Shooting Star Candlestick Pattern

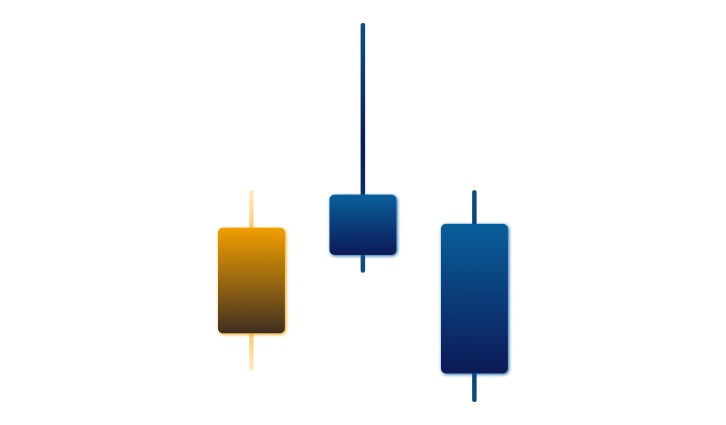

The Shooting Star candlestick pattern is a bearish reversal pattern that occurs at the top of an uptrend. It is a single candlestick pattern that is formed when the open, high, and close prices are all relatively close together, but the candle has a long upper shadow (wick) that is at least twice the size of the real body (the difference between the open and close prices). The lower shadow, if present, is typically very small or non-existent.

The Shooting Star pattern gets its name from its appearance, which is said to resemble a shooting star falling from the sky. It is important to note that the Shooting Star candlestick pattern is only considered to be valid if it occurs after a sustained uptrend and not in isolation.

How to identify the Shooting Star candlestick pattern?

To identify a Shooting Star candlestick pattern, traders should look for a candle with a small real body and a long upper shadow (wick). The candle should also have a relatively small or non-existent lower shadow. The open, high, and close prices should be relatively close together, with the high being very close to the open.

The size of the upper shadow is important in identifying the Shooting Star pattern. It should be at least twice the size of the real body, but can be longer. The longer the upper shadow, the stronger the signal.

It is important to note that the Shooting Star candle should not be confused with other candlestick patterns that have a similar appearance, such as the Inverted Hammer or the Hanging Man. While these patterns have a long lower shadow and a small real body, the Shooting Star pattern has a long upper shadow and a small or non-existent lower shadow.

What does it tell about market sentiment?

The Shooting Star candlestick pattern is a bearish reversal pattern that signals a potential shift in market sentiment from bullish to bearish. The pattern suggests that buyers were in control during the trading session, pushing prices higher, but that sellers stepped in and pushed prices back down before the close.

The long upper shadow of the Shooting Star trading indicates that prices were pushed up to a high level, but that the bulls were unable to maintain control. This suggests that there may be resistance at that level, and that sellers may be taking control of the market. The small or non-existent lower shadow suggests that there is little to no support at lower levels, which further supports the bearish reversal signal.

Traders often look for confirmation of the Shooting Star candle by looking for follow-through selling in the next trading session. If prices continue to fall, it is seen as confirmation that the Shooting Star trading was a valid signal and that the trend may be reversing.

What trading strategies can be used with the Shooting Star candlestick pattern?

Traders can use the Shooting Star candlestick pattern in a number of different trading strategies. Some traders look for the pattern as a signal to sell or short a particular security, particularly if it occurs at a key resistance level. Other traders use the Shooting Star pattern as a confirmation signal, waiting for follow-through selling to confirm the reversal signal before taking action.

Another strategy that traders can use with the Shooting Star candle is to look for it in combination with other candlestick patterns. For example, if a Shooting Star pattern occurs after a long white candlestick (a bullish candlestick), it may signal a shooting star bearish reversal. If this is followed by a Bearish Engulfing pattern (where a large bearish candlestick engulfs the previous bullish candlestick), it may further support the reversal signal.