Delving into the intricate world of the stock market, astute traders often seek reliable patterns to inform their trading strategies. The h pattern, a distinctive formation on stock price charts, serves as a harbinger of potential trend reversals after a significant price decline. Known for its resemblance to the lowercase ‘h’, this pattern unfolds through a sharp fall in a stock’s price, followed by a false recovery that fails to sustain momentum—the infamous “dead-cat bounce.” Understanding h pattern stocks involves more than mere recognition; mastery comes with the ability to patiently wait for the pattern to provide confirmation by breaching key support levels.

Employing effective trading strategies, market participants deploy tools like trailing stop-loss orders, carefully aligning them above the highest preceding weekly candle on a daily chart. This safeguards investments from sudden market turns while enabling traders to set ambitious profit targets, ensuring potential gains justify the risks undertaken. To succeed in h pattern trading, one must navigate risks with precision, scaling into positions judiciously to optimize outcomes in the volatile arena of financial trading.

Exploring the H Pattern in Financial Markets

The identification and understanding of the h pattern trading configuration serve as pivotal elements for market participants engaging in technical analysis. This geometrical pattern, observed within financial charts, signifies a critical stage for investors to reassess their positions against the market’s psychological currents.

Identification of the H Pattern

To successfully identify an h pattern, traders look for a specific structure in the price charts following a sharp decline. This involves close observation for a retest of recent lows, which then leads to creating new lows, a standard sequence for this pattern. Technical analysis skills are paramount here, allowing traders to distinguish between normal market fluctuations and the formation of a genuine h pattern.

The Psychology Behind H Pattern Formations

Trading psychology plays a substantial role in the development of h pattern formations. The ballet of emotions unfolds as traders initially react to a dip with a bout of buying, only to be quickly countered by the realization that the trend may not reverse. This oftentimes triggers a sell-off by those same market participants, intensifying the downtrend. Such scenarios encapsulate the swift shift in sentiment from optimism to pessimism, which is emblematic of the trading psychology that molds market movements.

- Key Visual Markers: Support breaks and subsequent lows

- Volume Dynamics: Diminishing buy volume as pattern matures

- Psychological Shifts: A change from bullish to bearish sentiment

- Technical Resemblance: Similarity to the Head & Shoulders pattern

While examining the role of the h pattern in market psychology, it is essential to appreciate how this pattern can signal not just temporary pullbacks but a more definitive turn in the market’s trend.

| Aspect | Significance in H Pattern Formations |

|---|---|

| Market Sentiment | Indicator of bearish reversal after a false bullish recovery |

| Trader Behavior | Quick shift from accumulation to distribution phase |

| Pattern Recognition | Crucial for timing and strategizing trades |

| Technical Indicators | Used to confirm and refine h pattern signals |

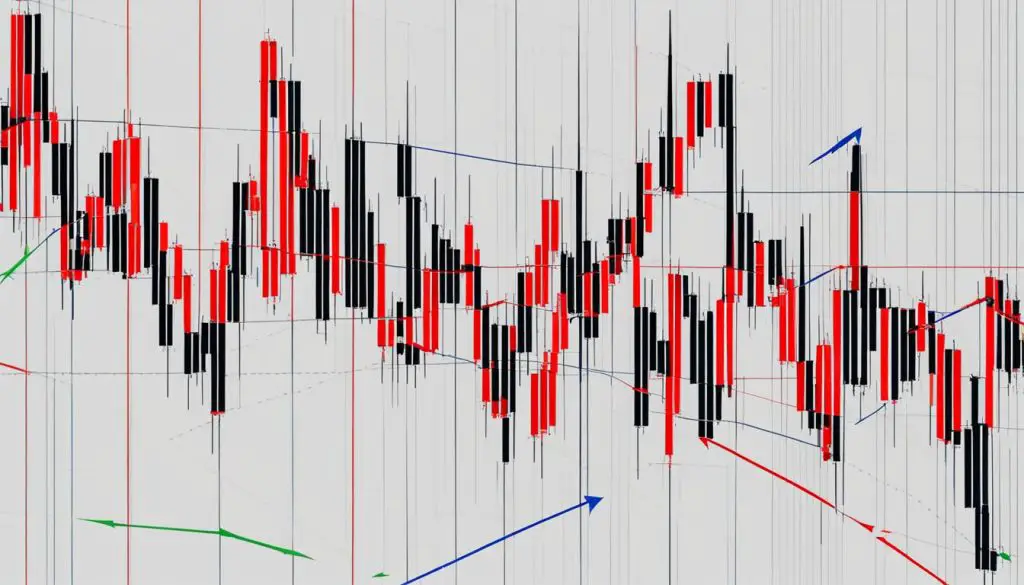

Detailed Chart Analysis of H Pattern Trading

The journey into the realm of h pattern chart analysis unfolds with a scrupulous examination of price movements and trading volumes. Skilled practitioners of h pattern trading anchor their strategy in vigilant study, seeking those lucid moments when patterns emerge from the tumult of market activity.

Technical indicators and trade signals serve as the celestial navigation tools for these financial explorers, as they chart a course through the constellations of data. Let us embark on a methodical exploration of the signs, confirmations, and caveats that mark the way.

Key Signs and Signals

True mastery in identifying an authentic h pattern requires an acute sense of the market’s undercurrents. The demarcation of a substantial decline is merely the opening chapter—the subsequent volumes of the story are penned by nuanced details. A discerning eye observes the trading volume’s ebb and flow for signs of momentum loss, setting the stage for potential pattern recognition.

The unequivocal signal, the trader’s clairvoyance, comes with the break of the initial low—a succinct confirmation that a valid h pattern may be in play. One must chart these signs with precision, as the line between profit and loss in trading is oft as fine as the strands spun by an orb weaver.

- Spot substantial declines that hint at an h pattern silhouette

- Monitor trading volumes for evidence of fading momentum

- Wait for a decisive breach of the initial low as confirmation

Common Pitfalls in Spotting H Patterns

Yet, even the most seasoned traders must tread with caution; the crucible of market analysis is fraught with illusion and missteps. Misidentifying the pattern’s key confirmations or prematurely committing to a formation sans thorough volume analysis—these are the siren calls that might lead an incautious trader to wreckage upon unseen shoals.

To stand steadfast against these perils, one calls upon rigorous validation and a refusal to yield to the tempting whispers of anticipation. For in h pattern trading, as in all worthy pursuits, it is only through discipline and scrupulous due diligence that one might attain the coveted success.

- Avoid misreading volume indicators and misunderstanding confirmation points

- Resist the lure of entering trades on incomplete or ambiguous formations

- Conduct methodical validation of all h pattern signals prior to engagement

In sum, detailed chart analysis embodies the nexus of knowledge and foresight—an essential guidepost on the trader’s odyssey through the tumultuous seas of financial markets. As we navigate through the various waves of information available, let this exploration ground our trading decisions in both precision and deliberate caution.

Strategic Entries and Exits in H Pattern Trading

The efficiency in trade execution significantly relies on the timing and strategy applied to both entry and exit points in the world of h pattern stocks. To capitalize on the opportunities present in the market, confirming h pattern sightings for informed decision-making is essential. This segment delves into the details of employing a prudent approach towards trade execution, highlighting the pivotal role of entry and exit strategies.

Confirming the H Pattern for Trade Entry

Executing a trade based upon an h pattern necessitates confirmation. A trader must be patient enough to wait for the price to breach the previous low, which constitutes the initial leg down. This action serves as a critical factor in confirming the h pattern’s realization and signifies the opportune moment for strategic trade execution. The illustration below showcases such typical entry points after confirmation.

Cautious Approach to H Pattern Execution

Once an h pattern is confirmed, a measured entry strategy demands that traders look for resistance levels to short the stock. These resistance levels often coincide with the top of the h’s curve, providing traders a strategic advantage to enter a trade with a greater perspective on market movement. Managing exits through a strategic exit strategy involves defining risk with a trailing stop-loss above the prior high candle, ensuring protection against sudden adverse fluctuations. However, profit-taking is also necessary, and thus, scaling positions and targeting profits must be precise, balancing the associated risk with the expected reward.

| Trade Execution Step | Entry Strategy | Exit Strategy |

|---|---|---|

| Confirming H Pattern | Wait for the price to break the first leg down | Set a trailing stop-loss above the highest preceding candle |

| Resistance Level | Enter short when price touches the h curve’s top | Adjust stop-loss in response to market movements |

| Risk Management | Calculate position size with a cautious approach | Target profits while maintaining a balance with risk |

When applied judiciously, these strategies can contribute to effective trade management in h pattern stocks, paving the way for improved trade execution and potential profitability.

Effective Risk Management with H Pattern Trades

For traders specializing in h pattern trading, the emphasis on risk management cannot be overstated. Adhering to a prudent stop-loss strategy forms the core of averting substantial losses, while meticulous trading discipline ensures that decisions are not swayed by transient market emotions but grounded in calculated, strategic planning.

- Define clear stop-loss levels to limit potential losses effectively.

- Implement trailing stop losses to protect gains as the trade advances favorably.

- Ensure that profit targets substantially exceed the predefined risk to optimize the reward-to-risk ratio.

- Assess the potential for scaling up the trade size only after the initial risk is mitigated.

Executing these steps is imperative in forging a resilient h pattern trading approach, capable of withstanding market uncertainties and fluctuations.

Critical to the process is the establishment of a downside target that pays homage to the original risk posed by the stop-loss placement. This target should align with the trade’s risk profile while ensuring the efficient use of capital resources. Traders endeavoring to attain profit targets are advised to scale their expectations to eclipse potential losses, laying the groundwork for a risk-averse yet assertive strategy.

The ability to adapt to market movements with a flexible but firm stop-loss approach, trailed to lock in achievements, complements the vigilant trader’s arsenal. Such adeptness in trade adjustments is a testament to the trader’s adept dynamics at play within h pattern market environments. Amplifying one’s position size is a decision that warrants granular deliberation, balancing between courage and caution, always with a nod to the inherent risks undertaken.

- Downside target setting in line with initial risk

- Profit target establishment with a favorable risk-reward outlook

- Application of trailing stop-loss strategy for profit retention

- Disciplined evaluation of position size adjustments

Adhering to these principles forms the quintessence of a trading doctrine that prioritizes capital preservation while aiming for potential profitability within the realms of h pattern trading scenarios.

Complementing H Pattern Analysis with Other Indicators

Traders devoted to mastering h pattern trading understand that while the h pattern itself can be a powerful tool, incorporating additional trading indicators can substantially enhance the robustness of their analysis. It’s not just about recognizing the shape on the chart; it’s about validating it with supportive data to make more informed decisions.

Role of Volume in Confirming H Patterns

Effective trading strategies often hinge on the use of volume analysis. When charting an h pattern, the associated volume can either confirm or cast doubt on the pattern’s integrity. A decreasing volume profile as the price tries to rebound after a fall can indicate lack of interest in buying the security, suggesting the rebound may be short-lived and the pattern might complete as expected.

Combining H Pattern with Moving Averages and Momentum Indicators

Adding layers such as moving averages to your h pattern strategies could serve as a trend confirmation tool. For instance, if the h pattern’s rebound peaks below a significant moving average, this serves as a potential confirmation of the downtrend continuation. Moreover, employing momentum trading techniques with tools like the Relative Strength Index (RSI) or Stochastic Oscillator can provide insight into the velocity of price movements, adding context to the likelihood of a pattern’s reliability.

- Look for the H pattern rebound to peak below key moving averages as a bearish confirmation.

- Use momentum indicators to assess the speed and conviction of price movements.

- Combine these tools to fine-tune entries and exits, enhancing trade outcomes.

By integrating h pattern analysis with volume, moving averages, and momentum indicators, traders can create a multi-dimensional approach that allows for more precise market entries and exits. This broader perspective helps to construct a more complete and potentially more profitable trading strategy.

Real-World Examples of H Pattern Trading Success

The inherently volatile nature of the stock market often presents unique configurations that can lead to profitable opportunities. Among such configurations is the h pattern—a technical analysis favorite. H pattern trading success is not a myth but a practical reality backed by numerous case studies and market experience. These real-world examples serve as instructional blueprints—analogous to navigational charts for traders seeking to devise robust strategies in the tempest of financial markets.

Historical chart analysis reveals the efficacy of the h pattern when traders judiciously time their entries after the confirmation phase. Notably, a disciplined approach towards stop-loss order placements has proven indispensable in securing profits and mitigating losses. These trading case studies typically illustrate the skillful execution of trades where meticulous risk assessments were paired with supplementary technical indicators—offering deeper insights into market conditions and trader sentiment that go beyond mere pattern recognition.

Providing a grounded and practical view, these demonstrated examples highlight the relevance of the h pattern across various market scenarios. From sudden bull rallies turning bear to deceptive market bounces, these instances show how the h pattern has consistently provided a strategic edge to those who can harness its potential. Here, success is not just about recognizing the pattern but also understanding its interplay with the broader market dynamics—a testament to the layered complexities of modern trading.

FAQ

What is H Pattern Trading?

H Pattern trading is a technical chart analysis strategy that identifies potential trend reversals after a stock has experienced a sharp decline. This pattern is characterized by a steep price drop, a temporary rebound, and a subsequent fall below the previous low, forming a shape that resembles the letter “h”.

How do Market Participants Influence the Formation of H Patterns?

Market participants often influence the formation of H patterns through their collective response to price movements. After a sharp decline, buyers might rush in, leading to a temporary rebound. However, if this demand is not sustained, the price can fall again, contributing to the completion of the pattern.

What Psychological Factors are at Play in H Pattern Formations?

The psychology behind H Pattern formations typically involves the traders’ reaction to a false signal of recovery in a bearish market. Traders may anticipate a reversal and start buying, only to be proven wrong as the price drops again, completing the H pattern and signaling a bearish trend.

What are Key Signs and Signals for H Pattern Chart Analysis?

Key signs and signals in H Pattern chart analysis include a significant price decline followed by a recovery attempt with declining volume, which suggests waning momentum. A confirmation is often obtained when the price breaks below the initial low point of the pattern.

What Common Pitfalls Should Traders Avoid When Trading H Patterns?

Traders should be wary of improperly identifying confirmation points, interpreting pattern formations without sufficient volume analysis, and entering trades prematurely based on anticipated patterns that have not been validated completely.

How is Trade Entry Confirmed in H Pattern Trading?

Trade entry is confirmed in H Pattern trading when the price breaks through the low point that started the first leg of the decline. This serves as a solid indication that the pattern is complete and increases the reliability of the trade.

Why is a Cautious Approach Recommended in H Pattern Execution?

A cautious approach is recommended as the H Pattern inherently suggests a bearish trend. Traders often wait for a pullback to the resistance level at the top of the “h” before executing the trade, and employ trailing stop-loss to mitigate risk.

How is Risk Management Implemented in H Pattern Trading?

Risk management in H Pattern trading is achieved by setting stop-loss orders to limit potential losses and targeting profits that are greater than the potential risks. Traders may use trailing stops to protect profits as the trade progresses.

What Role Does Volume Play in Confirming H Patterns?

Volume plays a critical role in confirming H Patterns, as a decline in trading volume indicates a lack of buying interest and increases the likelihood of pattern completion. It is an essential factor to consider before confirming a trade.

How Can Traders Combine H Pattern with Other Indicators?

Traders can combine H Pattern analysis with other indicators such as moving averages to gauge support and resistance levels, and momentum indicators to understand the strength and speed of price movements, which can assist in refining entry and exit strategies.