The realm of technical analysis in financial markets is rich with strategies and signals that aim to predict potential moves and trends. Among them, the m trading pattern stands out as a technical indicator revered for its ability to flag turning points in market sentiments. Identifiable by its resemblance to the apex letter ‘M’, it signals a market strategy that is central to bearish reversals. In the intricate dance of supply and demand, these patterns serve as crucial pivot points for traders.

This chart formation not only represents a high-stakes showdown between bulls and bears but also encapsulates the moment when the ascending force loses its grip, presaging a potential downward spiral. For those who seek to excel in market strategy, a robust understanding of the m trading pattern can be a formidable addition to their analytical arsenal.

Introduction to M and W Patterns in Trading

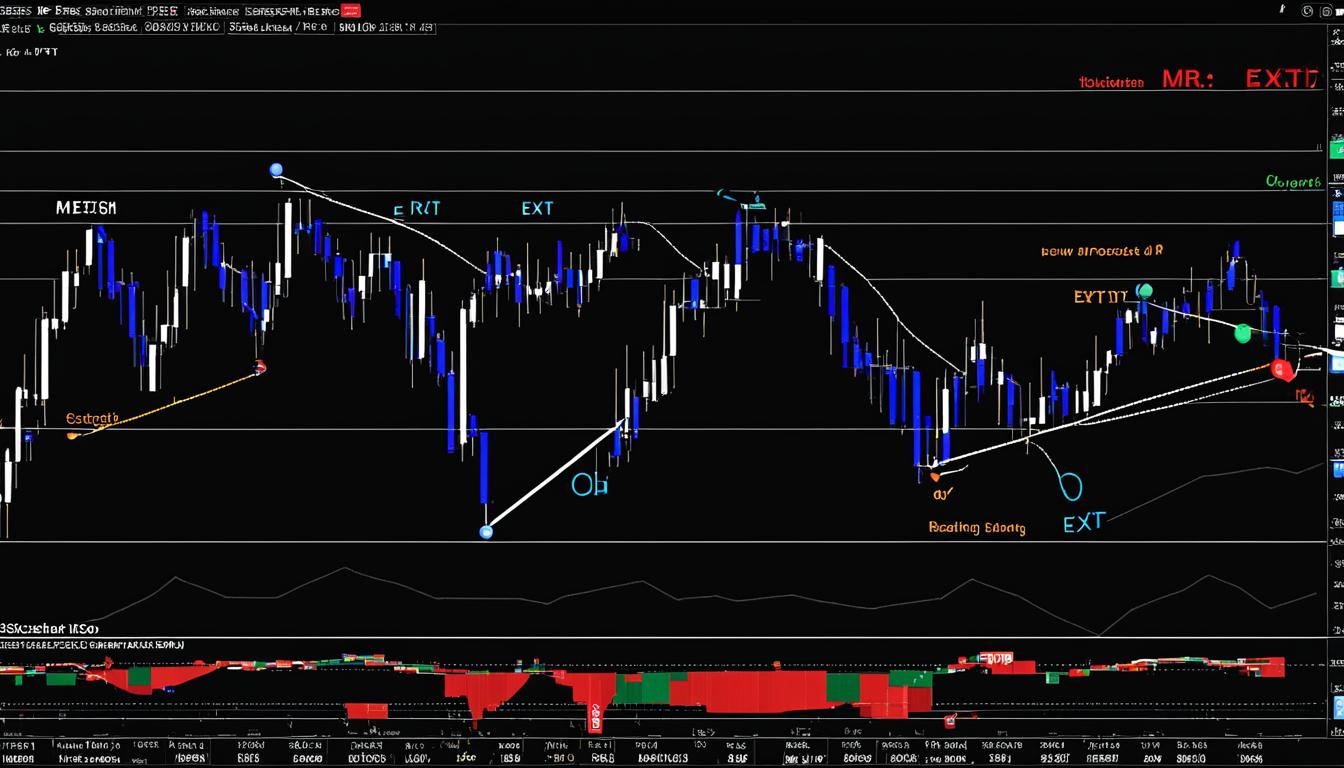

Discerning the patterns of the financial markets is akin to understanding a language written in charts and graphs. M pattern trading and W pattern trading present a lexicon of technical analysis that, when mastered, can signal key support and resistance levels and potential trend reversals. Such insights are invaluable to traders looking to transact with precision.

The classic M pattern, or double top, suggests an imminent bearish shift after failing to break resistance twice. In contrast, the W pattern, known as the double bottom, anticipates a bullish upturn following the support being tested successfully. These patterns are not merely abstract shapes, but are testaments to market sentiment and cyclical movements, where resistance and support play starring roles.

Here, we unfurl the story told by M and W patterns, interpreting their significance in the grand narrative of market trends:

- M Pattern Trading: A tale of two peaks—resistance that couldn’t be breached, leading to a potential downturn.

- W Pattern Trading: A narrative of resilience where support holds firm, suggesting a possible ascent.

As the art of charting these patterns has evolved, so too has the technology that aids in their discovery. Where once traders toiled with manual drawings, modern-day chartists employ advanced indicators that automatically illuminate these patterns, crafting a new chapter in the annals of technical analysis.

| Pattern | Implication | Position to Consider |

|---|---|---|

| M (Double Top) | Bearish Reversal | Short |

| W (Double Bottom) | Bullish Reversal | Long |

In essence, M and W patterns serve as harbingers of potential shifts, as traders watch the peaks and troughs with bated breath. The dance of prices between these significant levels is one of the most powerful narratives crafted in the financial markets, carrying the weight of traders’ expectations and the hopes of predictive prowess.

A Breakdown of the M Trading Pattern

Traders often encounter the double top pattern, popularly known as the M trading pattern, which is a cogent example of symmetric trading patterns. Recognized for its clear imagery and predictive qualities, this bearish reversal chart pattern provides crucial insights into potential market shifts, as it typifies a resistance challenge followed by a bearish outcome. The intricacies of analyzing this pattern lie in the understanding of its formation and its contextual implications.

Analysis of the M Pattern: Understanding Peaks and Troughs

The M pattern chart boasts a high level of recognition due to its two peaks, which signal price resistance. These peaks, characterized by similar price highs, are divided by a trough indicating a temporary decline in price. The reliability of the M pattern as a bearish reversal signal grows once the price action reveals a significant dip below the support level, previously established between the two peaks. Here’s a helpful break down of the essential attributes of this pattern:

- First Peak: Signifies the initial test of resistance level where the bullish momentum starts to dwindle.

- Second Peak: Confirms the resistance level, typically mirroring the height of the first peak, and suggests a market failing to move higher.

- Trough: The dip between peaks representing the price pullback that must not surpass the initial peak’s height.

- Support Break: Critical for a bearish confirmation; it’s the point where the price crosses below the trough level.

The Importance of Symmetry in M Patterns

Symmetry is paramount when it comes to the M pattern, ensuring that the bearish reversal signals it generates are stable and predictable. When the peaks almost touch the same price point, they exemplify an established price resistance that the market cannot breach, enhancing the viability of the pattern. The uniformity of these two peaks performs as a litmus test for traders, affirming the pattern’s integrity and the potential for a noticeable market shift.

| Symmetric Aspect | Significance in M Pattern |

|---|---|

| Peak Alignment | Indicates strong resistance and increases pattern reliability. |

| Equal Peak Height | Reinforces the concept of maximum price threshold. |

| Consistent Volume Levels | Signals trader sentiment alignment at peak formation stages. |

For traders, the emphasis on symmetric properties doesn’t merely aid in diagnosis but also counsels on strategic positioning. It sheds light on optimal exit and entry points, helping market participants to fortify their decision-making process by backing it with tangible chart-based evidence of impending reversals.

Technological Innovations in M Pattern Identification

As the landscape of financial markets continues to evolve, technology has become a cornerstone in the development of trading strategies. Among the innovative breakthroughs, XABCD Pattern Suite software has emerged as a frontrunner in facilitating the identification of M and W patterns. This cutting-edge technology in trading has revolutionized how pattern indicators are used by equipping traders with the tools to swiftly decode complex chart patterns.

The intricacies of M pattern recognition often required a meticulous and time-consuming approach. However, today’s traders leverage the efficiency and precision that XABCD Pattern Suite software provides. The software automates the process of spotting potential trading opportunities by identifying patterns which may have previously gone unnoticed by the manual observer.

- Instantaneous Pattern Alerts: The software enables real-time detection and alerts, granting traders the opportunity to act promptly on potential market shifts.

- Advanced Charting Capabilities: With the incorporation of graphical representations, traders can visualize the patterns within the complex market tapestry, leading to more informed trading decisions.

- Historical Data Analysis: By examining past market patterns, the software aids in refining strategies for future trades, supported by empirical evidence and trend analysis.

The table below offers an insightful comparison of manual versus automated trading pattern recognition, showcasing the heightened efficiency and accuracy when utilizing XABCD Pattern Suite software.

| Aspect of Pattern Identification | Manual Analysis | XABCD Pattern Suite Software |

|---|---|---|

| Time Required | Potentially Hours | Seconds to Minutes |

| Accuracy | Subject to Human Error | Highly Accurate |

| Historical Data Utilization | Limited and Time-Consuming | Extensive and Efficient |

| User-Friendly Interface | Not Applicable | Designed for Ease of Use |

| Ability to Backtest | Challenging and Limited | Comprehensive Backtesting Features |

With technological advancements such as the XABCD Pattern Suite software, the realm of technical analysis has greatly enhanced the trader experience. These tools not only expedite the process of pattern identification but also augment the potential for successful trade outcomes through advanced pattern indicators and refined analytics.

Strategic Approaches to M Pattern Trading

Developing a robust trading strategy is essential when engaging with M pattern formations in the financial markets. The strategic trader not only looks for the visual cues of the M formation but engages in a thorough market trend analysis to enhance the probability of a successful trade. Identifying these high-probability reversal points requires a fusion of technical signals and a steadfast appreciation of market sentiment.

Key to navigating the intricacies of M pattern trading is the concept of the risk-reward ratio. This financial principle is crucial, as it quantifies the potential risk against the potential reward of any given trade. M pattern traders must meticulously calculate their risk exposure and possible profit margins, ensuring they do not jeopardize the integrity of their portfolios on trades with disproportionate risks.

Upon a confirmed M pattern, which sees a break below the established support level, it is advised to place stop-loss orders judiciously above the resistance peaks. This maneuver safeguards the trader from unwanted loss should the market reverse unexpectedly. Precision in positioning these orders can either fortify the trader’s confidence or leave them susceptible to market volatility.

Additionally, traders might integrate supplementary technical analysis tools to fortify their strategies. The use of trend lines, the Moving Average Convergence Divergence (MACD), or the Relative Strength Index (RSI) can offer further substantiation of the impending bearish reversal signaled by the M pattern. When these tools converge in their forecasting, the trader’s confidence in executing the trade is justifiably heightened.

It is imperative for traders to understand that while the M pattern presents a framework for identifying potential market reversals, it is the strategic layering of these aforementioned components that propels an ordinary trade into a well-founded strategic decision. Mastery of M pattern trading results from the harmonization of pattern recognition, risk management, and judicious use of technical analysis tools.

The Advantages and Limitations of M Pattern Trading

The intricacies of trading the M pattern, a tool widely utilized in technical analysis, present both clear advantages for astute traders and notable challenges that warrant a considered approach. Below, we delve into the duality of using M patterns to pinpoint market shifts and the inherent complexities it involves.

Pros: High Probability Reversal Points

Among the primary benefits of M pattern trading is the compelling edge it provides in high probability trading. The precision of this pattern allows traders to identify trend reversals with a higher level of confidence. By recognizing these significant reversal points, investors can make calculated decisions for entry and exit moments leading to a more favorable risk-reward scenario. This strategic advantage is tied to the clarity with which M patterns manifest on price charts, marking them as reliable indicators for potential shifts in market trends.

Cons: Challenges in Manual Pattern Identification

Conversely, M pattern trading is not without its challenges. The manual identification process can be particularly fraught with obstacles, including the likelihood of human error. Traders analyzing charts can misinterpret price movements or incorrectly apply the stringent rules required for pattern validation, resulting in potential misjudgments. Furthermore, the meticulous demands of pattern identification necessitate a level of technical prowess that some may find daunting. In response to these challenges, leveraging technological solutions is imperative. Through automated pattern recognition software, traders can significantly reduce errors, optimize their trading strategies, and harness the full potential of technical analysis in the trading arena.

Step-by-Step Guide to Trading M Patterns

To effectively navigate the financial markets through pattern trading, one must understand how to leverage bearish market signals for optimal trade execution. The M pattern offers a framework to do just that. Below is a systematic guide to trading M patterns, incorporating essential pattern trading rules every trader should follow.

- Identify an Uptrend: Begin by pinpointing a significant bullish trend that indicates market enthusiasm. This sets the stage for a potential bearish reversal.

- Spot a Swing High: The first peak of the M pattern sets the resistance level. Record this peak as it is critical for subsequent pattern observation.

- Monitor Price Retracement: Await a pullback that culminates before reaching the initial peak, signaling resistance strength and forming the pattern’s trough.

- Confirm the Second Peak: Watch for the emergence of a second peak that aligns closely with the level of the first peak, implying a strong resistance barrier.

- Validate the Reversal: When the price drops below the trough’s support level, look for confirmation by significant bearish price action.

- Execute the Trade: Upon validating the M pattern’s formation, consider taking a bearish position. The price break below the middle trough can serve as a cue for trade entry.

- Manage Risk: Place stop-loss orders above the M pattern’s peaks to mitigate risk. Adjust take-profit levels based on the expected magnitude of the reversal.

Following these steps delineated in this guide ensures adherence to disciplined trading habits when utilizing bearish market signals such as the M trading pattern. While not infallible, incorporating this method into your trading arsenal can lead to refined trade execution and more consistent outcomes.

Best Practices for Timeframe Selection in M Pattern Trading

Trading M patterns successfully is not solely about recognizing the shape on a chart—it’s also about choosing the right trading timeframes to suit your strategy. Utilizing effective market analysis strategies within different timeframes can greatly impact the outcome of your trades. Below are key considerations for selecting the most appropriate timeframe for your swing trading and pattern trading activities.

When embarking on M pattern trading, understanding the pros and cons of various timeframe scales can be a deciding factor in achieving consistent returns. Higher timeframes, such as daily or weekly charts, can afford traders a broader view of the market and are often preferred by beginners for their clearer trends and reduced ‘market noise.’

| Timeframe | Characteristics | Suitable for | Consideration |

|---|---|---|---|

| Intraday | Fast-paced, multiple trades within a single day | Experienced traders with ability to make quick decisions | Requires constant market monitoring |

| Daily | Provides general trend direction over days | Traders seeking to capture larger market moves | Trades may last several days to weeks |

| Weekly | Captures long-term market trends | Swing traders with a focus on extensive market analysis | Less time-sensitive and fewer trade management demands |

Starting with higher timeframes can prove advantageous for beginners, allowing for immersion in the process of market analysis with less pressure from rapid price movements. As traders advance, they may transition into shorter timeframes that present more opportunities but also demand quick decision-making skills.

- Analyze broader trends on higher timeframes to establish context.

- Decide on a trading style that fits your availability and risk tolerance.

- Use simulation trading to practice M pattern trading on your chosen timeframe without financial risk.

- Gradually shift to smaller timeframes as you grow more confident and seek greater challenge and granularity in your trades.

Regardless of the timeframe, consistent monitoring and adjustment to your strategies are crucial in navigating the volatile waters of trading. With a systematic approach to selecting your timeframes, you’ll be well-equipped to harness the potential of M pattern trading within your chosen market segments.

Conclusion

In sum, mastering the M pattern is an invaluable skill for traders looking to excel in market trend analysis and execution of trades. The M trading pattern, a well-recognized technical indicator, serves as a guide for identifying bearish reversal signals and executing trades with higher precision. By understanding its distinctive characteristics, traders can ascertain the market’s shift from bullish to bearish momentum and strategize accordingly.

Current market trends underscore the importance of integrating technological tools for enhanced trade analysis and management. Advancements in trading software facilitate efficient and accurate identification of M patterns, equipping traders with the capability to respond swiftly to market changes. A trader’s proficiency in trade management is also pivotal for mitigating risks and maximizing returns, emphasizing the significance of a methodical approach to trading.

The essence of successful trading with M patterns lies in a holistic strategy that combines pattern recognition, technological adoption, sound trading practices, and vigilant market analysis. By diligently applying these practices and harnessing the power of detailed technical analysis, traders are better positioned to navigate the markets with confidence and exploit the opportunities presented by bearish reversals. In essence, this pattern is a powerful tool in any trader’s arsenal, provided it is understood and deployed with care and consideration.

FAQ

What is the M Trading Pattern?

The M trading pattern, often referred to as a double top pattern, is a technical indicator recognized as a bearish reversal signal. It is characterized by its ‘M’ shape, which indicates a transition from an upward trend to a downward trend in market charts. The pattern is marked by two peaks at approximately the same level, suggesting a resistance point where the market could not progress further.

How do M and W patterns function in trading?

M and W patterns in trading, known respectively as double top and double bottom patterns, are critical chart formations used for signifying potential reversals in market trends. M patterns represent a bearish setup where the price is expected to fall after the formation, whereas W patterns imply a bullish setup and suggest a rising trend upon completion of the pattern.

Why is symmetry important in M patterns?

Symmetry in M patterns is crucial because it provides balance and consistent resistance at the peaks of the formation. This symmetry makes the pattern more reliable for predicting price reversals, as it clearly shows that the market is repeatedly failing to exceed a specific price level.

What technological tools are used to identify M trading patterns?

Technological advancements have led to the development of tools like the XABCD Pattern Suite software, designed to identify, alert, and graphically represent M and other trading patterns on charts. Such technology allows traders to quickly and accurately detect these patterns, enhancing their trading strategies and efficiency.

What strategic approaches are used in M Pattern Trading?

Strategic approaches in M pattern trading involve careful market trend analysis, verification of the pattern formation through a potential break below support level, and employing risk management measures such as stop-loss orders. Additionally, traders might use other technical analysis tools for confirmation of reversal signals.

What are the advantages of trading M patterns?

Trading M patterns offers clear signals for potential trend reversals, well-defined entry and exit points, and a generally favorable risk-reward ratio, making them an attractive tool for traders looking to identify precise points near the peak of patterns for taking profits or cutting losses.

What are the challenges in trading M patterns manually?

Manually identifying M patterns presents challenges like human error in interpreting price movements and the complexity of applying strict rules for pattern validation. These challenges can lead to incorrect pattern drawing and trading decisions, which is why some traders prefer using pattern recognition software.

How should a trader execute a trade based on an M Pattern?

Trading an M pattern involves identifying a significant uptrend, locating a notable resistance level, observing a retracement that doesn’t exceed the initial peak, and confirming the pattern with a decline below the previous low. A trade is typically executed upon validation of the pattern when the price drops below the trough.

How can traders master the M trading pattern?

Mastering the M trading pattern involves understanding its technical aspects, effectively using technological tools for pattern identification, implementing strategic trading and risk management plans, recognizing the benefits and limits of the pattern, and choosing appropriate timeframes for evaluation and trade execution.