Have you ever navigated the choppy waters of the forex market using the Donchian Channel Indicator? Named after its creator, Richard Donchian, known as “the father of trend following”, this tool is revered for its simplicity and effectiveness in trading. Whether you’re a indicator or a seasonal trader, the Donchian Channel Indicator can be an integral part of your trading strategy.

What is the Donchian Channel Indicator?

The Donchian Channel Indicator is a three-line channel that helps identify price breakouts and provide possible exit and entry points. In essence, it's a tool that aids in understanding the volatility and price levels of a particular market. This tool was developed by Richard Donchian, who is also known as the 'Father of Trend Following Trading.'

How is the Donchian Channel Indicator Calculated?

The Donchian Channel Indicator is calculated using the following formula:

- Upper Band: The highest high in the last ‘N’ periods.

- Middle Band: The average of the Upper Band and Lower Band, which is calculated as (Upper Band + Lower Band) / 2.

- Lower Band: The lowest low in the last ‘N’ periods.

The 'N' in this formula represents the lookback period that can be chosen based on your trading strategy. For example, a very common setting for N is 20 periods.

Using the Donchian Channel Indicator in Trading

The Donchian Channel Indicator can be a potent tool in your trading arsenal. Here's how you can leverage it for profitable trades:

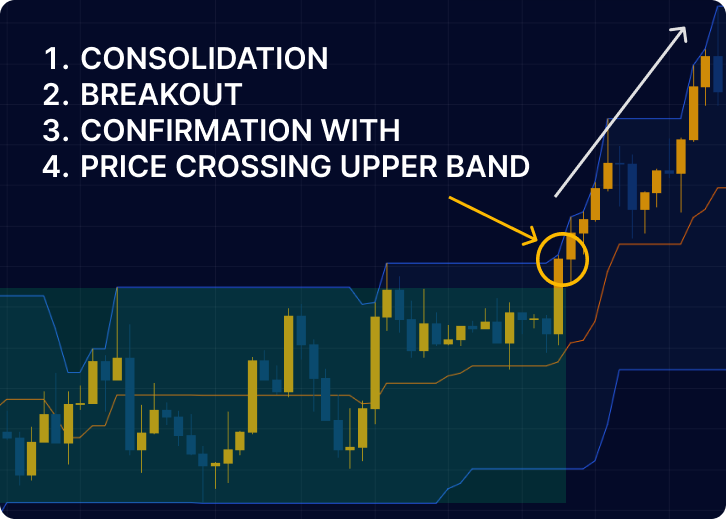

Identifying Breakouts: When the price crosses the upper band, it indicates a potential upward breakout, suggesting a buying opportunity. Conversely, when the price crosses the lower band, it signals a possible downward breakout, indicating a selling opportunity.

Determining Overbought and Oversold Conditions: If the price is near the upper band, the market might be overbought. Likewise, if the price is near the lower band, the market could be oversold.

Setting Stop-Loss and Take-Profit Points: The middle band can act as a dynamic level for stop-loss and take-profit points.

Using the Donchian Channel Indicator on MT4 and MT5

Using the Donchian Channel Indicator on popular platforms like MT4 and MT5 is straightforward. The indicator is usually listed under the 'Trend' or 'Channels' category in the indicator list. After selecting it, you can set the desired period for the upper and lower bands.

Donchian Channel Indicator vs. Other Indicators

While the Donchian Channel Indicator is excellent at identifying breakouts and potential trading ranges, it may generate false signals in a strongly trending market. This is where it might be beneficial to use it in conjunction with other indicators. For example, using the Donchian Channel Indicator with a VWMA indicator can help filter out false signals and confirm trends.

Risks and Drawbacks of the Donchian Channel Indicator

Like any trading tool, the Donchian Channel Indicator is not foolproof. It's most effective in a market with sufficient price movement. In a sideways or "choppy" market, the Donchian Channel may provide less reliable signals. Thus, it's crucial to use the Donchian Channel Indicator as part of a comprehensive trading strategy, incorporating other analysis tools and risk management techniques.

Expert Opinions and Case Studies

"The Donchian Channel Indicator is a robust tool for traders who understand how to interpret it. Like all technical analysis tools, it works best when used in conjunction with other indicators and not as a standalone predictor of market movement." – Richard Weiß.

"I've found the Donchian Channel Indicator to be particularly useful in trending markets, especially when used in combination with momentum indicators for entry signals." – Linda Reller, Professional Trader

In Conclusion

The Donchian Channel Indicator is an effective tool for identifying price trends and potential breakouts, but it shouldn't be used in isolation. Always combine it with other indicators and apply good risk management practices. Happy trading!

FAQs

The Donchian Channel Indicator is a tool that helps traders identify price breakouts and provide potential exit and entry points.

The Donchian Channel Indicator is calculated using the highest high and lowest low over a chosen period.

The Donchian Channel Indicator can be used to identify breakouts, determine overbought and oversold conditions, and set stop-loss and take-profit points.

Yes, the Donchian Channel Indicator can be used on both MT4 and MT5 trading platforms.

In a sideways or “choppy” market, the Donchian Channel Indicator may provide less reliable signals. It’s always recommended to use it as part of a comprehensive trading strategy.

While the Donchian Channel Indicator excels at identifying breakouts and trading ranges, it can generate false signals in a strongly trending market. Therefore, it’s beneficial to use it in combination with other indicators.