In the nuanced world of trading, a bearish harmonic pattern is not merely a jargon-laden concept but a critical tool for investors seeking to decipher market trends and strategize their next move. These intricate chart arrangements, gleaned from the reliable Fibonacci sequence, are known to shed light on potential trend reversals, allowing traders to anticipate and capitalize on market downturns with increased confidence. Especially within the dynamic realm of forex, understanding and implementing a harmonic pattern trading strategy can be transformative, optimizing decision-making in real-time market conditions.

Recognizing bearish chart patterns involves more than a cursory glance at a graph; it demands technical prowess and an analytical mindset to navigate the ebbs and flows of the forex market. As traders around the globe attest, the application of such patterns is not just an academic exercise but a grounded approach to harnessing the rhythms of the market. With a clear-eyed understanding of bearish harmonic patterns, traders empower themselves to make informed choices, celebrating the confluence of meticulous analysis and strategic foresight.

An Introduction to Harmonic Patterns in Trading

In the realm of financial markets, savvy traders often turn to the profound insights provided by harmonic patterns in trading. These intricate configurations are not just mere coincidences; they are the backbone of a sophisticated method of harmonic pattern analysis that can forecast market reversals with remarkable precision.

Defining Harmonic Patterns

At their core, harmonic patterns represent precise geometric formations, typically rooted in the historic Fibonacci sequence, which can be observed on price charts. These patterns are highly sought after by traders aiming to identify bearish patterns among other formations. Harmonic patterns such as the iconic Gartley, Bat, and the simple ABCD structure stand out due to their unique Fibonacci measurements, which forecast potential natural and cyclical price reversals in the markets.

The Role of Fibonacci Numbers in Chart Patterns

Fibonacci numbers play an indispensable role in the creation and confirmation of harmonic patterns. Utilizing Fibonacci ratios like 0.618, 0.382, and 0.786, these chart patterns harness the power of natural and mathematical proportions to provide traders with potential reversal zones that are uncannily precise, guiding the timings of entries and exits in trading positions.

The Importance of Technical Analysis Proficiency

Navigating the nuanced field of harmonic patterns in trading requires more than intuition; it necessitates a high degree of technical analysis proficiency. Traders trained in technical analysis can decode the complex signals of these patterns, swiftly acting upon bearish formations to mitigate risk and capitalize on the inherent forecasting capabilities of these powerful market indicators.

Identifying Bearish Patterns in Forex Markets

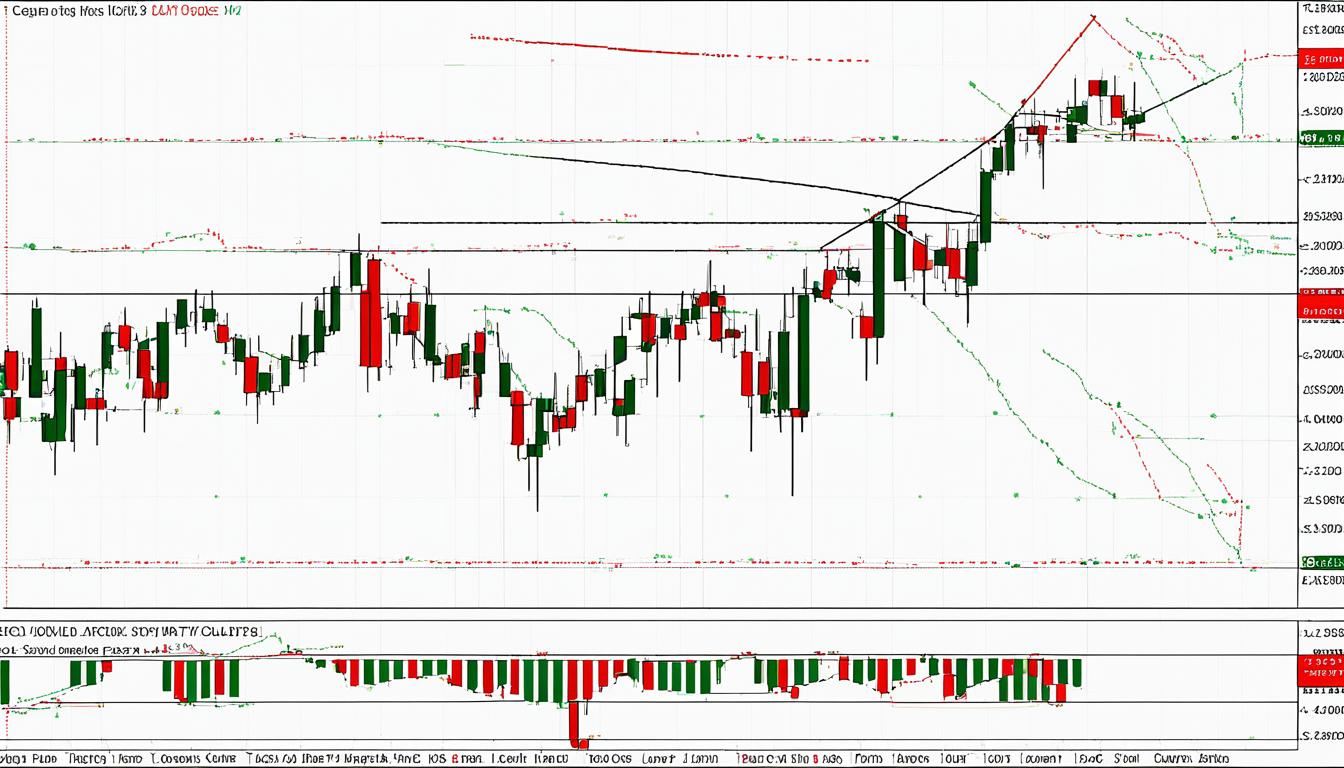

For the astute forex trader, identifying bearish patterns is a critical skill that can dictate the success of their trading strategy. Recognized as early indicators of downward price reversals, patterns such as the Bearish Crab and Bearish Shark are invaluable for investors looking to capitalize on shifts in market momentum. These formations, often spotted with a harmonic pattern indicator, allow for the refinement of entry and exit points – a process central to maximizing potential gains and minimizing losses in the volatile forex landscape.

The implementation of tools like Fibonacci retracements and extensions is pivotal in dissecting these complex patterns. The predictive nature of bearish harmonic pattern forex analysis relies heavily on the precision these technical instruments offer, transforming intricate market data into actionable trading insights. Below is a detailed breakdown of common bearish harmonic patterns identified in forex trading:

| Pattern Name | Key Characteristics | Typical Retracement Levels |

|---|---|---|

| Bearish Crab | Extended XA leg; extreme potential reversal zone | 88.6% of XA leg |

| Bearish Shark | Converging OX and XA legs; high probability of price reversal | 113% of OX leg |

| Bearish Gartley | M-shaped pattern; alignment with overall downtrend | 78.6% of XA leg |

| Bearish Bat | Deep B leg retracement; PRZ at an 88% retracement of XA leg | 88% of XA leg |

Identifying these bearish patterns with precision is not a task left to chance. Traders often leverage advanced harmonic pattern indicators that scan currency charts for potential setups, delivering timely and accurate signals. This technological edge is vitally important in markets that move as quickly as forex, ensuring that traders stay ahead of the curve and can respond with confidence to the ebb and flow of currency values.

Savvy traders understand that the journey to mastery in identifying and exploiting bearish harmonic patterns is ongoing. As forex markets evolve, so must the strategies and tools employed by those seeking to navigate them successfully. Through consistent study and application of technical analysis techniques, traders can cultivate an edge, turning the intricate dances of market price action into a clear narrative ripe with opportunity.

Understanding Bearish Harmonic Pattern Forex

The dynamics of the forex market are profoundly affected by the identification and application of harmonic trading patterns. For investors and traders, a critical aspect of market analysis is distinguishing between the nature of bearish and bullish harmonic patterns to predict market trends accurately. With the advent of complex trading tools, the harmonic pattern scanner has emerged as an essential technology for traders, allowing them to streamline their bearish harmonic pattern trading strategy for optimal outcomes.

Distinguishing Between Bearish and Bullish Harmonic Patterns

In forex markets, bearish harmonic patterns signal an impending move downward, which can lead discerning traders to consider initiating a short position. Conversely, bullish harmonic patterns suggest a market might be trending upwards, making it prime for taking a long position. Understanding the behavior of these patterns is fundamental in forecasting market movement and tailoring one’s trading approach.

The core difference lies in the final leg of the patterns, where bearish formations expect a price decline, and bullish configurations anticipate a rise. A keen insight into these nuances is instrumental in deploying a bearish vs bullish harmonic patterns analysis that can significantly influence trading decisions.

Strategies to Trade with Bearish Harmonic Patterns

To navigate the complex terrain of bearish harmonic patterns, traders can follow a meticulous trading strategy. This involves executing trades in alignment with the signals emanating from these patterns and vigilantly managing the positions to maximize returns while minimizing risk. Below are outlined key facets to consider when formulating a trading strategy.

- Pattern Recognition: This entails using a harmonic pattern scanner to identify potential bearish patterns across various currency pairs accurately.

- Technical Analysis: An in-depth analysis using tools such as Fibonacci retracement levels to confirm the bearish patterns and refine entry points.

- Trade Execution: Entering the market at the completion of the harmonic pattern, ensuring that stringent risk management protocols are in place.

- Risk Management: Utilizing stop-loss orders at calculated levels above the Potential Reversal Zone (PRZ) to safeguard against market reversals.

The inclusion of a systematic trading strategy aligned with coherent risk management principles can prove to be the cornerstone of successful bearish harmonic pattern trading. Coupling this strategy with sophisticated tools such as a harmonic pattern scanner amplifies a trader’s ability to make informed decisions in a volatile forex market.

| Bearish Harmonic Pattern | Key Characteristics | Suggested Trading Action |

|---|---|---|

| Bearish Gartley | Consists of an ‘M’ shape, with prices reversing from the last peak. | Consider short positions near the completion of the pattern. |

| Bearish Butterfly | Features longer retracements and wings, potentially indicating stronger reversals. | Short the market at the formation’s last leg. |

| Bearish Crab | Characterized by an extreme potential reversal zone which can pinpoint sharp turns. | Time the entry after confirmation of the price stalling in PRZ. |

| Bearish Shark | Followed often by sharp price increases, signaling a strong potential drop. | Execute short trades following the overshooting move within PRZ. |

The Significance of Bearish Chart Patterns in Market Analysis

Bearish chart patterns play a pivotal role in market analysis, frequently signaling not just a potential downtrend but a full-fledged pivot in market direction. Recognizing these patterns—often characterized by distinct peaks, valleys, and retracements—is vital for analysts and traders seeking to forecast and capitalize on price movements. Bearish pattern formation involves a meticulous process of identifying trend lines and price levels that adhere to the principles of harmonic pattern analysis. This technique is integral for deriving actionable insights from market data.

Consider some key bearish chart formations:

- The Head and Shoulders – indicates a reversal in an uptrend

- The Double Top – suggests exhaustion of a price increase and potential reversal

- The Rising Wedge – often forewarns of a downturn following a bullish trend

More complex patterns like the Bearish Crab, Shark, and the notable Gartley, are specifically categorized within harmonic pattern analysis. These patterns are based on Fibonacci numbers, a core concept in the identification of reversal zones. The reliable identification of such patterns enables traders to discern potential selling points or exit positions ahead of anticipated market downturns.

Shapes and structures in these patterns can be subtle and often require advanced software for detection. Nonetheless, their significance cannot be overstated—successful trading strategies frequently rely on spotting these formations early and with precision. Analysts draw upon a variety of harmonic patterns to provide a comprehensive overview of market sentiment, which in turn guides trading decisions informed by likely future price actions.

Bearish harmonic patterns are not mere predictions; they are studies backed by historical market behaviors which serve to improve the accuracy of forecasts. Familiarization with these patterns is, therefore, an essential aspect of technical analysis and a treasure trove for those dedicated to decoding market dynamics.

Applying a Harmonic Pattern Trading Strategy

Incorporating a harmonic pattern trading strategy into your trading routine requires precision, insight, and an understanding of the market’s subtle movements. The advanced techniques involved in this strategy can significantly enhance a trader’s ability to forecast and capitalize on potential price fluctuations.

Key Components of a Harmonic Pattern Trading Strategy

The core of any successful harmonic pattern trading strategy revolves around several essential elements that work in concert to deliver optimal results. These components not only guide in pattern identification but also in the meticulous management of trades.

- Recognition of harmonic pattern formations, allowing for timely and informed trade entry decisions.

- Effective use of harmonic pattern indicators to aid in the confirmation of pattern validity.

- Employment of stop loss and take profit strategies to manage risk and secure earnings.

- Adequate practice and backtesting to ensure familiarity and proficiency with pattern trading.

Utilizing Harmonic Pattern Indicators and Scanners

Advancements in trading technology have led to the development of tools that can automatically detect and evaluate harmonic pattern formations. A harmonic pattern scanner is a pivotal resource, simplifying the complex process of pattern recognition.

These tools empower traders to focus on strategic decisions rather than the cumbersome task of pattern identification. The incorporation of these scanners into your trading arsenal equips you with a distinct advantage—speed and accuracy in a market where every second counts.

| Harmonic Pattern Indicator | Functionality | Impact on Trading Decision |

|---|---|---|

| Auto Pattern Recognition | Automatically detects potential pattern formations in real-time. | Enables faster reaction times to market changes. |

| Pattern Completion Alerts | Provides notifications when a pattern is close to completion. | Assists traders in preparing to execute trades at optimal entry points. |

| Stop Loss and Take Profit Calculator | Calculates appropriate risk management levels based on the pattern. | Ensures consistent application of risk management strategies. |

To fully leverage the capabilities of harmonic pattern indicators and scanners, it is imperative to integrate them with a comprehensive approach to market analysis. This involves an appreciation of the broader market trends and economic factors that govern price movements.

Merging these cutting-edge tools with a trader’s own analytical skills forms a robust harmonic pattern trading strategy capable of navigating the intricacies of financial markets and helping to secure potential profitable opportunities.

Conclusion

The exploration of bearish harmonic pattern in trading is not just an academic exercise; it is a strategic tool that can sway the decision-making process of traders across the globe. These patterns, infused with the mathematical precision of Fibonacci numbers, offer a framework for anticipating and strategizing around potential market downturns. A trader’s skill in leveraging harmonic patterns in trading can be significantly enhanced by the rigorous application of technical analysis and the employment of sophisticated trading tools.

Essential to the mastery of these patterns is the trader’s ability to not only identify potential bearish diversions but also to utilize those insights to forge effective trading strategies. The synergy between a trader’s analytical acumen and the technological prowess of tools like harmonic pattern scanners is potent. It transforms raw data into actionable intelligence, potentially culminating in strategic market wins.

As we conclude, we emphasize the unparalleled value that understanding bearish harmonic patterns provides. An adept trader, equipped with knowledge and the right analytical tools, is well-positioned to interpret the subtle nuances of the market. This discernment, cultivated through persistence and precision, is what delineates an informed trader from the novices, thrusting them towards the path of consistent success in the complex arena of forex trading.

FAQ

Bearish harmonic patterns are technical analysis tools used in trading to predict potential market downturns. They are geometric price structures derived from Fibonacci numbers, indicating where the market could reverse from an uptrend to a downtrend.

Fibonacci numbers are used to predict points in a market where potential reversals could take place. They help in identifying the specific turning points by measuring swings and projecting the possible areas of pattern completion, which are crucial in shaping bearish harmonic patterns in forex trading.

Strategies to trade with bearish harmonic patterns include identifying potential reversal zones, using stop-loss orders to manage risk, and taking profit at the completion of the pattern. Traders also use harmonic pattern scanners and indicators to improve the accuracy of pattern detection.