential reversal |

| Breakout Direction | Can occur in either direction | Tends to favor the steeper trend line |

| Implications for Volume | May precede breakout with low volume | Volume often increases before breakout |

Implications for Traders

For traders, the implications of identifying asymmetrical versus symmetrical triangles are profound. Symmetrical triangles, with their characteristic consolidation phase, can lead to breakouts that are not as predictable, resulting in a strategy centered around waiting and observing. Asymmetrical triangles, however, typically suggest that the current trend may be running out of steam and a contrary move is on the horizon—often leading traders to anticipate a reversal with strategic positioning.

Each chart pattern informs trading strategy and position timing, underscoring the importance of precision in pattern recognition. Familiarity with these patterns allows for wiser decisions on when to enter or exit a trade around breakout points, proving that in the world of trading, knowledge truly is power.

Significance of Breakouts in Asymmetrical Triangle Patterns

Within the realm of technical chart analysis, breakouts from asymmetrical triangle patterns stand as pivotal events that can dictate the momentum of the markets. These trading indicators are signals widely respected by market participants for their insights into impending market trend predictions, be it bearish or bullish. A discerning look at the directionality of these breakouts can reveal the sentiment driving market participants and, in turn, suggest the strategic positioning required.

A bearish breakout, characterized by a price plunge through the pattern’s lower support level, often heralds a significant downtrend. Traders diligently monitor these formations, evaluating the penetration below support, which could be an indicator to initiate short-selling positions. Conversely, a bullish breakout occurs when the price springs through the triangle’s upper resistance, setting the stage for a potential uptrend—triggering insights for traders to acquire long positions.

- For Bearish Breakouts:

- Monitor key support lines for a substantial price dip

- Consider volume increase for validation of the breakout

- Evaluate market sentiment for wider bearish indicators

- For Bullish Breakouts:

- Watch resistance levels for a persuasive price surge

- Scrutinize the price action for a close above the triangle

- Analyze broader market trends for bullish confluence

As traders strategize around these breakouts, they often refer to previous price actions within the asymmetrical triangle for additional insights. The duration of the pattern’s formation and the convergence angle of the trend lines are meticulously studied to forecast the potential strength and duration of the post-breakout move.

In harnessing the power of asymmetrical triangle patterns in trading, market participants employ a mix of patience, vigilance, and swift action. Recognizing a bearish or bullish breakout early allows for the adjustments and moves critical for aligning with new market dynamics and maintaining a competitive edge in various trading scenarios.

Trading Strategies Involving Asymmetrical Triangles

Proficient trading strategies tailored to asymmetrical triangles rely heavily on the anticipation of price breakouts. These strategies enable traders to marshal decisive trading positions through strategic entry and exit points. To harness the full potential of such price movements, seasoned traders meticulously apply volume analysis and price movement validation techniques, ensuring robust breakout trading strategies.

Entry and Exit Strategies

Entry and exit strategies involving asymmetrical triangles are predicated on identifying precise moments when the market confirms the anticipated breakout. Traders might consider a position when there’s a definitive cross of either the resistance level in an ascending triangle or the support level in a descending one. Prompt execution after these levels are crossed, supplemented by other technical indicators, is critical for optimizing trade outcomes.

Volume and Price Confirmation

In conjunction with the recognition of breakout points, traders prioritize volume analysis to validate the strength behind a price movement. A breakout backed by substantial volume offers greater conviction, as it suggests a consensus among market participants aligning with the breakout direction. Price movement validation acts as a key confirmation tool, as traders scrutinize the breakout’s sustainability before committing to their positions.

- Monitor for increased volume during a breakthrough to confirm breakout validity.

- Validate breakout sustainability with subsequent closes above resistance or below support levels.

- Adjust trading positions based on post-breakout price stability and continuation patterns.

Utilizing Technical Analysis Tools for Asymmetrical Triangles

As the financial markets evolve, traders continually seek advanced tools to interpret complex chart patterns like asymmetrical triangles. Utilizing the right mix of chart pattern tools and technical indicators serves as the backbone for effective market analysis. Platforms such as TrendSpider have emerged as pivotal components in a trader’s toolkit, providing automated recognition features that streamline the identification of technical patterns.

Automated Chart Pattern Recognition

To fully tap into the potential of asymmetrical triangles, savvy traders leverage automated chart pattern recognition technology. Market scanners, integrated within platforms like TrendSpider, are engineered to meticulously analyze vast market data, spotting patterns that human eyes might miss. These automated solutions ensure that traders are equipped with the most precise and up-to-date information to make well-informed trading decisions.

Incorporating Asymmetrical Triangle Indicators

In the quest for market edge, the incorporation of technical indicators that align with asymmetrical triangle patterns is critical. These indicators serve as signals, helping traders determine the most opportune moments to enter or exit the market. Furthermore, correlating traditional indicators with the scanning capabilities of modern chart pattern tools amplifies the robustness of any trading strategy.

| Feature | TrendSpider | Traditional Tools |

|---|---|---|

| Pattern Recognition | Automated and rapid detection | Manual chart examination |

| Technical Indicators | Comprehensive suite including volume, momentum, and trend indicators | Limited by trader’s knowledge and manual setup |

| Accuracy | High precision with minimal user-based error | Dependent on user interpretation and expertise |

| Efficiency | Real-time data processing and alerts | Time-consuming analysis with slower reaction times |

| User Experience | User-friendly interface with customizable options | Often requires in-depth technical knowledge |

Conclusion

The foray into the intricate world of technical chart analysis ultimately leads us to the strategic importance of asymmetrical triangles. These chart formations stand out as powerful tools, equipping traders with an analytical edge to discern upcoming market trend analysis. The distinct convergence of trend lines at varying angles—a trademark characteristic of asymmetrical triangles—serves as a beacon, signaling both market consolidation and impending reversal points that are essential for establishing profitable trading setups.

With a profound understanding of asymmetrical triangle usage, investors and analysts alike can enhance their trading acumen, leveraging these patterns to forecast and exploit potential breakouts. The transition from theory to practice unfolds through the meticulous identification and careful application of these patterns, bolstered by an array of trading strategies and sophisticated technical tools. It’s this blend of knowledge and technology that instills confidence in traders’ decision-making processes and aids in navigating the multifaceted terrain of financial markets.

Be it through the adoption of high-tech market scanners or a steadfast commitment to traditional charting methodologies, the incorporation of asymmetrical triangles into trading practices underlines a crucial aspect of modern market analysis. As we encapsulate the significance of this chart pattern, it becomes clear that the adept use of asymmetrical triangles is not merely a beneficial skill but an integral component of a trader’s arsenal, paving the way toward confidently tackling the dynamic waves of the trading world for lucrative outcomes.

FAQ

What is an asymmetrical triangle in technical analysis?

An asymmetrical triangle is a type of chart pattern used in technical analysis which signifies a potential consolidation or reversal of market trends. It is characterized by two converging trend lines that come together at different angles, usually with one line being flatter than the other, often predicting the breakout direction.

How do asymmetrical triangles differ from symmetrical triangles?

Asymmetrical triangles differ from symmetrical triangles mainly in the slope of their converging trend lines. In asymmetrical triangles, the trend lines converge at differing angles, which implies an imbalance between buyers and sellers, often leading to a breakout. Symmetrical triangles have trend lines of equal slope, indicating a period of consolidation where a breakout could occur in either direction.

How to use asymmetrical triangles to identify trading opportunities?

Traders identify asymmetrical triangles on trading charts and interpret them as signals for potential trend continuations or reversals. The pattern suggests that a breakout is imminent, and traders will look for price movements above the upper trend line for a long position or below the lower trend line for a short position as strategic trading opportunities.

What are the implications of breakouts from asymmetrical triangle patterns?

Breakouts from asymmetrical triangle patterns are key indicators of potential market trends. A bearish breakout suggests a downtrend, possibly initiating a short trading position, whereas a bullish breakout indicates an uptrend, pointing traders toward a long position. These breakouts help determine strategic entry and exit points.

How important is volume analysis when trading with asymmetrical triangles?

Volume analysis is crucial when trading asymmetrical triangles as it confirms the breakout. An increasing volume during the breakout provides additional validation of the new trend’s strength, making it a more reliable indicator for traders to execute their trading strategies.

Can asymmetrical triangles be identified and traded automatically?

Yes, with advancements in trading software like TrendSpider, asymmetrical triangles can be identified automatically through market scanners that analyze chart patterns. These technologies can alert traders to potential asymmetrical triangle formations, allowing for timely and efficient trade execution.

Are asymmetrical triangles applicable to all market types?

Asymmetrical triangles can be found in various markets, including stocks, forex, commodities, and cryptocurrency. However, the validity and interpretation of these chart patterns might differ based on market conditions and should be considered in conjunction with other technical analysis tools and market data.