Evening Doji Star Candlestick Pattern

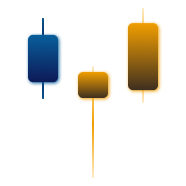

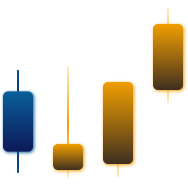

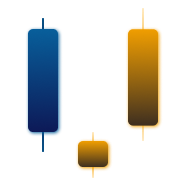

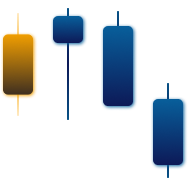

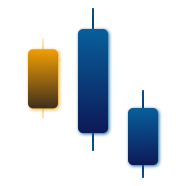

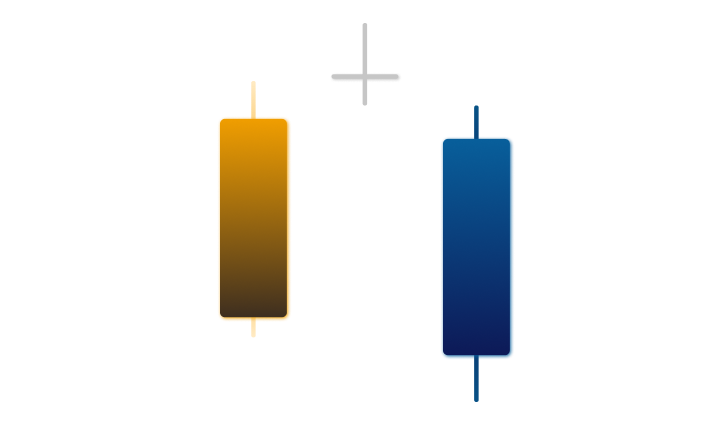

Evening Doji Star is a popular candlestick pattern that appears at the end of an uptrend, signaling a potential reversal in the trend. It is a three-candle pattern consisting of a long bullish candle, followed by a Doji candle, and then a long bearish candle. The Evening Doji Star pattern is considered to be a reliable reversal candle signal when it appears at the top of an uptrend.

In this article, we will discuss the characteristics of the Evening Doji Star pattern, its interpretation, and how traders can use it to make trading decisions.

Characteristics of the Evening Doji Star Pattern

The Evening Doji Star candlestick pattern is composed of three candles:

- The first candle is a long bullish candle, which indicates that the bulls are in control of the market.

- The second candle is a Doji candle, which indicates that the market is indecisive. A Doji candle has the same opening and closing price and has a small body with long upper and lower shadows.

- The third candle is a long bearish candle, which indicates that the bears are taking control of the market.

The Evening Doji Star candlestick pattern is characterized by a gap between the first candle and the Doji candle, and another gap between the Doji candle and the third candle. The gaps indicate a sudden change in market sentiment, where the bulls lose control and the bears take over.

Interpretation of the Evening Doji Star Pattern

The Evening Doji Star candlestick is a reversal pattern that signals a potential change in the trend. When this pattern appears at the top of an uptrend, it indicates that the bulls are losing their grip on the market and the bears are taking control. The Doji candle in the middle indicates indecision in the market and a potential reversal of the trend.

The Evening Doji Star candlestick pattern is considered to be a strong signal when it is confirmed by other technical indicators. For example, if the pattern appears near a resistance level, it increases the likelihood of a reversal. Similarly, if the pattern seems with high trading volume, it indicates that there is strong market sentiment behind the reversal.

Traders use the Evening Doji Star candlestick to make trading decisions. If they are holding long positions, they may consider closing them to lock in profits. If they are looking to enter the market, they may wait for the confirmation of the pattern and look for short opportunities.

Limitations of the Evening Doji Star Pattern

Although the Evening Doji Star candlestick pattern is a dependable signal for a potential reversal in an uptrend, traders must not rely solely on this pattern for making trading decisions. It is important to use other technical indicators to confirm the pattern and avoid making decisions based only on the Evening Doji Star pattern.

In addition, traders should be cautious of false signals that may arise, as a Doji candle can sometimes appear in the middle of a trend without indicating a reversal. Therefore, traders must use other technical indicators to validate the pattern and avoid basing their trading decisions solely on the Evening Doji Star candlestick pattern.