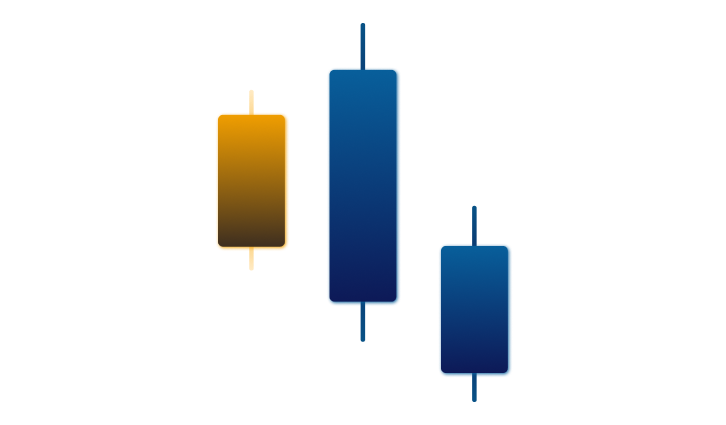

Three Outside Down Candlestick Pattern

Three Outside Down is a powerful bearish candlestick signal that technical analysts use to identify potential reversals in an uptrend. This pattern is formed by three consecutive candlesticks, where the first one is a long white candlestick, followed by a smaller black or white candlestick that opens higher but closes lower than the previous one, and finally, a long black candlestick that closes below the midpoint of the first candlestick’s body.

The bearish Three Outside Down is significant because it suggests that buyers have lost control of the market, and the bears have taken over, indicating a shift in sentiment from bullish to bearish. This pattern is often seen as a confirmation of a bearish trend and is used by traders to initiate short positions or sell their long positions.

Let’s break down the components of the Three Outside Down candlestick pattern and how it is formed:

First Candlestick – Green

The first candlestick of the Three Outside Down candlestick pattern is a long white candlestick that represents a bullish trend. This candlestick opens at or near the low of the period and closes at or near the high, indicating that buyers are in control of the market. The size of the candlestick is essential, and it should be relatively long compared to the previous candlesticks to represent a significant bullish move.

Second Candle – Long Red

The second candlestick of the Three Outside Down candlestick pattern is a small black or white candlestick that opens higher than the previous one but closes lower than the previous one. This candlestick indicates a shift in sentiment, as the buyers were unable to maintain the bullish momentum from the first candlestick. The small size of this candlestick represents a lack of conviction from both buyers and sellers, and it is often seen as a sign of indecision.

Third Candlestick – Smaller Red

The third candlestick of the Three Outside Down candlestick is a long black candlestick that closes below the midpoint of the first candlestick’s body. This candlestick confirms the shift in sentiment, as the bears have taken control of the market. The size of the candlestick is essential, and it should be relatively long compared to the previous candlesticks to represent a significant bearish move.

How Traders should use Three Outside Down

Traders who use candlestick patterns should thoroughly understand candlestick charting principles and technical analysis. They should also be aware of the limitations of using candlestick patterns, such as false signals or patterns that occur too frequently, making them less reliable. As with all trading strategies, proper risk management and position sizing are essential to manage potential losses and maximize profits.

In conclusion, the Three Outside Down candlestick pattern is a valuable tool for technical analysts to identify potential reversals in an uptrend. Traders who use this pattern should combine it with other technical analysis tools and principles to confirm its validity and make informed trading decisions. The Three Outside Down bearish is just one of many candlestick patterns that traders use to analyze market trends and make trading decisions. Still, it is undoubtedly one of the most reliable and powerful bearish reversal patterns in technical analysis.