The quest for mastering the intricacies of the bat harmonic pattern strategy marks a significant endeavor for traders within the complex tapestry of financial markets. This sophisticated approach is not merely a technique but an art form that, when perfected, yields the dual benefit of lucrative wins and minimized risks. The bat harmonic pattern, with its Fibonacci-based precision, offers traders a comprehensive blueprint for identifying those pivotal moments of market reversal.

At its core, this strategy involves an acute analysis of market swing points and retracements, aligning traders with the most opportune entry and exit points. It is the strategic anticipation of these points that empowers traders to position themselves favorably ahead of market turns. Whether dealing in equities, foreign exchange, or derivatives, the adaptability of the bat harmonic pattern ensures its application across a multitude of trading scenarios, establishing it as a cornerstone strategy for traders at all levels.

Demystifying the Bat Harmonic Pattern in Trading

The introduction of the Bat Harmonic Pattern by Scott Carney in 2001 redefined the approach traders take when forecasting potential market turns. Let’s delve into its origins and explore how the enigmatic interplay of Fibonacci measurements creates a robust predictive model used by seasoned traders worldwide.

Origins and Discovery of the Bat Pattern

Emerging from the rich tapestry of technical analysis, the Bat Pattern, while resonating with the foundational principles of H.M. Gartley’s seminal work, distinguishes itself through precise Fibonacci ratios. The scrupulous work of Carney highlighted its unique geometric structure, offering traders a powerful blend of predictive accuracy and elegance. This was a paradigm shift towards recognizing the subtle harmonics at play in the financial markets.

Understanding the Key Fibonacci Ratios

At its very core, the Bat Harmonic Pattern is underpinned by the meticulous application of Fibonacci retracements and extensions. By charting the price swings of XA, AB, BC, and CD, the trader embarks upon a numerically-synced journey, arriving at critical turning points that signal high-probability, high-reward, and lower-risk opportunities. The bearish bat pattern, in particular, relies on an optimal Fibonacci level of 88.6% retracement at the AB swing, promising fruitful ventures when these criteria align seamlessly with market movements.

Application Across Various Financial Markets

The versatility of the Bat Harmonic Pattern is never more evident than in its broad spectrum application across diverse financial landscapes. From the rapid ebb and flow of Forex markets to the dynamic arenas of equities and commodities, the bat pattern remains an unwavering beacon for those navigating the tumultuous seas of trading. The resemblance to the Gartley pattern serves only as a superficial comparison, as the nuanced Fibonacci levels of the Bat Pattern forge a new frontier of strategic trading that transcends markets, offering a universal toolkit for the analytical trader.

| Pattern | Distinguishing Ratio | Typical Market Application |

|---|---|---|

| Bearish Bat Pattern | 88.6% retracement at AB | Forex, Stock Markets |

| Bullish Bat Pattern | 38.2% – 50% retracement at BC | Commodities, Indices |

| Gartley Pattern | 61.8% retracement at AB | Diverse Markets |

Mapping the Bat Formation in Market Analysis

Traders often seek to decipher the price structure of financial instruments to anticipate potential reversal points. One of the most revered methods in this pursuit involves the harmonic chart patterns, and the Bat Harmonic Pattern figures prominently due to its efficacy in marking these critical junctures. The pattern’s identification is predicated on its five-point foundation, characterized by distinct Fibonacci measurements that, when accurately delineated, signal probable shifts in market trajectory.

By adhering to a disciplined approach towards charting this harmonic structure, investors can essentially map out their trading plan. Each point in the pattern corresponds to a pivot in price action, whereby the market could potentially enter a new phase. Adhering to these parameters not only furnishes investors with crucial entry and exit benchmarks but also brings a heightened level of precision to their market analysis.

The application of the Bat Harmonic Pattern is bolstered by its ability to integrate seamlessly with existing technical analysis methodologies. In practice, it enables a trader to point out the convergence of various Fibonacci levels, where confluence zones may further reinforce the strength of a potential reversal. Presented below is a comparative outline that encapsulates the key Fibonacci ratios defining the intrinsic swings of the Bat pattern:

| Fibonacci Ratio | Bat Pattern Swing | Significance |

|---|---|---|

| 0.382 – 0.500 | AB | Initial retracement against the XA impulse |

| 0.382 – 0.886 | BC | Secondary retracement proposing a potential continuation |

| 1.618 – 2.618 | CD | Final impulse harmonic leg, convergence point for reversal |

| 0.886 | XD | Reversal zone, entry point for traders |

Undeniably, a meticulous evaluation of the price structure via harmonic chart patterns like the Bat offers traders a vital edge. With a systematized framework to gauge market sentiment and anticipate potential reversal points, diligent investors are afforded an opportunity to strategically align their trades for potential success.

Essential Components of the Bat Harmonic Pattern

Traders relying on the Bat Harmonic Pattern are equipped with one of the most robust technical analysis tools designed for predicting price swings and market reversals with impressive accuracy. The potency of this pattern lies in its unique structure, which is derived from precise Fibonacci measurements, unveiling the blueprint for spotting reversals before they happen. A deep dive into this pattern reveals the critical elements that set it apart and fortify its predictive capabilities.

Distinct Characteristics of the Bat Structure

The Bat Harmonic Pattern, identifiable by its resemblance to a bat’s wings, is meticulously structured around specific Fibonacci ratios that are fundamental to its efficacy. This pattern is constructed from five essential points named X, A, B, C, and D, which map out four defining price swings inherent to the pattern’s execution. These swings guide traders in discerning potential reversal zones, marking critical junctures where market sentiment is likely to shift.

Comparative Analysis with Other Harmonic Patterns

Although the Bat Pattern is part of a broader family of harmonic patterns, each with their Fibonacci-based configurations, it boasts features that bestow traders with distinct advantages. Beyond the commonality in structure, the Bat stands out through its conservative retracement levels, which often lead to a higher probability of identifying true market reversals. Here’s how the Bat compares with some of its close counterparts in the harmonic family:

| Pattern | Defining Ratios | Reversal Precision |

|---|---|---|

| Bat | 88.6% XA retracement | High |

| Gartley | 78.6% XA retracement | Medium |

| Butterfly | 78.6% – 127% XA retracement | Low |

| Crab | 161.8% XA retracement | Medium-High |

Strategic Use of Fibonacci Retracements and Extensions

For traders to harness the full potential of the Bat Harmonic Pattern in forecasting market movements and capitalizing on market reversals, a strategic application of both Fibonacci retracements and extensions is crucial. These measurements serve as the navigational stars for traders, steering through the choppy waters of volatile markets to reach the shores of potential profitability. By focusing on the specific Fibonacci levels associated with each point on the pattern, traders can refine their entry and exit points, positioning themselves advantageously as they anticipate the next price movement.

Real-World Trading Scenarios Using the Bat Harmonic Pattern

In the arena of technical analysis, the Bat Harmonic Pattern stands as a testament to strategic trading emboldened by methodological precision. The real-world implications of employing such a pattern are vast, with traders around the globe documenting lucrative results. Underpinning these successes is the meticulous use of Fibonacci levels to time market entries and exits with formidable accuracy, laying the groundwork for profitable trades that are deeply rooted in risk management and coherent trading plans.

Case Studies and Success Stories

Case studies have abundantly demonstrated how the Bat Harmonic Pattern serves as a cornerstone for traders looking to navigate the tides of market volatility. Success stories from seasoned traders detail the integration of Bat pattern analytics into their trading regimes, citing heightened profit margins as a direct consequence. This pattern’s predictive nature has allowed for adept risk management, ensuring the conservation of capital while simultaneously proliferating wealth in an ever-changing market landscape.

Combining with Other Trading Strategies for Enhanced Profits

Integrating the Bat Harmonic Pattern within a diverse array of trading strategies has shown to amplify profitability. When utilized in concert with methodologies such as momentum and trend-following strategies, the precision of the Bat pattern provides an additional layer of validation that reinforces entry and exit points. This synergy maximizes the effectiveness of a trader’s plan, offering a fortified approach to securing profitable trades backed by resilient risk management techniques.

| Strategy | Without Bat Pattern | With Bat Pattern |

|---|---|---|

| Entry Precision | High Variability | Increased Accuracy |

| Exit Strategy | Narrower Profit Margin | Maximized Gains |

| Risk Management | Standard Stop Loss | Strategic Stop Placement |

| Overall Profitability | Moderate | Substantially Higher |

Step-by-Step Guide to Trading with the Bat Harmonic Pattern

Trading with the Bat Harmonic Pattern involves distinct phases, starting with the initial pattern identification, which is critical for successful trade entry. The rigorous analysis ensures that each Fibonacci level confirms the integrity of the pattern before proceeding to the execution phase. Here, traders establish stop-loss orders and calculate profit targets to manage risk and capitalize on potential market reversals.

Identifying the Pattern: Begin by analyzing charts to spot the characteristic ‘M’ or ‘W’ shapes of the Bat Harmonic Pattern. Validate the pattern’s formation with precise Fibonacci retracements and extensions to confirm trading signals.

Setting Up Trade Entry: Once the pattern is identified, prepare to enter the trade at point D when the price action confirms the reversal. Effective trade entry is contingent on waiting for the right signals and not preemptively jumping into a position.

Defining Stop-Loss Orders: To secure your investment and minimize losses, establish a stop-loss order just beyond point X. This serves as a safeguard against any invalidation of the pattern and substantial adverse market movements. Here’s how to set effective stop-loss orders:

- Determine the maximum amount you’re willing to risk on each trade.

- Place the stop-loss order a few pips or points beyond point X to allow for market volatility.

- Adjust your stop-loss order according to live market conditions, if necessary.

Calculating Profit Targets: Profit targets are optimally placed at point A, where the pattern completed its initial leg. Experienced traders might aim for extended targets if supported by strong market momentum or other confirming technical indicators.

Executing the Trade: Following the clear criteria for trade entry, stop-loss orders, and profit targets ensures a structured approach to trading with the Bat Harmonic Pattern. Below is a table that provides a comprehensive overview of each step and its importance:

| Trade Phase | Description | Importance |

|---|---|---|

| Pattern Identification | Locating the Bat Harmonic Pattern on charts using Fibonacci levels. | Foundation for accurate trade entry and exit points. |

| Trade Entry | Initiate a trade at point D upon pattern confirmation. | Capitalizes on the predicted market reversal at strategic points. |

| Stop-Loss Orders | Setting a stop-loss beyond point X to minimize potential losses. | Protects capital by limiting downside risk if the pattern invalidates. |

| Profit Targets | Establishing profit targets at the completion of the pattern’s initial leg. | Aims to maximize returns when the reversal occurs as anticipated. |

Incorporating the Bat Harmonic Pattern into your trading approach involves methodical steps and a disciplined adherence to technical analysis principles. By following this guide, traders can optimize their trade entry, set effective stop-loss orders, and define profit targets that align with bullish or bearish reversals signaled by the Bat Harmonic Pattern.

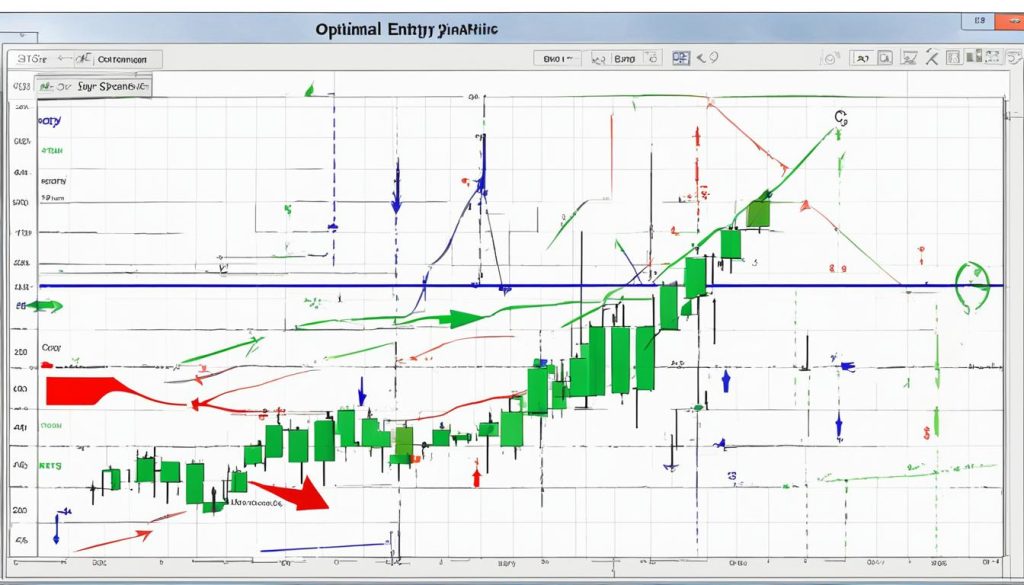

Advanced Techniques: Optimizing the Bat Harmonic Pattern Strategy

To maximize the efficacy of the Bat Harmonic Pattern in trading, it is imperative to integrate advanced techniques that refine strategy execution. Achieving optimal trade execution is not simply a matter of recognizing the pattern but understanding the art of timing and the interplay of market dynamics.

Entering and Exiting Trades at Optimal Times

To make optimal use of the Bat Harmonic Pattern, entry and exit points must be precisely calibrated. Technical indicators serve as the compass for navigating these critical junctures. Superior market forecasting hinges on the confluence of signals from an array of indicators, such as Moving Averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD).

Incorporating Price Action and Market Sentiment

Price action and market sentiment are crucial elements in the tapestry of trading. To amplify the predictive power of the Bat Harmonic Pattern, traders should synthesize the narrative told by price behaviors with the prevailing mood of the market ecosystem. Together, these factors can affirm or contest the potential trades suggested by the pattern.

Backtesting Your Strategy for Reliability and Effectiveness

Assurance of a strategy’s robustness comes from rigorous backtesting. Historical data provides a backdrop against which traders can measure the Bat Harmonic Pattern’s performance. This empirical approach is invaluable in establishing the conditions under which the pattern thrives, ensuring a trader’s confidence is well placed when real capital is at stake.

The following table illustrates how different technical indicators may align with the Bat Harmonic Pattern to signal optimal trade execution:

| Technical Indicator | Function | Utility with Bat Harmonic Pattern |

|---|---|---|

| MACD | Momentum Measurement | Confirms momentum shift at potential reversal zones indicated by the pattern |

| RSI | Overbought/Oversold Indicator | Identifies extremes in market sentiment as the pattern completes |

| Bollinger Bands | Volatility Indicator | Highlights contraction and expansion phases near the pattern’s critical points |

| Fibonacci Retracements | Price Reversal Levels | Reinforces the structural levels within the pattern for more informed entry/exit decisions |

Conclusion

The integrative approach of the bat harmonic pattern represents more than just a trading formula; it is a nuanced strategy born out of the meticulous study of Fibonacci levels. The precision of this pattern’s structure offers traders a competitive edge in predicting market reversals with greater accuracy. As the financial landscape grows more complex, the application of such rigorous analytical tools underscores the trader’s quest for trading success.

Utilizing the bat harmonic pattern, traders have introduced a level of discipline and precision to their trading practices that was once thought unattainable. This pattern’s utility in pinpointing entry and exit points establishes a methodical framework that aids in the reduction of risks, while simultaneously opening a vista of profitable trading opportunities in the dynamic expanse of the financial markets.

In sum, the enduring relevance of the bat harmonic pattern stands as a testament to the continuing importance of Fibonacci-based strategies in trading. For those dedicated to mastering its intricacies, the strategy offers a powerful advantage in an industry where success hinges on the ability to anticipate and capitalize on the perpetual ebb and flow of market forces.

FAQ

The Bat Harmonic Pattern Strategy is a comprehensive trading methodology used by professional traders to identify potential reversals in financial markets. It employs specific Fibonacci levels that are derived from distinct price movements, ultimately creating a pattern that resembles a bat’s wingspan. This strategy is noted for providing precise entry and exit points conducive to profitable trades.

The Bat Harmonic Pattern was discovered by Scott Carney in 2001. It is differentiated from other patterns like the Gartley pattern due to its unique Fibonacci ratios, which contribute to its precision in predicting market reversals.

The Bat Harmonic Pattern can be applied in various financial markets including stocks, forex, and futures. Traders use key Fibonacci retracements and extensions to recognize and leverage potential reversal points, which facilitates low-risk and high-reward trading opportunities.

The Bat Harmonic Pattern consists of five critical points labeled X, A, B, C, and D, creating four distinct price swings. The use of strategic Fibonacci retracements and extensions is essential for forming its precise structure and capitalizing on market reversals signaled by the pattern.

Trading using the Bat Harmonic Pattern involves identifying the pattern on charts, confirming it with Fibonacci ratios, entering a trade at point D, placing stop-loss orders at point X, and setting profit targets at point A. Diligent application of each step is crucial in managing risks and exploiting the reversal opportunities indicated by the pattern.