Bearish Marubozu Candlestick Pattern

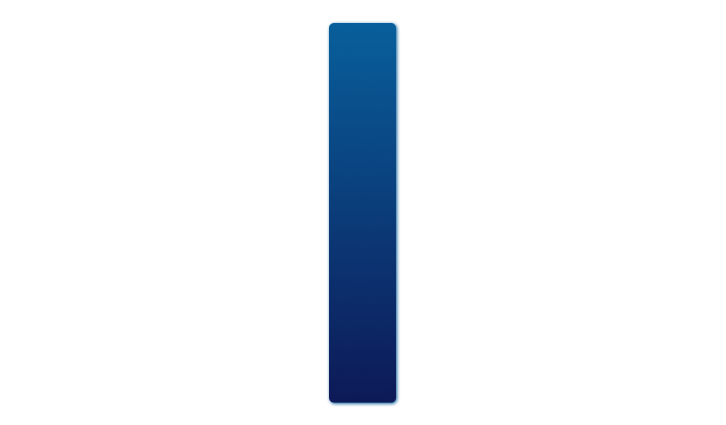

In technical analysis, a bearish marubozu is a candlestick pattern that signals a potential trend reversal to the downside. The pattern consists of a long red (or black) candlestick with little or no upper shadow and no lower shadow, indicating that the bears have controlled the market throughout the entire trading session.

What is Bearish Marubozu?

The term “marubozu” comes from the Japanese word for “shaved head,” referring to the fact that the candlestick has no shadows. This indicates that there was little to no trading activity outside the range of the candlestick, and that the bears were in control throughout the entire session.

The bearish marubozu candlestick pattern is considered to be a strong bearish candlestick signal because it shows that the bears were able to maintain control of the market from the opening bell to the closing bell. This indicates that there is significant selling pressure in the market, and that the bears are likely to continue pushing prices lower in the near term.

Implementation in your Trading Strategy

The bearish marubozu candlestick pattern is often used by technical analysts as a confirmation of other bearish signals, such as a trendline break or a bearish divergence on an oscillator like the relative strength index (RSI). When these other bearish signals are present along with a bearish marubozu, it is considered to be a strong indication that the market is likely to continue moving lower.

One important thing to note about the bearish marubozu pattern is that it is a single candlestick pattern. This means that it can be useful for short-term traders who are looking for a quick move in the market, but it may not be as reliable for longer-term trend analysis. Traders should always use other technical indicators and chart patterns to confirm the validity of any trading signal, including the bearish marubozu candlestick pattern.

Identification

To identify a bearish marubozu candlestick pattern, traders should look for a candlestick with a long red (or black) body and little or no upper or lower shadow. The body of the candlestick should be at least two times the length of the average candlestick body for the chart interval being analyzed.

The lack of an upper shadow on the candlestick indicates that the bears were able to push prices lower throughout the entire trading session, without any significant selling pressure from the bulls. The lack of a lower shadow indicates that there was little to no buying pressure during the session.

It is important to note that the length of the candlestick body is relative to the chart interval being analyzed. For example, a candlestick with a body length of 2% of the stock price may be considered long on a daily chart, but short on an hourly chart. Traders should always adjust their analysis to the chart interval being used.

Trading with Bearish Marubozu

There are several trading strategies that traders can use with the bearish marubozu pattern. One common strategy is to wait for a confirmation of the bearish signal before entering a short position. This confirmation can come from other technical indicators, such as a trendline break or a bearish divergence on an oscillator.

Another strategy is to use the bearish marubozu as a stop-loss level for an existing long position. This can help traders limit their losses if the market moves against them. If the market breaks below the low of the bearish marubozu, it is considered to be a strong indication that the market is likely to continue moving lower, and traders may want to exit their long position.

Traders can also use the bearish marubozu candlestick pattern to identify potential short-term support and resistance levels. If the market approaches the low of the bearish marubozu and bounces higher, it may be a sign that the market has found short-term support at that level. On the other hand, if the market breaks below the low of the bearish marubozu, it may be a sign that the market is likely to continue moving lower, and traders may want to consider shorting the market.

It is important for traders to always use proper risk management techniques when trading with the bearish marubozu pattern, or any other trading strategy. Traders should always use stop-loss orders to limit their losses if the market moves against them, and they should never risk more than they can afford to lose.