The Swing High Swing Low Indicator is a fundamental tool that market cycle traders use to understand and navigate the volatile terrains of the financial markets. It provides critical insights into price trends by identifying major peaks (swing highs) and troughs (swing lows) in market price data. This powerful indicator helps traders forecast potential reversal points and identify trend continuations, enabling the formulation of strategic trading decisions.

Understanding the Swing High Swing Low Indicator

The Swing High Swing Low Indicator is inherently simple. A swing high is a price peak, while a swing low is a price trough. This pattern is prevalent in all markets – be it stocks, forex, commodities, or cryptocurrencies. However, correctly identifying these swings can be the key to successful trading.

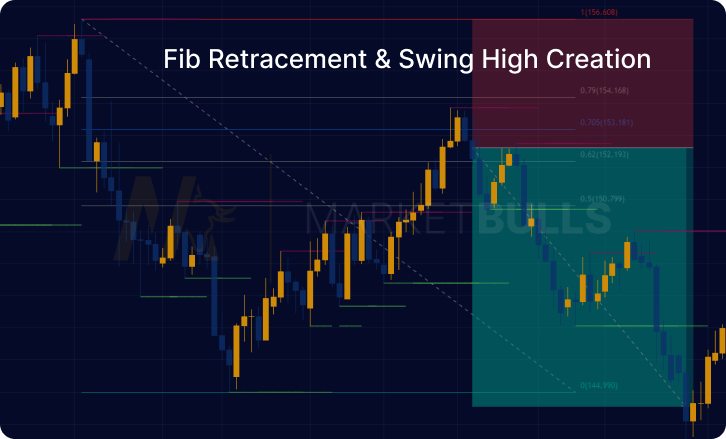

For a valid swing high, the peak should be higher than the adjacent price points on both sides. Conversely, a swing low is a price point lower than its neighbors. This contrast creates a zigzag pattern across a price chart, outlining market trends.

The Importance in Trading

Understanding the Swing High Swing Low Indicator is fundamental to implementing various trading strategies. By pinpointing swing highs and lows, traders can better grasp the market's underlying momentum and the possible future direction of price movements.

Trend Identification: An upward trend is usually marked by higher swing highs and higher swing lows. Conversely, a downward trend often features lower swing highs and lower swing lows.

Potential Reversal Points: Swing highs and swing lows can act as potential support and resistance levels. Prices often tend to reverse after reaching these points.

Risk Management: By identifying swing points, traders can place effective stop-loss and take-profit levels, managing their trading risk more effectively.

Confirmation of Breakouts: The breakout of a price level is often confirmed if the price creates a swing high (in an upward breakout) or a swing low (in a downward breakout).

Swing High Swing Low Indicator MT4 & MT5

MT4 and MT5 platforms are widely used by traders across the globe. The good news is the Swing High Swing Low Indicator is available on mt4 and mt5. They can help automatically spot swing points, making it easier for traders to spot potential trading opportunities without manually scanning entire price charts.

Developing Trading Strategies with Swing High Swing Low Indicator

There are multiple ways to use the Swing High Swing Low Indicator in a trading strategy:

Trend Following: Traders can enter a long position when a new swing low is formed during an uptrend, and similarly, enter a short position when a new swing high is formed during a downtrend.

Counter Trend Trading: Traders can wait for the price to reach a swing point and then enter a trade in the opposite direction, expecting a price reversal.

Breakout Trading: Traders can enter a trade when the price breaks past a swing high/low, expecting the price to continue in the direction of the breakout.

Swing Trading: Traders can enter trades at swing points and aim to exit at the next swing point.

Remember, while the Swing High Swing Low Indicator can be an excellent tool, it's essential to use it alongside other indicators and not rely on it solely for making trading decisions. For that different kind of the moving average, like the exponential moving average can be perfect.

Conclusion

In conclusion, the Swing High Swing Low Indicator is an invaluable tool for any trader. It allows a clear view of the market's possible direction and helps formulate effective trading strategies. Whether you're using MT4, MT5, or any other platform, integrating this indicator into your trading toolkit can greatly enhance your trading results.

FAQs About Swing High Swing Low Indicator

It identifies significant price peaks (swing highs) and troughs (swing lows) in market data.

Traders use it to identify trends, potential reversal points, manage risk, and confirm breakouts.

Yes, this indicator is equally useful in both upward and downward trending markets

An upward trend is identified by higher swing highs and higher swing lows, while a downward trend is marked by lower swing highs and lower swing lows.

Yes, this indicator is available in both MT4 and MT5 trading platforms.

While it’s a valuable tool, it’s best used in conjunction with other indicators and not relied upon solely for trading decisions.