Are you seeking an effective, tried-and-true technical analysis tool that could transform your trading experience? Look no further than the VWAP indicator strategy, a tool widely utilized by traders across the globe.

Understanding the VWAP Indicator

Before we delve into the strategy, it's essential to understand what VWAP—Volume Weighted Average Price—is. Simply put, it's an indicator used by traders to determine the average price at which a currency or security has been traded throughout the day, based on both volume and price. It is a common tool integrated into many trading platforms, including VWAP MT4 and VWAP MT5. It can be used in conjunction with COT Data to get high accuracy rading signals

Calculating the VWAP Indicator

To make the most of the VWAP indicator, understanding its calculation is critical. The formula involves multiplying the price of each transaction by its volume, adding these values together, and then dividing by the total volume traded for the day. Here is the mathematical representation of the VWAP formula:

VWAP = ∑ (Price x Volume) / ∑ Volume

This powerful calculation helps traders determine whether a security is being traded at a fair price, making it an invaluable tool for assessing market trends and predicting future price movements.

VWAP Trading Strategy: A Step-By-Step Guide

Once you've mastered the VWAP calculation, it's time to implement it into your trading strategy. Here is a step-by-step guide on how you can do that:

- Identify the VWAP line: Using your VWAP charting tool, locate the VWAP line. This line gives a visual representation of the average price weighted by volume, and it is critical for making trading decisions.

- Wait for price to touch the VWAP line: One key element of the VWAP trading strategy is patience. The strategy only comes into play when the price of the security touches the VWAP line.

- Look for confirmation from other indicators: To minimize risk, use other indicators alongside VWAP. For example, a moving average or RSI can offer additional insights into market trends.

- Enter the trade: Depending on your trading style and the signals from your indicators, you can decide to go long or short.

Trading Signals and Responses

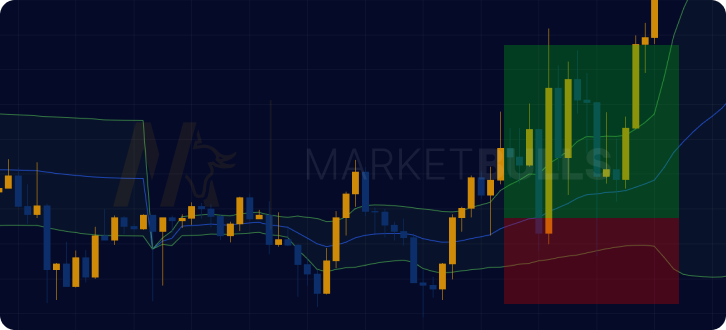

One of the most significant aspects of the VWAP indicator strategy is the signals it provides. Key among these signals are the VWAP upper and lower bands. These bands often act as dynamic resistance or support levels. If the price falls below the VWAP line or lower band, this signals an opportunity to buy. Conversely, if the price rises above the VWAP line or upper band, this could be a selling opportunity. Understanding these signals can greatly enhance your trading outcomes.

Common Pitfalls and How to Avoid Them

As with any trading strategy, using the VWAP indicator comes with potential pitfalls. Some of these include:

- False signals: Like any other indicator, VWAP can generate false signals. To avoid this, always use VWAP in conjunction with other indicators or candlestick patterns for signal confirmation.

- Applicability: VWAP is most effective in intraday trading. If you try to use it for longer time frames, it might not yield the best results.

Conclusion

Mastering the VWAP indicator strategy can significantly improve your trading outcomes, especially in forex markets. It's a powerful tool, but like any trading instrument, it requires practice and a thorough understanding of its mechanisms. Keep the above points in mind as you incorporate this invaluable tool into your trading strategy.

FAQs

The Volume Weighted Average Price (VWAP) is a trading benchmark used by traders that gives the average price a security has traded at throughout the day, based on both volume and price.

VWAP is calculated by multiplying the price of each transaction by its volume, adding these values together, and then dividing by the total volume traded for the day.

Traders often use VWAP for determining entry and exit points for their trades. When the price of a security is below the VWAP line, it may be considered a good time to buy. Conversely, if the price is above the VWAP line, it might be a good time to sell.

Some common pitfalls include receiving false signals from the VWAP and using it outside of its optimal use case, intraday trading.

To avoid pitfalls, traders should use the VWAP indicator in conjunction with other indicators to confirm signals. Additionally, it’s best to use VWAP for intraday trading.

Yes, the VWAP indicator can be a powerful tool in forex trading, helping traders identify potential buy and sell points based on volume-weighted price averages.