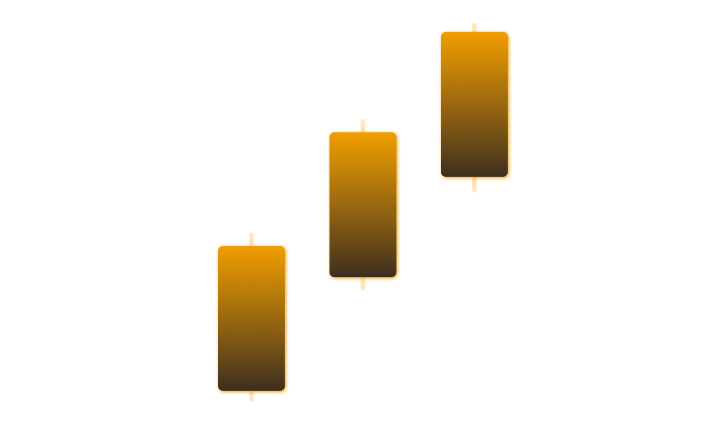

Three White Soldiers Candlestick Pattern

Candlestick charts are a popular method of analyzing financial markets, particularly in the realm of technical analysis. Candlestick signals help traders identify potential trends and reversals in the market. One such pattern is the Three White Soldiers, a bullish reversal pattern that occurs after a downtrend.

What is the Three White Soldiers Candlestick Pattern?

The Three White Soldiers candlestick pattern consists of three long bullish candles that open within the previous candle’s real body and close higher than the previous candle. Each candle has a longer real body than the previous one, and the pattern usually occurs after a downtrend, indicating a possible reversal of the trend. This pattern is considered a strong bullish signal, with the third candle representing confirmation of the trend reversal.

Trading with the Three White Soldiers Pattern

Traders can use the Three White Soldiers pattern in a variety of ways. Some traders use the pattern to identify a trend reversal and enter a long position at the close of the third candle. Others may use the pattern to confirm an existing bullish trend and add to their position.

Traders should use additional technical analysis tools to confirm the pattern’s validity, such as trend lines, moving averages, and oscillators. It’s also important to consider fundamental factors that can affect the market’s direction, such as economic data, company news, and geopolitical events.

Combination with Other Indicators

Traders should use the Three White Soldiers pattern in combination with other technical indicators to confirm the pattern’s validity and avoid false signals.

For example, traders could use trend lines to confirm that the stock is in a downtrend before looking for the Three White Soldiers pattern. They could also use moving averages, such as the 50-day and 200-day moving averages, to confirm that the stock is in a bullish trend before entering a long position.

Additionally, traders could use oscillators, such as the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD), to confirm that the stock is oversold before looking for the Three White Soldiers pattern.