Morning Doji Star Candlestick Pattern

In the trading market, the Morning Doji Star is a candle signal that signals a bullish reversal after a downtrend. In this article, we will explore this pattern, how it works, and how traders can use it to their benefit. The Morning Doji Star is a three-candlestick pattern that appears after a downtrend. It is similar to Morning Star Candlestick Pattern but has an extra layer.

What is the Morning Doji Star Candlestick Pattern?

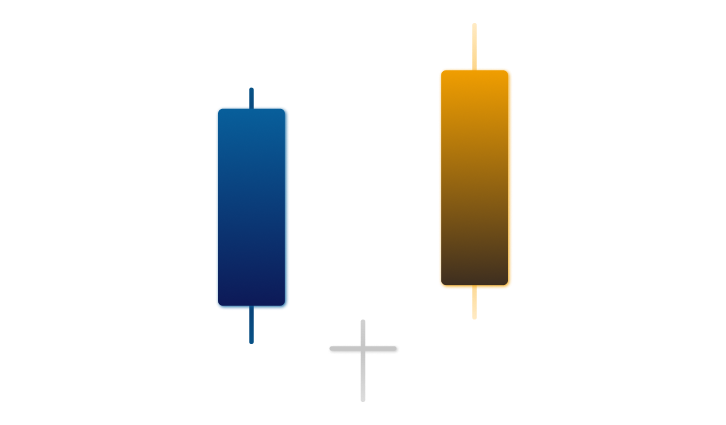

In Morning Doji, the first candle is a long bearish candle, representing the continuation of the downtrend. The second candle is a Doji, which has open and close prices that are almost the same. The third candle is a long bullish candle, which opens above the Doji’s high and closes near the middle of the first candle.

The Morning Doji Star candlestick pattern is a reversal pattern that signifies a potential change in market sentiment. The pattern suggests that selling pressure has been exhausted, and buying pressure is starting to emerge. However, traders should always be cautious and wait for confirmation before entering a trade based on the Morning Doji.

How to Identify the Pattern?

The Morning Doji Star pattern is easy to identify on a price chart. Traders should look for the following characteristics:

A Downtrend: The pattern should occur after a prolonged downtrend. This can be identified by the chart’s lower lows and lower highs.

First Candle: The first candle should be a long bearish candle with a large real body. This indicates that selling pressure is dominating the market.

Second Candle: The second candle should be a Doji, which represents indecision in the market. The Doji’s open and close prices should be within the range of the first candle.

Third Candle: The third candle should be a long bullish candle with a large real body. This means that buying pressure has emerged and is likely to continue.

It’s important to note that the third candle’s close should be above the midpoint of the first candle. This confirms that buying pressure has taken control of the market.

How to Trade the Morning Doji Star?

Traders can use the Morning Doji Star pattern to make informed trading decisions. Traders can use the following steps to trade the Morning Doji:

Identify the Pattern

The first step is to identify the Morning Doji Star candlestick pattern on the price chart.

Wait for Confirmation

Traders should wait for confirmation before entering a trade based on the pattern. Confirmation can be in the form of a bullish candle closing above the third candle’s high or a break above a significant resistance level.

Enter the Trade

Traders can enter a long position once confirmation is received. The stop loss should be placed below the low of the Doji candle, and the take profit should be set at a reasonable level.

Manage the Trade

Traders should manage the trade by monitoring price action, adjusting the stop loss, and taking profit levels accordingly. They should also be prepared to exit the trade if the market conditions change.

Combine with Other Indicators

Traders can enhance the accuracy of the Morning Doji Star pattern by combining it with other technical indicators, such as moving averages, oscillators, or trendlines.

It’s essential to note that no trading strategy or pattern is 100% accurate. Traders should always use risk management techniques, such as setting stop losses and taking profits, to protect their capital.

Limitations

False Signals: The Morning Doji Star can produce false signals like any other trading pattern. Traders should always await confirmation before entering a trade based on the pattern.

Not Suitable for All Markets: The Morning Star Doji is best suited for trending markets. In range-bound markets, the pattern may be less reliable.

Requires Technical Analysis Skills: To identify the Morning Doji Star pattern, traders need to have a good understanding of technical analysis and be able to read price charts effectively.