For seasoned traders and investors seeking a clearer understanding of market trends, the key might just lie in the mastery of chart patterns. These visual clues embedded within financial charts are the compasses by which many navigate the tempestuous sea of market data. A solid grasp of chart patterns is not just a facet of technical analysis; it is an integral part of a cohesive trading strategy.

The intricacies involved in decoding these patterns extend beyond mere lines and curves; they symbolize the collective actions of market participants. Whether it’s the peaks and troughs of a stock price or the ebb and flow of a cryptocurrency wave, harnessing the predictive power of chart patterns can provide traders with actionable insights to align with or capitalize on prevailing market trends.

Join us as we delve into the comprehensive realm where shapes and trends converge, empowering traders to make prompt, informed decisions in the relentless world of finance.

Understanding the Role of Chart Patterns in Technical Analysis

In the realm of technical trading, financial charts offer an invaluable tool for investors. By decoding the myriad of lines and curves on these charts, those engaged in crypto trading and other market disciplines can navigate the complexities of market analysis. Chart patterns form a crucial element in this analysis, helping those who trade to understand and act on market signals. Recognizing various trend analysis techniques, price action, and pattern types, such as bullish patterns or bearish trends, can influence a trader’s ability to make informed decisions.

Definition and Significance of Chart Patterns

Chart patterns provide a graphical representation of security prices over time and are a staple in technical trading. Through the study of these formations, traders can infer both the psychological and fundamental dynamics at play within the markets. These patterns are not limited to traditional financial markets but are equally applicable to the volatile domain of crypto trading, where they become essential to predicting future price movements. For traders, the ability to discern these patterns can mean the difference between a successful trade and a missed opportunity.

Interpretation of Price Movements

Traders who master the art of interpreting price action through chart patterns gain insight into the underlying market trends. The ability to read chart patterns, from flags and pennants to wedges, equips investors with foresight into potential market continuations or reversals. The correct interpretation of these formations can offer tactical advantages by highlighting potential entry and exit points for traders, vital for maintaining profitability in the often unpredictable realms of stock and crypto trading.

Identifying Trend Reversals and Continuations

To excel in market anticipation and strategy, recognizing the signs of trend reversals and continuations is pivotal. Chart patterns serve as a beacon, signaling impending shifts in market dynamics. Apprehending the significance of formations like the head and shoulders, or the double tops and bottoms patterns, can alert traders to approaching reversals, while patterns like triangles can suggest the likelihood of trend continuation. Deploying this knowledge effectively allows for agile adjustments in trading strategies, in line with market behavior.

Consult the table below for a reference to common bullish and bearish chart patterns and their typical market implications:

| Chart Pattern | Type | Description | Market Implication |

|---|---|---|---|

| Head and Shoulders | Bearish Reversal | A pattern featuring three peaks, with the outer two at a similar level and the middle one the highest. | Indicates a reversal of an uptrend. |

| Double Bottom | Bullish Reversal | Formation resembling the letter ‘W’, indicating two attempts to push price to a new low. | Suggests an upcoming bullish reversal following a downtrend. |

| Ascending Triangle | Continuation | Characterized by a flat upper trend line and an upward-sloping lower trend line. | Signals continuation of a current uptrend. |

| Flags and Pennants | Continuation | Short-lived patterns indicating a small pause in an active trend before continuation. | Typically implies that the prior trend will resume. |

Chart Patterns Cheat Sheet: An Essential Tool for Traders

Arming yourself with a trading cheat sheet can be the linchpin to unlocking the complexities of market behavior. Not just any guide, a cheat sheet specifically designed with chart patterns centralizes years of trading knowledge into a single, accessible format. It’s the compilation of distilled wisdom essential for both novice and seasoned market players. This arsenal of technical tools empowers you to decipher market movements, predict outcomes, and make more informed decisions.

A trading guide isn’t just about information; it’s about accessibility and speed. With formats ranging from sleek digital PDFs to dynamic mobile apps—traders can pull up historical patterns in seconds, juxtapose them with live charts, and catch the start of a trend as it unfolds. This widespread availability ensures that whether you’re at your desk or on the move, the cheat sheet remains a steadfast ally in your trading endeavors.

- ID Tips: Quick pointers to single out each pattern amidst market noise.

- Outcome Forecasts: Probable scenarios following the pattern’s emergence.

- Historical Reliability: Performance rating based on past market data.

- Actionable Tactics: Recommended strategic moves for each pattern type.

Integrate these insights with your existing knowledge base to capitalize on the ebbs and flows of market dynamics. Rely on the trading cheat sheet to streamline your workflow and complement your set of technical tools. It’s not just about recognizing patterns; it’s about crafting a nuanced trading guide imbued with the potential for precision, speed, and intelligence in your market maneuvers.

Exploring Different Types of Chart Patterns

Chart patterns are like the footprints of market sentiment, laying out the historical paths of price action, which serve as a map for future predictions. Deciphering this map requires understanding three fundamental pattern types, each indicative of the market’s pulse: bilateral, continuation, and reversal.

Bilateral Chart Patterns: Trading in Indecision

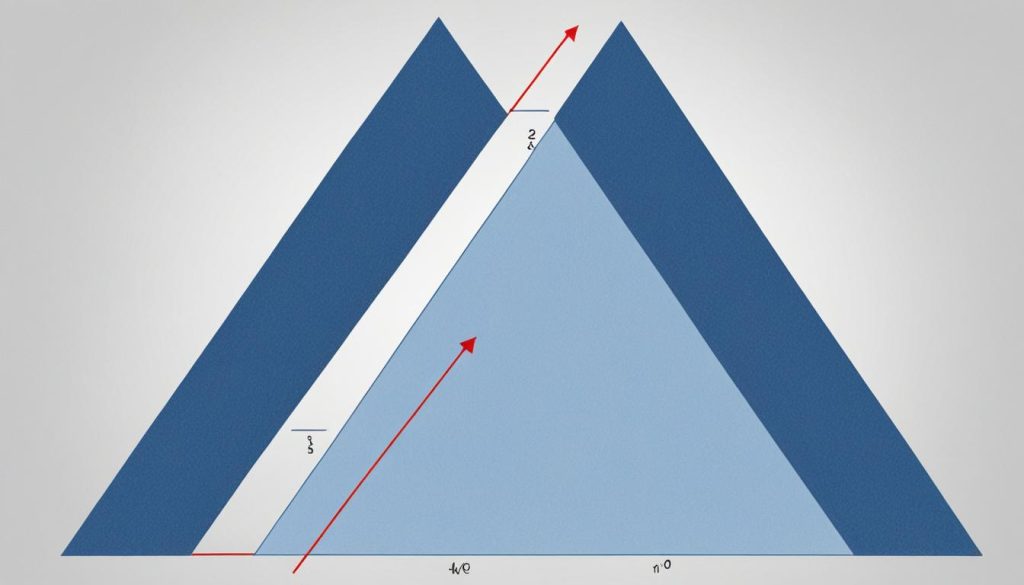

In the landscape of technical analysis, bilateral chart patterns represent the battlegrounds of market indecision, areas where the forces of supply and demand are locked in equilibrium. The classic symmetrical triangle is a quintessential neutral chart pattern, often materializing on charts as a converging of price lines that reflect a state of uncertainty. The market could tilt in favor of the bulls or bears, making vigilant monitoring of technical signals essential.

Continuation Patterns: Identifying Market Stagnation and Progression

- Bull flags and pennants signal a brief consolidation before the market re-energizes to continue along its trend, depicting a metaphorical ‘catching of the breath’.

- Ascending and descending triangles suggest a simmering momentum about to boil over, offering cues for trend resumption.

Recognizing these formations empowers traders to align their strategies with the anticipated directional movement, potentially harnessing the momentum for gainful trades.

Reversal Chart Patterns: Spotting Trend Opposites

Those understanding the language of reversal chart patterns hold the key to foreseeing significant market shifts. A head and shoulders pattern or a double top configuration often ushers in a bearish reversal. Conversely, a double bottom may prelude a bullish uprising. Reading these technical signals informs trend prediction, allowing nimble-footed traders to pivot in response to these crucial trend turnabouts. It’s a dynamic that underscores the essence of timing in trading – know when to hold and when to fold.

As we dissect the ecology of chart patterns, we uncover the critical intelligence they provide, a beacon to guide traders through the fog of market unpredictability. Armed with this knowledge, one attunes to the rhythm of price movements, turns indecision into strategy, stagnation into opportunity, and unforeseen reversals into calculated risks.

Maximizing Trading Strategies with Chart Patterns Cheat Sheet

For investors looking to refine their trade execution and market strategy, leveraging chart patterns is non-negotiable. Chart patterns serve as the backbone of technical analysis and play a pivotal role in position management. The meticulous application of these patterns can vastly improve the precision and effectiveness of trading moves in the financial markets.

One of the fundamental steps in utilizing chart patterns is establishing clear entry and exit points, ensuring that traders are well-positioned to capitalize on the market’s movements. Integrating chart patterns with supplementary tools, such as the Relative Strength Index (RSI) and volume indicators, enhance decision-making and provide confirmatory signals for pattern validity.

Additionally, ensuring consistent gains and minimizing losses demand diligent position management, which includes the implementation of stop-loss orders. These orders act as a safety net, protecting the trader’s capital in the event of sudden market reversals.

- Identifying key chart patterns integral to current market strategy

- Utilizing RSI and volume indicators for additional trade confirmation

- Pinpointing precise entry and exit points to optimize trade execution

- Employing strict stop-loss parameters for robust position management

The intelligent use of chart patterns, when combined with an investor’s understanding of the market, can yield a powerful strategy for navigating the complexities of trading. The goal is not only to identify opportunities but also to execute trades with confidence and manage positions proactively towards achieving trading success.

How to Effectively Utilize a Chart Patterns Cheat Sheet

Successful trading hinges on the accuracy of pattern identification and the judicious application of market analysis. With a comprehensive chart patterns cheat sheet, traders are equipped with the visual tools needed to recognize key formations and apply them to their trading strategies.

Getting Acquainted with Chart Pattern Basics

Understanding the foundation is essential in constructing a stable trading approach. Pattern basics are the alphabets of the language of technical analysis. Through learning about **support and resistance levels**, traders gain the ability to interpret market sentiment and predict potential zones of buying or selling pressure, key in setting targets for trade execution. Traders should familiarize themselves with the common patterns delineated in their cheat sheets—recognizing a flag, pennant, or wedge—thereby laying the groundwork for more advanced chart analysis.

The Art of Pattern Recognition on Trading Charts

Pattern recognition is not just a skill, but an art. Refining this ability means traders can rapidly scan charts and identify formations that signify potential trading signals. With pattern recognition, quick and decisive action can be taken when a familiar shape emerges on the chart, suggesting an imminent opportunity. Whether it’s noticing the consolidation before the breakout of a triangle pattern or the top formation signaling a downturn, traders should be adept at spotting such cues to implement timely strategies.

Combining Chart Patterns with Other Technical Indicators

To solidify the predictive value of pattern identification, savvy traders often marry pattern recognition with momentum indicators and other market analysis tools. This union allows for stronger confirmation of trading signals, refining **risk management** strategies and improving the likelihood of successful trade execution. By cross-referencing patterns with indicators like moving averages or volume profiles, one can filter out the noise and focus on significant signals that corroborate the analysis drawn from the chart patterns cheat sheet.

Ultimately, the integration of these multifaceted analytical tools aims to provide a holistic and disciplined approach to the markets. The cheat sheet serves not only as a shortcut for quick reference but as part of a broader, robust trading system that incorporates continuous learning and adaptation to the dynamic nature of financial markets.

Conclusion

In the realm of technical analysis, the utilization of chart patterns equips traders with invaluable insight into market behavior. It’s the sagacity to discern these patterns that fosters trading precision—a prowess that is significantly augmented by the use of a chart patterns cheat sheet. Whether one is surveying the tides of the stock market, analyzing the fluctuations of forex trades, or delving into the crypto-verse, the thorough understanding and application of these visual tools can be transformative. However, it must be emphasized that while cheat sheets serve to streamline the analytical process, they should complement rather than supplant a comprehensive market analysis.

The efficacy of a cheat sheet is most potent when it is integrated into a larger, well-thought-out trading strategy that includes robust technical tools. It’s this synergy that can sharpen an investor’s edge, allowing for reactions to market movements with both speed and confidence. Chart patterns offer a snapshot of past trading behavior, affording those in the financial markets a gauge of potential future movements.

Incorporating these patterns into trading routines develops a trader’s ability to navigate and profit from the markets. When chart patterns intertwine with solid risk management practices and adaptive tactics, traders empower themselves to navigate the markets with increased dexterity. As with all aspects of investing and trading, ongoing education and experience are key to leveraging the full potential of chart pattern analysis. In essence, chart pattern cheat sheets can offer a clear path to enhanced market success for diligent and discerning traders.