Embark on a trading journey through the world of forex, zigzagging your way to potential profits. The zigzag trading strategy could be your GPS, navigating you through the oscillations of the market.

The ABCs of the Zigzag Trading Strategy

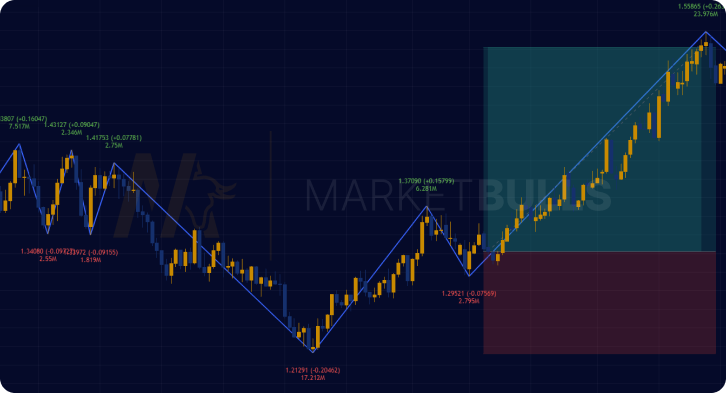

The zigzag trading strategy, which is a pivotal element in zigzag pattern trading, serves as a beacon in the bustling trading marketplace. It employs the zig zag indicator to highlight significant price trends, filters out minor fluctuations, and provides an eagle-eye view of market trends. The powerhouse behind this strategy? It's the zigzag indicator, a key tool in technical analysis. The combination of this indicator with candlestick patterns can be lead into high accuracy.

The Nitty-Gritty of the Zigzag Indicator

The zig zag indicator is the heart of the zigzag trading strategy. When price fluctuations surpass a predetermined threshold percentage, this tool plots a line linking price peaks and troughs. This zigzag line, a result of the zigzag indicator formula, serves as a roadmap for traders to discern overarching market trends.

So, how is the zigzag indicator calculated? It's simple. The zigzag indicator uses a unique formula: if the price deviates more than a certain percentage from a prior high or low, a line is drawn connecting these peaks and valleys. This is the backbone of the zigzag trading strategy.

Harnessing the Zigzag Indicator MT4

The MT4 trading platform, celebrated for its user-friendly interface and vast features, proudly hosts the zigzag indicator MT4. This tool can be customized to mirror your trading preferences, ensuring alignment with your zigzag strategy and objectives.

Calibrating Your Zigzag Indicator Settings

Adjusting your zig zag indicator settings is the key to unlocking the true potential of this tool. The percentage change threshold, which determines the sensitivity of the zigzag indicator, is at your command. While the optimal percentage depends on individual trading goals and market volatility, a common rule of thumb is a price shift of 5% or more. These are considered the zigzag indicator best settings, helping you cruise smoothly in the trading ocean.

Step by Step Guide to Zigzag Trading

Ready to start trading using the zigzag strategy? Follow these steps:

- Set Up the Zigzag Indicator: Tailor the zigzag indicator MT4 settings to your trading style.

- Interpret the Zigzag Lines: Zigzag lines connect price peaks and troughs when the price shifts more than your predetermined percentage.

- Spot Trading Opportunities: Look for potential reversals and breakouts. A zigzag line changing direction could hint at a reversal, while a price moving beyond the recent zigzag line might signal a breakout.

- Trade Smart: Use zigzag lines to make well-informed decisions. Buy at the low point (a swing low) of a zigzag line and sell at its high point (a swing high).

With these steps, you're well on your way to mastering the art of trade zigzag.

Is the Zigzag Trading Strategy the Ultimate Solution?

Every trading tool comes with its pros and cons. While the zigzag trading strategy excels at identifying past market trends, it's not designed to predict the future. A trader should be always aware in which market cycles the market is. Traders who solely rely on this tool may risk being caught off guard by sudden market shifts.

In Conclusion

In the world of trading, the zigzag trading strategy could be your guiding light. It empowers you to interpret price trends and make informed decisions. As you learn and grow, this tool can be a steadfast companion on your trading journey. So gear up, apply this knowledge, and may your trading ventures be successful.

FAQs

The zigzag trading strategy uses the zigzag indicator to highlight significant price trends and filter out minor price fluctuations.

The zigzag indicator uses a formula that includes a percentage change threshold. When price changes more than this threshold from a previous high or low, lines connect the peaks and valleys.

The optimal settings depend on individual trading objectives and the specific market being traded. A common recommendation is a 5% price shift.

The zigzag strategy can help identify potential buying and selling points. Remember, it should be used in conjunction with other analysis tools for best results.

No, the zigzag indicator is not designed to predict future price movements. It is used to identify past market trends.

You can fine-tune the zigzag indicator settings based on your trading style, regularly interpret zigzag lines for potential trading opportunities, and use the zigzag lines to make informed trading decisions.