Discover the enigma of the Gann Square of Nine, a timeless tool that continues to pique the curiosity of traders seeking to decipher the secrets of market movements. Created as part of a profound gann trading technique, this method is based on a numerical and geometrical framework that stands as a beacon for identifying pivotal price levels, crucial support and resistance lines, and optimal trade timing.

The Gann lies in its intricate Gann Square of 9 matrix calculator, built upon the principles of harmony and proportion that are intricately linked to the natural order influencing trading strategies. By leveraging the precise angling within the grid, traders can formulate predictions with a greater degree of accuracy, harnessing the predictive power long-associated with the Gann Square of 9.

Embrace the legacy that defines financial analysis. The Gann Square of Nine threads through the tapestry of technical analysis, offering a roadmap for those who aim to navigate the ever-changing cinema of financial markets.

The Pioneering Legacy of W.D. Gann

The impact of W.D. Gann on the financial markets continues to be of pivotal importance, even after more than half a century since his passing. Widely recognized as a financial legend, Gann’s innovative approaches to trading have withstood the wave of technological advancement, proving his methods to be timelessly beneficial for market analysis.

From Humble Beginnings to Market Luminary

W.D. Gann’s journey from a simple origin to becoming a luminary in the world of finance is nothing short of remarkable. His aptitude for numbers and an uncanny understanding of market principles led him to develop what is known today as gann theory—a beacon of predictive accuracy in trading circles.

Gann’s Unique Intersection of Mathematics and Mysticism

What sets Gann apart was his fearless integration of the logical with the ostensibly illogical. He delved deep into the realm of mathematics and mysticism, merging planetary cycles with market movements to provide a fresh perspective on gann forecasting. For Gann, astrology was more than a mere curiosity—it was a critical dimension in decoding the markets’ future directions.

The Gann Square: A Window into Market Cycles

Gann’s methodologies revolutionized how traders understood the cyclical nature of markets. By leveraging tools such as the Gann Square, traders gained an invaluable window into market cycles, thereby improving their ability to forecast and capitalize on future trends.

In a field where many tout complexity, Gann’s work exemplifies how a blend of simplicity and depth can provide groundbreaking insight, making him a true financial visionary whose legacy endures.

Understanding the Gann Square of Nine

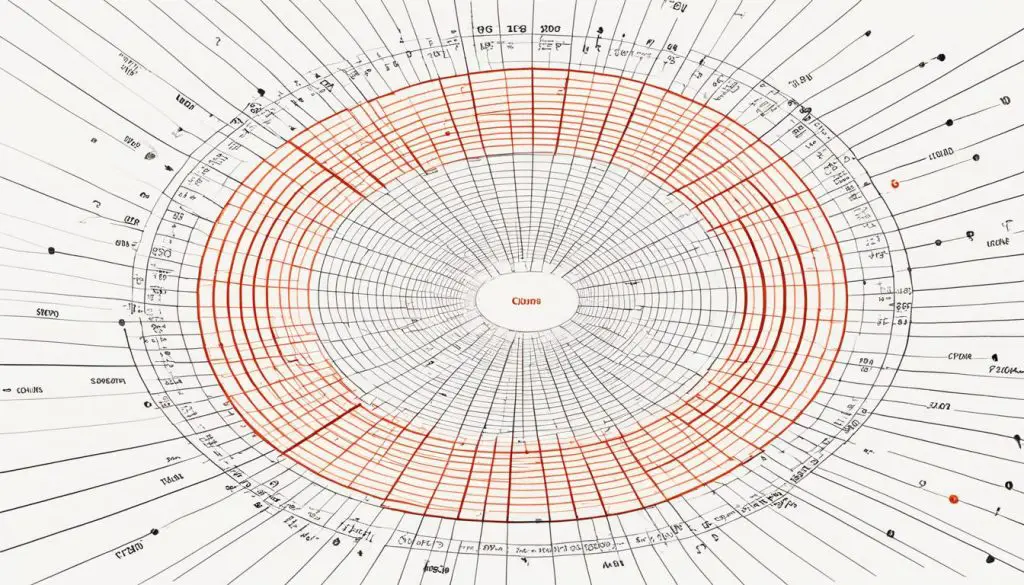

The Gann Square of Nine, an influential tool in technical analysis and trading, is often surrounded by an aura of mystique due its intricate design and profound implications for market forecasting. Codified by the legendary trader W.D. Gann, the Gann Square of 9 is more than just a trading instrument; it’s a composite of numerological and geometrical theories interwoven with market principles.

This three-dimensional model requires traders to engage in square of nine analysis to uncover pivotal price points that have the potential to signal significant market moves. Each number on the chart represents a potential price level, with the center of the square symbolizing the key price from which these levels are projected.

At the heart of the model is the 45-degree angle, which is pivotal in Gann’s theory for gauging market equilibrium. When prices deviate from this angle, it’s an indication for traders to look for resistance and support levels—an essential part of a robust trading strategy.

Here’s a basic walkthrough of how traders might use the Gann Square of Nine chart in their trading:

- Identify a significant high or low point on a price chart.

- Project this price onto the Gann square to find the corresponding number.

- Trace diagonals within the square to determine potential future resistance or support levels.

- Monitor price action as it approaches these levels for trading opportunities.

It’s important to note that proficiency with the Gann Square of Nine demands commitment, as it encompasses a high level of complexity within its framework. Traders should endeavor to comprehend the full scope of its rules and applications, which may require an extensive period of study and practice, particularly when applying it to fast-paced environments like intraday trading.

In spite of the effort required to master, traders who have diligently applied the Gann Square of Nine technique often praise its efficacy and the edge it provides in predicting market movement, a testimony to the timeless nature of Gann’s trading methodologies.

Gann’s Geometric Approach to Market Analysis

The power of geometry in finance can be vividly observed through the gann angles, a cornerstone method of W.D. Gann’s market analysis technique. Fusing together mathematical rigor with an intimate knowledge of market timing, Gann’s approach revolutionized the way traders forecast and capitalize on market movements. A holistic understanding of Gann’s trading strategy not only requires insight into these angles but also a practical understanding of how to construct and interpret the Gann Square. A gann angle calculator can be used to specificly calculate price levels bassed on gann angles..

Deciphering Gann Angles and Their Significance

Gann angles are critical in determining market trends and strength levels. These distinctive lines span across a chart in a fan-like fashion, each offering insights correlated to time and price. The most pivotal of these angles is the 45-degree angle, also referred to as the 1×1, signifying a balanced market. A market ascending above this angle is considered to be bullish, while a descent below implies bearish conditions. The correct application of gann angles in gann square analysis is instrumental in building a sound gann trading strategy.

Constructing the Gann Square: A Step-by-Step Guide

Building the Gann Square requires meticulous attention to detail and a stepwise approach. A trader starts by identifying a significant pivot point in market price or time and then plots various Gann angles from this juncture. Key angles include the 1×1, which equates a one unit of price with one unit of time, as well as the 2×1 (two units of price with one unit of time) and the 1×2 (one unit of price with two units of time). The confluence of these angles helps in establishing prospective support and resistance zones, vital for market analysis.

The Role of Astrology in Gann’s Market Forecasting

While modern market analysis often relies solely on quantitative analytics, Gann’s trading strategy integrated an unconventional component: astrology. Gann posited that planetary alignments and lunar phases could influence the psychological state of the market, potentially leading to discernible patterns in price and volume. Comprehending these subtle astrological influences is essential for traders who employ Gann’s methods as part of their market analysis toolkit, offering a unique lens through which to anticipate market dynamics.

By mastering the intricacies of Gann’s geometric trading techniques, traders can unlock new perspectives in market analysis and devise strategies that synthesize both traditional and esoteric elements. As markets have grown increasingly complex, the resurgence of interest in Gann’s methods underscores the quest for innovative techniques that capture the multifaceted nature of financial trading environments.

Practical Applications of the Gann Square of Nine

The prolific tool known as the Gann Square of Nine is not limited to theoretical models—it is a versatile mechanism that applies to real-world trading environments across various asset classes. Among the most intriguing gann square of nine techniques, is its application in forecasting key market movements which is crucial for traders aiming to optimize their strategies. Here are some practical ways in which Gann’s method provides actionable market insights:

- Anticipating potential pivot points in major indices, thereby equipping traders with the foresight to plan entries and exits.

- Applying the square’s calculative framework to commodities trading, where volatile price swings are common, to identify price resistances or support levels.

- Employing the ratio calculations derived from the grid on the Forex platform to set strategic stops or target levels.

The Gann Square of Nine is not merely a analytical curiosity—it’s a practical asset, underpinning gann trading strategies with its profound interpretation of price and time. It challenges traders to look beyond the surface of charts and patterns and delve into the realm where mathematics and market psychology converge. With continued study and implementation, traders can develop a significant edge in predicting market movements.

In essence, the tools and techniques derived from W.D. Gann’s ingenuity are more than historical artifacts; they continue to serve as pillars in the architecture of modern trading strategies. As we advance enveloped by ever-complicating market dynamics, the Gann Square of Nine stands resolute—a testament to the timelessness of well-formulated analytical instruments in the financial world.

Critical Insights from Real-World Case Studies

The robustness of Gann angle trading and stock trading Gann squares is not just a theoretical construct, but a proven reality in the competitive world of finance. By delving into real-world case studies, traders can elevate their understanding of trading strategies, blending the time-honored principles of W.D. Gann with modern market analysis.

Using Gann Angles for Forex Market Entry Points

In practice, savvy Forex traders have utilized Gann angles as a strategic tool for determining lucrative entry points on trending currency pairs. Precision in predicting price momentum is greatly enhanced when Gann’s methodologies intersect with contemporary chart analysis, allowing traders to execute entry positions with greater confidence.

Identifying Stock Resistance Levels with Gann Squares

Through the application of Gann Squares, investors have identified key resistance levels that act as a barometer for stock performance. This insight is invaluable in sculpting sound investment strategies, by indicating when to expect a trend reversal or a continuation of the pattern.

Trading Strategies Enhanced by Astrological Events

Gann astrology has found its application in real-world trading circumstances where specific astrological events provide an additional layer to strategy development. Traders who synchronize their trades with the perceived influence of planetary alignments often find their predictions imbued with an additional edge, derived from celestial movements understood to impact market psychology.

Conclusion

The exploration of W.D. Gann’s Gann Square of Nine reveals a timeless framework that continues to guide traders through the complexities of market analysis. Its fascinating blend of geometric design, numerological insights, and celestial phenomena distinguishes this tool from conventional trading strategies. For those seeking to delve deeper into market behavior, the Square offers an exceptional method of divining potential price movements and timing entries and exits with improved precision.

Over the years, the implementation of Gann trading techniques in various financial markets has validated the versatility and enduring relevance of Gann’s work. As traders cultivate a deeper understanding of these principles, the Square of Nine transitions from an esoteric concept into a formidable instrument for trading strategy formulation. It is this synthesis of arithmetic rigor and astrological elements that creates the robust analytical capabilities traders have come to value.

In summary, W.D. Gann’s legacy looms large in the world of financial analysis, with the Gann Square of Nine standing as a testament to his innovative vision. For modern-day traders, these techniques offer the means to evaluate and act upon market cycles and trends, rendering Gann’s vision into concrete, actionable market analysis. It is more than a strategy; it is a holistic approach to understanding the rhythms of the markets we navigate.

FAQ

The Gann Square of Nine is a mathematical and geometric tool used for market analysis, which helps predict potential support and resistance levels, timing for trades, and key price points. It is especially renowned for its application in gann trading techniques.

Yes, the Gann Square of Nine can be applied across various market scenarios, including stocks, forex, commodities, and indices. It serves as a dynamic reference point for determining significant price and time levels.

The Gann Square of Nine requires a deep understanding of its principles and is known for its complexity. It may be challenging for beginners, but with dedicated study and practice, it can become a valuable component of a trader’s analytical toolkit.

Constructing a Gann Square involves marking a series of numbers in a spiral on a square of nine grid, starting from the center and expanding outwards. From this, geometric angles such as the 1×1, 2×1, and 1×2 are plotted from a significant pivot point on the price chart, thus creating a framework for market forecasting.

While the Gann Square of Nine is particularly useful for intraday trading and short-term market movements, its principles can also be applied to long-term investment decisions by identifying larger cyclical market patterns and important price levels.