Piercing Line Candlestick Pattern

If you are a trader, you have likely come across the piercing line pattern while analyzing charts. This candlestick pattern is known for its potential to signal a bullish reversal in a downtrend. However, before you start incorporating it into your trading strategy, it is important to backtest the piercing line candlestick pattern to determine its effectiveness.

What is the Piercing Line Pattern?

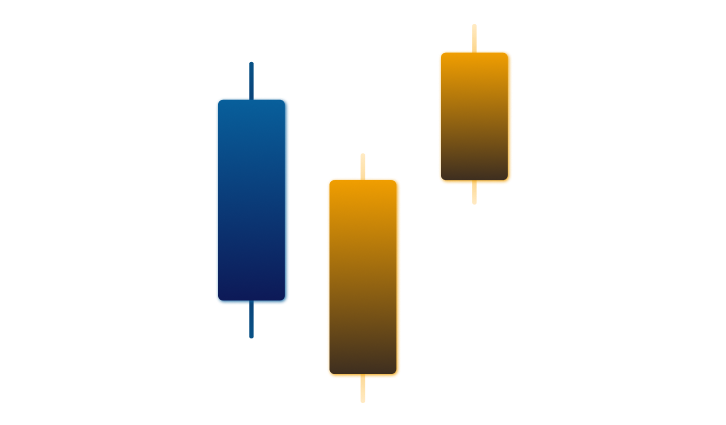

The piercing line pattern is a two-candlestick pattern that occurs during a downtrend. The first candlestick is a bearish candle that closes near its low. The second candlestick is a bullish candle that opens below the low of the first candlestick and closes above the midpoint of the first candlestick. This pattern is also known as the “piercing pattern”.

The piercing line candle suggests that the bulls are gaining strength and are starting to push the price up. The pattern is considered more reliable if it occurs after a long downtrend and if the second candlestick has a long real body and a small upper shadow.

Backtesting the Piercing Line Pattern

Backtesting involves analyzing historical data to determine the effectiveness of a trading strategy. In the piercing case, you would analyze charts to determine how often the pattern appears and how often it leads to a profitable trade.

To backtest this pattern, you can use a trading platform that allows you to view historical data and test different strategies. Many trading platforms also provide tools for backtesting and analyzing candlestick patterns.

When backtesting the piercing line pattern, you should consider the following factors:

Timeframe

The effectiveness of the pattern may vary depending on the timeframe you are trading on. You should backtest the pattern on different timeframes to determine which timeframe produces the most profitable trades.

Market Conditions

The piercing line pattern may be more effective in certain market conditions. For example, it may work better in a trending market than in a sideways market. Backtesting the pattern in different market conditions to determine its effectiveness.

Confirmation

The piercing line candlestick pattern is not a standalone trading signal. It should be used in conjunction with other technical indicators and analysis to confirm a potential reversal. Its effectiveness can be determined by backtesting.

Improving Your Trading Strategy with the Piercing Line Candlestick

Once you have backtested, you can incorporate it into your trading strategy. Here are some tips for using the pattern effectively:

Confirm the Pattern

As mentioned earlier, the pattern should be used in conjunction with other technical indicators and analysis to confirm a potential reversal. For example, you could use a moving average crossover or a trendline break to confirm the pattern.

Set Stop Losses

As with any trading strategy, it is important to manage your risk. You should set stop losses to limit your potential losses if the trade does not go as planned. The stop loss should be placed below the low of the piercing line pattern.

Take Profit

You should also have a target for taking profit. This could be a certain percentage of the price movement or a specific price level. You should also consider trailing your stop loss to lock in profits as the price moves in your favor.

Manage Your Emotions

Trading can be emotional, especially when trades are not going as planned. It is important to manage your emotions and stick to your trading plan. You should also avoid overtrading and be patient for the right opportunities to present themselves.