In the intricate world of financial trading, mastering impulse waveform patterns becomes a quintessential skill for seasoned investors aiming toward strategic decision-making. These patterns impart critical insights into the underlying momentum of asset prices, forming the crux of a robust trading strategy. Grounded in the core principles of market analysis, recognizing and understanding the rhythm of these waves enables traders to make informed decisions, aligned with the fabric of market sentiment.

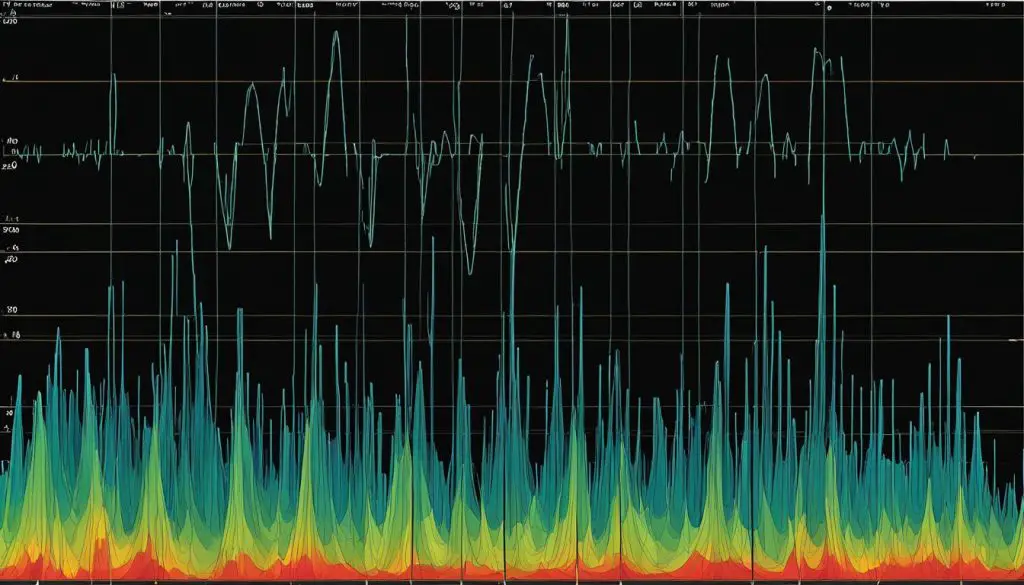

As an integral component of market analysis, impulse waveforms offer a window into the strength and direction of a trend. By meticulously dissecting the progression of these patterns, traders become equipped to foresee probable market movements and adjust their strategies accordingly. The dynamism of impulse waveform patterns lies in their adaptability to myriad time frames, crafting a versatile approach for various trading scenarios. This confluence of technical prowess and agile decision-making paves the path for financial accomplishment.

Exploring the Basics of Impulse Waveform Theory

At the heart of financial market dynamics lies the intriguing concept of impulse waveform analysis. This facet of technical analysis provides investors with a critical lens to view market trends and patterns through a time-tested framework known as Elliott Wave theory. By deconstructing the core elements of this theory, we can ascertain the inherent market sentiments that drive financial decisions. Let’s delve into the birth and maturation of this analytic approach, its psychological implications, and the key tenets that constitute the impulse waveform framework.

Origins and Evolution of Elliott Wave Theory

The Elliott Wave theory emerged from the astute observations of R.N. Elliott in the 1930s. By scrutinizing the stock market’s behavior, Elliott postulated that markets move in recurrent long-term patterns, which are a direct reflection of investor psychology. These patterns, known as “waves,” give investors the ability to decode complex market movements and apply this knowledge to enhance their signal processing techniques.

The Psychology Behind Impulse Wave Movements

Understanding the motivation behind an investor’s decision-making can often feel like deciphering an enigma. However, at the base of the impulse waveform’s peaks and troughs lies investor sentiment—a mainstay component worth dissecting. Each stride and stumble within the wave structure highlights the collective emotions of fear, optimism, and trepidation influencing the market’s direction. Engaging in time-domain analysis allows us to trace these sentiment-driven fluctuations and predict subsequent market behavior.

Key Principles Defining Impulse Wave Patterns

The formation rules of an impulse wave pattern are stringent, and it is this characteristic that ensures the accuracy of the pattern analyses. Let’s break down the essential principles that give this theory its backbone:

- Formation Rules: Each impulse wave must conform to three primary rules that prevent any ambiguity in its structure. Failure to meet these rules would invalidate the wave count, making disciplined adherence to the rules critical for accurate analysis.

- Five Sub-Wave Construction: The impulse wave is traditionally segmented into a 5-3-5-3-5 structure. This distinctive pattern reflects the continuous interaction between uptrends and corrective phases, mirroring the pulse of market sentiment.

- Flexibility in Time Frames: An impulse wave’s adaptability across various time scales from hours to years exemplifies its versatility. This aligns with signal processing’s demand for elasticity in deciphering transient to long-term signals.

In addition to these principles, the utility of impulse waveform analysis in trading practices is rooted in its time-sensitive nature, offering investors a comprehensive tool for navigating the turbulent waters of financial markets.

For a clearer visualization, the table below presents the crux of the Elliott Wave theory’s principles juxtaposed with its practical implications within the sphere of signal processing.

| Elliott Wave Principle | Signal Processing Correlation | Investor Sentiment Indicator |

|---|---|---|

| 3 Unbreakable Formation Rules | Ensures clear signal demarcation in analysis | Defines boundaries of market confidence levels |

| 5-3-5-3-5 Sub-Wave Structure | Enhances time-domain accuracy for trades | Matches market psychology with waveform peaks and troughs |

| Adaptability to Multiple Time Frames | Offers flexibility for both short and long-term signal analysis | Provides insight on shifting short-term trends and enduring market sentiments |

Each facet of impulse waveform analysis tightly interlinks with Elliott Wave theory, showcasing its transformative potential in elevating trading strategies. By embracing the core principles and their psychological substrates, traders gain a competitive edge in the financial marketplace.

Deciphering the Structure of Impulse Waveform

The detailed architecture of an impulse waveform is critical in the fields of signal measurement and digital signal processing. The fundamental structure is based on a meticulous five-part sub-wave sequence, which helps in transient signal analysis and contributes to a profound understanding of the system response. These waveforms are pivotal for professionals and researchers committed to dissecting the intricate patterns of signals and their propagation.

Characteristically, these sub-waves are divided into a distinct pattern: three motive waves that drive the trend, interspersed with two corrective waves that modulate the trajectory. The emergence of each wave is governed by immutable rules that impose limitations on their respective formations, thereby assuring the maintenance of a proper impulse response. Key to this is the recognition and application of the 5-3-5-3-5 arrangement within these sequences.

- The first wave sets the motion, forming the initial surge in the directional trend.

- Wave two follows with a retraction that must never exceed 100% of the first wave’s progress, ensuring the trend is upheld.

- The third wave often emerges as the most potent segment, driving the most significant distance and never being the shortest among the odd-numbered waves.

- Wave four brings a contrasting correction that stays clear of the first wave’s peak, adhering to the non-overlapping mandate of the sub-wave sequence.

- The sequence concludes with the fifth wave, which often reflects final pushes or exhales in price movement before a more pronounced correction or trend change.

Traders and analysts utilize the unyielding nature of these rules in conjecturing the potential pathways that markets may choose. Below is a schematic representation highlighting the stringent requirements of impulse wave construction:

| Wave | Classification | Rule | Consequence for Analysis |

|---|---|---|---|

| 1 | Motive | Initiates Trend | Establishes the directional groundwork |

| 2 | Corrective | No more than 100% retracement | Validates wave 1 and sets a floor for future projections |

| 3 | Motive | Not the shortest | Typically shows strongest push, critical for momentum analysis |

| 4 | Corrective | Doesn’t overlap wave 1 | Confirms trend integrity and establishes range for final wave |

| 5 | Motive | Final push | Exhaustion of the current trend and precursor to a trend change |

Engagement in digital signal processing and accurate interpretation of such waveforms enable traders and engineers to project and strategize effectively, delineating the very core of transient signal patterns and system response. This scientific approach to signal measurement lays the groundwork for a more predictive and strategic response to the ebbs and flows observed in various signal-dependent spaces.

Real-World Application of Impulse Waveform Analysis

The pragmatic utility of calculating impulse waveforms can be observed across various financial markets, where its principles aid traders in forecasting and strategizing. Elucidating market dynamics through this lens provides a tactical advantage which is especially relevant in highly competitive trading environments.

Case Studies: Impulse Waveform in Different Markets

Case studies from disparate markets underscore the marked effectiveness of impulse waveform analysis. For instance, in the equities market, an insightful analysis of impulse waveforms has facilitated traders in pinpointing the beginning of growth periods, thereby enabling timely investments that yield substantial returns. In the realm of forex, currency traders rely on impulse waveform insights to determine pivotal turning points that signal either consolidation or breakout trends, significantly impacting their currency pair positions.

Integrating Impulse Wave Analysis With Other Technical Tools

Seasoned traders often merge impulse waveform analysis with other fundamental technical tools to cultivate a holistic trading strategy. This synthesis enhances the predictive accuracy of market analysis, ensuring an informed approach to buying and selling decisions.

| Technical Tool | Function | Integration with Impulse Waveform |

|---|---|---|

| Trend Lines | Identify directional market momentum | Validate impulse waveform predictions and identify potential breakout points |

| Moving Averages | Determine the average market price over a specific time period | Aid in affirming the trend direction indicated by the impulse waveform |

| Fibonacci Retracements | Assess market correction levels and potential reversal zones | Provide price targets and validate the reactions within impulse and corrective waves |

| Oscillators (RSI, Stochastics) | Measure the velocity of market movements | Highlight overbought or oversold conditions during impulse wave formations |

Recognizing the interconnectivity between digital signal processing and trading, the role of impulse response in such strategies becomes evident. As traders continue to deploy these multifaceted approaches, the sophistication of market analysis is expected to ascend, aligning with continual advancements in trading technologies.

Strategic Trading Tactics Using Impulse Waveform

The nuances of impulse waveform patterns are pivotal in designing a robust trading strategy. These patterns not only contribute to high precision in market analysis but also enhance the quality of signal processing in trading systems. When utilized correctly, impulse waveforms can significantly influence decision-making, providing traders with insights to secure a competitive edge in tumultuous markets.

To harness the full potential of impulse waveform patterns, a strategic application that blends pattern recognition with analytical tools is essential. Below we outline some key tactics traders employ when leveraging the power of impulse waveforms:

- Entry Point Analysis: Traders inspect the formation of impulse waveforms, determining the most opportune moments to enter the market.

- Exit Point Calculation: Setting precise exit points helps in capitalizing on peak momentum, thereby locking in profits.

- Risk Management: Appropriate use of stop-loss orders in response to waveform indications is critical to preserving capital.

- Multifaceted Approach: Combining impulse waveform analysis with other technical indicators for comprehensive trading scenarios.

Those who apply these techniques effectively are often able to steer their portfolios through the fluctuating currents of the financial markets with greater confidence. To illustrate the application of these strategies, let’s refer to the following table, which showcases the intersection of impulse waveform utilization and critical market decision points.

| Trade Initiation Point | Trailing Stop-Loss Adjustment | Take Profit Zone | Risk Management |

|---|---|---|---|

| Completion of Waveform Pattern | Just Beyond Wave 1 Retracement | Peak of Wave 5 Projection | Predefined Loss Threshold |

| Confirmation via Supplementary Indicators | Wave 4’s Inflection Point | Correlation with Resistance Levels | Account Equity Percentage |

Expert traders skillfully integrate impulse waveform analysis with broader market indicators, ensuring their approach is both dynamic and nuanced. As they navigate through the peaks and troughs of market trends, the knowledge of impulse waveforms serves as a map to uncharted territories of potential profit and steeled risk aversion.

Conclusion

In the dynamic world of financial trading, the utility of impulse waveform analysis transcends conventional market analysis, becoming a cornerstone in the design of robust trading strategies. Market patterns, often fraught with complexities, can be navigated with enhanced clarity through the lens of impulse waveform theory. It’s this in-depth understanding of market behavior that equips traders with the ability to interpret and act on the key signals that steer market momentum.

Impulse Waveform’s Role in Modern Trading Strategies

Integrating impulse waveform within modern trading strategies has substantially elevated the rigor with which traders can forecast and capitalize on market trends. As a versatile component grounded in signal processing and market analysis, its disciplined application offers a quantifiable edge when mapping investor sentiment. The preciseness of this approach benefits from a synergy with cutting-edge tools, from traditional signal characterization to the transformative capacities of artificial intelligence.

Navigating Market Patterns With Enhanced Confidence

Empowered by the insights provided by impulse waveform analysis, today’s trader approaches the market with a newfound confidence. This confidence is buoyed by an ability to anticipate and understand the deep-seated psychological factors that govern market shifts. Reinforced by rigorous application of proven impulse waveform principles, investors stand better positioned to finesse their trading strategy, culminating in the vital ability to generate value in the face of ever-shifting market dynamics.

FAQ

Impulse waveform patterns are a key concept in Elliott Wave theory, indicating strong price movements in the direction of the prevailing trend of a financial asset. These patterns consist of five sub-waves that net movement in the trend’s direction and can help traders improve their market analysis and strategic decision-making.

Impulse waveform analysis, as part of Elliott Wave theory, reflects the psychological patterns of investors through recurring price movements. Understanding these patterns can reveal shifts in investor sentiment and potential future market directions, aiding in signal processing and time-domain analysis during market assessments.

Impulse wave patterns are defined by three core principles: wave 2 never retraces more than 100% of wave 1; wave 3 is never the shortest if compared to waves 1 and 5; and wave 4 does not overlap the price territory of wave 1. These principles are critical for signal measurement and ensure the pattern’s integrity.

The structure of an impulse waveform is decoded through its sub-wave sequence, which comprises five distinct parts, with three motive waves and two corrective waves. This 5-3-5-3-5 structure is pivotal for traders in transient signal analysis, impulse response, and system response to anticipate market trends.

Yes, impulse waveform analysis has practical applications in various markets, including equity, currency, and commodity markets. It is effective in revealing directional trends and potential reversals, becoming a valuable element of an overall market analysis strategy when combined with other technical tools.