Delving into the world of trading, one encounters unique jargon and patterns that form the roadmap to understanding market fluctuations. Among these vital concepts, the swing low in trading stands out as a cornerstone in the architecture of technical analysis. The swing low definition speaks to the heart of capital movement, marking the nadir of a security’s price over a specified, short-term period. A confluence of buyers at this moment often represents a strategic inflection point, providing a beacon for bullish presence amid a potentially bearish seascape.

The swing low meaning extends beyond a simple inflection point, however. It signifies a potent signal to astute traders, hinting at a potential pivot or continuation in the trend’s narrative. It is this deft interplay between the lows, the sentiment, and market dynamics that traders harness to navigate the often treacherous pathways of investing. Knowledge of swing lows, in this regard, is not merely theoretical; it is applied wisdom, a key to unlock market opportunities and mitigate undue risks.

Introduction to Swing Low in Trading

For investors and traders aiming to excel in the financial markets, understanding the importance of swing lows in trading is a cornerstone of technical analysis. These pivotal points represent more than mere blips on a chart—they are significant turning points in the price action that provide deep insights into market structure and movement. Because of their influential role, knowing how to identify swing lows in trading is an essential skill for crafting effective entry and exit strategies.

Swing lows act as a vital foundation for a multitude of trading techniques. They are applicable in any market—be it equities, forex, commodities, or cryptocurrencies—and are a universal concept that transcends the specificities of individual time frames or assets. Whether you are engaged in day trading or are a long-term player in the swing trading arena, recognizing and utilizing swing lows can dramatically enhance your analytical prowess and decision-making process.

Implementing swing lows into a trading strategy can differentiate between average and sophisticated market strategies. Below is an overview that illustrates the key aspects of swing lows and their identification:

- Swing lows occur at the trough of a price movement, where prices start to rebound.

- These lows are usually identified by the presence of higher lows on both sides of the trough.

- The context around a swing low—the preceding and succeeding price movements—sheds light on potential future market behavior.

As the market ebbs and flows, so too should your approach to trading analysis. Herein lies the adaptability and value of using swing lows; they are not just static events but dynamic and predictive tools.

| Time Frame | Swing Low Relevance | Approach |

|---|---|---|

| Intraday | Identify short-term price recovery points | Day trading, scalping |

| Daily to Weekly | Locate significant support zones | Swing trading, position trading |

| Monthly to Yearly | Detect long-term market trends | Investment, long-term speculation |

Conclusively, grasping the intricacy of swing lows is integral to the repertoire of any trader. It enables the identification of critical junctures in market sentiment, offering a reliable basis for entry and exit decisions. Embracing swing lows into your analytical framework can enrich your market perspective, allowing for a more nuanced and confident approach to trading.

Understanding the Swing Low Pattern in Trading

Mastering the art of technical analysis in trading hinges significantly on understanding certain key patterns, one of which is the “swing low.” This particular pattern is a cornerstone for numerous trading strategies and is pivotal in highlighting potential turning points in market price action. To become proficient traders, one must learn how to identify swing lows in trading, as this skill can enhance decision-making processes in real-time market scenarios.

The Technical Definition

A swing low is a term employed by traders and analysts to describe a specific pattern on a price chart. This pattern reflects a dip in price that represents a temporary trough, which is then succeeded by an immediate rise characterized by at least two higher lows on either side. The ability to spot a swing low candlestick pattern or a more general swing low pattern is essential for understanding overall market sentiment and preparing for potential future price movements.

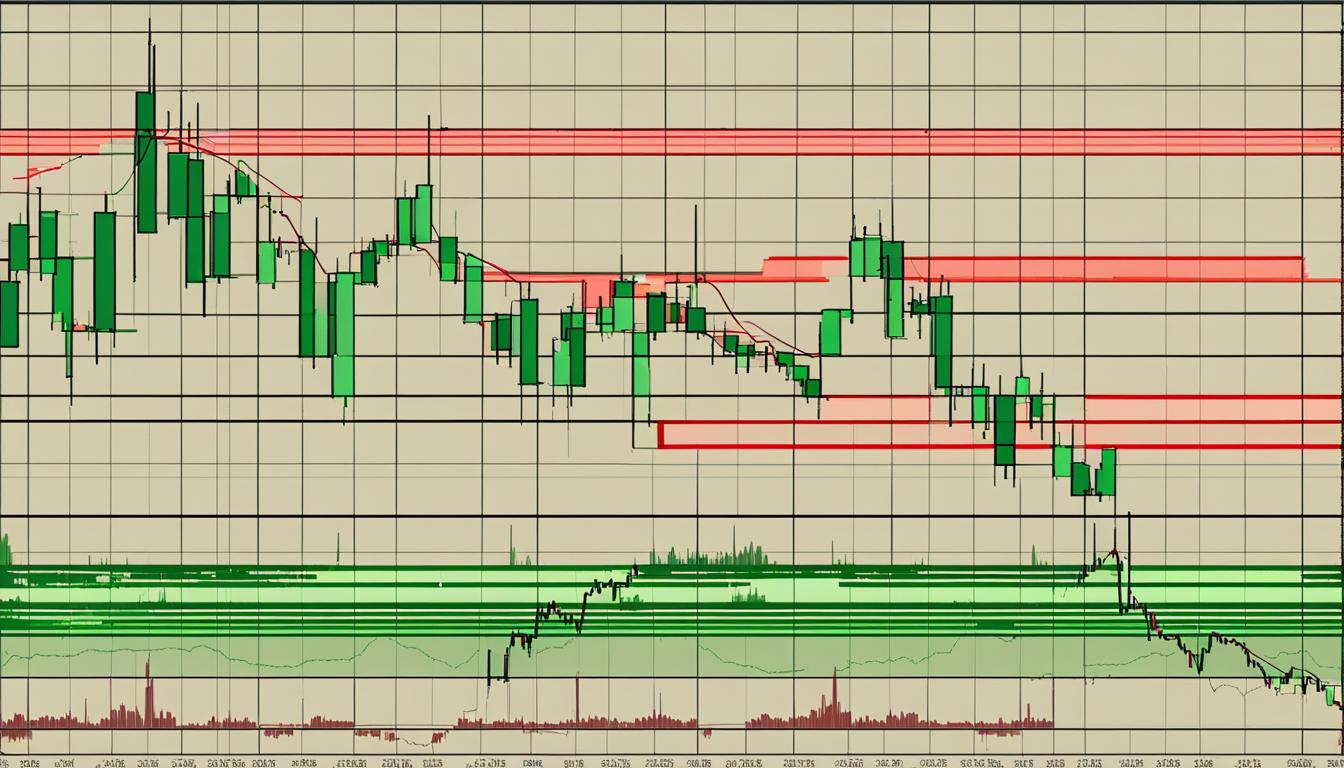

Examples and Identification

Identifying swing lows can be accomplished through a keen observation of price charts, whereby one seeks out the distinctive dips that constitute a clear nadir in price action before an ascent. These critical points can be isolated events within a single trading session or emerge over a more extended period, revealing a broader trend. It is here that a swing low indicator might be particularly useful. By utilizing technical tools, these indicators can both automate and enhance the detection of swing lows.

The following table outlines the characteristics of various swing lows patterns and the corresponding indicators:

| Swing Low Pattern | Description | Indicators to Identify |

|---|---|---|

| Single-session Swing Low | A notable low point in a single trading session surrounded by higher prices immediately before and after. | Candlestick Recognition Software, Volume Oscillators |

| Multi-session Swing Low | A low point spread across several sessions, indicating a potential longer-term market shift. | Moving Averages, Fibonacci Retracement, RSI |

| Fractal Swing Low | A pattern that appears consistently across multiple time frames and may indicate a more significant trend. | Fractals Indicator, Alligator Indicator |

Utilizing the table’s outlined indicators can tremendously assist in distinguishing swing lows amidst the myriad of market movements. Recognizing these patterns not only guides in plotting support and resistance levels but also feeds into the formulation of strategic entry and exit points for trades.

By integrating the recognition of swing lows into your trading methodology, you can see beyond the surface of price fluctuations and discern the underlying narratives that propel market dynamics. Whether you prefer the precision of a candlestick pattern or the broader perspective of consecutive session analysis, the detection of swing lows is an irreplaceable component in the domain of technical trading analysis.

Key Uses of a Swing Low in Market Analysis

The importance of swing lows in trading cannot be overemphasized. Recognizing a swing low enables market participants to interpret and forecast market movements with greater precision. Let’s delve into the strategic applications of swing lows in market analysis and understand their pivotal role in a robust swing low trading strategy.

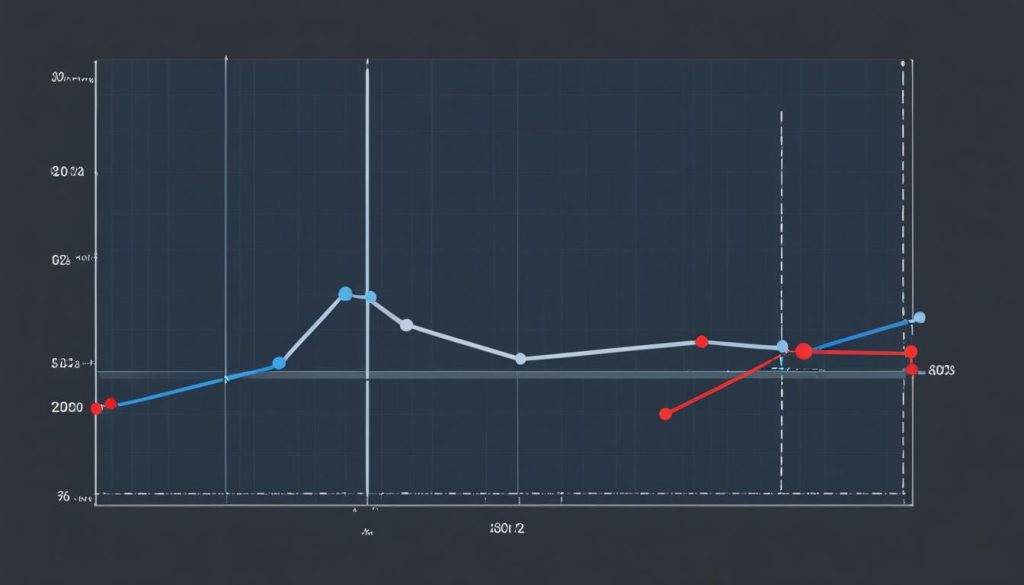

Identifying Trend Directions

The presence of swing lows is integral to determining the overall trend direction of a market. Traders recognize that a sequence of higher swing lows typically signals an upward trend—an invaluable insight for those employing trend-following strategies. Conversely, tracking swing lows that progressively lower indicates a dominant bearish trend. Consequently, understanding the swing low meaning in chart formations is paramount for traders seeking to align with the market’s bias.

Setting Stop-Loss Orders

As a precautionary measure, traders often utilize swing lows to position their stop-loss orders. This tactic helps to constrain potential losses, ensuring the security of their investments. Placing a stop-loss order slightly below a swing low in a bullish trend provides a safety net against unexpected downturns and guards against excessive loss. This practice underpins the key role of the swing low in a trader’s exit strategy.

Divergence and Trend Reversal Patterns

Swing lows also serve as a radar for detecting possible divergences and impending trend reversals. Noticeable discrepancies between price action and momentum indicators can reveal positive divergence, hinting at weakening downtrends and the potential for a market rally. Furthermore, a sequence of swing lows might shape indispensable reversal patterns, such as double bottoms, which herald a tide shift in market sentiment and offer traders opportune moments for entry.

| Trend Type | Swing Low Pattern | Stop-Loss Placement | Typical Reversal Pattern |

|---|---|---|---|

| Bullish Uptrend | Higher swing lows | Below recent swing low | Double bottom |

| Bearish Downtrend | Lower swing lows | Below previous swing low (for short selling) | Head and shoulders |

Swing Low Trading Strategies

Developing successful swing low trading strategies entails a deep understanding of market dynamics and an ability to identify key patterns that signal trading opportunities. Utilizing swing lows in conjunction with technical indicators not only aids traders in pinpointing market entry points but also helps in the meticulous planning of exit strategies to effectively manage risk and secure profits within both trending and fluctuating markets.

Role in Trend Retracement and Reversal Strategies

Recognizing the power of swing lows can be transformative in trend retracement and reversal strategies. With the application of a swing low indicator, such as Fibonacci retracement levels or moving averages, traders can determine the strength of a trend and the likelihood of its continuation or reversal. These indicators, when overlaid on price action charts, can illuminate potential bounce points, making them essential tools for deciding when to engage in a trade.

To maximize the efficiency of these strategies, mastering how to identify swing lows in trading is crucial. This involves an analytical approach where traders look for specific patterns such as lower troughs following a significant downtrend, or a series of gradual troughs in a more stable market condition that may suggest the approaching reversal or retracement.

Managing Trades and Risk

Successful trading isn’t just about knowing when to enter the market; it’s equally critical to understand how to manage active trades and mitigate potential losses. Managing swing low trades encompasses the setting of stop-loss orders based on swing low levels to safeguard against unexpected market drops, as well as the implementation of trailing stops to lock in profits while the position remains favorable.

As market conditions evolve, swing lows serve as a reference point that can be recalibrated over time, ensuring that risk management practices are both dynamic and attuned to current market realities. Indeed, incorporating the concept of swing lows into trading mechanics cultivates a disciplined, strategic approach to the markets—vital for long-term success in the ever-changing world of trading.

Conclusion

At the foundation of technical analysis, understanding what is a swing low in trading is paramount for traders aiming to decipher and strategize within the intricate movements of the financial markets. The swing low definition encapsulates a key analytical concept that identifies the troughs or the lowest points in the price chart of an asset, serving as a crucial navigational beacon through the ebbs and flows of market pricing. It is this understanding that equips traders with the ability to pinpoint trend reversals, craft nuanced risk management protocols, and make informed decisions geared towards the pursuit of trading excellence.

The implementation of swing lows into a trading strategy transcends mere theoretical knowledge—it is a practical toolkit that empowers traders to chart a course through volatile market conditions with confidence. The ability to discern and harness these pivotal points allows for the development of strategies that are not just reactive but predictive, giving traders an edge in a competitive environment that thrives on precision and foresight.

In essence, the mastery of swing lows is not merely an option but an essential element for anyone serious about trading. It provides the insight necessary to distinguish fleeting market noise from genuine trend setting movements, thereby unlocking opportunities for astute investment and trading decisions. For traders at all levels, an adeptness at identifying swing lows is tantamount to having a finger on the pulse of market dynamics, which is instrumental in achieving and sustaining success within the ever-evolving arena of financial trading.

FAQ

What is the definition of a swing low in trading?

In trading, a swing low is the lowest point in a security’s price during a specific time frame, which is surrounded by at least two higher price points on both sides. It reflects a temporary trough in price action.

How do swing lows impact trading strategies?

Swing lows are pivotal in trading strategies as they can indicate potential entry and exit points, help ascertain the market’s overall direction, and facilitate risk management through strategic stop-loss placement. They are also used in identifying trend reversals and continuations.

How can a trader identify swing lows on a chart?

Traders can identify swing lows by looking for price troughs that are immediately followed by higher lows on the chart. These are visually discernible low points that can also be detected with the help of technical indicators and candlestick patterns specific to swing lows.

Why are swing lows important in market analysis?

Swing lows are important in market analysis because they provide insights into potential support areas, market sentiment, trend direction, and volatility. They serve as benchmarks for making informed decisions and refining trading strategies.

What is the role of swing lows in setting stop-loss orders?

Swing lows are used as reference points for setting stop-loss orders, which are designed to limit a trader’s loss on a position. By placing a stop-loss just below a swing low, traders aim to exit a trade if the price continues to fall, thus protecting against larger downside risks.

How can swing lows indicate trend reversals?

Swing lows can form patterns that indicate potential trend reversals, such as double or triple bottoms. Additionally, if an indicator shows a positive divergence—failing to register a new swing low while the price drops—it may signal that the downtrend is losing momentum and a reversal may be imminent.

What strategies utilize swing lows?

Some common strategies that utilize swing lows include trend retracement and reversal trading, where swing lows provide potential entry points. Swing lows are also part of trend following and range trading strategies. Technical indicators like moving averages and oscillators are often employed in conjunction with swing lows to enhance these strategies.

How does understanding swing lows benefit trade management?

Understanding swing lows helps traders manage trades by establishing points for implementing stop-loss and trailing stop orders. This knowledge aids in managing risk, maximizing potential gains, and promoting disciplined trading.