Mastering the trendline strategy is key for any trader serious about the market. It’s about spotting and using trendlines on price charts to understand market trends. This skill is vital for both new and seasoned traders. It helps in making better decisions by analyzing chart patterns with trendlines.

It also gives clear signals for when to buy or sell in different markets. This technique marks support and resistance levels clearly. This makes it easier for traders to handle market ups and downs with confidence.

Key Takeaways

- Trendline strategy is crucial for identifying market trends and making informed trading decisions.

- Mastery of trendline trading involves recognizing and utilizing support and resistance levels on price charts.

- Accurate trendline analysis can significantly improve your entry and exit positions in the market.

- Integrating trendline insights into your trading toolkit helps navigate market fluctuations with precision.

- Trendline trading mastery is a foundational skill for both novice and experienced traders aiming for sustained success.

Understanding Trendline Trading

Trendline trading is a key strategy for traders who use technical analysis to guess where prices will go next. By drawing lines between certain data points on a chart, traders can see where stocks might move. This helps them spot good times to buy or sell.

What is Trendline Trading?

Trendline trading uses trendline analysis to understand market trends. Traders draw lines to connect highs or lows, making trendlines that show the market’s direction. Knowing how to trade with trendlines helps them spot important patterns and signals. This makes their buying and selling decisions better.

Importance of Trendline Trading in Market Analysis

Adding trendline trading to market analysis makes stock behavior clearer, showing trends and possible changes. Traders use trendlines to find support and resistance levels. These are key for reducing risks and making more money. Trendline trading is vital for those wanting to get good at technical analysis.

Basic Concepts and Definitions

To use trendline analysis well, knowing key terms is crucial. Terms like support, resistance, uptrend, and downtrend are important. Support is where a downtrend might stop due to strong buying. Resistance is where selling is stronger than buying. Uptrends mean prices are going up, while downtrends mean they’re falling. Understanding these terms is key to trading with trendlines well.

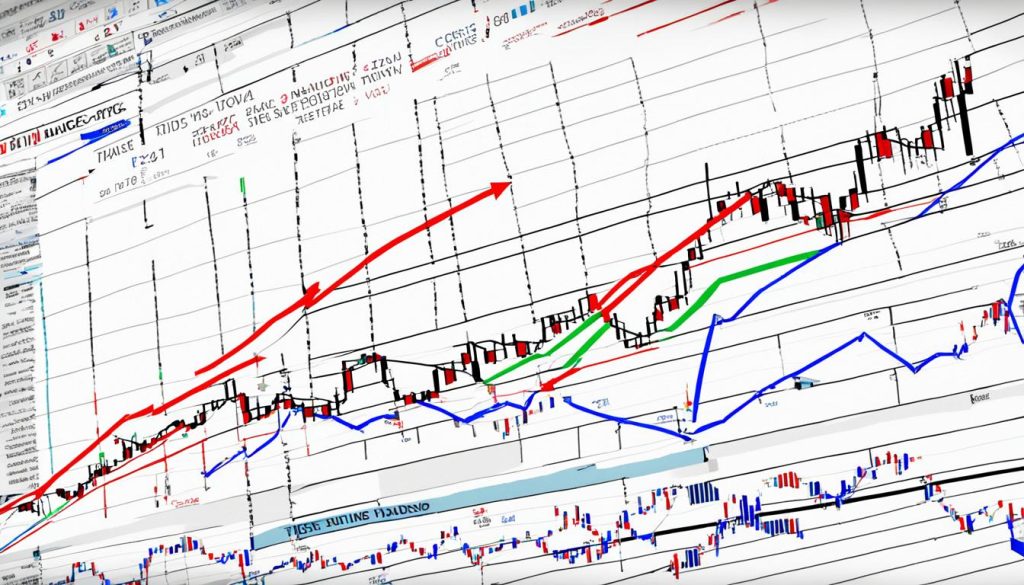

Key Elements of Effective Trendline Analysis

To master trendline analysis, traders must focus on identifying, drawing, and using the right tools. This helps them understand market movements better and make better decisions.

Identifying Trendline Patterns

It’s key to spot different trendline patterns like channels, wedges, and flags. These patterns show how the market might move next. They help traders predict market trends and improve their strategies.

Drawing Trendlines Accurately

Accurate trendline drawing is vital. Traders should link important highs and lows to create clear trendlines. This method helps show the market’s true direction. It also makes sure the trendlines are trustworthy indicators of market trends.

Trendline Indicator Tools

Using trendline indicator tools can make drawing trendlines easier and more accurate. Tools like TradingView and MetaTrader are favorites among traders. They offer automated trendline detection. This means traders don’t miss important trend signals.

Advanced Trendline Strategies

Exploring advanced trendline techniques means understanding trendline breakout methods well. Using trendlines with technical indicators makes their analysis stronger. This helps fill in the gaps left by just using trendlines alone.

Experts use top trendline trading methods by mixing trendlines with tools like moving averages and Bollinger Bands. This strategy gives a full view of the market. It makes predictions and trading choices more accurate.

Using advanced trendline techniques in different markets like stocks, commodities, and forex needs a careful plan. Tailoring these methods to each market’s unique traits helps traders do better. Experienced traders know a one-size-fits-all approach doesn’t work well. Instead, they use trendlines in ways that best suit each asset.

An example of how to compare these methods is shown below:

| Indicator | Benefits | Best Use Cases |

|---|---|---|

| Moving Averages | Smooths out price data for trend identification | Stock and forex markets |

| Bollinger Bands | Highlights price volatility and potential overbought/oversold conditions | Commodities and forex markets |

Using the best trendline trading techniques means knowing how different markets behave. By combining trendline breakouts with advanced indicators, traders can improve their trading methods a lot.

Incorporating Trendlines into Your Technical Analysis Toolkit

Effective trading requires a complete approach. Traders should use different tools and techniques to improve their market strategies with trendlines. A strong method is to mix trendlines with indicators for better analysis.

To get the most out of it, add trendlines to your technical analysis with other indicators. Here’s how trendlines work well with common technical indicators:

| Technical Indicator | How It Combines with Trendlines | Benefits |

|---|---|---|

| Moving Averages | Identify trend direction and smooth out price data | Aids in confirming trendline breakouts and entries |

| Oscillators (RSI, MACD) | Track overbought/oversold conditions relative to trendlines | Refine entry and exit points by signaling potential reversals |

| Bollinger Bands | Monitor volatility around trendlines | Highlight potential price breakouts or consolidations |

Using trendlines with these indicators can greatly improve your technical analysis tools. This method helps spot important market trends and create precise, profitable strategies with trendlines. Remember, mixing trendlines with indicators leads to a stronger analysis. It ensures better timing for entering and leaving the market.

Trendline Trading Do’s and Don’ts

Trendline trading can be greatly improved by following certain best practices in trendline trading. We will share key do’s and don’ts to help traders increase their profits and reduce mistakes.

- Do’s:

- Accurately identify trendline support and resistance to determine entry and exit points.

- Use multiple timeframes to check if trendlines are correct.

- Add other technical indicators to make sure trendline signals are right.

- Keep updating trendlines to match market changes.

- Wait for clear trendline patterns before making trades.

- Don’ts:

- Avoid making trendlines fit what you think the market should do.

- Don’t ignore big market signals that could change trendline predictions.

- Don’t trade based on just one trendline without more proof.

- Remember, trendline support and resistance are key.

- Don’t overdo it with too many trendlines, it can confuse your decisions.

Using these best practices in trendline trading will make your trading better. It will help you stay disciplined and strategic. Knowing about trendline support and resistance and following these tips is crucial. It makes your trendline trading stronger, helping you make money from market changes.

| Do’s | Don’ts |

|---|---|

| Identify trendline support and resistance accurately. | Avoid forcing trendlines to fit market views. |

| Use multiple timeframes for validation. | Don’t ignore important market signals. |

| Add technical indicators for confirmation. | Don’t trade based on a single trendline. |

| Update trendlines with market changes. | Don’t overlook crucial support and resistance levels. |

| Wait for clear patterns before trading. | Avoid making charts too complex with many trendlines. |

Analyzing Trendline Breakouts and Reversals

Understanding analyzing trendline breakouts and reversals is key for traders. A trendline break shows a big change in market feelings. It often means a new trend is starting.

To spot these breakouts, traders should check with other indicators. Look for volume spikes or momentum changes. This helps avoid false signals and matches the breakout with the market’s wider moves.

Trendline reversals are also crucial. They signal possible changes in market trends. Spotting these early can lead to big wins. Watch for patterns like head and shoulders or double tops/bottoms before reversals happen.

Knowing the trendline trading signals during breakouts and reversals boosts trading accuracy. For example, a breakout above a resistance line might mean a bullish trend. A drop below a support line could signal a bearish trend.

Here’s a look at what to expect with breakouts and reversals:

| Key Aspect | Breakouts | Reversals |

|---|---|---|

| Pattern Indicator | Resistance break, Support break | Head and Shoulders, Double Tops/Bottoms |

| Market Sentiment | Shifts to new trend | Indicates trend change |

| Confirmation Tools | Volume spikes, Momentum oscillators | Chart patterns, Divergence |

| Trading Signals | Bullish/Bearish trend indication | Warning of potential trend shifts |

By deeply analyzing trendline breakouts and reversals, traders can better understand the market. This helps improve their decision-making.

Optimizing Your Trendline Trading Approach for Maximum Profit

Optimizing your trendline trading strategy can help you make more money in the financial markets. It’s about managing risks, setting the right trade sizes, and having a detailed trading plan. This plan should include trendline analysis.

First, managing risks well is key. Use stop-loss orders and set profit goals to limit losses and lock in gains. Make sure your trade sizes match your risk level. This helps avoid too much risk and keeps your portfolio stable, even when markets are up and down.

Improving your trendline trading is also important. Keep a trading journal to track your trades and see how they did. Reviewing this journal often can show you what to do better. Also, keep up with market news and adjust your strategies as needed to stay profitable.

Being flexible is crucial. Markets change, and what works in a trending market might not work in a flat one. Being ready to change your approach based on the market will help you make the most of trendline trading.

FAQ

What is Trendline Trading?

Trendline trading uses lines on charts to connect highs or lows. It helps predict market trends. These lines guide traders on price movement direction and strength.

Why is Trendline Trading Important in Market Analysis?

It’s key for spotting support and resistance levels. This helps traders know when to buy or sell. It’s a basic tool for making smart trading choices based on past prices and market feelings.

What are the Basic Concepts and Definitions of Trendline Trading?

Key concepts include “uptrend” and “downtrend”. Uptrends have higher highs and lows, while downtrends have lower ones. Support and resistance levels are also important. Support is where a downtrend might pause, and resistance is where an uptrend might pause.

How Do You Identify Trendline Patterns?

Spotting trendline patterns means looking for different shapes like channels and wedges. These patterns suggest if the market might keep going or change direction.

How Do You Draw Trendlines Accurately?

Pick high points for a downtrend line or low points for an uptrend. Then, connect them and extend the line forward. This helps predict the trend’s future direction. It’s important to be precise with these points.

What Trendline Indicator Tools Can Assist in Analysis?

Tools like the Fibonacci retracement tool and moving averages help with trendline analysis. They automate trendline detection and confirm trading decisions.

What Are Advanced Trendline Trading Techniques?

Advanced techniques include spotting trendline breakouts. Combining trendlines with indicators like RSI or MACD gives stronger signals and improves market movement predictions.

How Can You Incorporate Trendlines into Your Technical Analysis Toolkit?

Use trendlines with indicators like moving averages and oscillators. This mix offers a full analysis, helping traders confirm trends and make smart trades.

What Are the Do’s and Don’ts in Trendline Trading?

Do update your trendlines regularly and use them for stop-loss orders. Combine them with other indicators for validation. Don’t ignore the market trend, draw lines randomly, or rely only on trendlines.

How Do You Analyze Trendline Breakouts and Reversals?

Watch price action near a trendline and confirm breakouts with volume or indicators. Reversals can be spotted with patterns like head and shoulders, signaling a trend change.

How Can You Optimize Your Trendline Trading Strategy for Maximum Profit?

Use strong risk management, like setting stop-loss and take-profit levels. Refine your strategy based on performance and adapt to market changes to maximize profits and reduce losses.