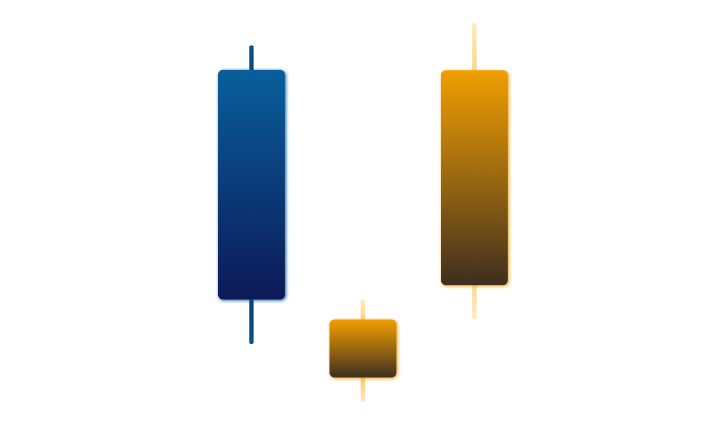

Morning Star Candlestick Pattern

The morning star candlestick pattern is a bullish reversal pattern that signals a potential trend reversal from a bearish to a bullish trend. The candlechart pattern is made up of three candles, with the first and third being long candles in opposite directions, and the second being a small candle that is typically a doji or spinning top. The first candle in the pattern is a long bearish candle that shows the market is in a downtrend. The second candle is a small candle that shows indecision in the market. It can be a doji, which means the opening and closing prices are the same, or a spinning top, which has a small real body and long upper and lower shadows. The third candle is a long bullish candle that shows the market is now in an uptrend. This candle closes above the midpoint of the first candle, which confirms the reversal.

How to Identify the Morning Star Pattern

Identifying the morning star candlestick pattern is relatively easy, as it consists of three candles with distinct characteristics. Here’s what to look for:

First Candle: The first candle in the pattern should be a long bearish candle, which shows that the market is in a downtrend.

Second Candle: The second candle is a small candle that shows indecision in the market. It can be a doji or spinning top.

Third Candle: The third candle is a long bullish candle that shows the market is now in an uptrend. This candle closes above the midpoint of the first candle, which confirms the reversal.

Why the Morning Star Candlestick Pattern is Important for Traders

Now that we’ve covered what this pattern is and how to identify it, let’s discuss why it’s essential for traders to know.

Signals a Potential Reversal

The morning star pattern is a powerful signal that a potential trend reversal is imminent. When you see this pattern on a chart, it’s a sign that the market may be changing direction from a bearish trend to a bullish trend. As a trader, this can be a valuable signal to know, as it can help you avoid potential losses from holding onto a bearish position.

Provides a Buying Opportunity

The morning star candlestick can also provide traders with a buying opportunity. When you see the pattern on a chart, it’s a sign that the market is potentially transitioning from a bearish to a bullish trend.

Can Be Used in Conjunction with Other Indicators

Traders can use moving averages, trendlines, or support and resistance levels to confirm the morning star pattern’s signal. By combining these indicators, traders can increase their chances of making a profitable trade.

Applicable in Different Markets

The morning star candle is not limited to a specific market or time frame. It can be applied to any market, including stocks, forex, commodities, and cryptocurrencies. As such, traders can use this pattern to make profitable trades in different markets.

Helps with Risk Management

Knowing the morning star candlestick pattern can also help with risk management. By recognizing the pattern and understanding its implications, traders can avoid taking unnecessary risks and potentially losing money. For example, if a trader holds a bearish position and sees a morning star pattern forming, they can use it as a signal to close their position and avoid further losses.

Increases Trading Confidence

Finally, knowing the pattern can increase a trader’s confidence in their trading decisions. When you can identify a pattern on a chart, it can give you the confidence to make a trade based on that signal. This can be especially valuable for new traders who may feel unsure about their trading decisions.