Bullish Marubozu Candlestick Pattern

In technical analysis, candlestick charts are one of the most popular tools used by traders to identify trends, price movements, and potential entry and exit points for trades. Among the various types of candlestick patterns, the bullish marubozu is considered to be a strong indicator of market momentum in favor of buyers. In this article, we will explore the bullish marubozu candlestick pattern, how it is formed, what it signifies, and how traders can use it to their advantage.

What is a Bullish Marubozu Candlestick?

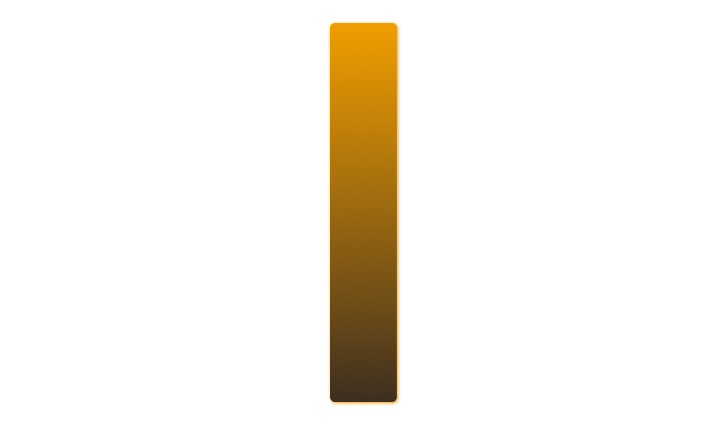

A bullish marubozu is a single candlestick pattern that appears on a chart and has a long body with little or no wicks or shadows. It is a bullish candlestick pattern indicating strong market buying momentum. The word ‘marubozu’ comes from the Japanese word meaning ‘shaved’ or ‘bald.’ The term ‘marubozu’ refers to the fact that the candlestick has no upper or lower shadow, and the opening and closing prices are at the extreme ends of the candlestick’s range.

The Formation

A bullish marubozu candle is formed when the opening price is equal to the low of the day, and the closing price is equal to the high of the day. This means that there is a strong buying pressure in the market, and the buyers have been able to maintain control throughout the entire trading day, resulting in a bullish candlestick with no wicks or shadows.

The bullish marubozu candlestick pattern can be seen in various timeframes, such as daily, weekly, or monthly charts. The longer the timeframe, the stronger the bullish signal. Additionally, if the bullish marubozu candlestick appears after a period of consolidation or downtrend, it is considered to be a more reliable signal of a potential bullish reversal.

Significance of a Bullish Marubozu

The bullish marubozu is significant because it indicates a strong buying pressure in the market, and the buyers are in control of the price action. It also suggests that the opening price was the low of the day, and the closing price was the high of the day, which clearly indicates bullish sentiment.

Traders often use the bullish marubozu candlestick as a signal to enter a long position in the market, as it indicates a potential bullish reversal. The bullish marubozu candle can also be used as a confirmation signal for other technical indicators or chart patterns, such as moving averages or trendlines.

Difference to Other Candlestick Patterns

The bullish marubozu candlestick pattern is similar to other bullish candlestick patterns, such as bullish engulfing and bullish harami patterns. However, the bullish marubozu is different from these patterns in terms of its long body and lack of shadows. This indicates that the buying pressure in the market is strong and sustained, unlike the other patterns that show a change in sentiment from bearish to bullish.

Additionally, the bullish marubozu candle is different from the doji candlestick pattern, which has a very small body and indicates indecision in the market. The bullish marubozu candlestick, on the other hand, indicates a clear bullish sentiment and a potential bullish reversal.

Usage in Trading

Traders can use the bullish marubozu candlestick in various ways in their trading strategies. Here are a few examples:

- Trading Long: Traders can enter a long position in the market when a bullish marubozu appears on the chart. The long position can be taken at the next trading day’s opening or on a pullback, depending on the trader’s risk tolerance and trading strategy. Traders can also use other technical indicators or chart patterns to confirm this pattern before entering a long position.

- Setting Stop Loss: Traders can set a stop loss below the low of the bullish marubozu candle to limit their potential losses in case the market turns against them. The stop loss can be adjusted as the price moves in favor of the trade, following the trader’s risk management rules.

- Profit Targets: Traders can set profit targets based on the price action or other technical indicators. For example, traders can set a profit target at a key resistance level or a Fibonacci retracement level. Alternatively, traders can use a trailing stop loss to capture profits as the price continues to move in favor of the trade.

Limitations of Bullish Marubozu Candlestick

While the bullish marubozu is a reliable indicator of bullish momentum, it is not infallible. Here are some limitations of this candlestick pattern:

False Signals

Like any other technical indicator or chart pattern, the bullish marubozu candle can produce false signals. Traders should use other technical indicators or chart patterns to confirm the signal before entering a trade.

Overbought Market

If the market is already overbought, the bullish marubozu candlestick pattern may not lead to a sustained bullish reversal. In such cases, the market may experience a pullback or consolidation before resuming the uptrend.

Low Trading Volume

The bullish marubozu candlestick is more reliable when it appears on a chart with high trading volume. Low trading volume can indicate a lack of participation in the market, which may lead to false signals or lack of follow-through.