The realm of trading is replete with tools designed to pinpoint lucrative trade exits and potential price pivots, one of the most revered being Fibonacci extensions. These mathematical marvels allow traders to anticipate and capitalize on market movements with uncanny precision. Mastering how to use Fibonacci extensions is quintessential for every savvy trader, and to facilitate this, an easy-to-follow Fibonacci extensions tutorial is indispensable.

Whether you are taking your first steps in trading or looking to sharpen your analytical arsenal, understanding Fibonacci extensions explained in clear terms can enhance your market strategies. Drawing upon natural patterns that underpin market trends, these extensions embody the golden fibres of trading wisdom, providing a robust framework for profit targeting and retracement gauging—with no complex formulas involved.

Embrace the synergy of technical analysis and natural phenomena as we delve into the practical application of Fibonacci extensions, transforming the abstract into actionable insights for your trades.

Understanding the Basics of Fibonacci Extensions

Fibonacci extensions are a sophisticated tool embraced by traders across the globe. Leveraging the mathematics of the Fibonacci sequence, these extensions offer a roadmap for navigating the financial markets. They stand as a testament to the Fibonacci extensions strategy, playing a pivotal role in shaping trading decisions.

What Are Fibonacci Extensions?

Fibonacci extensions explained in their simplest form are a set of price levels that traders use to anticipate potential support or resistance areas. These price levels are calculated after a market has made a significant move and are used to forecast how far the price might move in the future after a retracement is completed.

Fibonacci Ratios in Nature and Markets

The underlying principle of Fibonacci extensions draws from the natural world, where the Fibonacci ratios are frequently observable. In finance, the rationale is that these natural proportions resonate within market movements and can be applied effectively to predict price actions.

Common Fibonacci Extension Levels

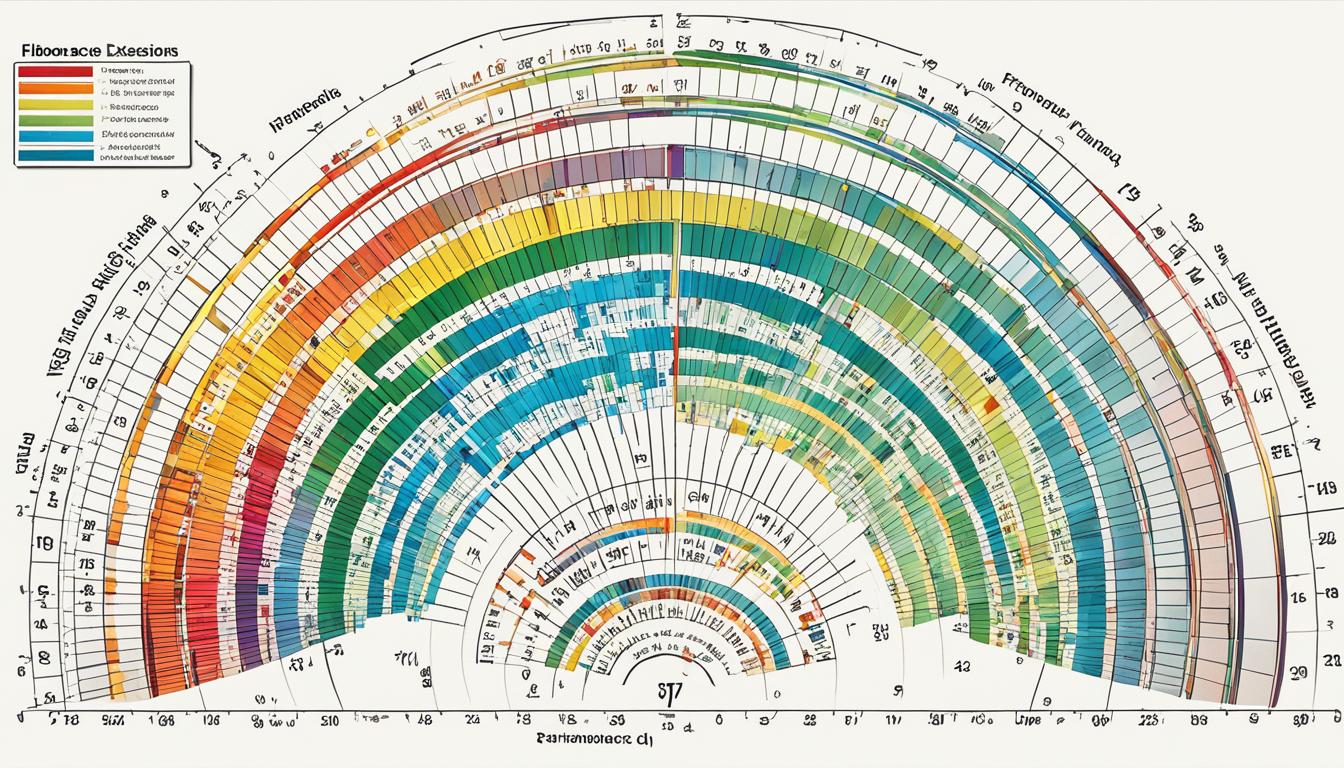

Fibonacci extensions levels include several key percentages which are considered significant markers for trading activity. You can calculate theses levels with our fibonacci calculator. These levels are often watched by traders and act as signposts for potential price reactions.

| Extension Level | Description | Predictive Use |

|---|---|---|

| 61.8% | The ‘Golden Ratio’ | Speculated area for profit-taking following a pullback |

| 100% | Full retracement | Key level for a complete reversal of the initial price movement |

| 161.8% | Projection of the first move | Often used to identify strong continuation of the trend |

| 200% | Double the initial move | Monitored for significant resistance or support |

| 261.8% | Strong projection level | Considered highly influential for setting far-reaching targets |

Setting Up Fibonacci Extensions on Your Chart

When integrating the powerful analysis tool of Fibonacci extensions into your trading strategy, a trader begins by pinpointing key price movements pivotal for accurate forecasting. This not only enhances the potential for successful trades but also refines risk management. Let’s delve into the foundational steps of incorporating Fibonacci extensions onto your charts, ensuring a robust approach to deciphering market dynamics.

Identifying Significant Swing Points

Locating significant swing points is the cornerstone of Fibonacci extensions trading. These points, marked as A (the start of the price move), B (the end of the price move), and C (the end of the retracement), form the bedrock from which extensions are projected. Traders meticulously select these points as they signify the breadth of a trend before retracement and set the stage for future price action.

Drawing Extensions from A to B Move

The A to B move is a critical component in mapping out Fibonacci extensions. Characterized by a peak and a trough, this segment establishes the framework upon which Fibonacci-based percentages will apply. A Fibonacci extensions tutorial often emphasizes the importance of the third point, C, representing the retracement’s reversal. Deploying the Fibonacci extensions tool, traders simply click at three pivotal junctures on their chart: the commencement of the uptrend or downtrend, the peak or trough of the trend, and the retracement’s conclusion, thereby obtaining a predictive view of the market’s direction—and potential reversal points.

This methodology offers traders a structured approach, imbued with the precision of mathematical ratios, to gauge potential future price levels. As you master how to use Fibonacci extensions, remember that the practice combines both art and science—requiring analytical skills to interpret chart patterns and the strategic application of Fibonacci levels for optimized trading execution.

How to Use Fibonacci Extensions in Trading

Delving into the practical applications of Fibonacci extensions in the financial markets reveals their dual utility for traders. These technical indicators not only help in crafting exit strategies for positions but also facilitate the identification of critical pivot points within price trends. By incorporating a Fibonacci extensions strategy into their analysis, traders can navigate the markets with a quantitative edge grounded in mathematical insights derived from historical price action.

Fibonacci Extensions for Establishing Profit Targets

Using Fibonacci extensions to set profit targets involves pinpointing the levels where price momentum is likely to pause or reverse. In an uptrend, traders examine Fibonacci extensions examples to determine potential levels to book profits on long positions. Conversely, in downtrends, the extensions guide the establishment of profit targets for short trades. The precision with which these levels are respected often depends on market conditions, historical adherence to these levels, and volume at these price points. It is a wise practice to consider Fibonacci extensions levels not as definitive targets but as zones of interest for profit-taking operations.

Extensions as Indicators of Reversal Zones

As price approaches a Fibonacci extension level, traders remain vigilant for signs of a possible reversal, which would signal an opportunity to either take profits or prepare for a change in market direction. The theory behind this approach is founded on the natural tendency of prices to retrace a portion of their primary movements before continuing along the original trend or reversing altogether. However, these potential reversal points are not guarantees, but rather probabilistic indications that require corroboration from additional technical indicators or price patterns. This reinforces the necessity for a comprehensive trading approach where Fibonacci extensions serve as one among several critical analytical components.

Ultimately, successful trading hinges on the strategic application of Fibonacci extensions in concert with other forms of technical analysis, enabling traders to make well-informed decisions. Knowledge of market psychology, technical patterns, and price history enriches the utility of Fibonacci extensions, making them a powerful tool in the trader’s arsenal.

Combining Fibonacci Extensions with Other Trading Tools

Market analysts often enhance the effectiveness of Fibonacci extensions techniques by integrating them with other analytical tools. This multifaceted approach provides a more comprehensive understanding of market dynamics and trader sentiment, ultimately leading to more informed trading decisions. Explore how these tools can complement your use of Fibonacci extensions.

Integration with Candlestick Patterns

One of the most powerful amalgamations in the field of technical analysis is the combination of Fibonacci extension tools with candlestick patterns. Recognizing patterns such as the ‘doji’, ‘hammer’, and ‘engulfing’ can suggest potential reversals, affirming the conclusions drawn from the price levels indicated by Fibonacci extensions. Traders can effectively pinpoint high-probability entry and exit points by correlating these two methods.

Complementing Extensions with Trend Analysis

Understanding the prevalent trend adds another layer to how to use Fibonacci extensions. Observing whether the market is trending upward or downward, or consolidating within a range, provides invaluable context. Traders may rely on Fibonacci extension levels to set profit targets more accurately once the current trend’s strength and duration are known, enhancing the precision of these tools.

The Role of Fibonacci in Market Sentiment Analysis

Fibonacci extensions act as a gauge for market sentiments, revealing how traders at large respond to specific price levels. When collective behavior aligns with Fibonacci-based support or resistance levels, it may indicate a shared belief in the potential reversal or continuation of the trend, cementing the importance of Fibonacci as a consensus-forming mechanism in market analysis.

| Candlestick Pattern | Fibonacci Extension Level | Interpretation |

|---|---|---|

| Doji | 61.8% | Potential price reversal after retracement |

| Hammer | 100% | Signaling the continuation of an uptrend |

| Engulfing | 161.8% | Possible end of a corrective phase and start of a new price wave |

Advanced Techniques Using Fibonacci Extensions

Building on the foundation of Fibonacci extensions trading, the adept trader often seeks to employ advanced Fibonacci extensions techniques to gain an edge in an ever-competitive market. Mastery of these techniques not only bolsters the resilience of trading strategies but also offers a more nuanced comprehension of market dynamics. Let’s delve into some of these sophisticated approaches that experienced traders utilize.

Fibonacci Confluence Zones

Fibonacci confluence zones emerge when a trader discerns the overlay of multiple Fibonacci extensions levels originating from different price movements, all converging at a singular price region. These zones are instrumental for traders striving to pinpoint robust areas of support or resistance. As these confluence zones represent a harmonic agreement among various Fibonacci retracements and extensions, they are often viewed as powerful indicators for potential market reversals or accelerations.

Temporal Aspects of Fibonacci Extensions

While most discussions on how to use Fibonacci extensions focus on price, incorporating the temporal aspects can offer traders a more holistic analysis. By evaluating the alignment of Fibonacci extension levels across different timeframes, traders can uncover patterns related to the duration and timing of market moves. This cross-temporal analysis can be critical for executing trades with higher confidence, ensuring that both price and time are considered in the strategic approach.

Recommended Practice for Fibonacci Extensions:

- Locate confluence zones by overlaying Fibonacci extensions from distinct price swings.

- Analyze extension levels across various timeframes to discern broader market patterns.

- Enhance trade entry and exit strategies by integrating price and time Fibonacci extensions.

For visual learners, a table representing confluence zones that combine both price and temporal aspects can succinctly display how these advanced techniques might align within a trading scenario:

| Time Frame | Price Swing High | Price Swing Low | Fibonacci Extension Level |

|---|---|---|---|

| 1-Day | $12,500 | $11,000 | 161.8% |

| 4-Hour | $12,300 | $11,150 | 161.8% |

By studying advanced Fibonacci extensions techniques diligently, traders can significantly refine their market forecast capabilities and trading efficiency. Incorporating the Fibonacci extensions trading strategy within a broader analytic framework can provide a more profound insight into potential price movement scenarios.

Conclusion

In the intricate dance of financial markets, Fibonacci extensions have emerged as a compelling instrument for traders aiming to fine-tune their market forecasts and strategies. As illustrated through this exploration, from the establishment of accurate price targets to recognizing critical zones for potential reversals, the tactical applications of Fibonacci extensions are diverse. A proficient grasp of Fibonacci extensions trading requires more than a cursory understanding; it is a skill honed through continuous practice and reflection on the interplay between various market forces.

The strategic advantage conferred by Fibonacci extensions is not isolated to their standalone use; rather, it is magnified when paired with other analytical tools. Integration of these extensions into a broader Fibonacci extensions strategy enhances the trader’s ability to make well-informed decisions. This tutorial has endeavored to demystify the complexity behind these mathematical marvels, delineating a pathway for traders to employ them with confidence and precision within their trading repertoire.

Ultimately, it is imperative to recognize the limitations intrinsic to any single mode of analysis, including Fibonacci extensions. The principles and techniques we’ve discussed serve as stepping stones toward a comprehensive approach to market analysis. For those dedicated to refining their craft in Fibonacci extensions trading, the cumulative effect of diligent application and integration of these concepts is likely to resonate through their trading outcomes, reflecting a well-rounded, strategic market engagement—the hallmark of a seasoned trader.