Bearish Engulfing Candlestick Pattern

The bearish engulfing pattern is a popular technical analysis tool used in trading and investing to identify potential trend reversals in financial markets. It is a two-candlestick pattern that occurs during an uptrend and signals a possible shift in market sentiment from bullish to bearish.

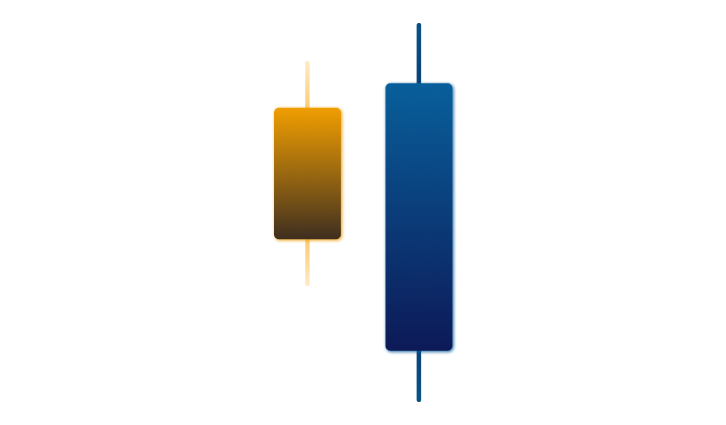

The pattern consists of a small bullish candlestick, followed by a larger bearish candlestick that completely engulfs the previous candle. This means that the bearish candle opens below the close of the previous bullish candle and closes below the opening of the same candle, forming a bearish body that covers the entire range of the previous candle. Let’s discuss this candlestick pattern in detail.

When is Bearish Engulfing formed?

The bearish engulfing candlestick pattern is formed when a small bullish candlestick is followed by a larger bearish candlestick that completely engulfs the previous candlestick. The bearish candlestick opens above the previous candlestick’s close and closes below the previous candlestick’s open, indicating that sellers have taken control of the market and are pushing prices lower.

The bearish engulfing pattern is a strong signal of a potential trend reversal because it shows that the bulls have lost control of the market, and the bears are taking over. This can happen for several reasons, such as a change in market sentiment, economic news, or a shift in supply and demand.

How do Traders Use Bearish Engulfing?

Traders often use other technical indicators and analyses to confirm the bearish engulfing candle and determine whether to enter a short or exit a long position. Some of these indicators include moving averages, relative strength index (RSI), and volume.

Moving Averages

Moving averages can help traders identify the market’s overall trend and whether it is bullish or bearish. When the price of an asset is below the moving average, it is a bearish signal, and when it is above the moving average, it is a bullish signal.

Relative Strength Index (RSI)

RSI is a momentum indicator that measures the strength of a trend. When the RSI is above 70, it is considered overbought; when it is below 30, it is considered oversold. Traders can use the RSI to identify potential trend reversals and to confirm the bearish engulfing candle.

Volume

Volume is another important indicator that can confirm the bearish engulfing candlestick. Suppose the volume on the bearish candlestick is significantly higher than the previous bullish candlestick. In that case, it indicates that there is strong selling pressure and that the trend is likely to reverse.

Stop-loss order

Traders often use stop-loss orders to limit their losses in case the trend does not reverse as expected. A stop-loss order is an order placed with a broker to sell an asset if it reaches a certain price. This allows traders to limit their losses if the market moves against them.